Consumers in the early part of June took a considerably less pessimistic about the economy and potential surges in inflation as progress appeared possible in the global trade war, according to a University of Michigan survey Friday.

The university’s closely watched Surveys of Consumers showed across-the-board rebounds from previously dour readings, while respondents also sharply cut back their outlook for near-term inflation.

For the headline index of consumer sentiment, the gauge was at 60.5, well ahead of the Dow Jones estimate for 54 and a 15.9% increase from a month ago. The current conditions index jumped 8.1%, while the future expectations measure soared 21.9%.

The moves coincided with a softening in the heated rhetoric that has surrounded President Donald Trump’s tariffs. After releasing his April 2 “liberation day” announcement, Trump has eased off the threats and instituted a 90-day negotiation period that appears to be showing progress, particularly with top trade rival China.

“Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed,” survey director Joanne Hsu said in a statement. “However, consumers still perceive wide-ranging downside risks to the economy.”

To be sure, all of the sentiment indexes were still considerably below their year-ago readings as consumers worry about what impact the tariffs will have on prices, along with a host of other geopolitical concerns.

On inflation, the one-year outlook tumbled from levels not seen since 1981.

The one-year estimate slid to 5.1%, a 1.5 percentage point drop, while the five-year view edged lower to 4.1%, a 0.1 percentage point decrease.

“Consumers’ fears about the potential impact of tariffs on future inflation have softened somewhat in June,” Hsu said. “Still, inflation expectations remain above readings seen throughout the second half of 2024, reflecting widespread beliefs that trade policy may still contribute to an increase in inflation in the year ahead.”

The Michigan survey, which will be updated at the end of the month, had been an outlier on inflation fears, with other sentiment and market indicators showing the outlook was fairly contained despite the tariff tensions. Earlier this week, the Federal Reserve of New York reported that the one-year view had fallen to 3.2% in May, a 0.4 percentage point drop from the prior month.

At the same time, the Bureau of Labor Statistics this week reported that both producer and consumer prices increase just 0.1% on a monthly basis, pointing toward little upward pressure from the duties. Economists still largely expect the tariffs to show impact in the coming months.

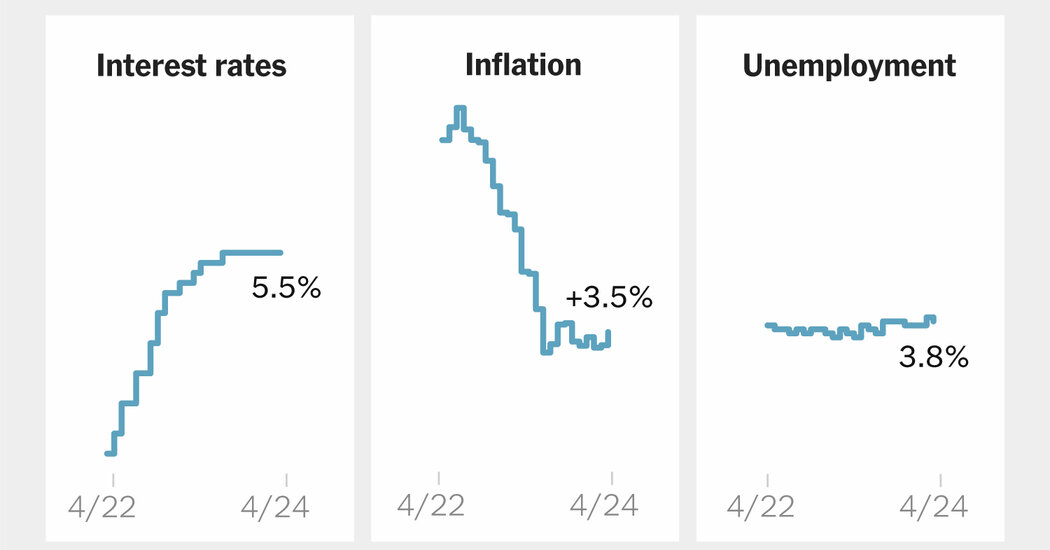

The soft inflation numbers have led Trump and other White House officials to demand the Fed start lowering interest rates again. The central bank is slated to meet next week, with market expectations strongly pointing to no cuts until September.

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago