Personal Finance

86-year-old grandmother got her nearly $32,000 student loan debt forgiven

Published

7 months agoon

Mrs | Moment | Getty Images

Rebecca Finch couldn’t think of a better gift for her 86th birthday.

She received a notice in early September from Navient that the lender would forgive the private student loan on which she was a co-signer.

“We’ve waived the remaining balance on your private student loan in the amount of $31,730.76,” the Aug. 29 letter said, in part.

Navient had determined that Rebecca qualified for its disability discharge. Rebecca received the news from the lender not long after CNBC wrote about the Finch family’s situation.

Rebecca Finch

Courtesy: Rebecca Finch

But the road to that relief was long, confusing and intensely stressful, said Rebecca’s daughter, Sabrina Finch.

“Finding out about the forgiveness option was very difficult,” said Sabrina, 53.

‘Transparency is severely lacking’

As the cost of higher education swells, the $130 billion private education loan industry has quickly grown. But private student loans come with few protections for those who run into repayment issues, including becoming disabled, consumer advocates say.

Only about half of the private lenders offer student borrowers the possibility of loan discharge if they become severely disabled and unable to work, according to an analysis by higher education expert Mark Kantrowitz.

In comparison, all federal student loans come with that option.

Even when a private student lender provides a disability discharge, it often doesn’t make the information widely known, advocates say.

“Transparency is severely lacking,” said Carolina Rodriguez, director of the Education Debt Consumer Assistance Program, or EDCAP, based in New York.

“It’s often difficult for borrowers to even reach a representative who is knowledgeable about the disability discharge option,” Rodriguez said.

More from Personal Finance:

How tax bracket changes could affect your brokerage account

Crypto relationship scams pose ‘catastrophic harm,’ SEC says

Many Americans would rather talk about politics than money

Anna Anderson, a staff attorney at the National Consumer Law Center, has seen that play out as well.

“Even the borrowers who allegedly have access to it, it’s still very, very difficult for them to actually seek and receive a discharge,” Anderson said.

On Sept. 9, in the course of reporting on the Finch family’s story, CNBC asked Navient if it had a link to a disability discharge application on its website.

“No,” Paul Hartwick, vice president of corporate communications at Navient, wrote in an email the same day.

He sent a link to a page on the lender’s website that encourages struggling borrowers to reach out to learn of their options. By the time of publication, that link no longer worked. Hartwick explained that that was because a different company, Mohela, or the Missouri Higher Education Loan Authority, began servicing the private student debt owned by Navient in October. That portfolio includes around 2.5 million borrowers.

Hartwick directed CNBC to Mohela’s website, which contained similarly limited information about loan discharge opportunities for those with disabilities.

In response to a request for comment, a Mohela spokesperson pointed CNBC back to Navient.

“MOHELA is a service provider for private loans and does not determine the benefits available by lenders,” the spokesperson wrote in an email. “Program attributes and terms are defined by each lender/loan holder.”

For comparison, the U.S. Department of Education has an easy-to-access disability application for federal student loan borrowers, and detailed information on its website about documentation and eligibility requirements.

Around 13% of Americans report having a disability, according to Pew Research Center. People with a disability are much less likely to be employed than those without one, and unemployment rates are far higher for those with disabilities, the U.S. Department of Labor found.

Disabled mother and daughter, and a $31,000 debt

Most private student lenders require a co-signer who is equally legally and financially responsible for the debt. That’s because student borrowers tend to have a thin or nonexistent credit history.

Originally, Sabrina was the primary borrower of the Navient private student loan, and her mother, Rebecca, was the co-signer. Rebecca co-signed the loan in 2007 while Sabrina — then in her 30s — was in school to become a nurse.

In the 20 years that followed, both women developed serious health issues.

In 2023, Sabrina was approved for Social Security disability benefits due to her bipolar disorder, she said. Even though she could no longer work, she assumed she was still responsible for the Navient loan. She researched her relief options but couldn’t find any information.

Sabrina said she just kept describing her situation to multiple customer service representatives at Navient. For weeks, those conversations led nowhere — until one day, an agent mentioned the disability option.

The next headache was figuring out the proof she’d need to gather, Sabrina said.

She only learned what the requirements were a few weeks later when Navient mailed her documents outlining the needed materials. In the end, Sabrina said, she sent as much information as she could to the lender, including evidence from her doctors.

In May, Navient excused Sabrina from her private student loan.

But that news was bittersweet. Almost immediately, the lender transferred the loan to her then 85-year-old mother.

Sabrina said she had told Navient that Rebecca has serious health conditions of her own, including cardiovascular disease and constant pain from a fractured hip. Several strokes have left Rebecca with speech and cognitive issues, Sabrina said. Sabrina spoke with CNBC on her mother’s behalf, given Rebecca’s extensive medical issues.

Even so, Sabrina said, a customer service agent at Navient told her that it would be hard for Rebecca to receive a loan discharge.

“Navient said that she would probably not be excused, regardless of [the documents] submitted,” Sabrina said.

On Oct. 25, Hartwick declined to comment on that conversation, but said that the private student loan was “discharged in full for Rebecca once her disability information was processed.”

But there’s no question it’s incredibly difficult for co-signers to be forgiven from a private student loan, consumer advocates say. The Consumer Financial Protection Bureau found in 2015 that private student lenders rejected 90% of co-signer release applications.

Advocates say those odds haven’t improved.

“Based on my experience, co-signer release is virtually non-existent in practice,” EDCAP’s Rodriguez told CNBC in August.

Navient’s attempts earlier this year to collect the debt severely upset Rebecca, Sabrina said.

The women were most afraid the lender could sue Rebecca and get a lien on her house in Troutville, Virginia. Sabrina said one of the callers from Navient mentioned that possibility to her mother.

A spokesperson for Navient told CNBC on Aug. 8 that he couldn’t comment on whether the lender discussed the possibility of a lien on Rebecca’s house.

“But I can say, in general, private student loans do not go into collections until after a period of delinquency,” he said. “And, like other loans, there’s a process, often lengthy, to take legal action toward repayment.”

On July 26, Sabrina emailed Navient as much information as she could on her mother’s physical condition, sending copies to CNBC.

Around two weeks after CNBC published an article on the family’s experience, Navient informed Rebecca that the lender would release her from the debt.

It was a tremendous relief to her and her mother, Sabrina said.

But she remains angry at how difficult she found it to even learn about the disability discharge option.

“There has got to be great deal of people out there that are disabled and fighting to stay afloat with these loans,” Sabrina said. “And I assure you the lenders are not volunteering the options for loan forgiveness to those asking them for help.”

You may like

Olga Rolenko | Moment | Getty Images

There are all sorts of ways for consumers to misuse credit cards, from failing to pay monthly bills in full to running up your balance. But here’s one risky behavior that experts say you likely haven’t heard of: “credit cycling.”

Credit cards come with a spending limit. Cardholders are usually aware of this limit, which represents the overall cap to how much they can borrow. The limit resets with each billing statement when users pay their bill in full and on time.

Users who credit-cycle will reach that limit and quickly pay down their balance; this frees up more headroom so consumers can effectively charge beyond their typical allowance.

Doing this occasionally is usually not a big deal, experts said. It’s akin to driving a few miles per hour over the speed limit — something less likely to get a driver pulled over for speeding, said Ted Rossman, senior industry analyst at CreditCards.com.

But consistently “churning” through available credit comes with risks, Rossman said.

For example, card issuers may cancel a user’s card and take away their reward points, experts said. This might negatively impact a user’s credit score, they said.

“If there’s even the slightest chance credit cycling can go sideways, it’s best not to do it and look for alternatives,” said Bruce McClary, senior vice president at the National Foundation for Credit Counseling. “You have to be very careful.”

Card companies see credit cycling as a risk

The average American’s credit card limit was about $34,000 at the end of the second quarter of 2024, according to Experian, one the three major credit bureaus. (This was the limit across all their cards.)

The amount varies across generations, and according to factors like income and credit usage, according to Experian.

It’s understandable why some consumers would want to credit cycle, experts said.

More from Personal Finance:

Why summer Fridays are increasingly rare

How GOP megabill affects families with kids

What a Trump, Powell showdown means for your money

Certain consumers may have a relatively low credit limit, and credit cycling might help them pay for a big-ticket purchase like a home repair, wedding or a costly vacation, experts said. Others may do it to accelerate the rewards and points they get for making purchases, they said.

But card issuers would likely see repeat offenders as a red flag, Rossman said.

Maxing out a card frequently may run afoul of certain terms and conditions, or signal that a user is experiencing financial difficulty and struggling to stay within their budget, he said.

Issuers may also view it as a potential sign of illegal activity like money laundering, he said.

“You could be putting yourself at risk by appearing to be a risk in that way,” McClary said.

Credit cycling consequences

If a card issuer penalizes a credit-cycling customer by closing their account, it could have negative repercussions for their credit score, experts said.

Credit utilization is the share of one’s outstanding debt relative to their credit limit. Keeping utilization relatively low generally helps boost one’s credit score, while a high rate generally hurts it, McClary said.

Experts generally recommend keeping credit utilization below 30%, and below 10% if you really want to improve your credit score.

A canceled card would reduce one’s overall credit limit, raising the odds that a user’s credit utilization rate would increase if they have outstanding debt on other credit cards, McClary said.

Further, a card company could flag misuse as a reason for the account closure, potentially making the user look like more of a risk to future creditors, he added.

Consistently butting up against one’s credit limit also increases the chances of accidentally breaching that threshold, McClary said. Doing so could lead creditors to charge over-limit fees or raise a user’s interest rate, he said.

Consumers who credit-cycle should be cognizant of any recurring monthly subscriptions or other charges that might inadvertently push them over the limit, he said.

What to do instead

Instead of credit cycling, consumers may be better served by asking their card issuer for a higher credit limit, opening a new credit card account or spreading payments over more than one card, Rossman said.

As a general practice, Rossman is a “big fan” of paying down one’s credit card bill early, such as in the middle of the billing cycle instead of waiting for the end. (To be clear, this isn’t the same as credit cycling, since consumers wouldn’t be paying down their balance early in order to spend beyond their allotted credit.)

This can reduce a consumer’s credit utilization rate — and boost one’s credit score — since card balances are generally only reported to the credit bureaus at the end of the monthly billing cycle, he said.

“It can be a good way to improve your score, especially if you use your card a lot,” he said.

Personal Finance

Summer Fridays are increasingly rare as hybrid schedules gain steam

Published

1 day agoon

June 13, 2025

People enjoy an unusually warm day in New York City as temperatures reach the low 80s on June 4, 2025 in New York City.

Spencer Platt | Getty Images

Summer Fridays may be considered the most desirable perk of the season, but fewer employers are on board with the shortened workweek.

Companies have steadily phased out summer Fridays — a policy that allows workers to take Friday afternoon off over the summer months — as work-from-home Fridays became more common, experts say.

“Pre-pandemic, summer Fridays were thing, but hybrid overall has taken over,” said Bill Driscoll, technology workplace trends expert at staffing and consulting firm Robert Half.

As more commuters settle into flexible working arrangements, fewer workers are making Friday trips at all compared to mid-week traffic patterns, according to the 2024 Global Traffic Scorecard released in January by INRIX Inc., a traffic-data analysis firm.

More from Personal Finance:

Job market is ‘trash’ right now, career coach says

Millions would lose health insurance under GOP megabill

Average 401(k) balances drop 3% due to market volatility

Among employees, however, summer Fridays are the most valued summer benefit, followed by summer hours and flextime, according to a new survey by job site Monster, which polled more than 400 U.S. workers in June.

“Summer Fridays are highly valued among workers because, for many, they represent more than just a few extra hours off,” said Scott Blumsack, Monster’s chief strategy and marketing officer. This perk “can go a long way in showing employees they’re valued, which can help prevent burnout, boost morale, and improve retention during a season when disengagement can run high.”

Still, 84% of workers are not offered any summer-specific benefits, even though 55% also said those benefits improve productivity, Monster found.

Instead, hybrid — and to a lesser extent fully remote — job postings have increased in the last year as employers compete for talented job seekers who prioritize flexibility, according to research by Robert Half.

“Hybrid is a highly desirable situation right now and one that all levels of employees are looking for,” said Robert Half’s Driscoll.

More than five years after the pandemic, 72% of organizations also have return-to-office mandates, according to a separate hybrid work study by Cisco.

But, even with the mandates, employees are less likely to work in the office on Fridays, and much more likely to commute Monday to Thursday, Cisco found.

Employees value flexibility

As employee burnout and disengagement grows amid the wave of in-office mandates, work-life balance and flexible hours have become increasingly important, other studies show.

Corporate wellness company Exos, which works with large organizations such as JetBlue and Adobe, says burnout has gone down significantly among employees at firms that have made Fridays more flexible. Exos also tested out “You Do You Fridays” — and found significant benefits.

The more adaptable the schedule, the more positively employees view their company’s policies, the Cisco report also found.

With hybrid arrangements now common, workers put a high value on that flexibility — and 63% of all workers would even accept a pay cut for the option to work remotely more often, according to Cisco’s global survey of more than 21,500 employers and employees working full-time.

Personal Finance

How House Republicans’ ‘big beautiful’ bill may affect children

Published

1 day agoon

June 13, 2025

Speaker of the House Mike Johnson, R-La., pictured at a press conference after the House narrowly passed a bill forwarding President Donald Trump’s agenda on May 22 in Washington, DC.

Kevin Dietsch | Getty Images

House reconciliation legislation, also known as the One, Big, Beautiful Bill, includes changes aimed at helping to boost family’s finances.

Those proposals — including $1,000 investment “Trump Accounts” for newborns and an enhanced maximum $2,500 child tax credit — would help support eligible parents.

Proposed tax cuts in the bill may also provide up to $13,300 more in take-home pay for the average family with two children, House Republicans estimate.

“What we’re trying to do is help hardworking Americans who are trying to provide for their families and make ends meet,” House Speaker Mike Johnson, R-La., said during a June 8 interview with ABC News’ “This Week.”

Yet the proposed changes, which emphasize work requirements, may reduce aid for children in low-income families when it comes to certain tax credits, health coverage and food assistance.

Households in the lowest decile of the income distribution would lose about $1,600 per year, or about 3.9% of their income, from 2026 through 2034, according to a June 12 letter from the Congressional Budget Office. That loss is mainly due to “reductions in in-kind transfers,” it notes — particularly Medicaid and the Supplemental Nutrition Assistance Program, or SNAP, formerly known as food stamps.

20 million children won’t get full $2,500 child tax credit

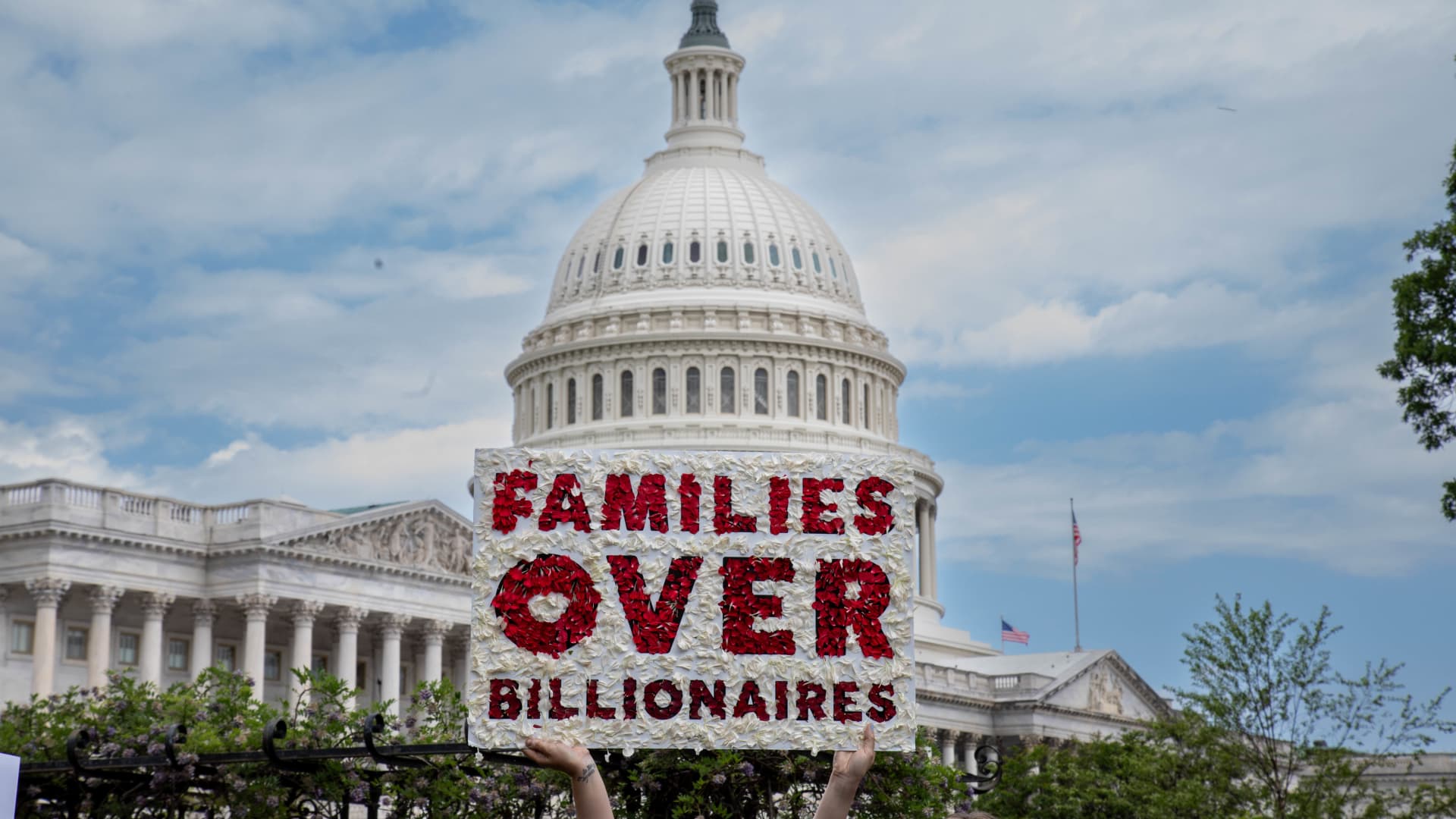

A member of MomsRising holds a sign on Capitol Hill to urge lawmakers to reject tax breaks for billionaires and protest cuts to Medicaid and child care on Capitol Hill on May 8 in Washington, D.C.

Brian Stukes | Getty Images Entertainment | Getty Images

House Republicans have proposed increasing the maximum child tax credit to $2,500 per child, up from $2,000, a change that would go into effect starting with tax year 2025 and expire after 2028.

The change would increase the number of low-income children who are locked out of the child tax credit because their parents’ income is too low, according to Adam Ruben, director of advocacy organization Economic Security Project Action. The tax credit is not refundable, meaning filers can’t claim it if they don’t have a tax obligation.

Today, there are 17 million children who either receive no credit or a partial credit because their family’s income is too low, Ruben said. Under the House Republicans’ plan, that would increase by 3 million children. Consequently, 20 million children would be left out of the full child tax credit because their families earn too little, he said.

“It is raising the credit for wealthier families while excluding those vulnerable families from the credit,” Ruben said. “And that’s not a pro-family policy.”

A single parent with two children would have to earn at least $40,000 per year to access the full child tax credit under the Republicans’ plan, he said. For families earning the minimum wage, it may be difficult to meet that threshold, according to Ruben.

In contrast, an enhanced child tax credit put in place under President Joe Biden made it fully refundable, which means very low-income families were eligible for the maximum benefit, according to Elaine Maag, senior fellow at the Urban-Brookings Tax Policy Center.

In 2021, the maximum child tax credit was $3,600 for children under six and $3,000 for children ages 6 to 17. That enhanced credit cut child poverty in half, Maag said. However, immediately following the expiration, child poverty increased, she said.

The current House proposal would also make about 4.5 million children who are citizens ineligible for the child tax credit because they have at least one undocumented parent who files taxes with an individual tax identification number, Ruben said. Those children are currently eligible for the child tax credit based on 2017 tax legislation but would be excluded based on the new proposal, he said.

New red tape for a low-income tax credit

House Republicans also want to change the earned income tax credit, or EITC, which targets low- to middle-income individuals and families, to require precertification to qualify.

When a similar requirement was tried about 20 years ago, it resulted in some eligible families not getting the benefit, Maag said. The new prospective administrative barrier may have the same result, she said.

More than 2 million children’s food assistance at risk

Momo Productions | Digitalvision | Getty Images

House Republican lawmakers’ plan includes almost $300 billion in proposed cuts to the Supplemental Nutrition Assistance Program, or SNAP, through 2034.

SNAP currently helps more than 42 million people in low-income families afford groceries, according to Katie Bergh, senior policy analyst at the Center on Budget and Policy Priorities. Children represent roughly 40% of SNAP participants, she said.

More than 7 million people may see their food assistance either substantially reduced or ended entirely due to the proposed cuts in the House reconciliation bill, estimates CBPP. Notably, that total includes more than 2 million children.

“We’re talking about the deepest cut to food assistance ever, potentially, if this bill becomes law,” Bergh said.

More from Personal Finance:

Experts weigh pros and cons of $1,000 Trump baby bonus

How Trump spending bill may curb low-income tax credit

Why millions would lose health insurance under House spending bill

Under the House proposal, work requirements would apply to households with children for the first time, Bergh said. Parents with children over the age of 6 would be subject to those rules, which limit people to receiving food assistance for just three months in a three-year period unless they work a minimum 20 hours per week.

Additionally, the House plan calls for states to fund 5% to 25% of SNAP food benefits — a departure from the 100% federal funding for those benefits for the first time in the program’s history, Bergh said.

States, which already pay to help administer SNAP, may face tough choices in the face of those higher costs. That may include cutting food assistance or other state benefits or even doing away with SNAP altogether, Bergh said.

While the bill does not directly propose cuts to school meal programs, it does put children’s eligibility for them at risk, according to Bergh. Children who are eligible for SNAP typically automatically qualify for free or reduced school meals. If a family loses SNAP benefits, their children may also miss out on those benefits, Bergh said.

Health coverage losses would adversely impact families

A protestor holds a sign on May 7, 2025 in Washington, D.C.

Leigh Vogel | Getty Images Entertainment | Getty Images

Families with children may face higher health care costs and reduced access to health care depending on how states react to federal spending cuts proposed by House Republicans, according to the Center on Budget and Policy Priorities.

The House Republican bill seeks to slash approximately $1 trillion in spending from Medicaid, the Children’s Health Insurance Program and Affordable Care Act marketplaces.

Medicaid work requirements may make low-income individuals vulnerable to losing health coverage if they are part of the expansion group and are unable to document they meet the requirements or qualify for an exemption, according to CBPP. Parents and pregnant women, who are on the list of exemptions, could be susceptible to losing coverage without proper documentation, according to the non-partisan research and policy institute.

Eligible children may face barriers to access Medicaid and CHIP coverage if the legislation blocks a rule that simplifies enrollment in those programs, according to CBPP.

In addition, an estimated 4.2 million individuals may be uninsured in 2034 if enhanced premium tax credits that help individuals and families afford health insurance are not extended, according to CBO estimates. Meanwhile, those who are covered by marketplace plans would have to pay higher premiums, according to CBPP. Without the premium tax credits, a family of four with $65,000 in income would pay $2,400 more per year for marketplace coverage.

Israel-Iran attacks and the 2 other things that drove the stock market this week

Uranium as big play due to AI-driven energy demand

How credit cycling works and why it’s risky

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoJobs report May 2025:

-

Economics1 week ago

Economics1 week agoDonald Trump has many ways to hurt Elon Musk

-

Economics6 days ago

Economics6 days agoSending the National Guard to LA is not about stopping rioting

-

Finance1 week ago

Finance1 week agoStocks making the biggest moves midday: WOOF, TSLA, CRCL, LULU

-

Blog Post7 days ago

Blog Post7 days agoMastering Bookkeeping Tasks During Peak Business Seasons

-

Economics1 week ago

Economics1 week agoDonald Trump has many ways to hurt Elon Musk

-

Personal Finance6 days ago

Personal Finance6 days agoWhat Pell Grant changes in Trump budget, House tax bill mean for students

-

Economics1 week ago

Economics1 week agoRussia cuts sky-high interest rates for the first time since 2022