Reporting is one of the most actionable pieces of running a business. Owners simply have to understand how their business is performing to chart out next steps and see opportunities for growth.

If you don’t report, you can’t measure what was successful, and — as equally important — what wasn’t. This information is no secret. But what might not be so obvious is how the most successful businesses utilize those reports. For accounting and finance, maximizing the reliable financial data in those reports unlocks critical information to help business owners make better business decisions.

What is monthly reporting and how did we get here?

Historically, financial reports are delivered each month. It’s a nice solid time measurement that enables regular check-ins without too much intention. Think: credit card statements, rent and utilities. Our most common bills are monthly, and businesses followed this timing. We’re here to tell you that one month is too long to not have a check-in on your financial standing. If you’re refreshing your email multiple times a day, you should not be waiting for the end of the month to take a look at your business’s cash flow. A report delivered on the 15th is no longer helpful when you need to pay rent on the 30th. In today’s fast-paced, data-driven environment, monthly isn’t cutting it.

Why monthly is no longer timely enough

Financial reports are primarily in 30-day increments and it is imperative small businesses know their financial position far more often than that. For example, businesses with a high velocity of transactions might not have a pulse if the reports are delivered monthly, which can easily lead to running out of money without knowing which bills are about to hit and the payments they need to make.

Monthly reports usually don’t come out until the middle of the following month, which is too late for any real-time course corrections. It’s what happened. Business owners need a current pulse on cash and understand what levers to pull as they forward in the present and future.

What if we checked in on our finances weekly?

Financial transactions are happening daily. Some are expected costs, such as rent and salaries, and others are unexpected and fluctuating, like travel and office supplies. Emergencies, such as malfunctioning machinery, can have a dramatic effect on a business’s liquidity if not prepared for.

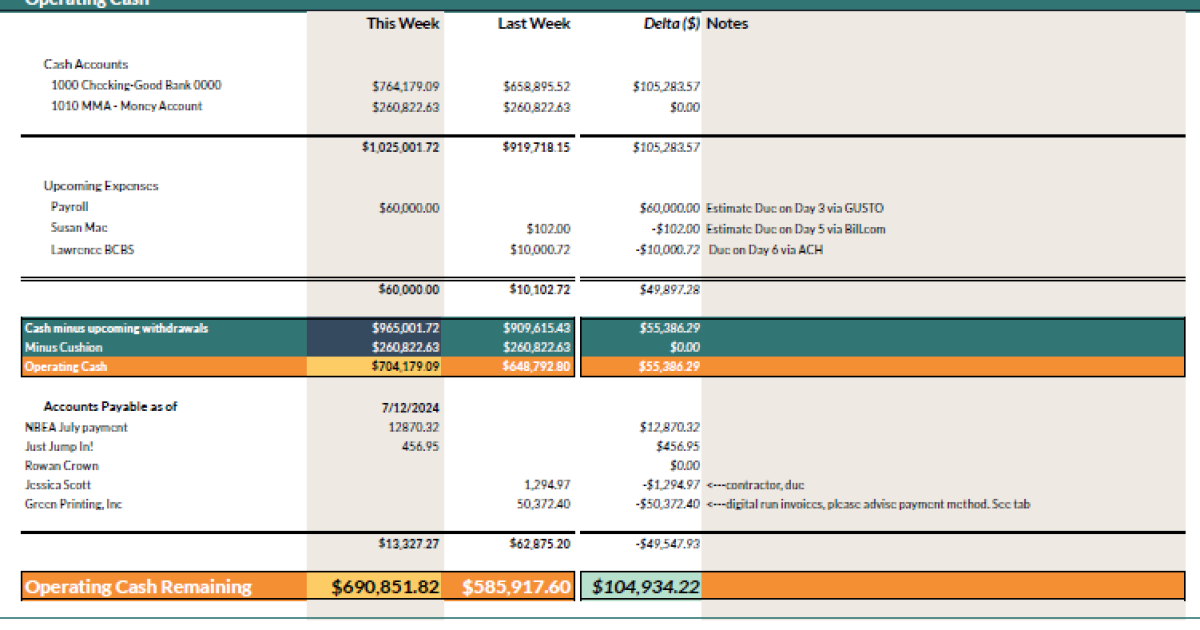

Checking in weekly, rather than monthly — this notion was envisioned when a client CEO said that he wanted to have a relaxing weekend and drink a beer knowing that he had the cash for the next week. Why isn’t the norm a report that considers both the operating cash now and upcoming expenses for the next seven days. Allowing CEOs everywhere to enjoy the weekend knowing that they will be covered for the coming week.

By providing cash flow reports weekly, the accountant and business owner are able to make strategic decisions because they have a pulse on the cash flow, accounts receivable, accounts payable, revenue and expenses each and every week. This near real-time view is the difference between overdrafting or adding new revenue streams. There is an opportunity for significant growth in revenue and profitability for clients utilizing weekly reports, including improvement of week-over-week cash balances, week-over week AR balances, and monthly progress through revenue forecasting and expense budget. Your clients will know where and who to go to if they need to make adjustments on a weekly basis.

Weekly reports can provide a clear snapshot of percentage of the month completed versus percentage of revenue and expense incurred. By tracking both revenue and expense progress weekly, leaders are able to engage their team to accommodate targets. For example, a business might be 30% of the way through the month but already 55% through their expense budget. The report can encourage action to readjust. In this case, one solution would be to freeze non-essential spending to preserve cash flow.

You can leverage the use of weekly reports for your own business development as well, including increasing revenue through upselling. Accounting professionals can differentiate your services in the marketplace by offering weekly reports and then taking more of an advisory role when working with clients to define what these snapshots mean for your clients’ businesses.

The companies that are currently putting this into practice have outperformed revenue targets and maintained their budgets with ease because they are gaming the results. When the leadership team is aware on a weekly basis of the cash position, percentage to revenue target, and aware of their spending compared to the expense budget, it keeps people motivated and able to make data driven decisions quickly.

Leveraging technology to automate reports

Weekly reports used to be avoided because of the time it would take to pull together and consolidate reports from different softwares, bank feeds, etc. But that is no longer the case. Automation means this can now be done in seconds.

That means you, as an accounting professional, can instead focus on interpretation and strategy, rather than time-consuming manual tasks. Furthermore, as AI and automation are able to seamlessly and quickly pull together reports, the ability of the accounting advisor to strategically interpret these reports is more important than ever.

It is critical that AI works with trusted human advisors who can advise clients using this information and guide them to make better decisions. The human advisor element turns numbers into action, reducing client anxiety over the math. Advisors can advise on exactly where the business is financially, on a weekly picture. No surprises.

Shifting the timing of monthly reports to weekly reports has the opportunity to change our industry. This strategic addition to typical accounting services elevates accounting professionals, bookkeepers, controllers and CFOs to further take a strategic and collaborative approach with their clients. The key component is utilizing the reported data and creating actionable insights for better business decisions. Clients may not always care to understand weekly cash flow, revenue and expense, but providing a snapshot, along with an advisor analysis, will provide insights that showcase a clear accounting picture for your clients.

Business owners aren’t able to make the best decisions if they are utilizing old, outdated information. Real-time accurate accounting is needed so companies can monitor cash flow, be timely with expected expenses and ensure they are reaching financial milestones.

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics7 days ago

Economics7 days ago

Finance1 week ago

Finance1 week ago

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance7 days ago

Personal Finance7 days ago

Economics1 week ago

Economics1 week ago