In just two weeks as Treasury chief, Scott Bessent has seen plenty of turbulence. The department became a target of Elon Musk’s crackdown on federal spending — triggering protests outside Bessent’s office — and investors are on edge over President Donald Trump’s unpredictable trade policies.

Yet in an interview with Bloomberg TV on Thursday, Bessent sought to telegraph a sense of normalcy — and of an administration that’s methodically pursuing its economic goals, including lower taxes and spending, and more balanced trade.

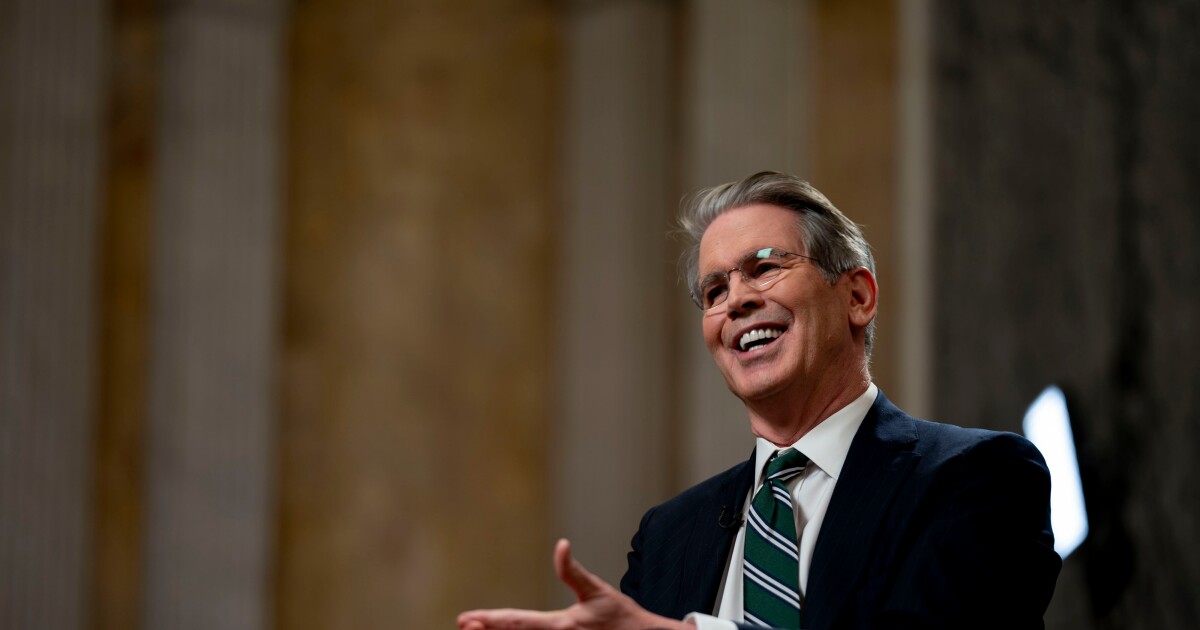

The new Treasury secretary has the kind of financial-market pedigree to run the department that Washington has seen countless times before, and is often used to project assurance. Sitting in the agency’s historic Cash Room, a few hundred yards from the White House, Bessent said America’s strong dollar policy is intact, promised not to preach to the Federal Reserve about interest rates, and insisted that the Treasury payments system — which Musk’s team has gained access to, in a move that shocked Washington — is safe.

“People shouldn’t be concerned. At Treasury, we move deliberately and we fix things,” Bessent said.

Behind the steady-as-she-goes surface, though, Bessent is part of an administration that aims to break sharply with the policies of its predecessors, both Democrat and Republican — and isn’t wasting time getting started.

The Treasury has been the early focus of the Department of Government Efficiency, the Musk-led effort to identify wasteful spending and modernize federal technology. Trillions of dollars of payments flow through the department every year, and DOGE’s access could give Musk visibility into sensitive information about taxpayers, beneficiaries, contractors and employees — one reason why it’s set off alarm bells.

Bessent said he’s “completely aligned” with Musk on a program that’s key to the administration’s broader economic target of lowering outlays. “There are gigantic cost savings for the American people here,” the Treasury chief said. “This is methodical and it is going to yield big savings.”

Bessent also dismissed concerns about outside personnel that DOGE has deployed to examine the sensitive payment systems. “These are highly trained professionals, this is not some roving band running around doing things,” he said.

DOGE departure

Just hours after Bessent spoke, news emerged that somewhat undercut the appearance of Bessent having full control. The Wall Street Journal reported that one of the key DOGE staffers granted access to Treasury payment systems had resigned, after he was linked to a social-media account that advocated for racism and eugenics. The Treasury didn’t immediately respond to a request for comment.

The Treasury civil servants emerging as potential obstacles to the DOGE campaign have been lauded for decades as competent and apolitical professionals — including by Steven Mnuchin, Trump’s Treasury chief from his first term. And Bessent sought to play down any concerns about politicization of the agency.

The DOGE investigation is “an operational review, it’s not an ideological review,” he said. “At Treasury, we move deliberately and we fix things. That’s the way we work. So everyone should know that all the payments are going to be made. They’re going to be in good order.”

The Treasury chief took a no-drama view of potentially disruptive shifts in other areas too, like currency and trade policies. He said the U.S. will continue to have a “strong dollar” policy under Trump, while keeping an eye on what trade partners are doing.

“What we don’t want is other countries to weaken their currencies, to manipulate their trade,” he said, adding that the accumulation of large trade surpluses by other countries like China shows “there is not a free-form trading system.”

Trump has vowed to use tariffs in order to rebalance trade — imposing new ones on China this week and threatening to do the same with Mexico and Canada, the two biggest U.S. trade partners. Bessent dismissed the idea that tariffs will be inflationary for the U.S., though he acknowledged there may be a “small, one-time price adjustment” as a consequence.

Bessent said he’s already held his first meeting with his Fed counterpart Jerome Powell — the chiefs of the two agencies typically meet regularly — and has no intention of telling him what to do, as Trump did many times during his last spell in the White House.

“Prospectively, monetary policy — I will not comment on, and I’m sure he’s going to do the right thing, so there’ll be no criticism,” Bessent said. The administration’s focus is not so much on Fed rates, he said, as on longer-term borrowing costs and “how do we get the whole curve down.”

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics6 days ago

Economics6 days ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Blog Post6 days ago

Blog Post6 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Finance6 days ago

Finance6 days ago