The American Institute of CPAs and the California Society of CPAs sent a joint comment letter to the California Air Resources Board asking for changes in...

In honor of Women’s History Month, I’ve taken time to reflect on my journey as a leader in the financial technology sector. Earlier in my career,...

The French government is deploying increasingly aggressive methods to uncover tax fraud, according to a lawyer who specializes in private wealth. “The administration has put in...

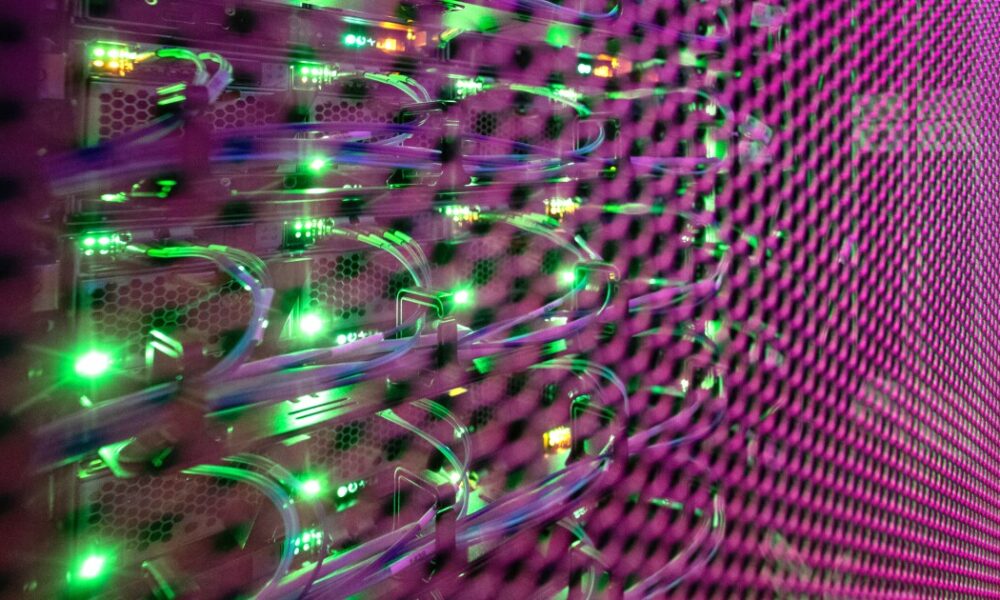

AI dreams are running into AI realities as companies that have adopted the technology report uneven gains, even in areas where there is improvement, the results...

Republican leaders say they are getting close to agreeing on a plan to pass an extension of President Donald Trump’s 2017 tax cuts and an increase...

Republican leaders say they are getting close to agreeing on a plan to pass an extension of President Donald Trump’s 2017 tax cuts and an increase...

Are private equity organizations knocking on the door of your firm? Have tech advancements helped reduce head count while increasing profitability? It may seem that growth...

The Internal Revenue Service has issued a chief counsel memorandum that offers guidance on who is eligible to take a theft loss deduction for scams. The...

Welcome to Tax Court; the subscription model; new blog on the block; and other highlights from our favorite tax bloggers. March madness Eide Bailly (https://www.eidebailly.com/taxblog): Favorite...

The American Institute of CPAs is asking the Treasury Department and the Internal Revenue Service for greater clarity on their proposed regulations for the SECURE 2.0...