The Treasury Department’s Financial Crimes Enforcement Network issued an interim final rule Friday removing the requirement under the Corporate Transparency Act for U.S. companies and people...

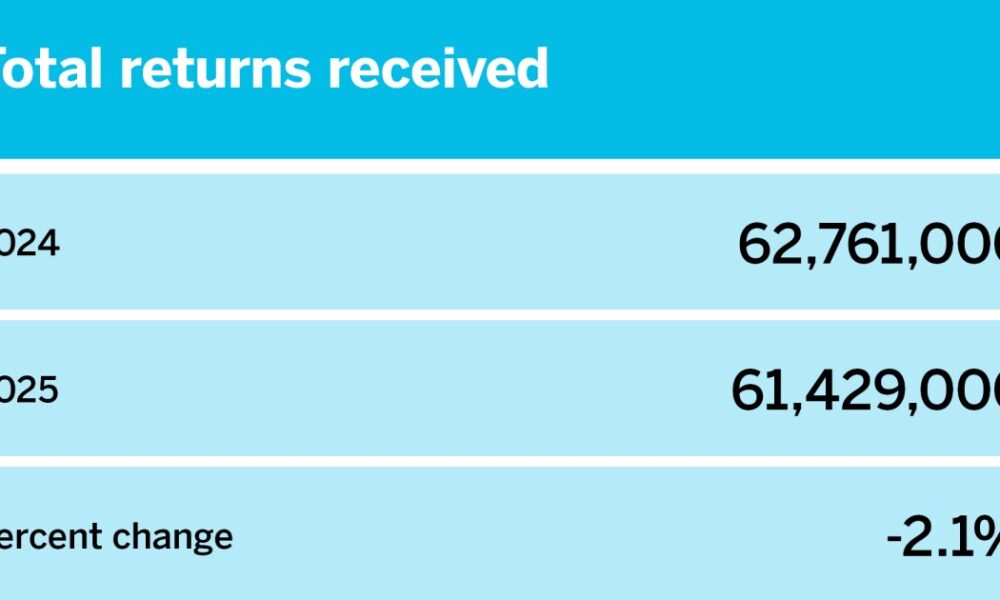

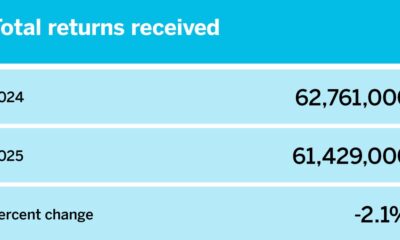

Enjoy complimentary access to top ideas and insights — selected by our editors. As tax season continues, data from the Internal Revenue Service reveal that fewer...

If artificial intelligence is eroding the base for the analytics-based transactional advisory work (see our feature story), what’s left? Where are the long-term, relationship-driven client-centric advisory...

Tax season is a busy time for financial advisors, but it also brings overlooked opportunities for client coaching on year-round tax savings and for future growth...

Considering that some are claiming that artificial intelligence could bring us biological immortality by 2030, it would not seem like a major leap for some to...

State-based job creation tax credit programs typically provide a tax credit against the state’s income tax liability. That credit may be passed through to a shareholder...

M&A is well known for its complexity, as it involves not just dollar and cent figures but also strategy, relationships, negotiations, judgment, and a thicket of...

The American Institute of CPAs’ Auditing Standards Board is looking for feedback on its proposed strategic plan for 2026-30, as it develops guidance in areas such...

Estate planning, like any advisory service in the accounting world, is concerned with dollars and cents. But, like other advisory areas relatively resistant to AI disruption,...

Artificial intelligence has brought new efficiency and productivity to the valuation field, particularly where it concerns data entry, processing and analysis, which is a major part...