THE FINAL election polls have been published, and in-person voting has yet to conclude. It is an anxious period, with little new information to parse about who might emerge victorious as America’s next president. But that is not stopping investors from placing, and adjusting, their bets. From prediction markets to bonds, they have more ways than ever to register their views about the likely outcome of the election. Most of their money is on Donald Trump, though his perceived lead over Kamala Harris has narrowed in the past few days.

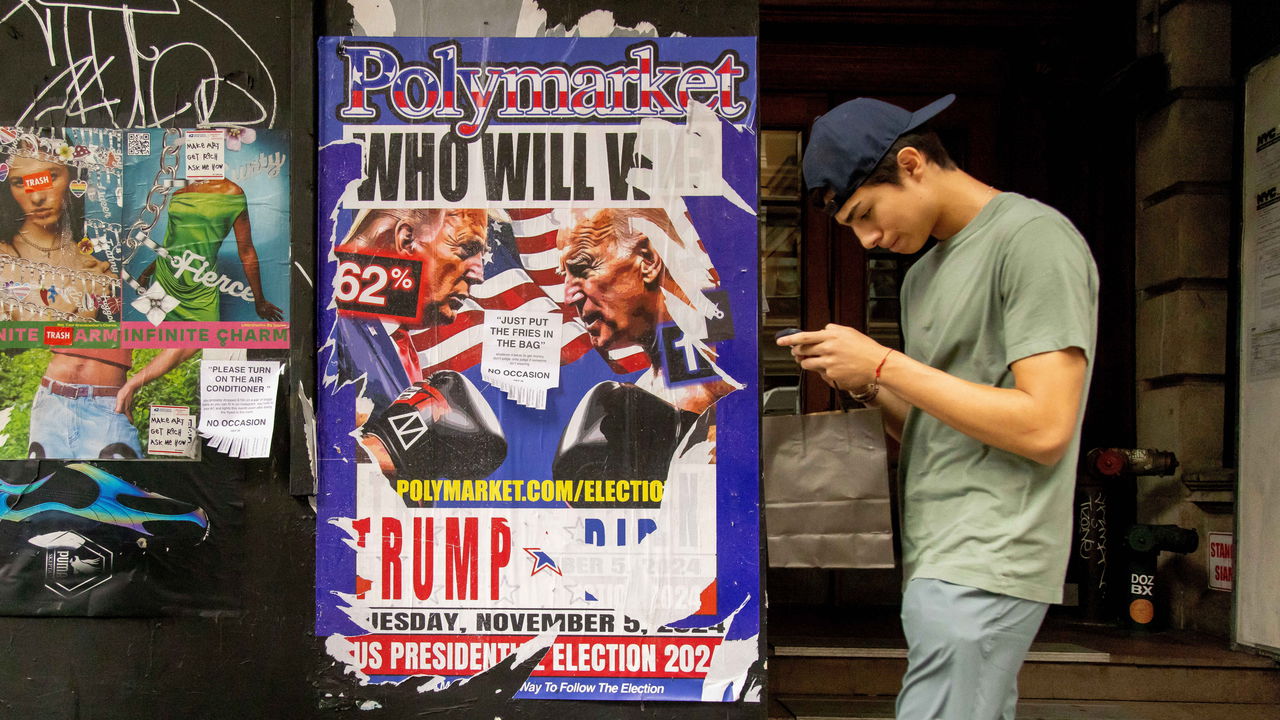

The easiest place to get a read on the thinking of punters is in election-betting markets. The three that get the most attention are Polymarket, Kalshi and PredictIt. Polymarket, a cryptocurrency-based platform that bills itself as the world’s biggest prediction market, gives Mr Trump a roughly 60% chance of winning the election, as of Monday afternoon in America. That is down from 67% last week, a shift that came after a few late polls—notably, the surprising Selzer poll in Iowa—were more positive for Ms Harris. But Polymarket has plenty of critics, with some arguing that its pricing is easily manipulated.

By contrast, PredictIt, the oldest of the three online betting markets, founded exactly a decade ago, has Ms Harris ahead by the slimmest of margins. But it is also the most limited of the platforms, by design, with strict caps on the number of bettors and the size of their bets. Kalshi, a regulated exchange, comes just about down the middle. It currently sees a 56% probability of victory for Mr Trump, down from 65% last week. In the immediate aftermath of the Selzer poll, Kalshi in fact briefly showed that Ms Harris was the favourite before shifting back in Mr Trump’s direction.

It may seem easy to dismiss these various platforms as silly betting arenas for punters, dominated by young men who spend many of their waking hours online. It is striking, however, that their pricing has closely mirrored “real money” in more established markets. To get a sense of how equity investors are positioned for the election, analysts at Piper Sandler, an investment bank, created two separate portfolios of stocks whose fortunes may rise or fall depending on the presidential victor. Their Trump portfolio features oil companies and weapons manufacturers, plus shorts on firms such as Apple that would be hurt by a trade war with China. Their Harris portfolio is heavy on producers of renewable energy and electric vehicles, while betting against financial firms and drug makers that may face more rules under Democrats.

The performance of the Piper Sandler portfolios lines up almost perfectly with the Polymarket odds. In October, as the betting markets turned against Ms Harris, the Trump portfolio gained about 3% and the Harris portfolio fell by 7%. But over the past week, that gap has closed. For instance, Geo Group, a prison operator in the Trump portfolio, has come under selling pressure, while First Solar, a solar-panel manufacturer in the Harris portfolio, has climbed higher. Citrini, a research firm, has yielded similar results with its Trump-aligned basket of stocks. It soared in July after Mr Trump survived an assassination attempt at a rally in Pennsylvania, tumbled when Ms Harris entered the race and recovered as she seemed to lose momentum. But on Monday, the first trading day after the Iowa poll, Citrini’s Trump basket was down by about 1.4% by the middle of the day.

Election predictions have also had an impact on much bigger, more diffuse markets. Yields on Treasuries and the dollar’s value have climbed over the past six weeks, in part because investors have been girding themselves for a Trump presidency. Their thinking is that his policies, including heftier federal deficits and higher tariffs, are likely to drive up both growth and inflation. Such a backdrop would, in theory, support the dollar and weigh on bond prices, leading to an upward drift in yields. But Monday brought a partial reversal of these trends, with small declines in both yields and the dollar—reflections of Ms Harris’s improved standing in the polls.

What to make of all this trading? One conclusion is that investors are a highly uncertain bunch. Polls have been neck and neck almost the entire race, even as the pricing of election-related trades has swung up and down.

Cutting through that volatility, a second conclusion is that investors have, fairly consistently, been more confident in Mr Trump’s chances than the polls themselves. The Economist’s model, based on polls and fundamental factors, rates the election as a true toss-up. Financial markets—from small-time punters on betting exchanges to the giant institutions that determine the prices of bonds—are closer to 55% in favour of Mr Trump. That is a coin flip but one clearly weighted against Ms Harris.■

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago