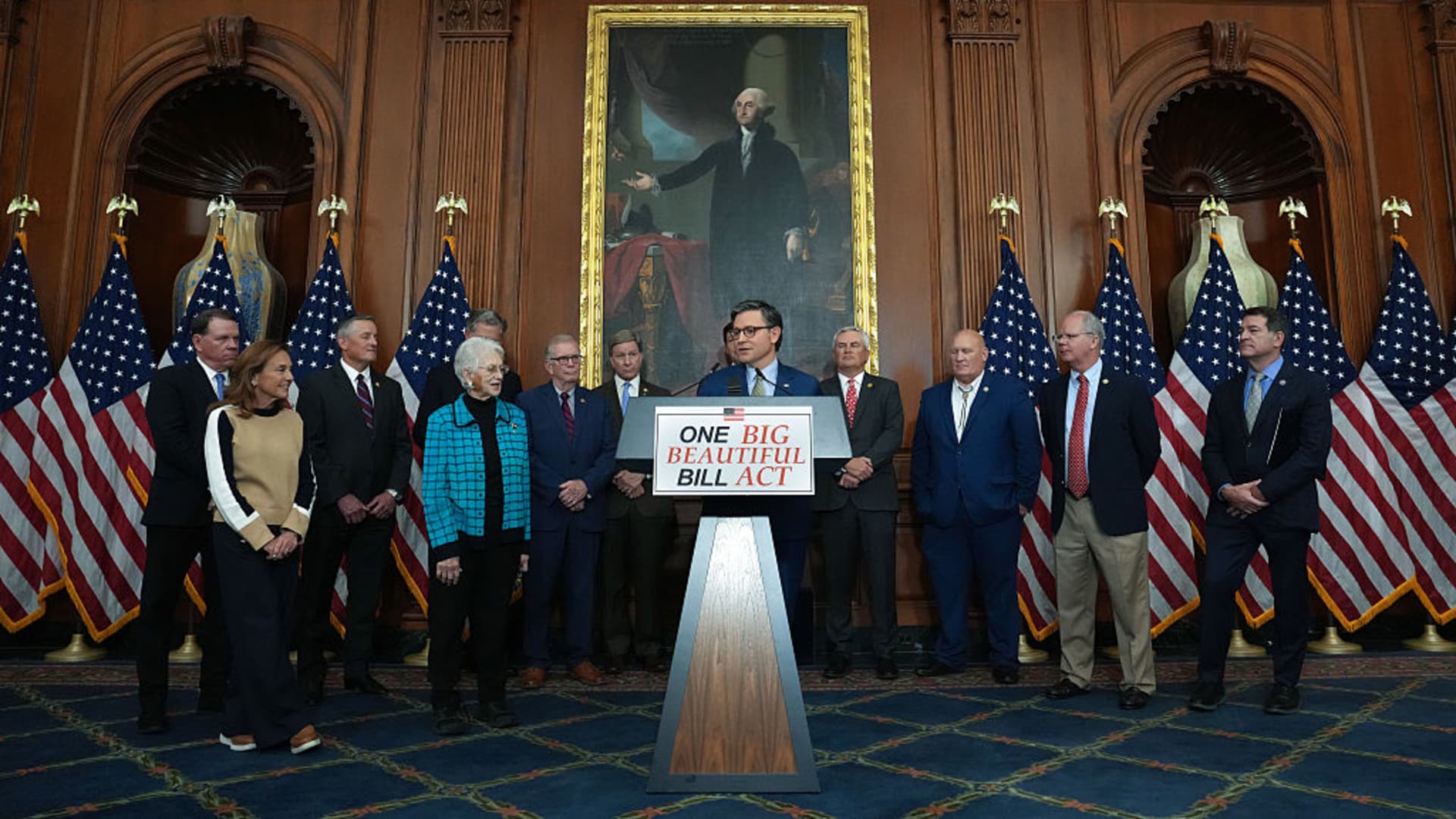

House Speaker Mike Johnson speaks to the media after the House narrowly passed a budget bill forwarding President Donald Trump’s agenda at the U.S. Capitol in Washington, May 22, 2025.

Kevin Dietsch | Getty Images

There’s a stark contrast between high-earners and low-income households in a sprawling legislative package House Republicans passed on Thursday.

The bulk of the financial benefits in the legislation — called the “One Big Beautiful Bill Act” — would flow to the wealthiest Americans, courtesy of tax-cutting measures like those for business owners, investors and homeowners in high-tax areas, experts said.

However, low earners would be worse off, they said. That’s largely because Republicans partially offset those tax cuts — estimated to cost about $4 trillion or more — with reductions to social safety net programs like Medicaid and the Supplemental Nutrition Assistance Program, or SNAP.

The tax and spending package now heads to the Senate, where it may face further changes.

‘It skews pretty heavily toward the wealthy’

The Congressional Budget Office, a nonpartisan federal scorekeeper, estimates income for the bottom tenth of households would fall by 2% in 2027 and by 4% in 2033 as a result of the bill’s changes.

By contrast, those in the top 10% would get an income boost from the legislation: 4% in 2027 and 2% in 2033, CBO found.

A Yale Budget Lab analysis found a similar dynamic.

The bottom fifth of households — who make less than $14,000 a year — would see their annual incomes fall about $800 in 2027, on average, Yale estimates.

The top 20% — who earn over $128,000 a year — would see theirs grow by $9,700, on average. The top 1% would gain $63,000.

The Yale and CBO analyses don’t account for last-minute changes to the House legislation, including stricter work requirements for Medicaid.

“It skews pretty heavily toward the wealthy,” said Ernie Tedeschi, director of economics at the Yale Budget Lab and former chief economist at the White House Council of Economic Advisers during the Biden administration.

The legislation compounds the regressive nature of the Trump administration’s recent tariff policies, economists said.

“If you incorporated the [Trump administration’s] hike in tariffs, this would be even more skewed against lower- and working-class families,” Tedeschi said.

Most bill tax cuts go to top-earning households

There are several reasons the House bill skews toward the wealthiest Americans, experts said.

Among them are more valuable tax breaks tied to business income, state and local taxes and the estate tax, experts said.

These tax breaks disproportionately flow to high earners, experts said. For example, the bottom 80% of earners would see no benefit from the House proposal to raise the SALT cap to $40,000 from the current $10,000, according to the Tax Foundation.

More from Personal Finance:

Tax bill includes $1,000 baby bonus in ‘Trump Accounts’

House bill boosts maximum child tax credit to $2,500

Food stamps face ‘biggest cut in the program’s history’

The bill also preserves a lower top tax rate, at 37%, set by the 2017 Tax Cuts and Jobs Act, which would have expired at the end of the year.

It kept a tax break intact that allows investors to shield their capital gains from tax by funneling money into “opportunity zones.”

Trump’s 2017 tax law created that tax break, aiming to incentivize investment in lower-income areas designated by state governors. Taxpayers with capital gains are “highly concentrated” among the wealthy, according to the Tax Policy Center.

All told, 60% of the bill’s tax cuts would go to the top 20% of households and more than a third would go to those making $460,000 or more, according to the Tax Policy Center.

“The variation among income groups is striking,” the analysis said.

Why many low earners are worse off

That said, more than eight in 10 households overall would get a tax cut in 2026 if the bill is enacted, the Tax Policy Center found.

Lower earners get various tax benefits from a higher standard deduction and temporarily enhanced child tax credit, and tax breaks tied to tip income and car loan interest, for example, experts said.

However, some of those benefits may not be as valuable as at first glance, experts said. For example, roughly one-third of tipped workers don’t pay federal income tax, Tedeschi said. They wouldn’t benefit from the proposed tax break on tips — it’s structured as a tax deduction, which doesn’t benefit households without tax liability, he said.

Meanwhile, lower-income households, which rely more on federal safety net programs, would see cuts to Medicaid, SNAP (formerly known as food stamps), and benefits linked to student loans and Affordable Care Act premiums, said Kent Smetters, an economist and faculty director at the Penn Wharton Budget Model.

The House bill would, for example, impose work requirements for Medicaid and SNAP beneficiaries. Total federal spending on those programs would fall by about $700 billion and $267 billion, respectively, through 2034, according to the Congressional Budget Office analysis.

That said, “if you are low income and don’t get SNAP, Medicaid or ACA premium support, you will be slightly better off,” Smetters said.

Some high earners would pay more in tax

In a sense, it may not be surprising most tax benefits accrue to the wealthy.

The U.S. has among the most progressive tax systems in the developed world, Smetters said.

The top 10% of households pay about 70% of all federal taxes, he said. Such households would get about 65% of the total value of the legislation, according to a Penn Wharton analysis published Monday.

A subset of high earners — 17% of the top 1% of households, who earn at least $1.1 million a year — would actually pay more in tax, according to the Tax Policy Center.

“In part this is due to limits on the ability of some pass-through businesses to fully deduct their state and local taxes and a limit on all deductions for top-bracket households,” wrote Howard Gleckman, senior fellow at the Tax Policy Center.

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics6 days ago

Economics6 days ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Blog Post6 days ago

Blog Post6 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Finance6 days ago

Finance6 days ago