Auditing & Assurance

How Technology Will Optimize – Not Replace – The Role of Accountants

Published

1 month agoon

By Irana Wasti.

The adoption of a new product or technology tends to follow a familiar cycle.

First, there is skepticism about whether it will live up to the hype. A few proven use cases later, people are talking about whether it will enhance or upend their professional lives. Before we reach the final stage where the technology is widely adopted, we pass through a period of uncertainty, where we wonder if this technology will be too helpful — to the point of being a threat to job security.

Generative AI programs like ChatGPT are a hot topic across all industries — and the accounting industry is no different. A 2023 Thomson Reuters study found that 52% of surveyed accounting firms believe generative AI should be used for tax, accounting and audit work.

On the technology adoption scale, this places the accounting industry somewhere between uncertainty and adoption: accountants can see the value that generative AI may offer, but we’re also hearing that some have real concerns these tools will become their clients’ new go-to source for accurate information and insights.

In my role at BILL, I spend a lot of time listening and talking to small and midsize businesses (SMBs) and accountants about how trends like AI are impacting them. Here are some key takeaways to help accountants understand where they sit on the AI adoption scale.

A Refresher on Basic Automation Tools

Many accountants will be familiar with automation tools that help to complete repetitive, manual processes and workflows. Basic automation tools are completing specific, defined tasks with stated parameters. One simple, universal example: if your firm records a meeting, automation tools may be used to automatically generate a transcript. For accountants, a more specific example would be using software to transfer information from invoices into the accounting console or an internal spreadsheet.

Another example is merging data from different sources or reconciling data from one period to another. These solutions tend to be easily scalable and have a low adoption barrier due to their clearly defined functions. And the necessary controls – i.e., needing to be deployed manually — provides peace of mind for accounting firms that the tools they deploy will not run amok.

For an example of how automation benefits accounting firms in real time, look no further than California-based firm Chaney & Associates. Thanks to efficiencies made possible by the AI-powered automated tools in BILL’s Spend and Expense solution, Chaney & Associates is able to serve 1,100 clients with a team of 17 employees. By automating manual processes and instead focusing on high-value client services, the firm has seen a spike in income.

Making Automation Even More Powerful With AI

Automation is so much more than manual data processes or workflows though. With the help of AI, automation tools and software can analyze increasingly large (and, in some cases, increasingly broad) sets of data to provide valuable insights and predictions.

Standard or non-generative AI refers to AI solutions that analyze and make predictions based on existing data. The use of existing information is what differentiates standard AI solutions from generative AI, which is generating new information based on whatever prompts the user inputs.

Both standard and generative AI solutions can help enable firms to transform traditional processes and stay competitive. This is especially important as the accounting industry continues to innovate and the role of an accountant evolves beyond simply completing tasks to also include providing high-level strategic analysis and recommendations.

The great news is that, in many cases, firms don’t have to go searching for new AI solutions — this technology is often built into the tools they are already using. On the BILL platform, for example, AI is used to automate tedious portions of the accounts payable process, like extracting data from invoices and separating multiple invoices into individual bills.

AI’s abilities to identify complex patterns and trends can provide enhanced analysis of large amounts of data. But while it is true that computers can crunch numbers at a faster rate than the human brain ever could, accountants needn’t be worried that these solutions will put them out of a job. Accountants are still essential for providing nuance and expertise that translates data into better insights and more informed decision-making for clients.

The human element of the client/accountant relationship is – and will remain – one of the most important components of a successful firm.

Where to Start

While AI solutions can provide time savings and cost reduction for accounting firms, adopting these tools requires a shift in mindset and some upskilling. Firms should consider the skillsets of their existing employees when deciding which tools to implement and develop thorough change management plans centered around their employees and their clients.

In addition to employee training, data integrity is also essential to a well-functioning AI or automation solution. This technology can only be as good as the data they are working with, making this another area where human oversight cannot be replaced. Firms need to review the quantity and quality of their available data to ensure enough information is available for any tech solution to do its work to the best of its ability.

What Comes Next?

As the accounting profession accelerates toward a more digital future, firms that want to remain competitive will figure out how best to employ the resources they have to increase efficiency and maximize employee productivity.

This does not mean jumping in headfirst without a plan. Instead, firms should ensure the right processes and procedures are in place to safeguard their businesses and their clients. But at the end of the day, these tools exist to aid in day-to-day operations. When work is more efficient, and clients can be provided with a higher level of service, everyone wins.

AI is most useful when paired with the knowledge and expertise of accounting professionals, helping to increase efficiency and provide employees with the bandwidth to do higher value work. And for firms that are still wary about generative AI, there are other tools, like automation and standard, non-generative AI, that could make your day-to-day operations more efficient.

At a time when accounting firms are laser-focused on growth and also dealing with continued staffing shortages, this technology – which is already built into the financial automation software you use every day – can play a huge role to fill some of these resource gaps and help accountants keep up with a growing workload.

====

Irana Wasti is Chief Product Officer at BILL.

You may like

Auditing & Assurance

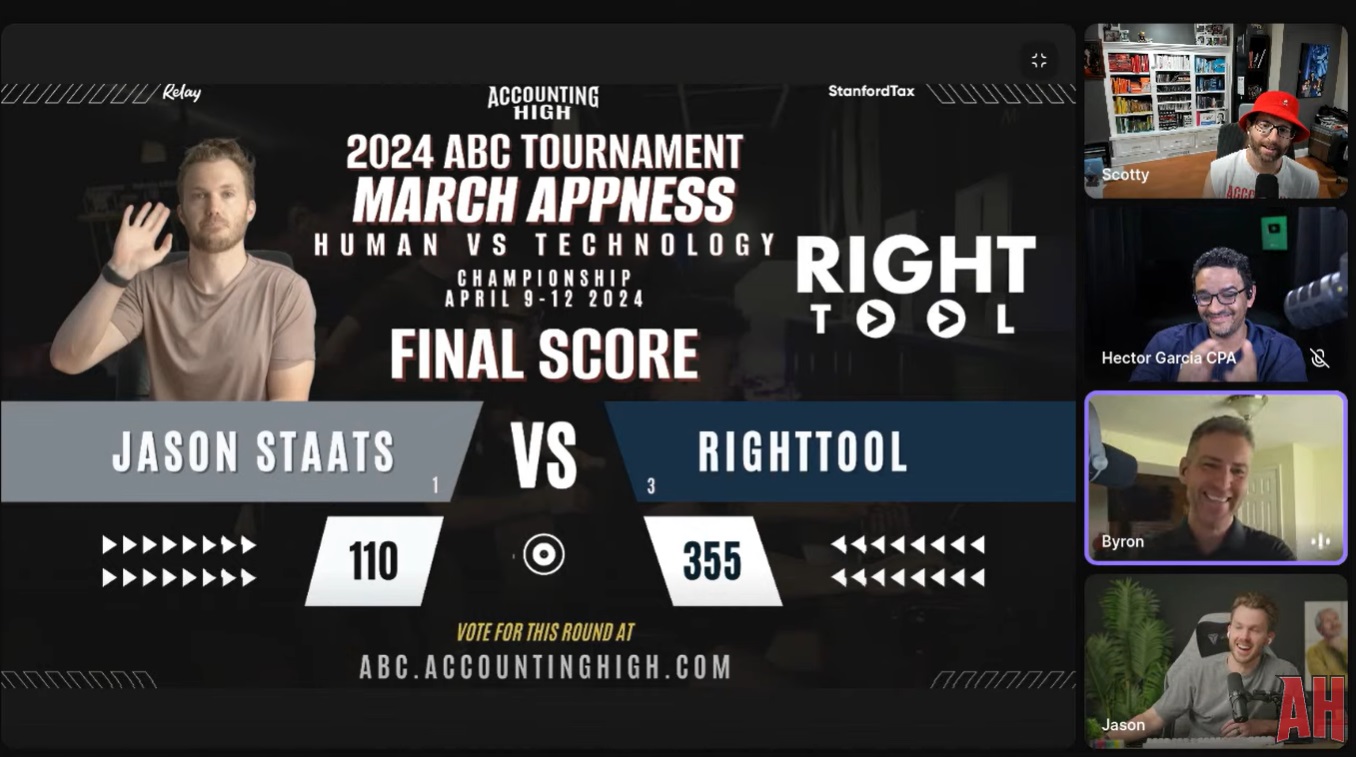

RightTool Wins 2024 Accountant Bracket Challenge

Published

1 month agoon

April 12, 2024

QuickBooks automation tool RightTool is the champion of the 2024 Accountant Bracket Challenge, presented by Accounting High, as the 3 seed defeated 1 seed CPA Jason Staats, host of the Jason Daily podcast, by a score of 355 votes to 110 votes in the final.

“To everybody in the RightTool Facebook community and all the RightTool users, all of you came together and helped us get the most votes, so I wanted to thank you guys for being the best community in the industry, in my opinion,” said Hector Garcia, CPA, co-founder of RightTool, during the championship final show, which was streamed by Accounting High on YouTube and LinkedIn earlier this afternoon.

RightTool joins accounting and bookkeeping app Uncat as winners of the ABC Tournament. In the inaugural Accountant Bracket Challenge last year, Uncat defeated Staats 339-190 in the championship match.

“I think what we’ve learned is … machines win,” Staats said about his consecutive losses in the tournament final. “We thought that would be down the road, but it’s happening.”

A grand total of 36,831 votes were cast during the three-week tournament.

“This has been so much fun. It only works if other people participate and pay attention and have fun, so thank you to the 1,806 ‘students’ who participated,” said Scott Scarano, an accounting firm owner who founded Accounting High, a community for forward-thinking accountants.

He added that the tournament will return next year, with some tweaks to make it better.

Dana Hull

Bloomberg News

(TNS)

Tesla Inc. plans to unveil its long-promised robotaxi later this year as the electric carmaker struggles with weak sales and competition from cheap Chinese EVs.

Chief Executive Officer Elon Musk posted Friday on X, his social media site, that Tesla’s robotaxi will be unveiled on Aug. 8.

Shares gained as much as 5.1% in postmarket trading in New York. Tesla’s stock has fallen 34% this year through Friday’s close. Shortly before Musk posted the news about the robotaxi, he lost the title of third-richest person in the works to Mark Zuckerberg, CEO of Meta Platforms Inc.

A fully autonomous vehicle, pitched to investors in 2019, has long been key to Tesla’s lofty valuation. In recent weeks, Tesla has rolled out the latest version of the driver-assistance software that it markets as FSD, or Full Self-Driving, to consumers.

The company has said that its next-generation vehicle platform will include both a cheaper car and a dedicated robotaxi. Though the company has teased both, it has yet to unveil prototypes of either. Musk’s Friday tweet indicates that the robotaxi is taking priority over the cheaper car, though both will be designed on the same platform.

Reuters reported earlier Friday that the carmaker had called off plans for the less-expensive vehicle and was shifting more resources toward trying to bring a robotaxi to market. Musk responded by saying “Reuters is lying,” without offering specifics.

Tesla also produced 46,561 more vehicles than it delivered in the first quarter, which has forced it to slash prices. U.S. consumers have been turning away from more expensive EVs in favor of hybrid models, causing many manufacturers to rethink pushes to electrify their fleets.

Splashy product announcements by Musk have always been a key part of Tesla’s ability to gin up enthusiasm among customers and investors without spending on traditional advertising. They don’t always work: the company unveiled the Cybertruck to enormous fanfare in November 2019, but production was delayed for years and the ramp up of that vehicle has been slow.

___

(With assistance from Catherine Larkin.)

Retail sales grew at a steady pace in March, according to the CNBC/NRF Retail Monitor, powered by Affinity Solutions, released today by the National Retail Federation.

“As inflation for goods levels off, March’s data demonstrates steady spending by value-focused consumers who continue to benefit from a strong labor market and real wage gains,” NRF President and CEO Matthew Shay said. “In this highly competitive market, retailers are having to keep prices as low as possible to meet the demand of consumers looking to stretch their family budgets.”

Total retail sales, excluding automobiles and gasoline, were up 0.36% seasonally adjusted month over month and up 2.72% unadjusted year over year in March, according to the Retail Monitor. That compared with increases of 0.4% month over month and 2.7% year over year in February, based on the first 28 days in February.

The Retail Monitor calculation of core retail sales – excluding restaurants in addition to automobiles and gasoline – was up 0.23% month over month and up 2.92% year over year in March. That compared with increases of 0.27% month over month and 2.99% year over year in February, based on the first 28 days in February.

For the first quarter, total retail sales were up 2.65% year over year and core sales were up 3.12%.

This is the sixth month that the Retail Monitor, which was launched in November, has provided data on monthly retail sales. Unlike survey-based numbers collected by the Census Bureau, the Retail Monitor uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions and does not need to be revised monthly or annually.

March sales were up in six out of nine retail categories on a yearly basis, led by online sales, sporting goods stores and health and personal care stores, and up in five categories on a monthly basis. Specifics from key sectors include:

- Online and other non-store sales were up 2.48% month over month seasonally adjusted and up 15.47% year over year unadjusted.

- Sporting goods, hobby, music and book stores were up 0.86% month over month seasonally adjusted and up 8.33% year over year unadjusted.

- Health and personal care stores were up 0.03% month over month seasonally adjusted and up 4.5% year over year unadjusted.

- Grocery and beverage stores were up 1.17% month over month and up 4.22% year over year unadjusted.

- General merchandise stores were up 0.13% month over month seasonally adjusted and up 3.38% year over year unadjusted.

- Clothing and accessories stores were down 0.01% month over month and up 2.13% year over year unadjusted.

- Building and garden supply stores were down 2.13% month over month and down 3.97% year over year unadjusted.

- Furniture and home furnishings stores were down 1.46% month over month seasonally adjusted and down 5.28% year over year unadjusted.

- Electronics and appliance stores were down 2.27% month over month seasonally adjusted and down 5.92% year over year unadjusted.

To learn more, visit nrf.com/nrf/cnbc-retail-monitor.

As the leading authority and voice for the retail industry, NRF provides data on retail sales each month and also forecasts annual retail sales and spending for key periods such as the holiday season each year.

Betting on the Kentucky Derby? Here’s how to think like a professional handicapper.

Warren Buffett says Greg Abel will make Berkshire Hathaway investing decisions when he’s gone

EV makers win 2-year extension to qualify for tax credits

Are American progressives making themselves sad?

‘Best Firms for Tech’ 2024 deadline extended to April 10