Accounting

PCAOB chair Erica Williams defends audit regulator amid possible SEC takeover

Published

3 weeks agoon

Public Company Accounting Oversight Board chair Erica Williams told Accounting Today that the role played by the PCAOB can’t simply be “cut and pasted” into the Securities and Exchange Commission after the House Financial Services Committee

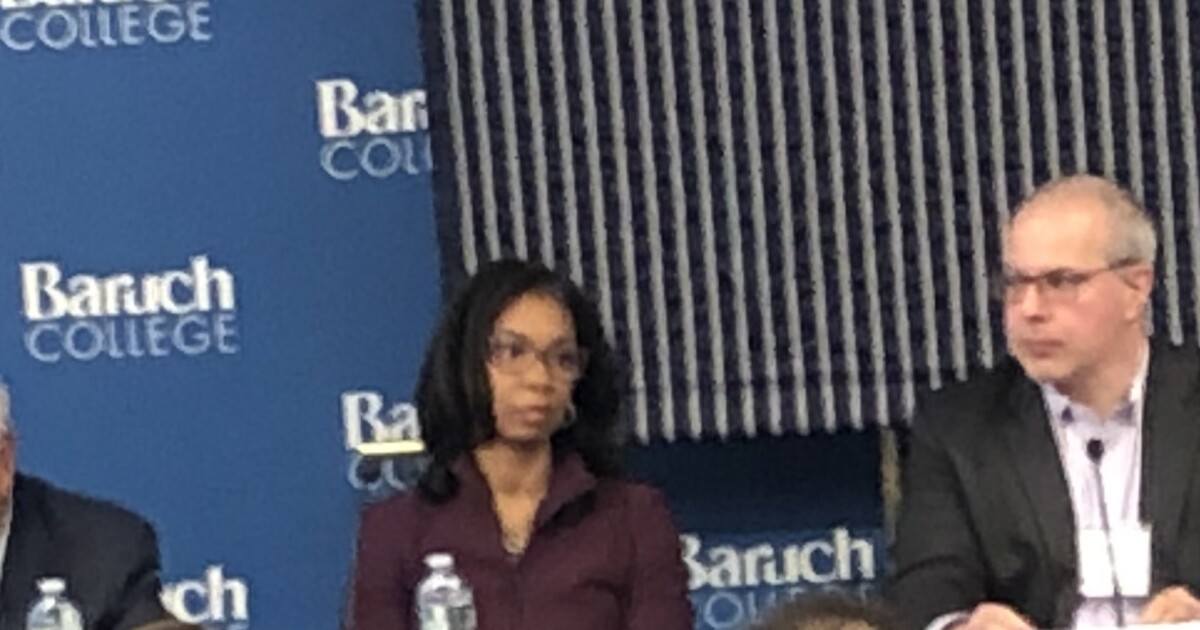

Speaking on the sidelines of Baruch College’s annual financial reporting conference in New York on Thursday, the day after Republicans on the committee voted Wednesday night to advance the bill, Williams declined to speculate on what would happen in the event of a

She noted that the PCAOB has provided technical assistance to the committee’s ranking member Rep. Maxine Waters, D-California, and would be happy to provide any additional technical assistance.Williams pointed to the agreements the PCAOB has with audit regulators around the world to do inspections, and its hard-won efforts to secure access to inspect auditing firms in China. She noted during a speech Wednesday at a meeting of the PCAOB’s Investor Advisory Group that those agreements are

“I don’t know if they’d be able to renegotiate it, but in order to be able to inspect and investigate completely there, as required by the HFCAA, they would need to have a new statement of protocol,” Williams replied. “History tells us that in times when the economy is tight, this is what companies do, so if there is a period of time when no one is watching, that’s when investors will be put at risk.”

The SEC is taking a friendlier stance toward the cryptocurrency industry,

Williams was asked about enforcement of audits of crypto companies.

“To the extent that companies are public companies with investors, we absolutely have been focused on the inspections of public companies who have involvement in cryptocurrency,” Williams replied. “That’s one of the areas of focus in our inspection reports, and we also have staff that are really expert in that area and happy to provide that expertise out there. But in general, what I can say is our staff is the most talented, dedicated, qualified folks. I worked with the SEC for more than 11 years. They are very expert in what they do and very different in what they do.”

She was asked about the possibility of people from the PCAOB being transferred over to the SEC.

“I think they would need to take on hundreds of new staff who have the qualifications to do these types of inspections that we do,” said Williams. “Every single member of the PCAOB that was critical to us being able to deliver on our investor protection.”

She pointed out there is currently a shortage of accountants. Williams was also asked about the standards that are currently on hold at the PCAOB, such as

“I can’t speculate on what might happen with the standards, but of course, in order for our standards to be implemented, they have to be approved by the SEC, so we want to make sure we’re aligned, and I need to have a discussion with Chairman Atkins, which I anticipate will happen to make sure that we’re aligned in those areas,” she said.

Asked about the possibility of the PCAOB operating as a subsidiary of the SEC, Williams replied, “That would be up to Congress.”

The legislation is expected to become part of the massive tax and budget reconciliation bill that is currently working its way through Congress, and would take effect in a year after enactment. Williams was asked about the possibility of alterations in the bill before it’s passed, but she declined to speculate on what might happen. “There’s a lot of uncertainty and a lot of questions that need to be answered,” she noted.

The proposal to fold the PCAOB into the SEC was among the ideas that were part of the Heritage Foundation’s Project 2025 plans for the Trump administration, but the legislation seemed to emerge just in the last few days and took many observers by surprise at how quickly it moved. Williams was asked if she had much advance warning about the bill.

“We weren’t asked about technical assistance,” she replied. “But what I can say is, our work protecting investors doesn’t stop. So we have inspectors all around the world conducting inspections. We have people who are doing enforcement investigations. We have folks who are helping to make sure that firms are prepared to implement our standards, quality control and others. So our work and our focus is really on our mission, and that’s what we’re continuing here. “

Williams also touched on Wednesday night’s vote during her speech at the Baruch College conference.

“I am deeply troubled by legislation passed by the House Financial Services Committee that proposes to eliminate the PCAOB as we know it,” she said. “The integrity of our markets is not inevitable. It takes vigilance to guard against negligence, recklessness, and fraud that threaten our system and the people who depend on it. The PCAOB plays a vital role in that effort — a role our talented and dedicated staff have developed over decades, building unique experience and expertise that cannot be simply cut and pasted elsewhere without significant risk to investors at a time when markets are already volatile, and investors have so much to lose.”

On an earlier panel featuring officials from the Securities and Exchange Commission and the Financial Accounting Standards Board, moderator Norman Strauss of Baruch College’s Zicklin School of Business asked about the impact of the legislation. SEC acting chief accountant Ryan Wolfe declined to comment specifically on the legislation other than to say he was aware of it, but added, “What I can say, with respect to the FASB issue, is just re-emphasizing the importance of an independent standard-setter. … We’re interested in supporting that in any way that we can. It’s obviously critical to the financial reporting ecosystem.”

“We’ve been around for a little over 50 years, and one thing I think we’ve certainly benefited from is we have a pretty narrowly focused mission: it’s financial accounting,” said FASB chair Richard Jones. “But while independent standard-setting is important, I sometimes worry about that term, because independence doesn’t mean us being unaccountable. We’re accountable to our stakeholders, and we earn the right to set standards by the standards we set.”

You may like

Accounting

House tax bill includes provision eliminating PCAOB

Published

12 hours agoon

May 22, 2025

The far-reaching tax legislation that passed early Thursday morning in the House included a provision that would transfer the responsibilities of the Public Company Accounting Oversight Board to the Securities and Exchange Commission, effectively eliminating the PCAOB.

The House Financial Services Committee

PCAOB chair Erica Williams has been

“Like many of you, I am deeply troubled by legislation being considered in Congress to eliminate the PCAOB as we know it,” she said. “This policy idea is not new. It has been around for decades, since the PCAOB was first created in response to Enron, WorldCom and the other accounting scandals of the early 2000s that left devastation in their wake. In the more than 20 years since, the PCAOB, led by its expert staff, has made invaluable contributions to the safety and security of U.S. capital markets. Investors are better protected because of the PCAOB. Audit quality has improved because of the PCAOB.”

Williams pointed out that she used to work for the SEC and is familiar with the agency. “The SEC was my professional home for 11 years,” she said. “I have deep admiration and respect for the incredible professional staff there. They are excellent at what they do. It is different from what we do here at the PCAOB. The unique experience and expertise built up by the PCAOB over decades cannot simply be cut and pasted without significant risk to investors at a time when markets are already volatile.”

She noted that the PCAOB has specific agreements with other audit regulators in countries around the world. “Getting an inspections program off the ground alone would take years,” she said. “It would require hiring hundreds of experienced inspectors and renegotiating agreements around the world, including in China, wasting time and money all while creating significant risk of fraud slipping through the cracks while no one is looking. Not to mention the disruption to enforcement around the world and potential loss of unmatched expertise built by [PCAOB chief auditor Barbara Vanich] and her team at a time when firms are relying on their support to implement new standards.I have said this before, and I will say it again any chance I get: every member of the PCAOB team plays a critical role in executing our mission of protecting investors on U.S. markets. And they are irreplaceable.”

SEC chairman Paul Atkins said at a conference this week that the SEC would be able to take over the tasks over the PCAOB, but would need the extra funding and staff provided under the bill.

“Congress outsourced those tasks to the PCAOB, and it’s up to Congress to decide where they should be housed,” he told reporters, according to

The SEC might also need to bring over staff from the PCAOB with the necessary experience. Atkins said under the bill “we could get the people who are at the PCAOB and be able to consolidate.”

However, a group of former PCAOB officials doubts the SEC could quickly take up those responsibilities and wrote a letter to the House committee, saying, “We are skeptical that the SEC could replicate the PCAOB’s expertise and infrastructure with similar positive results.”

The American Institute of CPAs has been

The AICPA had set auditing standards for public companies until the passage of the Sarbanes-Oxley Act of 2002 created the PCAOB in 2003 and still sets many assurance and attestation standards for private companies. The PCAOB has been working to update many of the older auditing standards it inherited from the AICPA, and former SEC chair Gary Gensler had

Cycles are nothing new in the world of white-collar enforcement, which often impact the perceived importance of corporate governance processes. However, as we say in my other home country, “plus ça change, moins ça change” (the more things change, the more they stay the same!)

Rules tighten in the aftermath of scandal or financial crisis, then loosen in the name of relaxing regulations that stifle innovation, economic growth or administrative priority shifts. Regulatory enforcement intensity waxes and wanes, but the importance of appropriate governance and controls remains critical to corporate well-being.

We now appear to be entering another familiar enforcement phase: a pullback in domestic focus, deeper scrutiny on specific areas, a lighter touch on corporate accountability and greater attention on foreign actors. While this is certainly not unprecedented, this environment raises important questions and challenges about corporate behavior, compliance resilience and the long-term risks of a less stringent enforcement environment.

Like a pandemic, fraud spreads silently at first — thriving in weak systems, exploiting human vulnerabilities and multiplying rapidly before anyone realizes the true scale of the contagion. Just as the Enron and WorldCom scandals

Where the risk may surface first

Certain sectors are especially vulnerable in this type of environment. As well as the more traditionally targeted industries, new areas like crypto and digital assets, which continue to develop ahead of clear regulatory frameworks, are particularly at risk. While high-profile prosecutions have taken place, certain new industry participants still operate in a regulatory gray zone, and investors lack many of the protections common in more mature financial markets.

Often overlooked, environmental claims also deserve attention. If enforcement around environmental disclosures and emissions standards weakens, it could create incentives for companies to exaggerate sustainability efforts or underreport risk. These actions often don’t attract immediate scrutiny — but they can lead to significant liability down the line.

Opportunity: The return of the light-touch era?

Recent developments suggest a clear change in tone from federal regulators. Penalties are being moderated in some cases, deferred prosecution agreements seem to have less teeth, and monitoring remedies may be refocused. While enforcement has not disappeared — nor is it likely to — its domestic focus appears to be narrowing. At the same time, there’s greater emphasis on foreign companies and overseas corruption and there are signals that

For today’s financial and compliance leaders — many of whom may not have been in senior roles during prior enforcement waves — this could seem like a reprieve. But it may also create blind spots. When rules seem less urgent or enforcement risk feels more distant, some organizations deprioritize the very controls and practices that help them navigate.

The past reminds us that such lulls can create fertile ground for misconduct, especially if companies start to believe that scrutiny is less likely, or consequences will be delayed.

Here’s a simple equation: Economic Pressure + Relaxed Oversight = Increased Fraud Risk.

At the same time, macroeconomic signals point to uncertainty. If economic headwinds intensify — especially with recessionary concerns, uncertainty around tariffs, extended and disrupted supply chains leading to margin compression — companies may feel increasing pressure to meet or maintain performance expectations. In such a climate, the line between aggressive accounting and earnings manipulation can start to blur and the need to gain market share may lead to bribes, among other malfeasance.

Misconduct in these environments rarely becomes visible right away. It builds quietly over time, often uncovered only years later during internal audits, in the aftermath of bankruptcies when performance was stretched to the breaking point, in the case of restatements, or as a result of a whistleblower. The risk may not be immediately visible — but it is cumulative and real.

The guardrails that remain

That said, several key safeguards are still intact — offering a measure of counterbalance even as federal enforcement evolves:

- International enforcement continues to expand. Regulators abroad are increasingly assertive, particularly in Europe and Asia. U.S.-based companies operating globally are still subject to foreign anti-corruption laws and cross-border cooperation among authorities is increasing.

- Domestically, state attorney generals can fill some of the gaps.

Many AGs have a long history of stepping in — particularly in areas like health care fraud, consumer protection and investor rights. But these offices may lack the scale, budget and investigative horsepower of federal agencies. - Federal action continues in targeted areas. Enforcement efforts remain active in sectors like health care, particularly in cases involving government reimbursement fraud or improper billing practices. These cases suggest that federal oversight has not disappeared — just narrowed in focus.

- Auditing standards are as demanding as ever. Despite other regulatory changes, public company auditors remain under pressure to detect fraud and report weaknesses. Regulatory expectations in this area have not been relaxed, and auditors are increasingly expected to identify red flags in financial statements.

- Private litigation remains a meaningful deterrent. Shareholder lawsuits and class actions continue to hold companies accountable when disclosures fall short or risks are misrepresented. This legal pressure — driven by investors and plaintiffs’ attorneys rather than government — operates independently of political cycles.

- Whistleblowers are still protected and can be highly incentivized. Tipsters have played a key role in uncovering many recent frauds, and protections for whistleblowers remain strong. In a lower-enforcement climate, their role becomes even more important.

Compliance programs: Relevance beyond enforcement

Many organizations have made real strides in strengthening internal compliance programs over the past decade — driven by regulatory pressure, investor expectations and reputational concerns. Even in a less stringent enforcement environment, these investments remain vital.

First, reputational risk and public accountability haven’t faded. In fact, social media and stakeholder activism make it easier than ever for ethical lapses to attract attention — even without government involvement.

Second, mergers and acquisitions continue to present risk. Acquiring entities are often held responsible for inherited compliance failures. Robust internal controls, due diligence and risk assessments are essential for identifying hidden liabilities before they become public problems.

Finally, even in the absence of immediate enforcement, forward-thinking organizations understand that compliance isn’t just about staying out of trouble. It’s about building sustainable operations, maintaining trust with stakeholders, establishing a reputation of integrity and anticipating risk — not reacting to it.

A moment to be proactive

As enforcement priorities shift, the temptation to loosen internal controls or scale back compliance efforts and investments may be tempting. But this moment is not one for complacency. If history is any guide (and it usually is), misconduct that begins under light scrutiny tends to end under a more intense spotlight — often years later.

Strong compliance programs can stop the spread of fraud before it takes hold, building organizational immunity through vigilance, accountability and early detection. This is a time to take stock:

- Are controls over financial reporting keeping pace with business complexity and the evolving new risks created by change in policies, and geopolitical uncertainty identified?

- Are new risks — especially in fast-evolving unregulated sectors — being properly identified, assessed and mitigated?

- Are compliance programs appropriately resourced and empowered to act?

These are the questions worth asking now, before risk has a chance to compound.

The enforcement cycle may be reprioritized, but risk itself hasn’t gone anywhere. Economic pressures, evolving industries and shifting regulatory priorities all create new vulnerabilities. And while some external guardrails remain in place, they are no substitute for proactive, internal risk management.

Those who treat this moment as a time to reinforce — rather than retreat from — strong compliance will be better positioned to navigate whatever comes next. Because while enforcement climates may rise and fall, the consequences of ethical failure are always significant, often lasting — and sometimes, fatal.

Accounting

Trump tax bill faces Senate’s arcane rules, desire for changes

Published

14 hours agoon

May 22, 2025

The Republican legislative balancing act now shifts to the Senate.

Senate Majority Leader John Thune (R-South Dakota) said this week House Republicans would like to see as few changes as possible to the sweeping tax and spending package (

“The Senate will have its imprint on it,” said Thune.

Indeed, GOP senators have their own demands, and the package will have to survive the chamber’s complex rules — a historically time-consuming process.

Byrd Rule issues

The reconciliation process allows tax and spending legislation to pass with a simple majority, but the bill still needs to survive the Byrd Rule — named after the late Sen. Robert Byrd (D-West Virginia), known for his mastery of parliamentary procedure. It prevents lawmakers from tucking non-budgetary provisions into the legislation.

“The committees are working closely to try and identify potential Byrd problems ahead of time,” Thune said.

The Senate parliamentarian makes calls on challenges against provisions in the bill and whether they survive the “Byrd Bath.” Democrats plan to aggressively use the rule to challenge items they believe don’t satisfy the Byrd standard. Once the package makes it to the floor, senators will be prepared for a marathon vote-a-rama on amendments.

GOP senators hope the advance work will help keep the measure moving, but a look at the history of the chamber’s experience with big bills shows it will likely be a lengthy process.

For the reconciliation bills enacted since 1980, the time between adoption of a budget resolution and enactment of the reconciliation bill ranges from 28 to 385 days, with a 152-day average, according to the

Independence Day target

“It will take longer than expected just because it is arduous and it’s designed to be that way,” Sen. Mike Rounds (R-South Dakota) said. “It would be great to get it out before the Fourth of July break.”

Majority Whip John Barrasso (R-Wyoming) said the Senate Finance Committee has been meeting since last summer and “have some ideas that may or may not be in the House bill.” Barrasso said he’ll work with every member of his conference, calling Trump and Vice President JD Vance persuasive members of the whip team as well.

Congress didn’t clear Republicans’ 2017 tax overhaul until December of that year, Barrasso said, but this bill faces a tighter deadline because it includes a debt ceiling hike. The borrowing limit could hit as soon as August.

Sen. John Hoeven (R-North Dakota) said the message to Senate Republicans right now is to work with committees of jurisdiction.

“Whatever committee you’re on, work with your chairman on your committee, is really where we’re at,” Hoeven said.

Thune originally proposed moving the measure in two parts, but Trump wants his agenda rolled into a single package, which the House dubbed “The One Big Beautiful Bill Act.” Sen. Ron Johnson (R-Wisconsin) is still advocating for the previous approach.

Asked when the Senate could get it done, Johnson said, “We are so far away from an acceptable bill, it’s hard to say.”

“I think we could move very quickly if we split it into two.”

Next steps

If the Senate amends the reconciliation legislation, the House would need to vote on the amended legislation or they would need to be reconciled in a conference committee. That’s likely to lead to more challenges, given the tight margins in the House.

Rep. Chip Roy (R-Texas), one of the most vocal conservative hardliners who ended up supporting the bill, acknowledged Senate changes are coming and suggested tough negotiations lie ahead between the chambers.

“We’ll give them some flexibility, they gotta work their will, but somewhere between us and the Senate and the White House, there’s gonna be some red lines and those will be public pretty soon,” Roy said.

Stocks making the biggest moves after hours: INTU, WDAY, ROST, DECK

House tax bill includes provision eliminating PCAOB

Ray Dalio says to fear the bond market as deficit becomes critical

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoCPI inflation April 2025: Rate hits 2.3%

-

Personal Finance1 week ago

Personal Finance1 week agoHouse Republicans advance Trump’s tax bill. ‘SALT’ deduction in limbo

-

Economics1 week ago

Economics1 week agoViolent crime is falling rapidly across America

-

Economics7 days ago

Economics7 days agoThe low-end consumer is about to feel the pinch as Trump restarts student loan collections

-

Personal Finance1 week ago

Personal Finance1 week agoHow to save on groceries amid food price inflation

-

Economics1 week ago

Economics1 week agoGerman business leaders tell new government: It’s time to deliver

-

Economics1 week ago

Economics1 week agoAre American Catholics ready for an American pope?

-

Economics1 week ago

Economics1 week agoEmbrace the woo woo