Senate Republicans unveiled a budget blueprint designed to fast-track a renewal of President Donald Trump’s tax cuts and an increase to the nation’s borrowing limit, ahead of a planned vote on the resolution later this week.

The Senate plan will allow for a $4 trillion extension of Trump’s tax cuts and an additional $1.5 trillion in further levy reductions. The House plan called for $4.5 trillion in total cuts.

Republicans say they are assuming that the cost of extending the expiring 2017 Trump tax cuts will cost zero dollars.

The draft is a sign that divisions within the Senate GOP over the size and scope of spending cuts to offset tax reductions are closer to being resolved.

Lawmakers, however, have yet to face some of the most difficult decisions, including which spending to cut and which tax reductions to prioritize. That will be negotiated in the coming weeks after both chambers approve identical budget resolutions unlocking the process.

The Senate budget plan would also increase the debt ceiling by up to $5 trillion, compared with the $4 trillion hike in the House plan. Senate Republicans say they want to ensure that Congress does not need to vote on the debt ceiling again before the 2026 midterm elections.

“This budget resolution unlocks the process to permanently extend proven, pro-growth tax policy,” Senate Finance Chairman Mike Crapo, an Idaho Republican, said.

The blueprint is the latest in a multi-step legislative process for Republicans to pass a renewal of Trump’s tax cuts through Congress. The bill will renew the president’s 2017 reductions set to expire at the end of this year, which include lower rates for households and deductions for privately held businesses.

Republicans are also hoping to include additional tax measures to the bill, including raising the state and local tax deduction cap and some of Trump’s campaign pledges to eliminate taxes on certain categories of income, including tips and overtime pay.

The plan would allow for the debt ceiling hike to be vote on separately from the rest of the tax and spending package. That gives lawmakers flexibility to move more quickly on the debt ceiling piece if a federal default looms before lawmakers can agree on the tax package.

Political realities

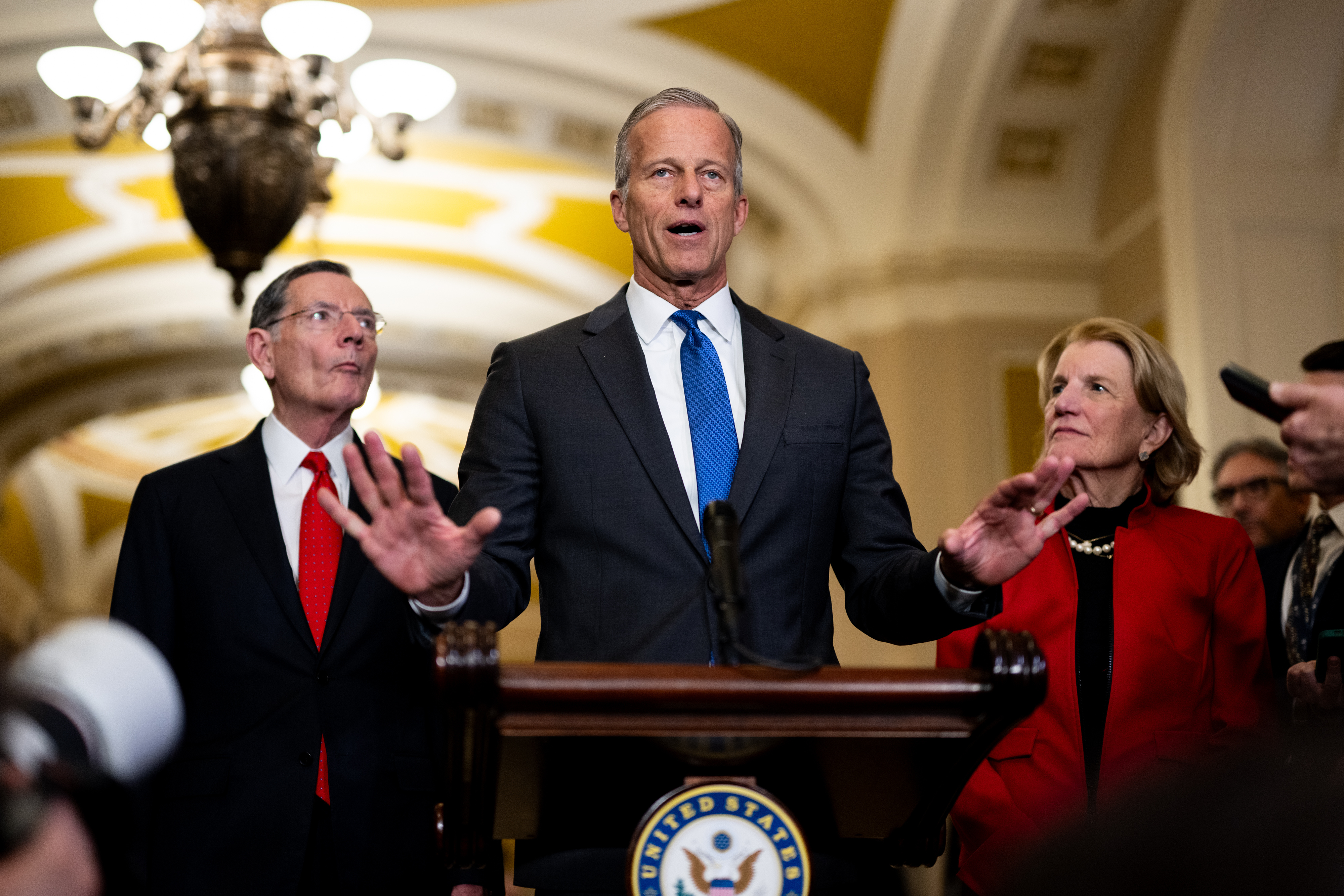

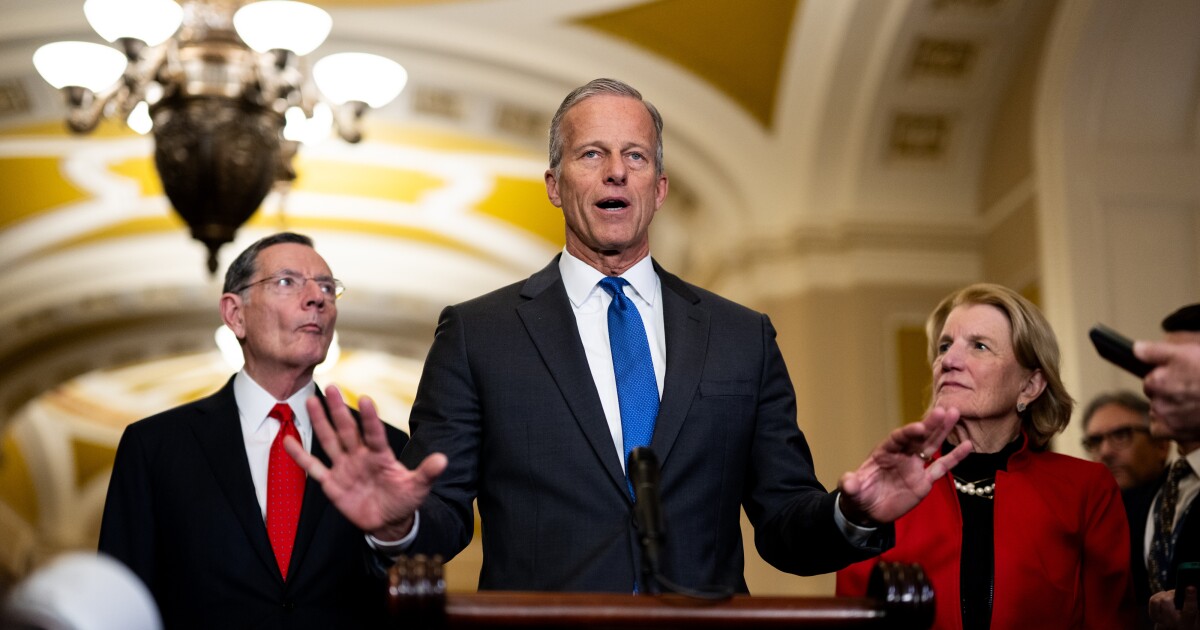

Senate Majority Leader John Thune told reporters on Wednesday, after meeting with Trump at the White House to discuss the tax blueprint, that he’s not sure yet if he has the votes to pass the measure.

Thune in a statement said the budget has been blessed by the top Senate ruleskeeper but Democrats said that it is still vulnerable to being challenged later.

The biggest differences in the Senate budget from the competing House plan are in the directives for spending cuts, a reflection of divisions among lawmakers over reductions to benefit programs, including Medicaid and food stamps.

The Senate plan pares back a House measure that calls for at least $2 trillion in spending reductions over a decade, a massive reduction that would likely mean curbing popular entitlement programs.

The Senate GOP budget grants significantly more flexibility. It instructs key committees that oversee entitlement programs to come up with at least $4 billion in cuts. Republicans say they expect the final tax package to contain much larger curbs on spending.

The Senate budget would also allow $150 billion in new spending for the military and $175 billion for border and immigration enforcement.

If the minimum spending cuts are achieved along with the maximum tax cuts, the plan would add $5.8 trillion in new deficits over 10 years, according to the Committee for a Responsible Federal Budget.

The Senate is planning a vote on the plan in the coming days. Then it goes to the House for a vote as soon as next week. There, it could face opposition from spending hawks like South Carolina’s Ralph Norman, who are signaling they want more aggressive cuts.

House Speaker Mike Johnson can likely afford just two or three defections on the budget vote given his slim majority and unified Democratic opposition.

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics6 days ago

Economics6 days ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Blog Post7 days ago

Blog Post7 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Finance6 days ago

Finance6 days ago