Personal Finance

Find out how good or bad your dream economy compared to today’s

Published

1 year agoon

Presidential candidates are already battling over the economy, promising to bring back the boom times or realize the prosperity that lies ahead, if only we vote for them.

But are you better off now than you were four, eight, 30 years ago?

We wanted to see how good the past really was, and how today measures up. So we pulled some important data for the past three decades to put current conditions in context. Tell us what your dream economy would look like, and we’ll tell you how your vision tracks with the real world — and what other readers thought, too.

How much would prices go up or down in your dream economy?

Prices grew 3.3 percent last year. That is much more of an increase than you would like to see. Very few readers .

User against readers:

% of readers were lower than you

% of readers were close to you

% of readers were higher than you

Readers against answer:

% of readers were lower than answer

% of readers were close to answer

% of readers were higher than answer

You’ve probably noticed that prices have been rising. Economists and policymakers actually believe prices should increase a little bit, steadily and predictably. Specifically, they aim for an inflation rate of 2 percent each year.

Inflation especially stings now because of the spike over the last few years.

Even when inflation is where it’s supposed to be, a lot of factors contribute to it. Workers lobbying for better pay can push prices up — from there, employers might charge more to help cover their costs, and then other workers might also start asking to be paid more. Inflation can also arise from a mismatch in supply and demand: If 100 people want to buy cars, but a dealer only has 10 available, they will raise the price, knowing someone will probably want to pay it.

But you might only notice inflation when it’s higher than usual — and prices start to feel like they’re rising too fast. That’s what’s been happening lately. Inflation soared during the pandemic and worsened with Russia’s invasion of Ukraine. But the Federal Reserve has been working hard to try to bring prices back under control.

Story continues below advertisement

Story continues below advertisement

The central bank’s goal isn’t to push prices themselves down, but to keep them from rising too fast. Prices only tend to fall when the economy is in real trouble, and deflation usually brings along a slew of its own problems.

How about wages?

Wages were up 4.3 percent in 2023, much better than what you would expect in a dream economy. Very few readers .

User against readers:

% of readers were lower than you

% of readers were close to you

% of readers were higher than you

Readers against answer:

% of readers were lower than answer

% of readers were close to answer

% of readers were higher than answer

Wages tend to go up with inflation. Ideally, as goods and services become more expensive, your paycheck rises enough to keep up.

But average pay has bounced around over the past 30 years. Wages fell dramatically during the Great Recession, when the financial system cratered, millions of people lost their jobs and the recovery was slow.

Story continues below advertisement

Story continues below advertisement

After the pandemic, though, pay started to pick up faster than usual because employers were desperate to hire, and there weren’t enough people coming back into the labor market to take jobs at hotels, restaurants, retail stores, airports and more. Wages have cooled a bit since but are still above normal levels.

How would gas prices change in your dream economy?

Last year, gas prices were down 10 percent. That’s more of a drop than your ideal. Very few readers selected a rate of change for gas prices.

User against readers:

% of readers were lower than you

% of readers were close to you

% of readers were higher than you

Readers against answer:

% of readers were lower than answer

% of readers were close to answer

% of readers were higher than answer

You can see gas prices changing all the time, with big billboards at every gas station nearby. Fuel costs also make up a large share of households’ budgets, so when prices at the pump rise, it can be especially tough.

Fuel prices swing around quite a bit, even in normal times. Gas costs often rise in the summer when there’s more consumer demand for travel and road trips. And they can be tied to global factors affecting oil supply and production.

Most recently, prices at the pump soared in the summer of 2022, breaking records at over $5 per gallon after Russia invaded Ukraine and roiled global energy markets. They’ve since come way down.

How many Americans would have $400 socked away for an emergency?

In 2022, about 63 percent of adults could cover a $400 emergency expence with cash. That is far more than what you expected in a dream economy. Very few readers .

User against readers:

% of readers were lower than you

% of readers were close to you

% of readers were higher than you

Readers against answer:

% of readers were lower than answer

% of readers were close to answer

% of readers were higher than answer

Even when the economy is doing well, a large share of the population doesn’t have more than a few hundred dollars stored away for an emergency cushion.

When the economy runs into trouble, people have an even harder time with emergencies: In 2013, in the wake of the Great Recession, only half of Americans could cover an unforeseen $400 expense. That share slowly grew as the economy continued to recover.

Story continues below advertisement

Story continues below advertisement

After the pandemic recession, an unprecedented level of government stimulus under the Trump and Biden administrations sent checks directly into peoples’ pockets and shored up unemployment benefits. That meant more people than usual could handle emergency expenses in 2021. Now that the extra support is drying up, the total is dropping again.

What’s your dream mortgage rate?

At the end of 2023, the mortgage rate was 6.4 percent, far higher than your ideal. Very few readers .

User against readers:

% of readers were lower than you

% of readers were close to you

% of readers were higher than you

Readers against answer:

% of readers were lower than answer

% of readers were close to answer

% of readers were higher than answer

Your mortgage rate can make or break whether you can afford a house. For most home buyers, higher rates mean higher monthly payments, even for homes at the same price.

Mortgage rates are influenced by a range of factors in the housing market. They’re also tied to the Federal Reserve’s benchmark interest rate: When the Fed raises rates, mortgage rates go up and vice versa.

Rates that seem high today were fairly normal throughout the 1990s. But the Fed cut rates after the Great Recession and kept them low for years — and then did the same after the pandemic began. That means many millennials came of age when mortgage rates were historically low, at or below 4 percent. If you’re a generation older, though, you may remember paying nearly 20 percent for a mortgage in the early 1980s.

How would stocks fare?

Last year, the S&P 500 was up 26 percent. That is much higher than what you thought it should be. Very few readers S&P 500 performance in 2023.

User against readers:

% of readers were lower than you

% of readers were close to you

% of readers were higher than you

Readers against answer:

% of readers were lower than answer

% of readers were close to answer

% of readers were higher than answer

The stock market doesn’t always have much to do with the economy overall. But you still probably pay close attention to it, like many people: More than half of American households do have retirement accounts, and about one in five own stock directly.

The market drops during recessions or after sudden shocks, like the Sept. 11, 2001, terrorist attacks. Stocks also took a beating in 2008, when the collapse of the housing market triggered a global financial crisis. They dropped fast when the pandemic began, but then rallied again.

Generally speaking, the stock market trends up. And now, major indexes are clinching new highs.

How fast would your dream economy grow?

The economy grew 2.5 percent in 2023. That much higher than your ideal. Very few readers selected a growth rate today’s.

User against readers:

% of readers were lower than you

% of readers were close to you

% of readers were higher than you

Readers against answer:

% of readers were lower than answer

% of readers were close to answer

% of readers were higher than answer

Growth looks at the value of all of the goods and services — basically, all of the stuff — produced inside the United States, and gauges whether we’re making more of it than we used to.

This can bounce around depending on what else is happening in the country or the world. Gross domestic product tanked, for example, in the wake of the Great Recession in 2008, then again when the pandemic hit in 2020. But growth also surged after both of those slowdowns — especially after the covid recession, thanks to massive government stimulus spending. Things have calmed down to more sustainable levels, but the economy is still growing at a solid pace.

Very few readers share your perspective.

Doesn’t sound like you? This is your dream economy — take the quiz again.

Answer all questions to see your results

So how does your dream economy compare with what’s happening now?

By many measures, the economy is doing really well in the real world. There’s no recession in sight, and growth is chugging along. The stock market is near record highs and still climbing. Inflation isn’t yet back to normal levels, but the Federal Reserve is working on that, and gas prices are simmering back down, while wages — even though they’ve settled a bit — are growing faster than prices are.

People still don’t love the economy, though, no matter how good the stats look. Will a few more months of solid performance change any minds? Only time will tell.

Photos from iStock.

You may like

Personal Finance

Most women wish they started investing sooner, Schwab finds

Published

4 hours agoon

June 17, 2025

D3sign | Moment | Getty Images

Women who invest began at an average age of 31, but most wish they had started putting money in the market earlier, a recent survey said.

Nearly all — 90% — of the women investors surveyed said they’re “on the right track” to achieve their financial goals, according to the survey, by Charles Schwab, an investment and financial services firm.

However, 85% share a common regret — they said they wish they had started investing at an earlier age, the survey said.

When the age is broken down by generation, Schwab found that millennials began investing at age 27, on average, Gen Xers’ average starting age was 31, and baby boomers started at an average age of 36.

More from FA Playbook:

Here’s a look at other stories affecting the financial advisor business.

Schwab polled 1,200 women in the U.S. ages 21 to 75 in January. The report said they each had at least $5,000 in investable assets, not including retirement accounts or real estate, and were all primary or joint household financial decision-makers.

Some of the top reasons respondents said they began investing later in life than they would have liked were a lack of financial knowledge, 54%, and limited funds to invest, 53%, according to Schwab’s report.

There’s an advantage in getting started with investing as soon as you can, even if you don’t have much to contribute at first: You’ll benefit from time in the market, according to Carolyn McClanahan, a certified financial planner and founder of Life Planning Partners in Jacksonville, Florida.

“Start saving while you’re young because you have lots of years for your money to grow,” said McClanahan, a member of CNBC’s Financial Advisor Council.

‘It’s a get-rich-slowly scheme’

An early start to investing harnesses the power of compounding.

Compound interest means your money earns interest on both the original amount you invest and on the interest you’ve already earned, said Jeannie Bidner, a managing director and head of the branch network at Charles Schwab. Compound returns are broader, and typically include other types of investment gains, such as dividends and capital gains.

Compounding creates a “snowball effect” for your cash, she said. “The sooner you get started, the better.”

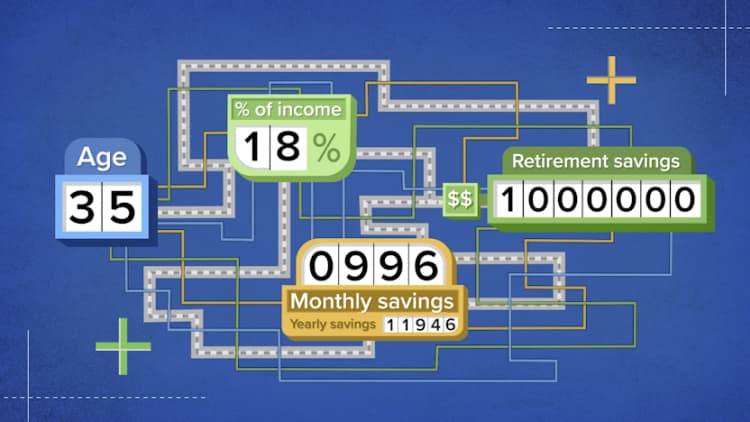

Let’s say a person begins at age 25 investing $6,000 per year, with an average 7% annual return. By the time they’re 67 years old, the account balance would be almost $1.5 million, according to Fidelity Investments. If that individual delays starting to invest until age 30, they would end up with just over $1 million by retirement.

In other words, that five-year head start offers a bonus of nearly half a million dollars.

It’s not just about getting a head start. Staying invested through major market swings and sticking to your plan are essential to meeting your financial goals.

More than half, or 58%, of the women in the survey said they learned to stay invested despite the ups and downs of the market, Schwab found, and 42% said they learned to create a plan and stick to it.

While market volatility can “feel like you’re at a casino,” it’s important to disregard the major swings and focus on your long-term outlook, Katie Gatti Tassin, author of “Rich Girl Nation: Taking Charge of Our Financial Futures,” said at an event Wednesday at 92NY, a cultural and community center in New York.

“It’s not a get-rich-quick scheme, it’s a get-rich-slowly scheme,” Gatti Tassin said.

Personal Finance

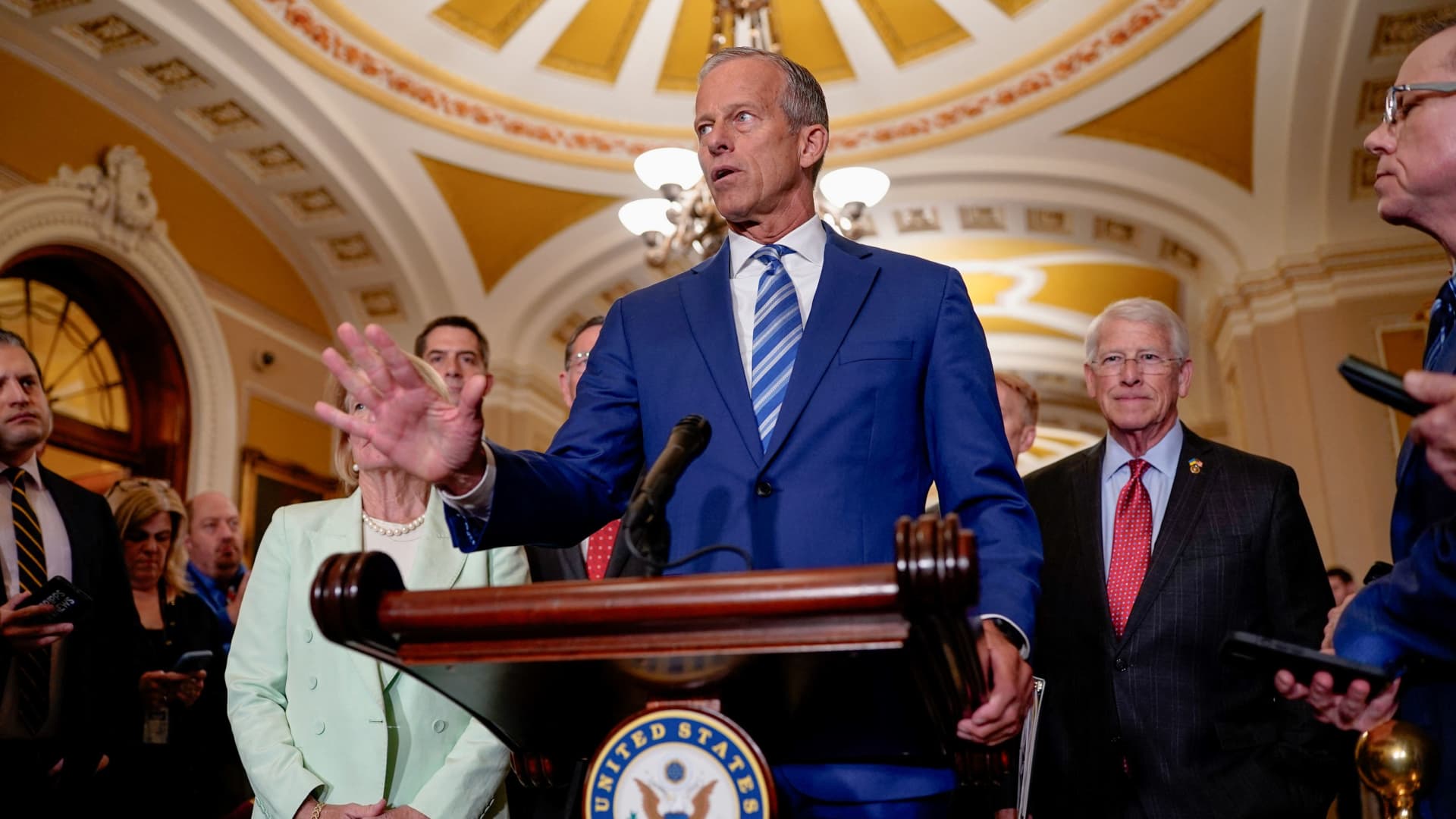

‘SALT’ deduction in limbo as Senate Republicans unveil tax plan

Published

17 hours agoon

June 16, 2025

U.S. Senate Majority Leader John Thune (R-SD) speaks at a press conference following the U.S. Senate Republicans’ weekly policy luncheon on Capitol Hill in Washington, D.C., U.S., June 10, 2025.

Kent Nishimura | Reuters

As Senate Republicans release key details of President Donald Trump‘s spending package, some provisions, including the federal deduction for state and local taxes, known as SALT, remain in limbo.

Enacted via the Tax Cuts and Jobs Act, or TCJA, of 2017, there’s currently a $10,000 limit on the SALT deduction through 2025. Before 2018, the tax break — including state and local income and property taxes — was unlimited for filers who itemized deductions. But the so-called alternative minimum tax reduced the benefit for some higher earners.

The Senate Finance Committee’s proposed text released on Monday includes a $10,000 SALT deduction cap, which is expected to change during Senate-House negotiations on the spending package. That limit is down from the $40,000 cap approved by House Republicans in May.

More from Personal Finance:

Fed is likely to hold rates steady this week. What it means for you

How to protect assets amid immigration raids, deportation worries

IRS: Make your second-quarter estimated tax payment by June 16

The SALT deduction has been ‘contentious’

“SALT has been contentious for eight years,” said Andrew Lautz, associate director for the Bipartisan Policy Center’s economic policy program.

Since 2017, the SALT deduction cap has been a key issue for certain lawmakers in high-tax states like New York, New Jersey and California. These House members have leverage during negotiations amid a slim House Republican majority.

Under current law, filers who itemize tax breaks can’t claim more than $10,000 for the SALT deduction, including married couples filing jointly, which is considered a “marriage penalty.”

However, raising the SALT deduction cap has been controversial. If enacted, benefits would primarily flow to higher-income households, according to a May analysis from the Committee for a Responsible Federal Budget.

Currently, the vast majority of filers — roughly 90%, according to the latest IRS data — use the standard deduction and don’t benefit from itemized tax breaks.

Plus, the 2017 SALT cap was enacted to help pay for other TCJA tax breaks, and some lawmakers support the lower limit for funding purposes.

In the Senate, “there isn’t a high level of interest in doing anything on SALT,” Senate Majority Leader John Thune said June 15 on “Fox News Sunday.”

“I think at the end of the day, we’ll find a landing spot, hopefully that will get the votes that we need in the House, a compromise position on the SALT issue,” he said.

But some House Republicans have already pushed back on the proposed $10,000 SALT deduction cap included in the Senate draft.

Rep. Mike Lawler, R-N.Y., on Monday described the Senate proposed $10,000 SALT deduction limit as “DEAD ON ARRIVAL” in an X post.

Meanwhile, Rep. Nicole Malliotakis, R-N.Y., on Monday also posted about the $10,000 cap on X. She said the lower limit was “not only insulting but a slap in the face to the Republican districts that delivered our majority and trifecta.”

Personal Finance

Welcome to the zoo. That’ll be $47 today — ask again tomorrow.

Published

22 hours agoon

June 16, 2025

Giant panda Bao Li chews on bamboo during his public debut at the Smithsonian’s National Zoo in Washington, U.S., January 24, 2025.

Kevin Lamarque | Reuters

How much will it cost to visit a museum, zoo or aquarium this summer? The answer, increasingly, is: It depends.

John Linehan can rattle off almost two dozen factors that Zoo New England’s dynamic pricing contractor, Digonex, uses to recommend what to charge guests.

“It’s complicated,” said Linehan, president and CEO of the operator of the two zoos in eastern Massachusetts.

Before adopting dynamic pricing, the organization was changing prices seasonally and increasing entry rates little by little. “As we watched that pattern, we were afraid some families were going to get priced out,” he said of the earlier approach. “I’m a father of four and I know what it is like.”

Now, Zoo New England’s system provides cheaper rates for tickets purchased far in advance. That, coupled with the zoo’s participation in the Mass Cultural Council’s discounted admissions program for low-income and working families, “puts some control back in the consumer’s hands,” Linehan said.

We charge what we need to make ends meet while delivering on our mission.

John Linehan

CEO of Zoo New England

The zoo is one of many attractions embracing pricing systems that were earlier pioneered by airlines, ride-hailing apps and theme parks. While these practices allow operators to lower prices when demand is soft, they also enable the reverse, threatening to squeeze consumers who are increasingly trimming their summer travel budgets.

Before the pandemic, less than 1% of attractions surveyed by Arival, a tourism market research and events firm, used variable or dynamic pricing. Today, 17% use variable pricing, in which entry fees are adjusted based on predictable factors such as the day of the week or the season, Arival said. And 6% use dynamic pricing, in which historical and real-time data on weather, staffing, demand patterns and more influence rates.

The changes come as barely half of U.S. museums, zoos, science centers and similar institutions have fully recovered to their pre-Covid attendance levels, according to the American Alliance of Museums. That has led many to pursue novel ways of filling budget gaps and offsetting cost increases.

“There’s a saying: ‘No margin, no mission,'” Linehan said, “and we charge what we need to make ends meet while delivering on our mission.”

Entry costs are climbing even at attractions that aren’t using price-setting technology. The broad “admissions” category in the federal government’s Consumer Price Index, which includes museum fees alongside sports and concert tickets, climbed 3.9% in May from the year before, well above the annual 2.4% inflation rate.

In 2024, the nonprofit Monterey Bay Aquarium raised adult ticket prices from $59.95 to $65 and recently upped its individual membership rate, which includes year-round admission, from $95 to $125. “Gate admission from ticket sales funds the core operation of the aquarium,” a spokesperson said.

While the Denver Art Museum has no plans to test dynamic pricing, it raised admissions fees last fall, three years after a $175 million renovation and a survey of ticket prices elsewhere, a spokesperson said. Entry costs went from $18 to $22 for Colorado residents and from $22 to $27 for out-of-state visitors. Prices rise on weekends and during busy times, to $25 and $30 for in- and out-of-state visitors, respectively. Guests under age 19 always get in free thanks to a sponsored program.

Some attractions are doing a daily analysis of their bookings over the next several days or weeks and making adjustments.

Douglas Quinby

CEO of Arival

Like many attractions, the art museum posts these prices on its website. But many attractions’ publicly listed ticket prices are liable to fluctuate. The Seattle Aquarium — which raised its price ranges last summer by about $10 ahead of the opening of a new ocean pavilion — also uses Digonex’s algorithmic recommendations.

During the week of June 8, for example, the aquarium’s online visit planner, which displays the relative ticket availability for each day, offered out-of-state adult admissions as low as $37.95 for dates later in the month and as much as $46.95 for walk-in tickets that week. In addition to booking in advance, there are more than half a dozen other discounts available to certain guests, including seniors and tribal and military members, a spokesperson noted.

At many attractions, however, admission fees aren’t even provided until a guest enters the specific day and time they want to visit — making it difficult to know that lower prices may be available at another time.

“Some attractions are doing a daily analysis of their bookings over the next several days or weeks and making adjustments” to prices continuously, said Arival CEO Douglas Quinby. Prices might rise quietly on a day when slots are filling up and dip when tickets don’t seem to be moving, he said.

Digonex, which says it provides automated dynamic pricing services to more than 70 attractions worldwide, offers recommendations as frequently as daily. It’s up to clients to decide how and whether to implement them, a spokesperson said. Each algorithm is tailored to organizations’ goals and can account for everything from weather to capacity constraints and even Google Analytics search patterns.

Data-driven pricing can be “a financial win for both the public and the museum,” said Elizabeth Merritt, vice president of strategic foresight at the American Alliance of Museums. It can reduce overcrowding, she said, while steering budget-minded guests toward dates that are both cheaper and less busy.

The stegosaurus fossil nicknamed Apex is unveiled to the media at the American Museum of Natural History in New York, December 5, 2024. Billionaire Kenneth C. Griffin, who bought the stegosaurus fossil for $44.6 million, is loaning it to the museum for four years.

Timothy A. Clary | Afp | Getty Images

But steeper prices during peak periods and for short-notice visits could rankle guests — who may see anything less than a top-notch experience as a rip-off, said Stephen Pratt, a professor at the University of Central Florida’s Rosen College of Hospitality Management who studies tourism.

“Because of the higher prices, you want an experience that’s really great,” he said, transforming a low-key day at the zoo into a big-ticket, high-stakes outing. “You’ve invested this money into family time, into creating memories, and you don’t want any service mishaps.”

That could raise the risk of blowback at many attractions, especially those grappling with Trump administration cuts this summer. Some historic sites and national parks have already warned that their operations are under pressure.

Consumers should expect more price complexity to come. Arival said 16% of attractions ranked implementing dynamic pricing as a top priority for 2025-26. Among large attractions serving at least half a million guests annually, 37% are prioritizing dynamic pricing, up from the 12% that use it currently.

For visitors, that could mean hunting harder for cheaper tickets. While many museums are free year-round, others provide lower rates for off-season visits and those booked in advance. It’s also common to reduce or waive fees on certain days or hours, and many kids and seniors can often get discounted entry.

Here are a few other ways to keep admissions costs low:

Ways to save on museum tickets:

- Ask your local library. Many have museum passes that cardholders can check out.

- Bundling programs such as CityPass, GetOutPass, Go City and others allow visitors to save money on admissions to a range of attractions.

- Bank of America’s Museums on Us program offers cardholders free entry to many institutions during the first full weekend of each month.

- For the past decade, Museums for All has been providing free or reduced entry at more 1,400 U.S. museums and attractions to anyone receiving SNAP food assistance benefits.

- And each summer, the Blue Star Museums program offers museum discounts to actively serving military personnel and their families.

“It may take a bit of research,” said Quinby, “but it’s still possible to find a good deal.”

Hong Kong’s Regencell Bioscience triples in latest surge for a speculative stock

Retail sales May 2025:

Stocks making the biggest moves premarket: RUN, VERV, TMUS

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Accounting1 week ago

Accounting1 week agoInstead adds AI-driven tax reports

-

Economics1 week ago

Economics1 week agoSending the National Guard to LA is not about stopping rioting

-

Blog Post1 week ago

Blog Post1 week agoMastering Bookkeeping Tasks During Peak Business Seasons

-

Personal Finance1 week ago

Personal Finance1 week agoWhat Pell Grant changes in Trump budget, House tax bill mean for students

-

Personal Finance7 days ago

Personal Finance7 days agoHow markets performed for investors so far

-

Personal Finance7 days ago

Personal Finance7 days agoTrump’s ‘big beautiful’ bill may curb access to low-income tax credit

-

Economics7 days ago

Economics7 days agoIs there a “woke right” in America?

-

Finance1 week ago

Finance1 week agoChina’s EV race to the bottom leaves a few possible winners