Personal Finance

These are the 10 most underrated places to travel, say travel agents

Published

4 months agoon

Klaus Vedfelt | Digitalvision | Getty Images

Looking for travel inspiration for 2025 and beyond?

Look no further: CNBC asked 10 travel agents for their recommendations of the most underhyped destinations in the world. We compiled their written answers below, including can’t-miss activities for each locale and the best times of year to visit.

You’ll also find average round-trip airfare from U.S. airports. The data, provided by travel app Hopper, is based on average fares that were available to book from Jan. 15 to Jan. 22. Prices are for May-July 2025, when most Americans plan to take their longer vacations, Hopper said.

Travelers should aim to book over the next few weeks to score the best prices, it said.

Albania

Valbona National Park, Albania.

Eduardo Fonseca Arraes | Moment | Getty Images

Recommended by: Scott Abbott, managing director of Wilderness Travel

Why to visit: “The Albanian Alps, also known as the Accursed Mountains, are a mountain range very few people know about, so are totally untouched by tourism. But have some of the most gorgeous and dramatic hikes in all of Europe. They also have guesthouses, mountain huts and hotels that feel like what the Alps were like 30-plus years ago, all owned by local families and run in a traditional way very authentic to the place and culture.”

Can’t-miss: Hiking in Valbona Valley National Park

Best time to go: June to September

Average flight price: $926 to Tirana, Albania

Ecuadorian cloud forest

Cloud forest in Ecuador.

Gerard Puigmal | Moment | Getty Images

Recommended by: Allie Almario, South America and Galapagos expert at Premier Tours

Why to visit: “Most people think of Costa Rica when they think of cloud forest, but Ecuador also has the lure of the Galapagos Islands, so it’s a terrific combination. About three hours from the capital city of Quito, Ecuador, the cloud forest feels primeval and otherworldly.

“I love the Mashpi Eco Lodge, which is on the cusp of the rain and cloud forest in a private sanctuary. You’ve got incredibly rich biodiversity in this remote area — so remote the silence is almost deafening.”

Can’t-miss: “Mashpi Lodge offers an activity called the Dragon Fly — it is up to an hour ride in an open air cable car (seating only for four guests at a time and a naturalist) where you soar over the tree canopy. You hear nothing but the wind and bird calls and the distant crash of waterfalls 500 feet below you. The butterflies are like confetti.”

Best time to go: “Temperatures are pretty consistent throughout the year, but the main difference is rainy vs. dry season. Be prepared and either way, hiking in the cloud and rain forest will always be an adventure.”

Average flight price: $588 to Quito, Ecuador

Hamburg, Germany

The canals of Hamburg, Germany

Inigo Cia | Moment | Getty Images

Recommended by: Kareem George, CEO of Culture Traveler

Why to visit: “This ultra chic city is beautiful, sophisticated and extremely fun, with a variety of attractions for diverse ages and interests. The setting of the city is quite picturesque, nestled between the Elbe River and Alster Lake with many canals in between. It is an extremely walkable city with many historic attractions in the city center — such as the Rathaus (City Hall) and St. Nikolai Church — flanked by very cool neighborhoods such as the Speicherstadt (Warehouse) District, raucous St. Pauli and the quirky Schanzenviertel.”

Can’t-miss: “Two of the many must-see attractions are the iconic Elbphilharmonie and the unique Miniatur Wunderland. Advance tickets are highly recommended for both.”

Best time to go: “Hamburg is truly a destination for all seasons, however I particularly enjoyed a recent visit in the fall. The weather was perfect and it was wonderful to stroll along the lake, canals and to explore several neighborhoods on foot.”

Average flight price: $1,090

Kyushu, Japan

A hot spring resort in Kurokawa Onsen, in Kyushu, Japan.

Bohistock | Moment | Getty Images

Recommended by: Kristin Braswell, founder of CrushGlobal Travel

Why to visit: “Brimming with natural beauty at every corner, the southern island of Japan’s Kyushu may be overlooked for its popular northern neighbors like Tokyo and Kyoto, but it’s just as thrilling. Teeming with active volcanoes, palm-forested coastlines and bubbling onsens [hot springs] to retreat in, you will be enamored at every turn by the great, wide outdoors here. I highly recommend visiting the electric metropolis, Fukuoka, and Beppu, a mountainside jewel that is home to the most spring waters in the country.”

Can’t-miss: “Visiting the famous onsens, particularly the Jigoku Circuit, which are all grouped and within walking distance. They are a sight to see.”

Best time to go: “In spring, during cherry-blossom season and when the weather is pleasantly warm, or the fall, as the foliage begins to change with the seasons.”

Average flight price: Top three airports in Kyushu, by popularity from U.S. cities based on search demand:

- Fukuoka: $1,326

- Nagasaki: $1,617

- Kumamoto: $1,594

Lençóis Maranhenses National Park, Brazil

Lençóis Maranhenses National Park, Brazil.

Ignacio Palacios | Stone | Getty Images

Recommended by: John Lansdell, planner at Trufflepig Travel

Why to visit: “Remote and staggeringly beautiful, this park of sand dunes, mangroves and freshwater lagoons is prime for both relaxing in and exploring — swimming, dune walks and quad tours, birding, etc.”

Can’t-miss: Swimming in the lagoons.

Best time to go: “When to visit is subjective, but high season is July and August: Full lagoons; warm, not too hot; rains have passed, but the gateway towns are busy. Either side of these months may be the best bet, although the park itself, a UNESCO World Heritage Site, is vast and won’t feel overly busy in high season.”

Average flight price: $1,069 to Sao Luis, Brazil

The Nordic countries (Sweden, Denmark, Finland, Norway)

Old town and town square in Stockholm, Sweden.

Leonardo Patrizi | E+ | Getty Images

Recommended by: Melissa Wu, founder of Woodlyn Travel

Why to visit: “The Nordics offer a great variety of destinations and activities, from the bustling nightlife and modern hotels of the cities, to rural pastimes like dog sledding and gazing up at the amazing northern lights. Classic Nordic activities like saunas and cold plunges share the stage with farm-to-table culinary extravaganzas. And the dollar is very strong right now, so you’ll get your money’s worth on some of the best seafood you’ll ever eat.”

More from Personal Finance:

What to expect from travel prices in 2025

Demand for international trips drives ‘travel momentum’

Here are 4 big ways to save on your next trip

Can’t-miss: “Sweden’s capital and largest city, Stockholm, is known for a great museum scene with some truly unique attractions. The ABBA museum is a must-see for music lovers, while the Viking Museum and Vasa Museum, which houses a salvaged 17th century ship, pay tribute to Sweden’s history. And no visit would be complete without a stop at the Spiritmuseum, which celebrates Sweden’s drinking culture.”

Best time to go: “The Nordics offer something unique no matter what time of year you visit. Long summer days give way to amazing fall foliage, followed by Christmas markets and ice hotels during the wintertime, and lovely island-hopping adventures in spring. Stockholm’s cherry-blossom trees bloom in mid- to late-April, with a gorgeous display that rivals more well-known (and crowded) spots like Washington, D.C. and Kyoto.”

Average flight price:

- Copenhagen: $769

- Helsinki: $890

- Oslo: $826

- Stockholm: $801

The Philippines

Boats on the serene, azure waters near Coron Palawan, Philippines.

Travelstoxphoto | Moment | Getty Images

Recommended by: Tesa Totengco, founder and CEO of Travels with Tesa

Why to visit: “Although it is very much a part of Southeast Asia, the Philippines is off to the side from the rest of its neighbors. I suggest devoting your entire trip to the country and island-hopping.

“It has some of the most beautiful white powdery sand beaches (Palawan, Boracay, Bohol). There is a thriving contemporary art scene (Art Fair in Manila, held in February), and galleries supporting local artists (Silverlens, Artinformal, Gravity Art Space, Orange Project). In the capital, you can tour Old Manila and learn of the past from the 16th century Spanish colonialization right up to the American War liberating the country from Japanese occupation. There are pop-up shops throughout the year that celebrate Filipino design, and celebrated chefs with their own restaurants celebrating Filipino cuisine. It’s a predominantly English-speaking country, so the traveler will never feel lost.”

Can’t-miss: “This country is made up of over 7,000 islands, each unique in culture, history and flavor. It’s best to make a ‘halo-halo’ (meaning ‘mixed’) experience: Not just beach, for which the country is most famous.”

Best time to go: “It’s a tropical country, so the Philippines is hot and humid year round. Avoid the rainy season from June to October and come from December to February when the country is at its coolest.”

Average flight price:

- Manila: $1,296

- Cebu City: $1,446

- Angeles City: $1,461

Tunisia

Sidi Bou Said, a town in northern Tunisia.

Max Shen | Moment | Getty Images

Recommended by: Sofia Markovich, owner of Sofia’s Travel

Why to visit: “Tunisia is home to some of the world’s most well-preserved Roman ruins, including the iconic El Jem Amphitheatre, a UNESCO World Heritage site that rivals Rome’s Colosseum in grandeur. Carthage, once a powerful city-state, showcases the remnants of an ancient civilization that shaped Mediterranean history.

“From the rolling dunes of the Sahara Desert to the pristine beaches of Hammamet, Sussa and Djerba, the country offers a variety of settings for adventure and relaxation. Matmata’s troglodyte homes, famously featured in Star Wars films, add a touch of cinematic wonder to the experience.”

“Tunisia’s cuisine is a highlight that captivates food lovers. With its bold flavors and Mediterranean influences, dishes like brik (a savory pastry), couscous and harissa-infused stews offer an authentic taste of the region. The country’s burgeoning wine industry adds to its allure.”

Amphitheatre of El Jem in Tunisia.

Westend61 | Westend61 | Getty Images

Can’t-miss: “Sidi Bou Said, with its white-washed houses and blue doors; and Carthage.”

Best time to go: “Tunisia is great to visit year-round”:

- Spring (March-May): “Warm, ideal for exploring ruins and nature.”

- Summer (June-August): “Hot, perfect for beaches but avoid inland heat.”

- Autumn (September-November): “Mild, great for both beaches and culture.”

- Winter (December-February): “Cool, best for the Sahara and fewer crowds.”

Average flight price: $1,360 to Tunis

Uzbekistan

Bibi Khanum Mosque in Samarkand, Uzbekistan.

Izzet Keribar | Stone | Getty Images

Recommended by: Jonathan Alder, CEO of Jonathan’s Travels

Why to visit: “This incredible melting pot of cultures is one of the most stunning destinations in the world, with architecture, history and nature that would surprise even the most experienced traveler.

“Its cuisine — a melting pot of Persian, Indian, Italian, and Chinese with hints of Russian — is a foodie’s dream. Once the heart of the Silk Road, the architecture doesn’t look like anything else you’ve ever seen. I love to start in the capital of Tashkent, which is a modern metropolis, then head to the ancient side of the country at the far end of the desert to step back in time. The mosque of Samarkand is one of the most incredible architectural highlights you’ll see in your life.

“Getting out of the cities, you can head into the mountains, which are essentially the back of the Himalayas, for incredible nature and green valleys outside of the stark, dramatic desert that you get for most of the rest of the country.”

The Old Town in the City of Bukhara, Uzbekistan.

Mlenny | E+ | Getty Images

Can’t-miss: “Samarkand. This was once the capital of the Silk Road, the crossing point for all trade routes between Europe and Asia. The sites here are the biggest in the country and some of the top highlights.”

When to go: “Spring and fall. The summers are quite hot and the winters get very cold. You can also make this a ski destination in the winter and combine it with the rest of the country.”

Average flight price:

- Tashkent: $1,470

- Samarkand: $2,226

Western Australia

James Price Point, Western Australia.

Luke Mackenzie | Moment | Getty Images

Recommended by: Kemi Wells-Conrad, founder and president of Wells Luxury Travel

Why to visit: “Everyone typically thinks of Sydney and the East Coast of Australia — and don’t get me wrong, it is a beautiful coastline. But I have always been a huge fan of Western Australia. It is incredibly diverse, and the landscapes are truly magnificent.

“Perth is your starting point and known as one of the most isolated cities in the world. There is world-class wine further south in Margaret River. The coast is filled with some of the most beautiful beaches in the world, such as Monkey Mia and Ningaloo Reef, which also are teeming with amazing marine life. The Kimberleys are wild, rugged and unique.”

Bungle Bungles, beehive-shaped sandstone towers in Purnululu National Park, in Eastern Kimberleys, Western Australia.

Michael Runkel | Imagebroker | Getty Images

Can’t-miss: “Ningaloo Reef. Forget the crowds of the Great Barrier Reef out of Cairns — imagine a pristine reef with no crowds. You can also swim with whale sharks here March to August. The luxury glamping experience at Sal Salis is a unique experience.”

When to go: “April to September. This is the sweet spot, their ‘winter.’ The temperatures are mild, however still much warmer than our northern hemisphere winter. And it would allow you to travel further north to the Kimberleys — outside of their wet season and before it heats up again from October on.”

Average flight price:

- Perth: $2,043

- Broome: $3,094

You may like

Olga Rolenko | Moment | Getty Images

There are all sorts of ways for consumers to misuse credit cards, from failing to pay monthly bills in full to running up your balance. But here’s one risky behavior that experts say you likely haven’t heard of: “credit cycling.”

Credit cards come with a spending limit. Cardholders are usually aware of this limit, which represents the overall cap to how much they can borrow. The limit resets with each billing statement when users pay their bill in full and on time.

Users who credit-cycle will reach that limit and quickly pay down their balance; this frees up more headroom so consumers can effectively charge beyond their typical allowance.

Doing this occasionally is usually not a big deal, experts said. It’s akin to driving a few miles per hour over the speed limit — something less likely to get a driver pulled over for speeding, said Ted Rossman, senior industry analyst at CreditCards.com.

But consistently “churning” through available credit comes with risks, Rossman said.

For example, card issuers may cancel a user’s card and take away their reward points, experts said. This might negatively impact a user’s credit score, they said.

“If there’s even the slightest chance credit cycling can go sideways, it’s best not to do it and look for alternatives,” said Bruce McClary, senior vice president at the National Foundation for Credit Counseling. “You have to be very careful.”

Card companies see credit cycling as a risk

The average American’s credit card limit was about $34,000 at the end of the second quarter of 2024, according to Experian, one the three major credit bureaus. (This was the limit across all their cards.)

The amount varies across generations, and according to factors like income and credit usage, according to Experian.

It’s understandable why some consumers would want to credit cycle, experts said.

More from Personal Finance:

Why summer Fridays are increasingly rare

How GOP megabill affects families with kids

What a Trump, Powell showdown means for your money

Certain consumers may have a relatively low credit limit, and credit cycling might help them pay for a big-ticket purchase like a home repair, wedding or a costly vacation, experts said. Others may do it to accelerate the rewards and points they get for making purchases, they said.

But card issuers would likely see repeat offenders as a red flag, Rossman said.

Maxing out a card frequently may run afoul of certain terms and conditions, or signal that a user is experiencing financial difficulty and struggling to stay within their budget, he said.

Issuers may also view it as a potential sign of illegal activity like money laundering, he said.

“You could be putting yourself at risk by appearing to be a risk in that way,” McClary said.

Credit cycling consequences

If a card issuer penalizes a credit-cycling customer by closing their account, it could have negative repercussions for their credit score, experts said.

Credit utilization is the share of one’s outstanding debt relative to their credit limit. Keeping utilization relatively low generally helps boost one’s credit score, while a high rate generally hurts it, McClary said.

Experts generally recommend keeping credit utilization below 30%, and below 10% if you really want to improve your credit score.

A canceled card would reduce one’s overall credit limit, raising the odds that a user’s credit utilization rate would increase if they have outstanding debt on other credit cards, McClary said.

Further, a card company could flag misuse as a reason for the account closure, potentially making the user look like more of a risk to future creditors, he added.

Consistently butting up against one’s credit limit also increases the chances of accidentally breaching that threshold, McClary said. Doing so could lead creditors to charge over-limit fees or raise a user’s interest rate, he said.

Consumers who credit-cycle should be cognizant of any recurring monthly subscriptions or other charges that might inadvertently push them over the limit, he said.

What to do instead

Instead of credit cycling, consumers may be better served by asking their card issuer for a higher credit limit, opening a new credit card account or spreading payments over more than one card, Rossman said.

As a general practice, Rossman is a “big fan” of paying down one’s credit card bill early, such as in the middle of the billing cycle instead of waiting for the end. (To be clear, this isn’t the same as credit cycling, since consumers wouldn’t be paying down their balance early in order to spend beyond their allotted credit.)

This can reduce a consumer’s credit utilization rate — and boost one’s credit score — since card balances are generally only reported to the credit bureaus at the end of the monthly billing cycle, he said.

“It can be a good way to improve your score, especially if you use your card a lot,” he said.

Personal Finance

Summer Fridays are increasingly rare as hybrid schedules gain steam

Published

1 day agoon

June 13, 2025

People enjoy an unusually warm day in New York City as temperatures reach the low 80s on June 4, 2025 in New York City.

Spencer Platt | Getty Images

Summer Fridays may be considered the most desirable perk of the season, but fewer employers are on board with the shortened workweek.

Companies have steadily phased out summer Fridays — a policy that allows workers to take Friday afternoon off over the summer months — as work-from-home Fridays became more common, experts say.

“Pre-pandemic, summer Fridays were thing, but hybrid overall has taken over,” said Bill Driscoll, technology workplace trends expert at staffing and consulting firm Robert Half.

As more commuters settle into flexible working arrangements, fewer workers are making Friday trips at all compared to mid-week traffic patterns, according to the 2024 Global Traffic Scorecard released in January by INRIX Inc., a traffic-data analysis firm.

More from Personal Finance:

Job market is ‘trash’ right now, career coach says

Millions would lose health insurance under GOP megabill

Average 401(k) balances drop 3% due to market volatility

Among employees, however, summer Fridays are the most valued summer benefit, followed by summer hours and flextime, according to a new survey by job site Monster, which polled more than 400 U.S. workers in June.

“Summer Fridays are highly valued among workers because, for many, they represent more than just a few extra hours off,” said Scott Blumsack, Monster’s chief strategy and marketing officer. This perk “can go a long way in showing employees they’re valued, which can help prevent burnout, boost morale, and improve retention during a season when disengagement can run high.”

Still, 84% of workers are not offered any summer-specific benefits, even though 55% also said those benefits improve productivity, Monster found.

Instead, hybrid — and to a lesser extent fully remote — job postings have increased in the last year as employers compete for talented job seekers who prioritize flexibility, according to research by Robert Half.

“Hybrid is a highly desirable situation right now and one that all levels of employees are looking for,” said Robert Half’s Driscoll.

More than five years after the pandemic, 72% of organizations also have return-to-office mandates, according to a separate hybrid work study by Cisco.

But, even with the mandates, employees are less likely to work in the office on Fridays, and much more likely to commute Monday to Thursday, Cisco found.

Employees value flexibility

As employee burnout and disengagement grows amid the wave of in-office mandates, work-life balance and flexible hours have become increasingly important, other studies show.

Corporate wellness company Exos, which works with large organizations such as JetBlue and Adobe, says burnout has gone down significantly among employees at firms that have made Fridays more flexible. Exos also tested out “You Do You Fridays” — and found significant benefits.

The more adaptable the schedule, the more positively employees view their company’s policies, the Cisco report also found.

With hybrid arrangements now common, workers put a high value on that flexibility — and 63% of all workers would even accept a pay cut for the option to work remotely more often, according to Cisco’s global survey of more than 21,500 employers and employees working full-time.

Personal Finance

How House Republicans’ ‘big beautiful’ bill may affect children

Published

1 day agoon

June 13, 2025

Speaker of the House Mike Johnson, R-La., pictured at a press conference after the House narrowly passed a bill forwarding President Donald Trump’s agenda on May 22 in Washington, DC.

Kevin Dietsch | Getty Images

House reconciliation legislation, also known as the One, Big, Beautiful Bill, includes changes aimed at helping to boost family’s finances.

Those proposals — including $1,000 investment “Trump Accounts” for newborns and an enhanced maximum $2,500 child tax credit — would help support eligible parents.

Proposed tax cuts in the bill may also provide up to $13,300 more in take-home pay for the average family with two children, House Republicans estimate.

“What we’re trying to do is help hardworking Americans who are trying to provide for their families and make ends meet,” House Speaker Mike Johnson, R-La., said during a June 8 interview with ABC News’ “This Week.”

Yet the proposed changes, which emphasize work requirements, may reduce aid for children in low-income families when it comes to certain tax credits, health coverage and food assistance.

Households in the lowest decile of the income distribution would lose about $1,600 per year, or about 3.9% of their income, from 2026 through 2034, according to a June 12 letter from the Congressional Budget Office. That loss is mainly due to “reductions in in-kind transfers,” it notes — particularly Medicaid and the Supplemental Nutrition Assistance Program, or SNAP, formerly known as food stamps.

20 million children won’t get full $2,500 child tax credit

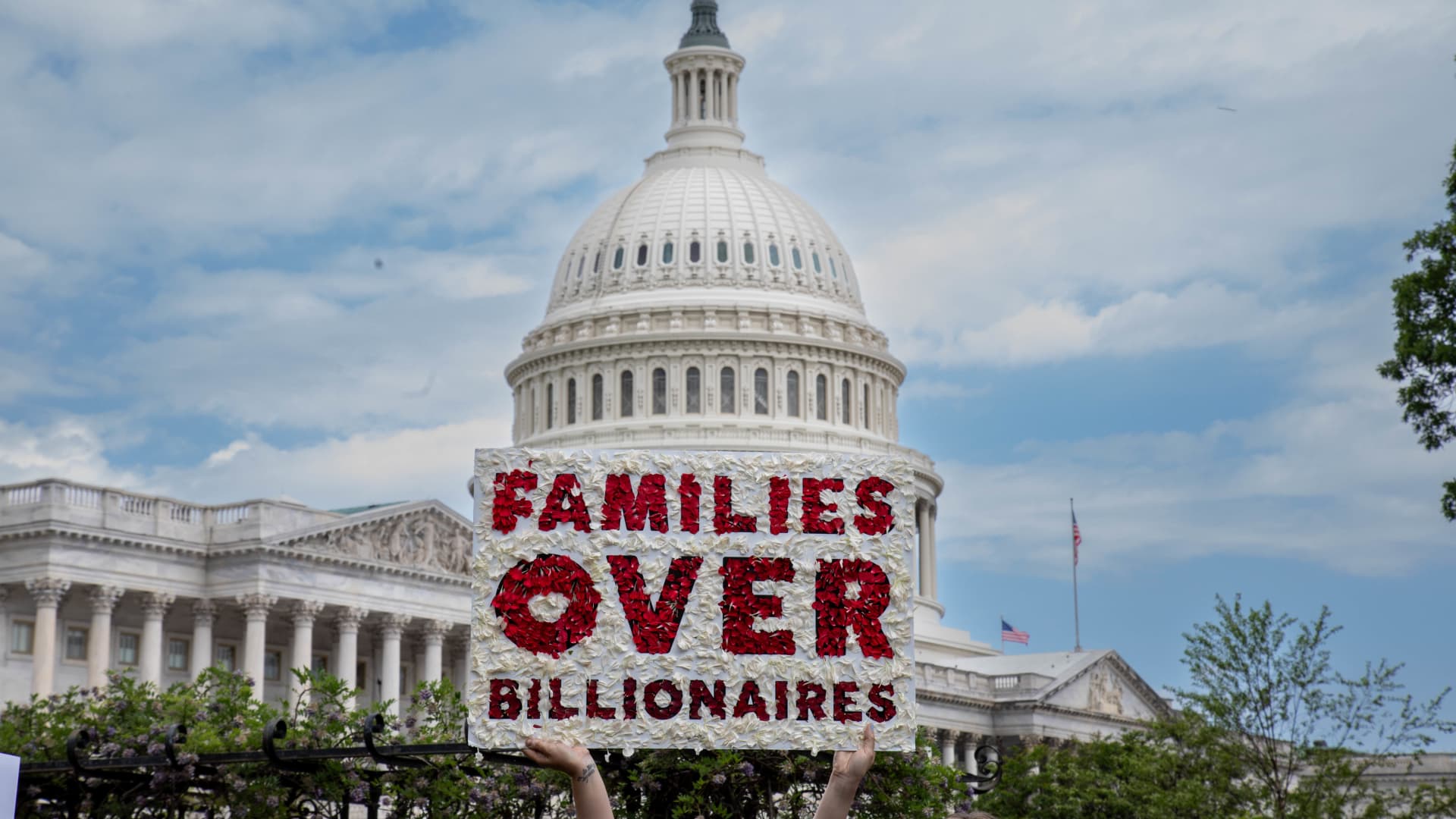

A member of MomsRising holds a sign on Capitol Hill to urge lawmakers to reject tax breaks for billionaires and protest cuts to Medicaid and child care on Capitol Hill on May 8 in Washington, D.C.

Brian Stukes | Getty Images Entertainment | Getty Images

House Republicans have proposed increasing the maximum child tax credit to $2,500 per child, up from $2,000, a change that would go into effect starting with tax year 2025 and expire after 2028.

The change would increase the number of low-income children who are locked out of the child tax credit because their parents’ income is too low, according to Adam Ruben, director of advocacy organization Economic Security Project Action. The tax credit is not refundable, meaning filers can’t claim it if they don’t have a tax obligation.

Today, there are 17 million children who either receive no credit or a partial credit because their family’s income is too low, Ruben said. Under the House Republicans’ plan, that would increase by 3 million children. Consequently, 20 million children would be left out of the full child tax credit because their families earn too little, he said.

“It is raising the credit for wealthier families while excluding those vulnerable families from the credit,” Ruben said. “And that’s not a pro-family policy.”

A single parent with two children would have to earn at least $40,000 per year to access the full child tax credit under the Republicans’ plan, he said. For families earning the minimum wage, it may be difficult to meet that threshold, according to Ruben.

In contrast, an enhanced child tax credit put in place under President Joe Biden made it fully refundable, which means very low-income families were eligible for the maximum benefit, according to Elaine Maag, senior fellow at the Urban-Brookings Tax Policy Center.

In 2021, the maximum child tax credit was $3,600 for children under six and $3,000 for children ages 6 to 17. That enhanced credit cut child poverty in half, Maag said. However, immediately following the expiration, child poverty increased, she said.

The current House proposal would also make about 4.5 million children who are citizens ineligible for the child tax credit because they have at least one undocumented parent who files taxes with an individual tax identification number, Ruben said. Those children are currently eligible for the child tax credit based on 2017 tax legislation but would be excluded based on the new proposal, he said.

New red tape for a low-income tax credit

House Republicans also want to change the earned income tax credit, or EITC, which targets low- to middle-income individuals and families, to require precertification to qualify.

When a similar requirement was tried about 20 years ago, it resulted in some eligible families not getting the benefit, Maag said. The new prospective administrative barrier may have the same result, she said.

More than 2 million children’s food assistance at risk

Momo Productions | Digitalvision | Getty Images

House Republican lawmakers’ plan includes almost $300 billion in proposed cuts to the Supplemental Nutrition Assistance Program, or SNAP, through 2034.

SNAP currently helps more than 42 million people in low-income families afford groceries, according to Katie Bergh, senior policy analyst at the Center on Budget and Policy Priorities. Children represent roughly 40% of SNAP participants, she said.

More than 7 million people may see their food assistance either substantially reduced or ended entirely due to the proposed cuts in the House reconciliation bill, estimates CBPP. Notably, that total includes more than 2 million children.

“We’re talking about the deepest cut to food assistance ever, potentially, if this bill becomes law,” Bergh said.

More from Personal Finance:

Experts weigh pros and cons of $1,000 Trump baby bonus

How Trump spending bill may curb low-income tax credit

Why millions would lose health insurance under House spending bill

Under the House proposal, work requirements would apply to households with children for the first time, Bergh said. Parents with children over the age of 6 would be subject to those rules, which limit people to receiving food assistance for just three months in a three-year period unless they work a minimum 20 hours per week.

Additionally, the House plan calls for states to fund 5% to 25% of SNAP food benefits — a departure from the 100% federal funding for those benefits for the first time in the program’s history, Bergh said.

States, which already pay to help administer SNAP, may face tough choices in the face of those higher costs. That may include cutting food assistance or other state benefits or even doing away with SNAP altogether, Bergh said.

While the bill does not directly propose cuts to school meal programs, it does put children’s eligibility for them at risk, according to Bergh. Children who are eligible for SNAP typically automatically qualify for free or reduced school meals. If a family loses SNAP benefits, their children may also miss out on those benefits, Bergh said.

Health coverage losses would adversely impact families

A protestor holds a sign on May 7, 2025 in Washington, D.C.

Leigh Vogel | Getty Images Entertainment | Getty Images

Families with children may face higher health care costs and reduced access to health care depending on how states react to federal spending cuts proposed by House Republicans, according to the Center on Budget and Policy Priorities.

The House Republican bill seeks to slash approximately $1 trillion in spending from Medicaid, the Children’s Health Insurance Program and Affordable Care Act marketplaces.

Medicaid work requirements may make low-income individuals vulnerable to losing health coverage if they are part of the expansion group and are unable to document they meet the requirements or qualify for an exemption, according to CBPP. Parents and pregnant women, who are on the list of exemptions, could be susceptible to losing coverage without proper documentation, according to the non-partisan research and policy institute.

Eligible children may face barriers to access Medicaid and CHIP coverage if the legislation blocks a rule that simplifies enrollment in those programs, according to CBPP.

In addition, an estimated 4.2 million individuals may be uninsured in 2034 if enhanced premium tax credits that help individuals and families afford health insurance are not extended, according to CBO estimates. Meanwhile, those who are covered by marketplace plans would have to pay higher premiums, according to CBPP. Without the premium tax credits, a family of four with $65,000 in income would pay $2,400 more per year for marketplace coverage.

Israel-Iran attacks and the 2 other things that drove the stock market this week

Uranium as big play due to AI-driven energy demand

How credit cycling works and why it’s risky

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoJobs report May 2025:

-

Economics1 week ago

Economics1 week agoDonald Trump has many ways to hurt Elon Musk

-

Economics6 days ago

Economics6 days agoSending the National Guard to LA is not about stopping rioting

-

Finance1 week ago

Finance1 week agoStocks making the biggest moves midday: WOOF, TSLA, CRCL, LULU

-

Blog Post7 days ago

Blog Post7 days agoMastering Bookkeeping Tasks During Peak Business Seasons

-

Economics1 week ago

Economics1 week agoDonald Trump has many ways to hurt Elon Musk

-

Personal Finance6 days ago

Personal Finance6 days agoWhat Pell Grant changes in Trump budget, House tax bill mean for students

-

Economics1 week ago

Economics1 week agoRussia cuts sky-high interest rates for the first time since 2022