Finance

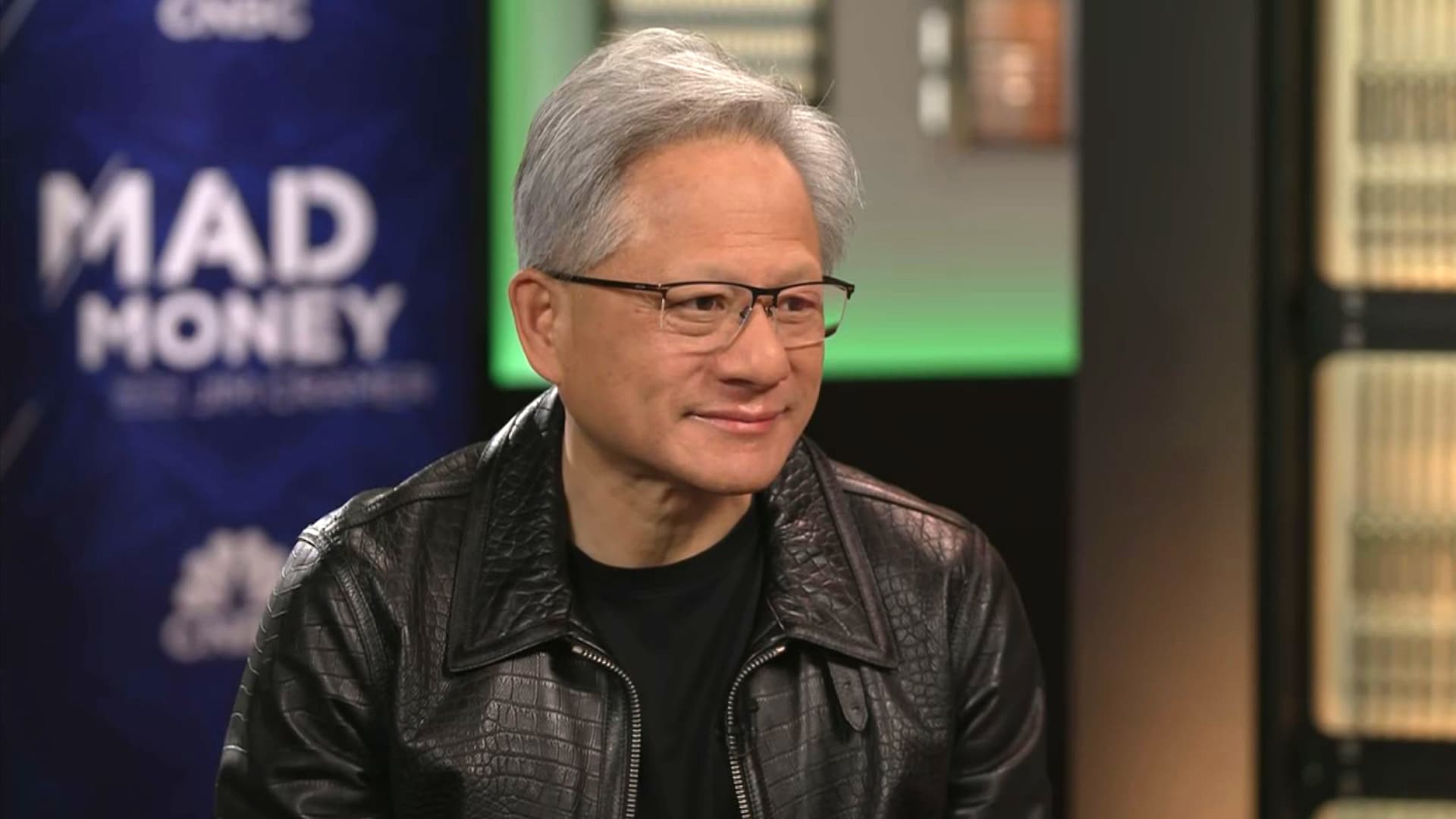

Nvidia CEO Jensen Huang says tariff impact won’t be meaningful in the near term

-

Economics1 week ago

Economics1 week agoChina risks deeper deflation by diverting exports to domestic market

-

Personal Finance5 days ago

Personal Finance5 days agoHow consumers prepare for an economic hit

-

Personal Finance7 days ago

Personal Finance7 days agoI bonds investments and Trump’s tariff policy: What to know

-

Personal Finance5 days ago

Personal Finance5 days agoReal estate and gold vs. stocks: Best long-term investment

-

Economics6 days ago

Economics6 days agoThe president has deleted a key tenet of American civil-rights law

-

Economics6 days ago

Economics6 days agoAndrew Bailey on why UK-U.S. trade deal won’t end uncertainty

-

Economics6 days ago

Economics6 days agoTrump knocks down a controversial pillar of civil-rights law

-

Finance4 days ago

Finance4 days agoAmerica failing its young investors, warns financial guru Ric Edelman