Economics

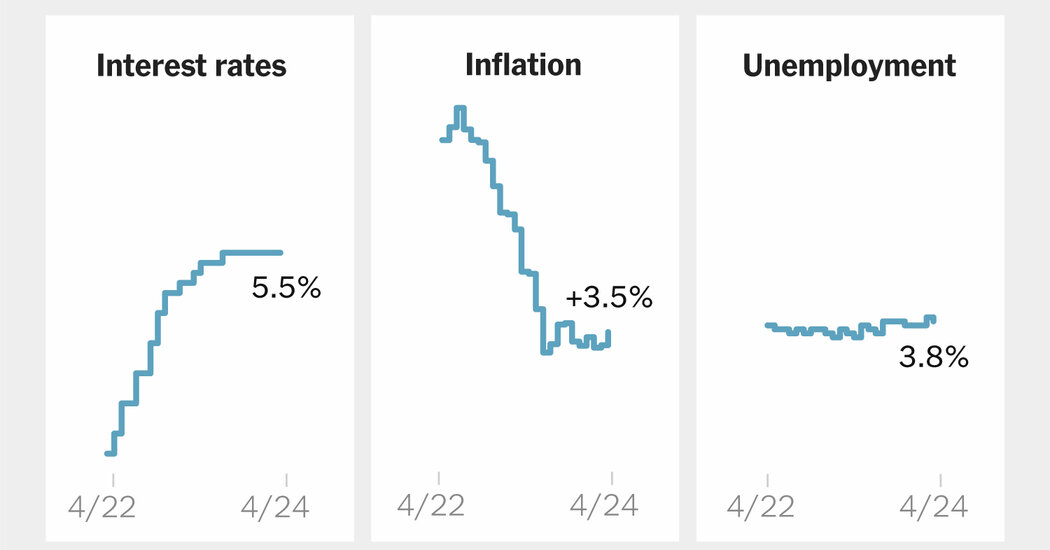

3 Facts That Help Explain a Confusing Economic Moment

-

Economics1 week ago

Economics1 week agoThe low-end consumer is about to feel the pinch as Trump restarts student loan collections

-

Blog Post1 week ago

Blog Post1 week agoBest Practices to Auditing Your Bookkeeping Records

-

Economics1 week ago

Economics1 week agoConsumer sentiment falls in May as Americans’ inflation expectations jump after tariffs

-

Economics1 week ago

Economics1 week agoThe MAGA revolution threatens America’s most innovative place

-

Accounting1 week ago

Accounting1 week agoGrant Thornton US to add GT Netherlands to platform

-

Economics4 days ago

Economics4 days agoWhat happens if the Inflation Reduction Act goes away?

-

Personal Finance3 days ago

Personal Finance3 days agoWhat House Republican ‘big beautiful’ budget bill means for your money

-

Economics1 week ago

Economics1 week agoThree paths the Supreme Court could take on birthright citizenship