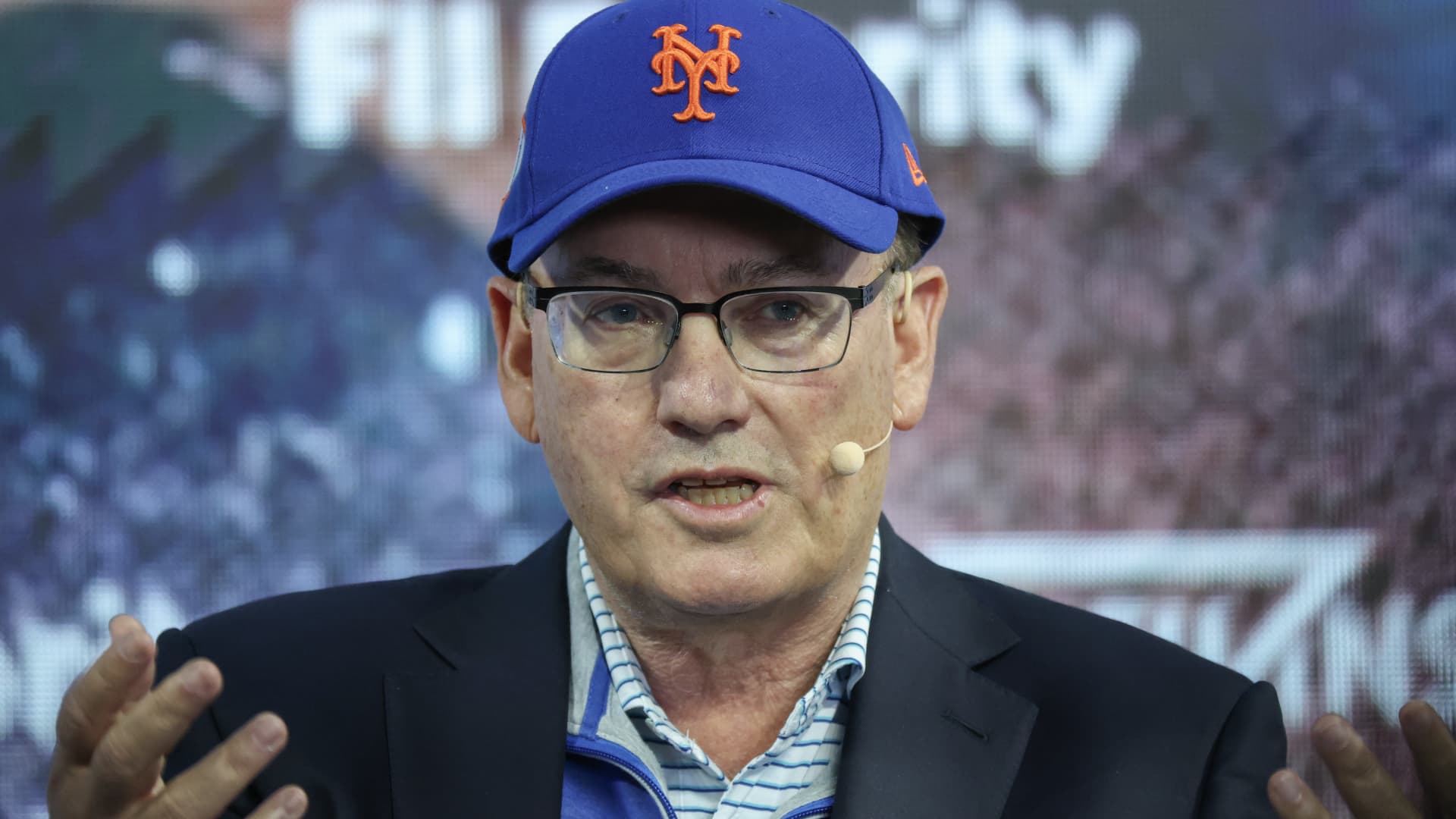

Revolut CEO Nikolay Storonsky at the Web Summit in Lisbon, Portugal, Nov. 7, 2019.

Pedro Nunes | Reuters

LONDON — British fintech firm Revolut on Thursday announced it topped $1 billion in annual profit for the first time, a major milestone for the company on the road to an eventual initial public offering.

Revolut, which offers a range of banking and financial services via an app, said that net profit for the year ending Dec. 31, 2024, totaled £1.1 billion ($1.5 billion), up 149% year over year. Revenues at the company increased 72% year on year to £3.1 billion, driven by growth across different revenue streams.

Revolut’s wealth unit — which includes its stock-trading business — saw outsized growth, with revenue surging 298% to £506 million, while subscriptions turnover jumped 74% to £423 million.

Revolut also saw significant growth in its loan book, which grew 86% to £979 million. Coupled with a jump in customer deposits, this contributed to a 58% increase in interest income, which totaled £790 million.

UK bank rollout

Revolut’s financial milestone arrives at a critical time for the almost decade-old-firm. The digital banking unicorn has been preparing a transition to becoming a fully operational bank in the U.K. after securing a banking license last summer.

It was granted a banking license with restrictions in July 2024 from the U.K.’s Prudential Regulation Authority, bringing an end to a lengthy application process that began back in 2021.

The restricted license means that Revolut is now in the “mobilization” stage, where it is focusing on building out its banking operations and infrastructure in the run-up to a full launch. The period typically lasts about 12 months.

Francesca Carlesi, Revolut’s U.K. CEO, told the Wall Street Journal last month that it views its journey to becoming a fully authorized U.K. bank as a crucial step in its global expansion and eventual IPO. “My main strategic focus is making Revolut the primary bank for everybody in the U.K.,” she told the WSJ.

Revolut is still awaiting approval from regulators to transfer all of its U.K. users to a new banking entity this summer. Once fully up and running, the firm will be able to begin offering loans, overdrafts and mortgages, opening up the path to new income streams.

It has a steep hill to climb — rivals Monzo and Starling have had a lengthy head start on Revolut. Monzo obtained its full banking license in 2017, while Starling was granted its own permit in 2016.

Personal Finance6 days ago

Personal Finance6 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance6 days ago

Personal Finance6 days ago

Economics7 days ago

Economics7 days ago

Economics1 week ago

Economics1 week ago

Economics7 days ago

Economics7 days ago

Economics7 days ago

Economics7 days ago

Economics7 days ago

Economics7 days ago