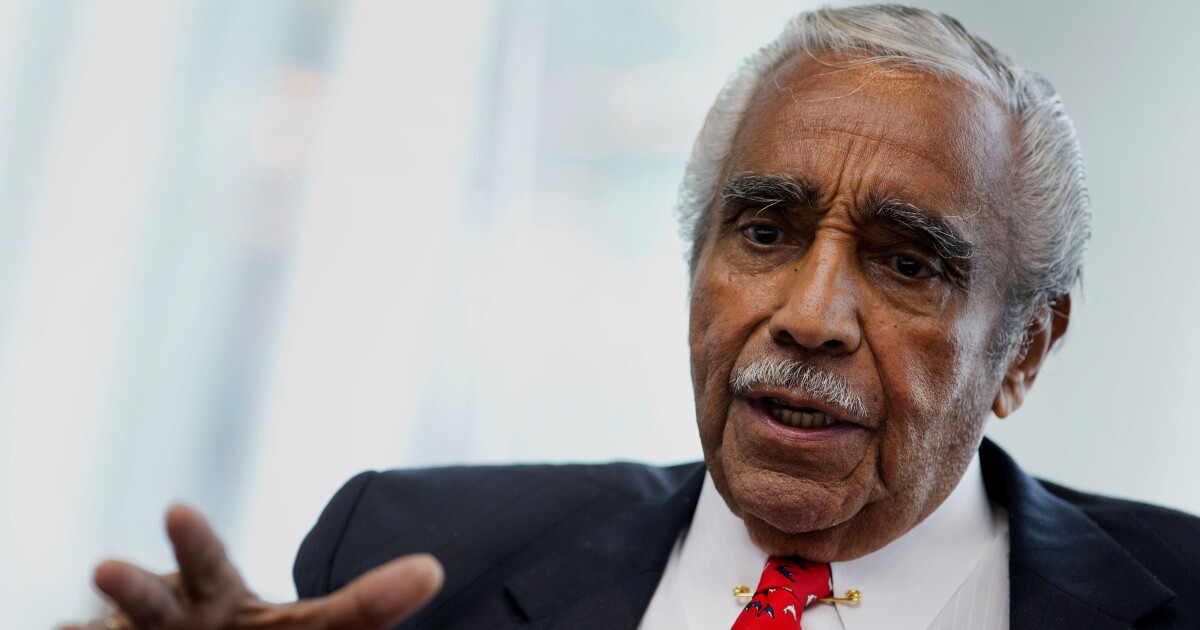

Charles Rangel, the dapper, voluble U.S. congressman from New York’s Harlem district who for four decades used his perch on the House tax-writing committee to advocate for inner cities and the people who live there, has died. He was 94.

The former congressman died on Monday, according to a statement from the City College of New York, where he had served as statesman-in-residence. No cause of death was given.

From 1974, when he became the first Black member of the House Ways and Means Committee, Rangel championed tax legislation to foster low-income housing and urban development, encourage trade with Caribbean nations and discourage U.S. business with South Africa’s apartheid government. He said the poor, the elderly and the infirm deserved and needed his protection.

“I don’t believe there’s any compassion in capitalism at all,” he said in 2013. “I believe it’s survival of the fittest.”

In 2007, he achieved his goal of becoming Ways and Means chairman. However, after just three years in the powerful post, he was pressured to step down during an investigation by the House ethics committee.

The panel found him guilty of 11 counts of violating House rules, including using his office to solicit donations for an academic center named after him at City College of New York and — particularly embarrassing for a member of the tax-writing committee — failing to pay taxes on rental income from his villa in the Dominican Republic. On Dec. 2, 2010, he became the first lawmaker censured by the House in 27 years.

Admitted mistakes

Rangel admitted making mistakes but insisted he had never sought to enrich himself.

“I’m not going to be judged by this Congress,” he told lawmakers after the censure vote, “but I’m going to be judged by my life, my activities, my contributions to society, and I just apologize for the awkward position that some of you are in.”

Even as the ethics case was proceeding, voters in New York City’s 15th congressional district awarded Rangel his 21st term in 2010. He finally retired at the start of 2017, at age 86, having served 46 years in Congress.

Rangel was the second congressman to represent his district since its creation during World War II. The first, Adam Clayton Powell Jr., pastor of the Abyssinian Baptist Church, served from 1945 to 1970 but spent part of the late 1960s in exile in the Bahamas, avoiding both a congressional investigation of his use of public funds and a contempt-of-court warrant in New York, where he had been found guilty of defamation. Rangel, a member of the New York legislature at the time, challenged and defeated the absent Powell in the 1970 primary.

O’Neill ally

In the House, Rangel allied himself with Massachusetts Representative Thomas “Tip” O’Neill, who would rise to Speaker in 1977. An original member of the Congressional Black Caucus from its founding in 1971, Rangel was elected its president in 1974 and led a push to get more Black congressmen onto key committees.

As part of a shakeup that placed 16 members of both parties onto Ways and Means, O’Neill created an opening for Rangel, who remarked that with the influx of new faces, the committee had “swung away from its conservative, rural orientation for the first time since the days of the 13 colonies.”

For the next four decades, no debate on tax or trade policy, Social Security or Medicare could be considered over until Rangel’s distinctive gravelly voice had been heard.

“There’s not a tax bill that poor and working people don’t come out ahead on because of my efforts,” he told the New Yorker for a 2000 profile. “It’s not because I’m that good. It’s just because other people want so many other things that I can say, ‘Hey, hold it. Stop the parade!'”

Reagan years

In no small part due to Rangel’s pressure, President Ronald Reagan approved factoring inflation into the earned income tax credit, which helps the working poor. In 1987, Rangel won passage of a measure — the so-called Rangel Amendment — denying U.S. companies doing business in South Africa, then under White apartheid rule, the customary tax credit for taxes paid in foreign countries.

He worked with Republicans on proposals to create so-called urban enterprise zones, where tax incentives would lure development. The idea was implemented in 1993 under President Bill Clinton, a Democrat, as empowerment zones, with one, the Upper Manhattan Empowerment Zone, located in Harlem.

In 1996, Rangel condemned as a “cruel monstrosity” Republican-drafted legislation that ended welfare as an entitlement. When Clinton agreed to sign the bill into law, Rangel lamented, “My president will boldly throw one million into poverty.”

Rangel also proposed reinstating a military draft of all men and women from 18 to 42, on the grounds that U.S. wars in Afghanistan and Iraq were being fought “predominantly by tough, loyal and patriotic young men and women from the barren hills and towns of rural and underprivileged neighborhoods in urban America where unemployment is high and opportunities are few.”

132nd and Lenox

Charles Bernard Rangel was born on June 11, 1930, in New York City, where he was raised in the home of his maternal grandfather, Charles Wharton — “by the tough corner of 132nd Street and Lenox Avenue in the heart of Harlem,” as he wrote in his 2007 memoir, authored with Leon Wynter.

His father, Ralph, who left the family when Rangel was six, was “absolutely no good,” Rangel said. He grew up around the apron strings of his working mother, Blanche, and was raised in part by his grandfather and his older brother, Ralph. He also had a younger sister, Frances.

One of Rangel’s early jobs was delivering copies of a newspaper published by Powell from his headquarters at Abyssinian Baptist Church. Rangel himself was Catholic.

As Rangel told it, he was an exceptional student until reaching DeWitt Clinton High School in the Bronx, where he felt “not able to compete” in the Jewish-dominated student body. He dropped out and signed up for the U.S. Army in 1948, an experience that left him with a sour taste for military recruiters — “no more than salesmen,” he said.

Purple Heart

In Korea in 1950, part of an artillery unit, Rangel was wounded by a mortar shell during a battle with advancing Chinese troops. He was awarded a Purple Heart and a Bronze Star for continuing to lead his heavily outnumbered men to safety.

Turning to the Veterans Administration for help in what to do next, Rangel said, he was given two options: electrician or mortician. But one counselor urged him to finish his education. Rangel took one year to complete his last two years of high school, then went on to graduate from New York University in 1957.

At St. John’s University, studying law on a full scholarship, he got involved with student government and displayed an ease with the ethnic politicking that dominates New York City elections.

“A group of us actually started our own national fraternity — mainly to stick it to the dean, because we thought he catered to one Irish fraternity,” Rangel wrote in his memoir. “And who was in our fraternity? Everybody except the preferred Irish majority.”

Enters politics

Following his graduation in 1960, Rangel worked as an attorney in private practice and a federal prosecutor while testing the waters in local Democratic politics. In 1966, he won election to the New York State Assembly to succeed Percy Sutton, who had been appointed Manhattan borough president. They became longtime allies.

Initially seen as reformers, Sutton and Rangel, along with Basil Paterson and future New York City Mayor David Dinkins, became known as the “Gang of Four” for their control of Harlem politics.

Rangel decided to challenge Powell for Congress after traveling to the Bahamian island of Bimini to try to persuade him to come home and serve. Rangel surpassed Powell by 150 votes out of 25,000 in the Democratic primary that September, then breezed to victory in the general election.

Drug trade

His initial priority was the illegal drug trade, and he urged more spending for rehabilitation programs. He was a member of the House Judiciary Committee when it approved articles of impeachment against President Richard Nixon.

While rising in seniority on Ways and Means, Rangel also sought a role in House Democratic leadership but was derailed in 1986, when Representative Tony Coelho of California defeated him for the role of House majority whip.

With his wife, the former Alma Carter, he had two children, Alicia and Steven.

Economics1 week ago

Economics1 week ago

Accounting5 days ago

Accounting5 days ago

Economics6 days ago

Economics6 days ago

Personal Finance5 days ago

Personal Finance5 days ago

Economics1 week ago

Economics1 week ago

Accounting5 days ago

Accounting5 days ago

Economics1 week ago

Economics1 week ago

Finance4 days ago

Finance4 days ago