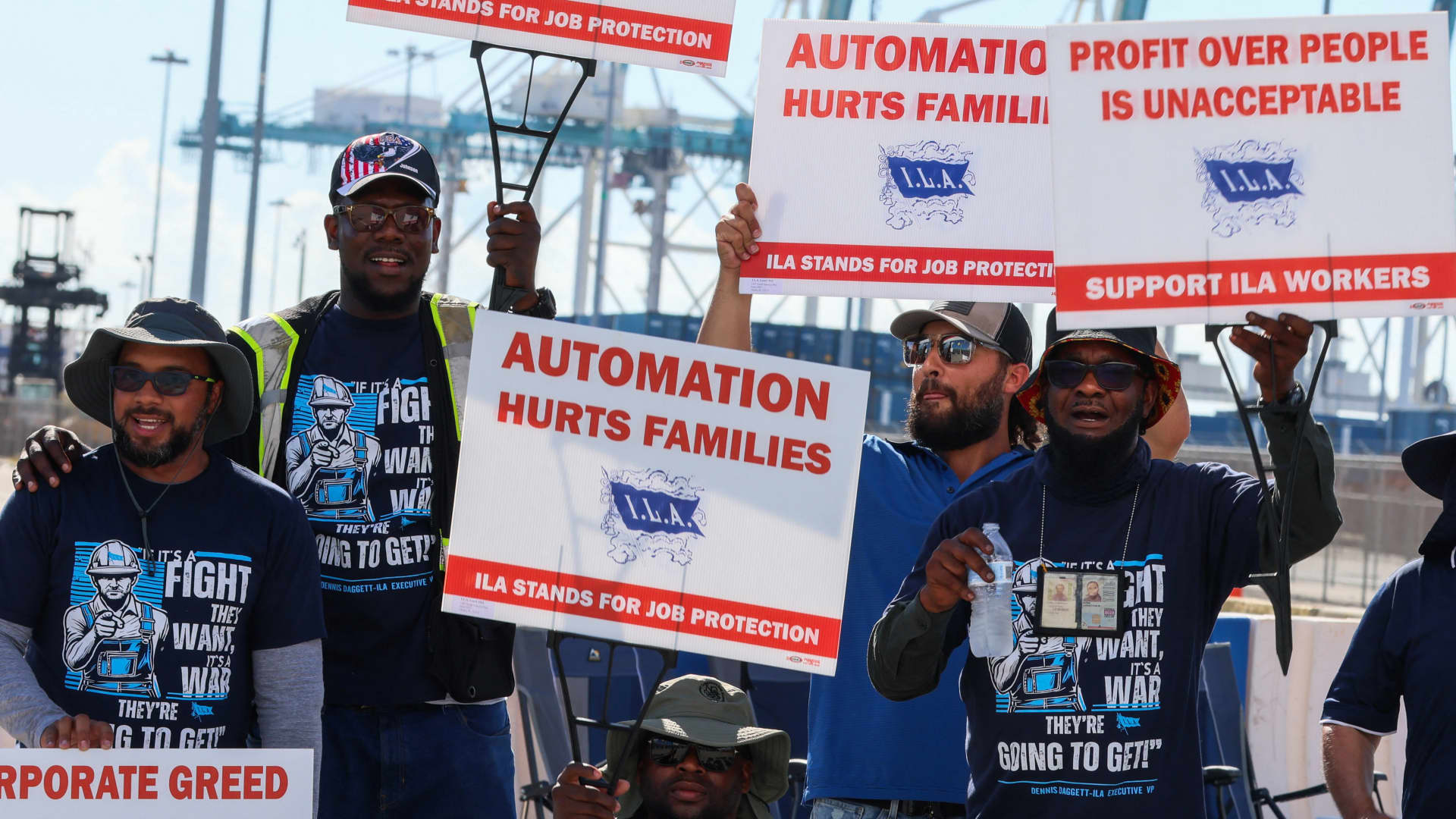

Port of Miami dockworkers strike near the port entrance and demand a new labor contract, on October 1, 2024 in Miami, Florida.

Giorgio Viera | Afp | Getty Images

A strike hitting ports along the East and Gulf coasts could stoke prices for food, autos and a host of other consumer goods but is expected to cause only modest broader impacts — so long as it doesn’t drag on for too long.

Manufacturers of everything from trucks to toys to artificial Christmas trees face obstacles now that the International Longshoreman’s Association has called a stoppage at major Eastern container and cargo ports.

From a macro perspective, the impact will depend on duration. President Joe Biden, under powers granted by the Taft-Hartley Act, could step in and order an 80-day cooling off period that would at least temporarily halt the stoppage, though there’s little indication he will do so.

That will leave hopes in the hands of negotiators for the union and the U.S. Maritime Alliance that the strike won’t drag on and cause greater hardship for a U.S. economy heading into the critical holiday shipping season.

“Labor action by port workers along the East and Gulf coast of the United States will provide a modest hit to GDP,” said RSM chief economist Joseph Brusuelas, who put the weekly impact at bit more than 0.1 percentage point of gross domestic product and $4.3 billion in lost imports and exports.

“Given that the American economy is on a 3% growth path at this time we do not expect the strike to derail the trajectory of the domestic economy or present a risk to an early and unnecessary end to the current economic expansion,” he added.

Indeed, the $29 trillion U.S. economy has dodged multiple landmines and has been in growth mode for the past two years. The Atlanta Federal Reserve is tracking third-quarter growth of 3.1%, boosted by an acceleration in net exports.

A prolonged work stoppage, though, could threaten that.

Impacted areas

Some of the main industries facing challenges include coal, energy and agricultural products. One rule of thumb is that for each strike day, it takes nearly a week to get ports operating at normal levels.

“The costs of the strike would escalate over time as backlogs of exports and imports grow,” Citigroup economist Andrew Hollenhorst said in a client note. “Perishable products like imported fresh fruit might be first to come into short supply. If the strike extends beyond a few days, shortages of certain production inputs could eventually slow production and raise prices for manufactured goods like autos.”

There are potential buffers, though, to the damage a strike could cause.

For one, West Coast ports are expected to take on some of the freight business that would normally go to the eastern ports. Also, some companies have been anticipating the stoppage and stockpiled ahead of time.

Moreover, pressure on supply chains, exacerbated sharply during the pandemic, has largely eased and is in fact below pre-Covid levels, according to a New York Fed measure.

“We think fears around the potential economic impacts are overdone,” wrote Bradley Saunders, North America economist at Capital Economics. “Frequent shocks to supply chains in recent years have left producers more attuned to the risks of running low inventories. It is therefore likely that firms will have taken precautionary measures in case of a strike – not least because the possibility has been touted by the ILA for months.”

Saunders added that he thinks there’s a strong possibility that the White House could step in to the fray and invoke a cooling-off period, despite the administration’s strongly pro-union leanings.

“There is little chance that the administration would risk jeopardizing its recent economic successes less than two months before a tightly-contested election,” he said.

Inflation threat

In the meantime, there are a slew of other issues that could complicate things.

Snags in the supply chain could exacerbate inflation just as it appears price pressures have cooled from their mid-2022 peak that sent the annual rate to its highest level in more than 40 years. The maritime association is proposing raises approaching 50%, another factor that could reignite inflation just as wage pressures also have receded. The union is looking for larger increases plus guarantees against automation.

“This is clearly transitory. They will have some resolution,” said Christopher Ball, economics professor at Quinnipiac University. “That being said, in the short run, if it lasts more than a few days, if it lasts more than a week … that will certainly push up the prices of a lot of those goods and services now. It could cause prices spikes in the short run during the strike, and I can easily see that pushing up prices of certain goods a lot.”

Ball expects the main areas to be impacted will be food and vehicles, both of which have exerted either disinflationary or deflationary pressures in recent months. Small businesses near the ports also could feel adverse impacts, he added.

“If it goes a week or two, you’re running into businesses that that have real shortages and, yeah, they’ll absolutely have to raise those prices just to prevent broad shortages of those goods,” Ball said.

That all comes at an inopportune time for the Federal Reserve. The central bank last month cut its benchmark borrowing rate by half a percentage point and indicated more easing is to come as it gains confidence that inflation is easing.

However, the strike could complicate decision-making. The October jobs report, which is the last one the Fed will see before its Nov. 6-7 policy meeting, will be influenced both by strike-impacted layoffs as well as those from Hurricane Helene.

It all comes with a looming presidential election on Nov. 5, and the economy as a pivotal issue.

“This would just completely complicate everything that the Fed is trying to do because they’re not getting a read to what the economy is actually performing,” Jim Bianco, head of Bianco Research, told CNBC.

Fed Chair Jerome Powell on Monday said he expects the Fed to lower rates by another half percentage point by the end of the year, somewhat slower than markets had been anticipating.

Accounting1 week ago

Accounting1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago