Accounting

Art of Accounting: Succeeding by being imaginative

Published

1 day agoon

Enjoy complimentary access to top ideas and insights — selected by our editors.

I have been very successful in part because I thought outside the box and tried new things. Not everything worked, but enough worked to make all the effort well worth it. Here is an illustration of an off-the-wall something I did that worked great. I forgot about this completely and never wrote about it and it wasn’t even considered for my Memoirs of a CPA book, until I received a text last week.

Some recent background

A couple of weeks ago I was on a podcast with Yuri Kapilovich, CPA, author and “the fun CPA.” We discussed the current situation in public accounting, and he asked if I had any suggestions to alleviate the shortage and the onerous hours at many firms. I suggested something that would solve both problems simultaneously. I don’t remember his reaction, but when I get the final podcast, I will see how I said it and how he responded.

My time-saving suggestion

I mentioned to Yuri that while every managing partner has an executive assistant, none of the other partners do. I suggested that a partner managing $2 to $3 million revenues with perhaps five to 10 staff also get an executive or administrative assistant. This would stop them from doing considerable non-chargeable or non-face time with clients. I figure that a full-time assistant at a cost of about $80,000 would save them about 20% of their time that would shift about eight hours a week to client or marketing services. Considering that the chargeable time at that level is about 1,200 hours a year, they would move away from 240 administrative hours to 240 client production hours. The cost of this $80,000 would have to be less than 20% of their added potential production. Even if it is a push, it would certainly make sense. There would be plenty of other work the administrative person could perform.

My definition of chargeable time does not assume that hours would be billed and collected. It assumes that the added hours would create greater client service or marketing activities or responsibilities. However, if your billings are strictly based on hours, then you could easily quantify the benefits.

I thought about this afterward and cannot understand why this isn’t being done.

Last week’s reconnection

This past week, actually the day before I wrote this, I received a text from a young lady who worked for me starting in 1968 when she was 15 and in high school. We spoke and it was a real pleasure finding out about her life since she graduated college when we parted company. It turns out she had a remarkable career with multiple advanced degrees and some very high level and interesting jobs with a lot of fun travel, and she is a grandmother of five. Her husband was a CPA and at some point she decided to become an accountant. She got a degree and started her own practice. Today a son is a partner with her and her husband also joined her practice after he retired. Unfortunately, he passed away two years ago. While she is located in Port St. Lucie, her practice is virtual, with clients throughout the country. If you need an accountant or a connection in that area of Florida, her name is Marcia Solomon Rubin and her practice is

Validation of my suggestion

Now comes the validation of my idea. In 1968 I had five years’ experience and had a job with Bernard D. Kleinman. I also owned a mail order business and had a partner running it full time. However, while I worked at it off hours, I was spending more time than I wanted to. I decided to hire an assistant, i.e., a go-fer, for about 15 hours a week. I asked Bernie if he would provide a desk for her and room for some inventory and supplies. I “justified” it by explaining that it would make me more effective for him by giving me more time to work on and think about his clients. It would eliminate nonproductive time I was spending, plus when she was in the office and his secretary had to take a short break, Marcia could answer the phones for him. Anyway, he agreed. A short time afterward, I decided to get my own apartment in Manhattan, instead of commuting from my parent’s apartment in the Bronx. I asked Marcia to find me an apartment in the area of the office. I explained what I wanted and the rent I wanted to pay. She spent a few days on it and found me a great apartment a short walk from Bernie’s office. She narrowed her search to two apartments and set up appointments for me. I rented one of them. This obviously saved me considerable time and added to my time working for Bernie.

Since then, I have always had a secretary or an administrative assistant. When I had my New York practice, we opened a satellite office near my house in East Brunswick, New Jersey (I was married with two children). I then decided to spend Mondays at that office and hired a part time secretary/assistant for four days, five hours a day. At another point I added a full-time secretary in our New York office who spent about 90% of her time working with me. Eventually we hired, in 1986, a full-time administrator, i.e., COO (who was not an accountant), to run our practice on a daily basis, which primarily relieved me of much of my administrative responsibilities. Of course he had many other things to do. My partners were fine with all of this.

I could go on with more, but the point is that the administrative assistant is not a new idea for me. It goes back to 1968 and was continuous. Yet, I do not know many firms doing this. I am not a genius and running a practice, no matter how profitable, was always a struggle juggling all the parts including cash flow. However, my partners and I made a decision that we would be richer by spending the money on that assistant.

Yuri’s podcast

Yuri and I spent over an hour together chatting about the current climate of the public accounting business. Some points were heated but always respectful. He brought a professional crew to my office and it is now being edited. However, he already posted two unedited clips from it. One is the final 15 minutes and I suggest watching it. You can listen to it, but you’ll miss my animation. Here is a YouTube link:

Key to success

You have to realize you are in a business and need to act like that with every decision. Running your business is a serious undertaking and needs to be deliberate with the right time allocated to it. It also needs thinking like a businessperson, not an accountant. When you work on your clients, you are the accountant. When you work on your business, you are not an accountant, but an owner. You should do things the way any other business would do it.

Using this example, would the owner of any of your clients do all of the administrative work a senior manager or non-managing partner does: scheduling and micromanaging some of the staffing, following up on projects, time scheduling and following through, handling correspondence, following up on missing information, keeping track of what staff members actually do compared to what they should have done, making sure staff are prepared and know how to prepare, advance planning of scheduling, creating the invoices, making collection calls, setting up their own appointments to meet with clients, booking their own flights and car service to and from airports, making sure the staff gets the right CPE and training and mentoring, developing marketing activities and spending time figuring how to add value to the clients. Actually, the last two things are what the senior manager or non-managing partner should do, not the other things.

New School idea

My “New School” idea that I suggested during Yuri’s podcast was a replication of something I started in 1968. You just need to be imaginative.

Do not hesitate to contact me at

You may like

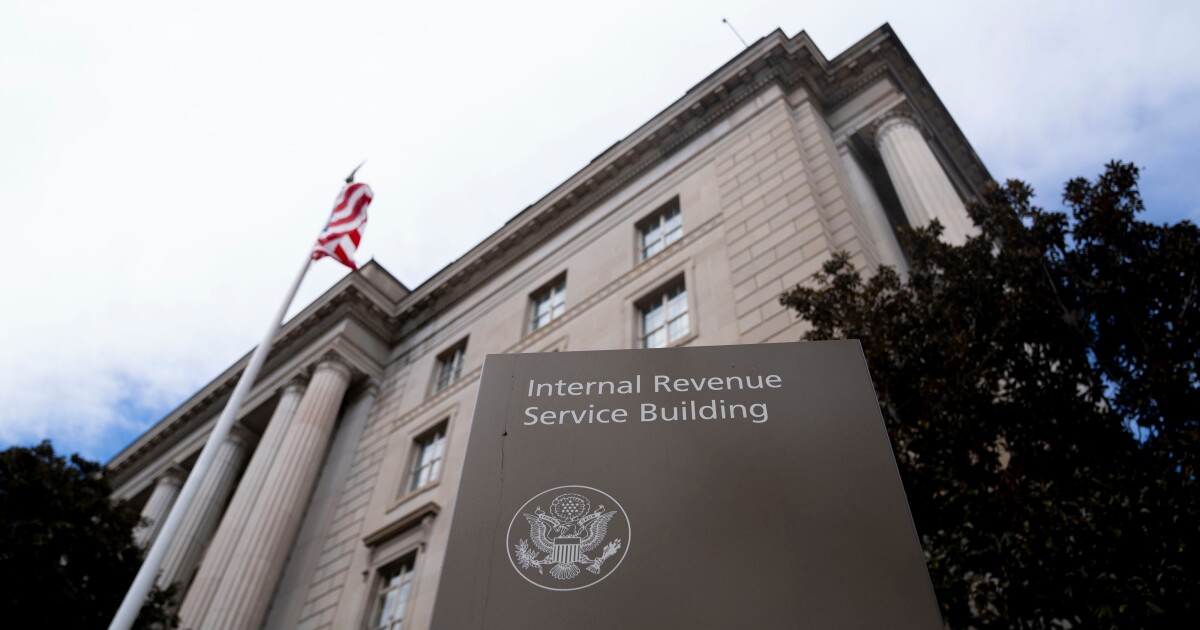

The Internal Revenue Service is expected to lean more heavily on artificial intelligence technology as it carries out widespread layoffs.

A

TIGTA assessed how effectively the IRS’s Large Business and International Division and the IRS Small Business/Self-Employed Division employ AI models to identify returns and issues for examinations.

The IRS started using AI several years ago and revamped how it selects tax returns and identifies issues for examination by using AI models that have been trained on current tax return data instead of relying on past audit results.

The report noted that historical examination results are informative and should be used by the IRS to monitor and improve AI models when available. For instance, the IRS could utilize examination results to improve return classification and return selection AI models that could potentially identify new areas of noncompliance. The IRS should also consider evaluating ensemble machine-learning for improving the accuracy of identifying noncompliant taxpayers and narrowing the tax gap. “Ensemble learning is an approach that combines multiple machine-learning algorithms to potentially improve performance by making more accurate predictions of which tax returns and/or issues to examine,” said the report.

The IRS has not set up processes to evaluate whether the performance of AI models is better than prior methods or is achieving the intended objectives, according to the report. But not evaluating performance results runs contrary to federal AI key practices to ensure accountability and responsible AI use.

The report recommended that the IRS’s chief tax compliance officer, in partnership with the chief data and analytics officer where appropriate, require division commissioners to use governance processes to ensure that examination performance results are part of the monitoring and continuing refinement of the return classification and selection AI models. They should also refine the AI models by incorporating ensemble machine-learning when appropriate; and establish a measurement plan with appropriate metrics to monitor AI models to ensure that they are achieving the expected benefits and to correct any model drifts.

The IRS agreed with all three of TIGTA’s recommendations, subject to staffing constraints and anticipated new guidance from the Treasury Department on AI governance, and stated it has already tested and implemented ensemble methods in these models, where appropriate.

“The IRS is committed to continuously improving the case selection process,” wrote Reza Rashidi, acting chief data and analytics officer. “This includes making use of well-established processes to evaluate model performance.”

She added that the IRS is currently awaiting guidance from the Treasury regarding new policies and priorities for AI governance.

IRS layoffs

The IRS is expected to rely further on AI as it continues cuts to its workforce. According to another

“About 11,000 employees have been let go since Inauguration Day, and that’s an 11% drop from the numbers in January,” said Anne Gibson, a senior legal analyst at Wolters Kluwer, earlier this month. “And it’s also been reported, more than 20,000 IRS employees have accepted this new second deferred resignation offer. That is really a lot of the workforce that’s already gone at this point, and that we’re potentially going to see leaving, and there have been reports of increased wait times, for instance, on the telephone lines.”

People are also concerned about how quickly tax refunds will be issued this year, she noted. “There’s definitely some concern out there about that,” said Gibson. “It’s also important to note that there have been other reports that the administration’s overall goal is to eventually reduce the IRS workforce down to about 60% or even 50% of the January 2025 levels. That would end up being a total of only 50,000 or 60,000 employees. It’s also important to keep in mind that, generally speaking, people have felt that the IRS has been understaffed and underfunded for the past decade. Although the numbers went up a little bit after the Inflation Reduction Act allowed for some more hiring, most people didn’t think it was yet at the level that they would want to see it at. So this is really a big reduction, which is likely to make things in all areas of the IRS a little more difficult or take longer.”

The cutbacks have led the IRS to drop many of the audits it already had in progress.

“There have been news reports about audits that are in process or that are even close to being wrapped up being canceled because members of that audit team were let go and they just didn’t have the staff to carry them on,” said Gibson. “I imagine we’ll see more of that. Now, with those reductions, I think we’ll probably see fewer audits going forward than we would have otherwise seen because a large number of the staff that’s been let go, and reports are the targeted cuts going forward, a lot of those are in compliance, so that’s going to directly impact the ability of the IRS to take on audits and cases.”

Illinois approved a bill on Thursday to create additional pathways to CPA licensure, and it awaits the signature of Gov. JB Pritzker.

The legislation,

The bill preserves the legacy pathway requiring 150 credit hours plus one year of experience and passing the exam. It also ensures practice mobility so that out-of-state CPAs can serve clients in Illinois without obtaining an Illinois license.

Dave Newman – Fotolia

“For more than a year, the Illinois CPA Society has focused on eliminating barriers to entry into the profession, most notably, the time and costs required to become a CPA,” Geof Brown, president and CEO of the Illinois CPA Society, said in a statement. “The passage of House Bill 2459 is an important step in keeping Illinois’ CPAs at the forefront of the national business landscape; protecting the needs of our state’s businesses, not-for-profits, and units of government; and ensuring there’s a pipeline of next-generation accounting talent ready to step up to serve. We thank the legislation’s sponsors, co-sponsors, and other supporters who were instrumental in advancing this important initiative for the accounting profession in our state.”

The ICPAS, one of the largest CPA state associations, originally proposed the legislation. The bill was introduced in March by Reps. Natalie Manley (D-Joliet) and Amy Elik (R-Edwardsville), both of whom are CPAs, and it passed unanimously out of the House in early April. In the Senate, it was supported by chief Senate sponsor Sen. Suzy Glowiak Hilton (D-Oakbrook Terrace) and co-sponsor Chris Balkema (R-Pontiac). It passed unanimously on May 22.

Illinois is one of

Accounting

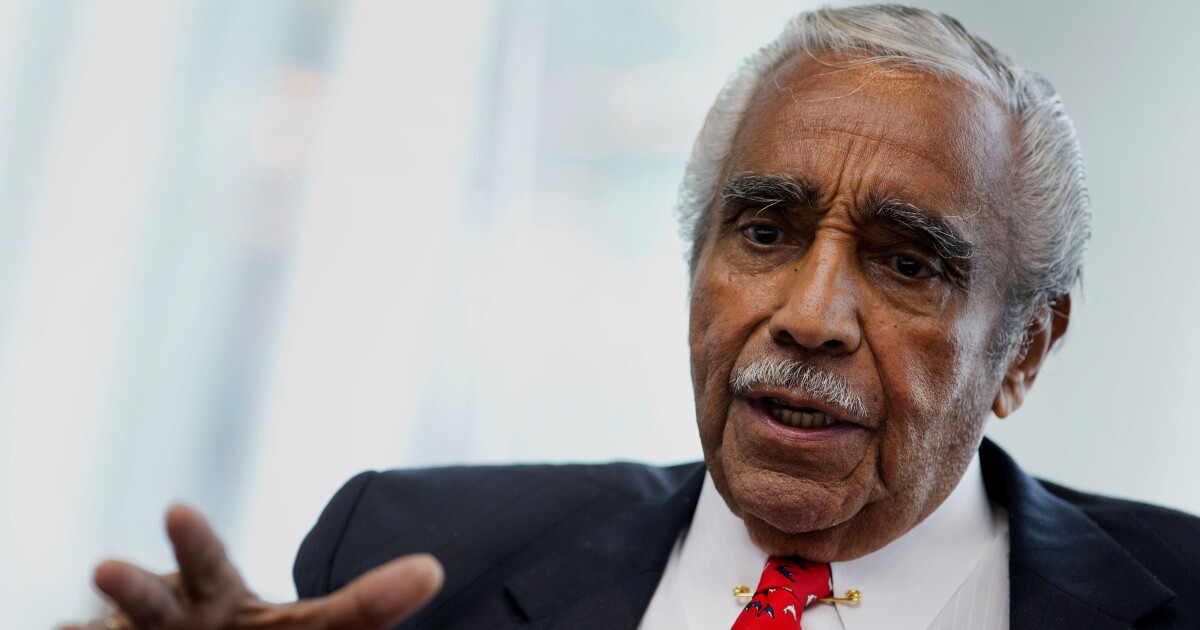

Charles Rangel, a voice for the poor in tax debates, dies at 94

Published

3 hours agoon

May 27, 2025

Charles Rangel, the dapper, voluble U.S. congressman from New York’s Harlem district who for four decades used his perch on the House tax-writing committee to advocate for inner cities and the people who live there, has died. He was 94.

The former congressman died on Monday, according to a

From 1974, when he became the first Black member of the House Ways and Means Committee, Rangel championed tax legislation to foster low-income housing and urban development, encourage trade with Caribbean nations and discourage U.S. business with South Africa’s apartheid government. He said the poor, the elderly and the infirm deserved and needed his protection.

“I don’t believe there’s any compassion in capitalism at all,” he said in 2013. “I believe it’s survival of the fittest.”

In 2007, he achieved his goal of becoming Ways and Means chairman. However, after just three years in the powerful post, he was pressured to step down during an investigation by the House ethics committee.

The panel found him guilty of 11 counts of violating House rules, including using his office to solicit donations for an academic center named after him at City College of New York and — particularly embarrassing for a member of the tax-writing committee — failing to pay taxes on rental income from his villa in the Dominican Republic. On Dec. 2, 2010, he became the first lawmaker

Admitted mistakes

Rangel admitted making mistakes but insisted he had never sought to enrich himself.

“I’m not going to be judged by this Congress,” he told lawmakers after the censure vote, “but I’m going to be judged by my life, my activities, my contributions to society, and I just apologize for the awkward position that some of you are in.”

Even as the ethics case was proceeding, voters in New York City’s 15th congressional district awarded

Rangel was the second congressman to represent his district since its creation during World War II. The first, Adam Clayton Powell Jr., pastor of the Abyssinian Baptist Church, served from 1945 to 1970 but spent part of the late 1960s in exile in the Bahamas, avoiding both a congressional investigation of his use of public funds and a contempt-of-court warrant in New York, where he had been found guilty of defamation. Rangel, a member of the New York legislature at the time, challenged and defeated the absent Powell in the 1970 primary.

O’Neill ally

In the House, Rangel allied himself with Massachusetts Representative Thomas “Tip” O’Neill, who would rise to Speaker in 1977. An original member of the Congressional Black Caucus from its founding in 1971, Rangel was elected its president in 1974 and led a push to get more Black congressmen onto key committees.

As part of a shakeup that placed 16 members of both parties onto Ways and Means, O’Neill created an opening for Rangel, who remarked that with the influx of new faces, the committee had “swung away from its conservative, rural orientation for the first time since the days of the 13 colonies.”

For the next four decades, no debate on tax or trade policy, Social Security or Medicare could be considered over until Rangel’s distinctive gravelly voice had been heard.

“There’s not a tax bill that poor and working people don’t come out ahead on because of my efforts,” he told the New Yorker for a 2000 profile. “It’s not because I’m that good. It’s just because other people want so many other things that I can say, ‘Hey, hold it. Stop the parade!'”

Reagan years

In no small part due to Rangel’s pressure, President Ronald Reagan approved factoring inflation into the earned income tax credit, which helps the working poor. In 1987, Rangel won passage of a measure — the so-called

He worked with Republicans on proposals to create so-called urban enterprise zones, where tax incentives would lure development. The idea was implemented in 1993 under President Bill Clinton, a Democrat, as empowerment zones, with one, the Upper Manhattan Empowerment Zone, located in Harlem.

In 1996, Rangel condemned as a “cruel monstrosity” Republican-drafted legislation that ended welfare as an entitlement. When Clinton agreed to sign the bill into law, Rangel lamented, “My president will boldly throw one million into poverty.”

Rangel also proposed reinstating a military draft of all men and women from 18 to 42, on the grounds that U.S. wars in Afghanistan and Iraq were being fought “predominantly by tough, loyal and patriotic young men and women from the barren hills and towns of rural and underprivileged neighborhoods in urban America where unemployment is high and opportunities are few.”

132nd and Lenox

Charles Bernard Rangel was born on June 11, 1930, in New York City, where he was raised in the home of his maternal grandfather, Charles Wharton — “by the tough corner of 132nd Street and Lenox Avenue in the heart of Harlem,” as he wrote in his 2007 memoir, authored with Leon Wynter.

His father, Ralph, who left the family when Rangel was six, was “absolutely no good,” Rangel said. He grew up around the apron strings of his working mother, Blanche, and was raised in part by his grandfather and his older brother, Ralph. He also had a younger sister, Frances.

One of Rangel’s early jobs was delivering copies of a newspaper published by Powell from his headquarters at Abyssinian Baptist Church. Rangel himself was Catholic.

As Rangel told it, he was an exceptional student until reaching DeWitt Clinton High School in the Bronx, where he felt “not able to compete” in the Jewish-dominated student body. He dropped out and signed up for the U.S. Army in 1948, an experience that left him with a sour taste for military recruiters — “no more than salesmen,” he said.

Purple Heart

In Korea in 1950, part of an artillery unit, Rangel was wounded by a mortar shell during a battle with advancing Chinese troops. He was awarded a Purple Heart and a Bronze Star for continuing to lead his heavily outnumbered men to safety.

Turning to the Veterans Administration for help in what to do next, Rangel said, he was given two options: electrician or mortician. But one counselor urged him to finish his education. Rangel took one year to complete his last two years of high school, then went on to graduate from New York University in 1957.

At St. John’s University, studying law on a full scholarship, he got involved with student government and displayed an ease with the ethnic politicking that dominates New York City elections.

“A group of us actually started our own national fraternity — mainly to stick it to the dean, because we thought he catered to one Irish fraternity,” Rangel wrote in his memoir. “And who was in our fraternity? Everybody except the preferred Irish majority.”

Enters politics

Following his graduation in 1960, Rangel worked as an attorney in private practice and a federal prosecutor while testing the waters in local Democratic politics. In 1966, he won election to the New York State Assembly to succeed Percy Sutton, who had been appointed Manhattan borough president. They became longtime allies.

Initially seen as reformers, Sutton and Rangel, along with Basil Paterson and future New York City Mayor David Dinkins, became known as the “Gang of Four” for their control of Harlem politics.

Rangel decided to challenge Powell for Congress after traveling to the Bahamian island of Bimini to try to persuade him to come home and serve. Rangel surpassed Powell by 150 votes out of 25,000 in the Democratic primary that September, then breezed to victory in the general election.

Drug trade

His initial priority was the illegal drug trade, and he urged more spending for rehabilitation programs. He was a member of the House Judiciary Committee when it approved articles of impeachment against President Richard Nixon.

While rising in seniority on Ways and Means, Rangel also sought a role in House Democratic leadership but was derailed in 1986, when Representative Tony Coelho of California defeated him for the role of House majority whip.

With his wife, the former Alma Carter, he had two children, Alicia and Steven.

IRS leveraging AI for audits amid layoffs

Illinois passes CPA licensure changes bill

Stocks making the biggest moves midday: DJT, CRM, TSLA, AMC

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoThe MAGA revolution threatens America’s most innovative place

-

Accounting5 days ago

Accounting5 days agoHouse tax bill includes provision eliminating PCAOB

-

Economics6 days ago

Economics6 days agoWhat happens if the Inflation Reduction Act goes away?

-

Personal Finance5 days ago

Personal Finance5 days agoWhat House Republican ‘big beautiful’ budget bill means for your money

-

Economics1 week ago

Economics1 week agoThree paths the Supreme Court could take on birthright citizenship

-

Accounting5 days ago

Accounting5 days agoTrump tax bill faces Senate’s arcane rules, desire for changes

-

Economics1 week ago

Economics1 week agoJoe Biden did not decline alone

-

Finance4 days ago

Finance4 days agoPersonal finance app Monarch raises $75 million