Storm damage in Little Rock, ArkansasBenjamin Krain/Photographer: Benjamin Krain/Get Individuals and businesses in all of Tennessee and Arkansas who were affected by severe storms, tornadoes, flooding...

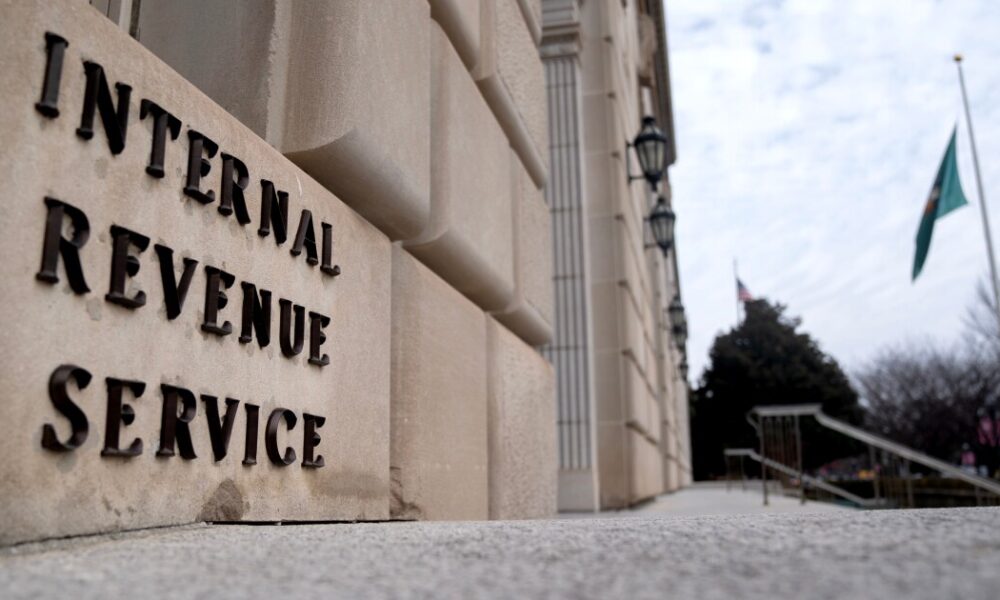

The conclusion of the tax filing season Tuesday is about to provide early clues toward resolving a nagging question hanging over the U.S. Treasury: How honest...

Enjoy complimentary access to top ideas and insights — selected by our editors. Busy season is tough, but it has its upside. This is when you’re...

President Donald Trump threatened Harvard University’s tax-exempt status after the school said it won’t accept his administration’s demands in exchange for continued federal funding. “Perhaps Harvard...

Scott Bessent ahead of an interview in Buenos Aires, Argentina, on April 14.Sarah Pabst/Photographer: Sarah Pabst/Bloomb Treasury Secretary Scott Bessent said Republicans are looking at all...

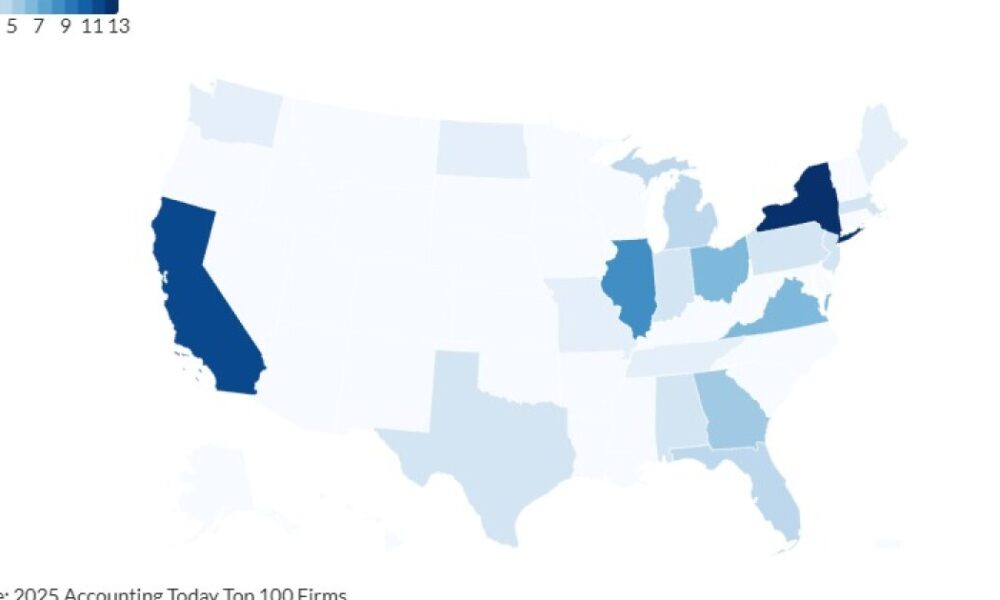

There are a great accounting firms of all sizes all over the country, but if you had to pick a capital for the profession, it would...

A majority of Americans don’t know that their taxes are about to increase. According to Cato Institute’s 2025 Fiscal Policy National Survey released Monday, 55% of...

Following its acquisition of Marcum last year, Top 10 Firm CBIZ has begun centralizing its disparate technology services offerings under a single office, headed by Peter...

Business and accounting solutions provider Wolters Kluwer is currently aware of, and is looking into, what could be a major data breach. Over the weekend it...

Forms 1042-S, “Foreign Person’s U.S. Source Income Subject to Withholding,” for tax year 2024 are now due this Thursday, April 17. The extended deadline applies to...