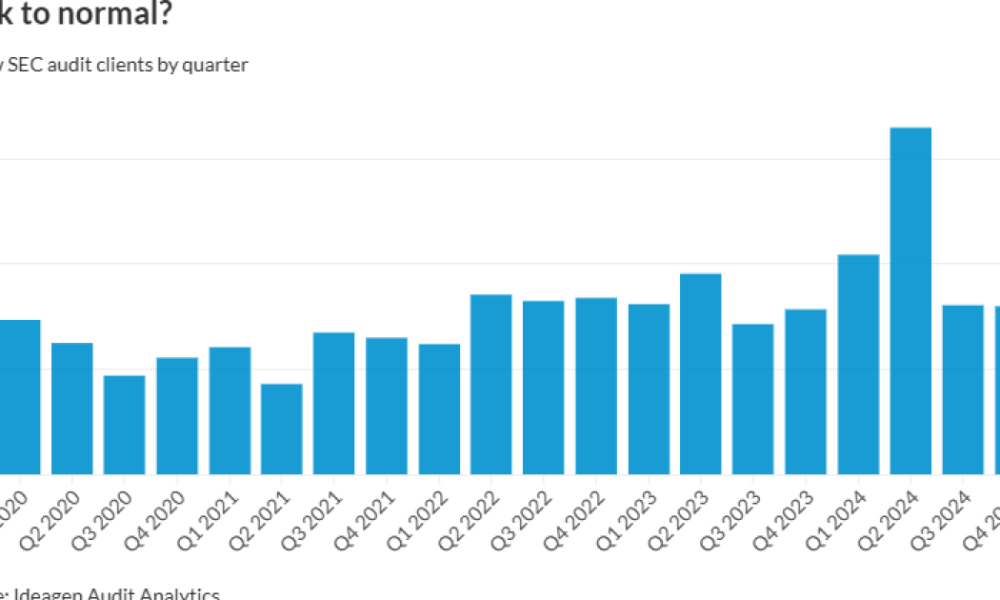

A small firm in Henderson, Nevada, Bush & Associates, topped the list of those with the most new Securities and Exchange Commission audit clients in 2024,...

Diversity, equity and inclusion is on the chopping block at accounting firms. In a February media flurry, big firms like Deloitte and KPMG said they were...

Right now, every conversation about technology seems to revolve around artificial intelligence. However, AI is a broad category — it includes machine learning, robotic process automation,...

Enjoy complimentary access to top ideas and insights — selected by our editors. My original headline was “The end of tax season,” but that is not...

We’re in the middle of a professional identity shift. Artificial intelligence is here. It’s integrated into tools we already use, embedded in platforms we rely on,...

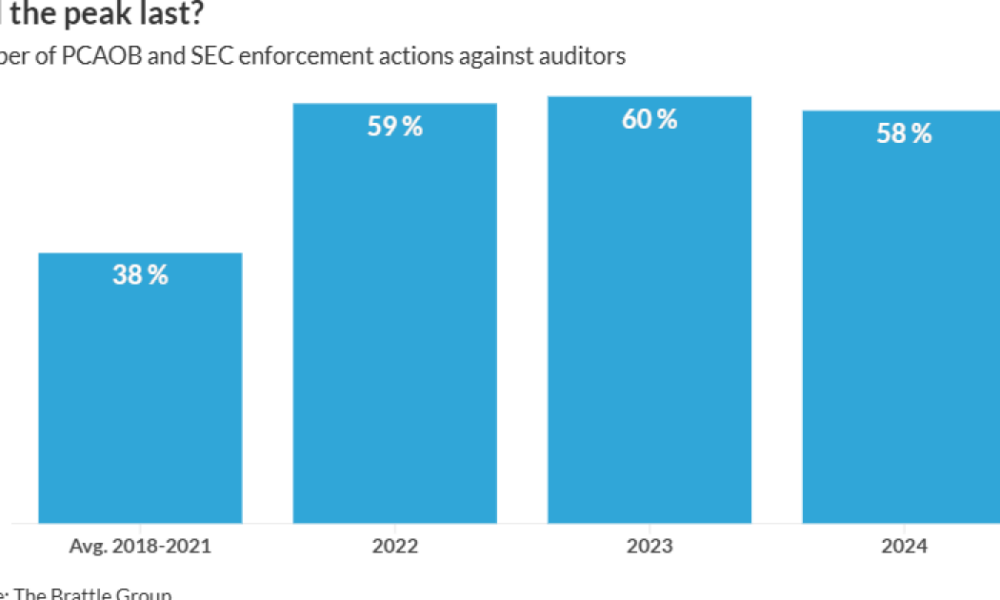

Enjoy complimentary access to top ideas and insights — selected by our editors. This week’s stats focus on the number of PCAOB and SEC enforcement actions...

The Internal Revenue Service issued a notice Friday giving some breathing room to participants and advisors involved with micro-captive insurance companies. In January, the IRS issued...

In my work with accounting firms, I’ve lost count of how many times I’ve heard partners say some version of: “We’re paying top dollar. Why are...

Ohio’s new law providing an alternative path to a CPA license has taken effect after 90 days and the Ohio Society of CPAs is pointing out...

Representative Jeff Van Drew said he thinks House Republicans will end up approving a $30,000 cap on the state and local tax deduction, a significant boost...