A well-maintained fixed asset register is a cornerstone of effective financial management for any organization. Often underestimated, this detailed inventory of a company’s tangible assets goes...

Petty cash management is often overlooked in corporate finance, but getting it right can make a big difference in keeping finances accurate and operations running smoothly....

Effective petty cash management is a vital component of maintaining financial discipline and operational efficiency within any organization. Though seemingly minor, petty cash plays a critical...

In financial management, maintaining a clear boundary between business and personal finances is essential for entrepreneurs and small business owners. While the temptation to combine these...

Effective accounts payable (AP) management is essential for organizations seeking to enhance profitability, improve cash flow, and maintain robust financial health. Properly managing money owed to...

Effective accounts receivable (AR) management is vital for maintaining a company’s cash flow, profitability, overall financial stability and is considered to be best practice for accounting...

A well-designed invoice is crucial to ensuring timely payments, maintaining consistent cash flow, and building strong client relationships. Invoicing is more than just paperwork—it plays a...

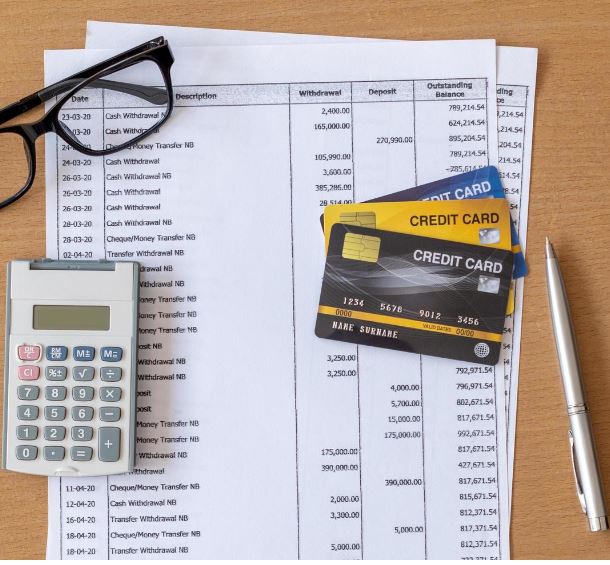

In the landscape of financial management, reconciling bank and credit card statements stands out as an indispensable practice that can make or break an organization’s financial...

In today’s fast-paced business world, maintaining efficient bookkeeping processes is key to staying financially organized and making sound business decisions. However, outdated practices and manual procedures...

In both personal and professional finance, maintaining organized records is crucial for accountability, contingency planning, and compliance with legal obligations. However, without a structured approach, the...