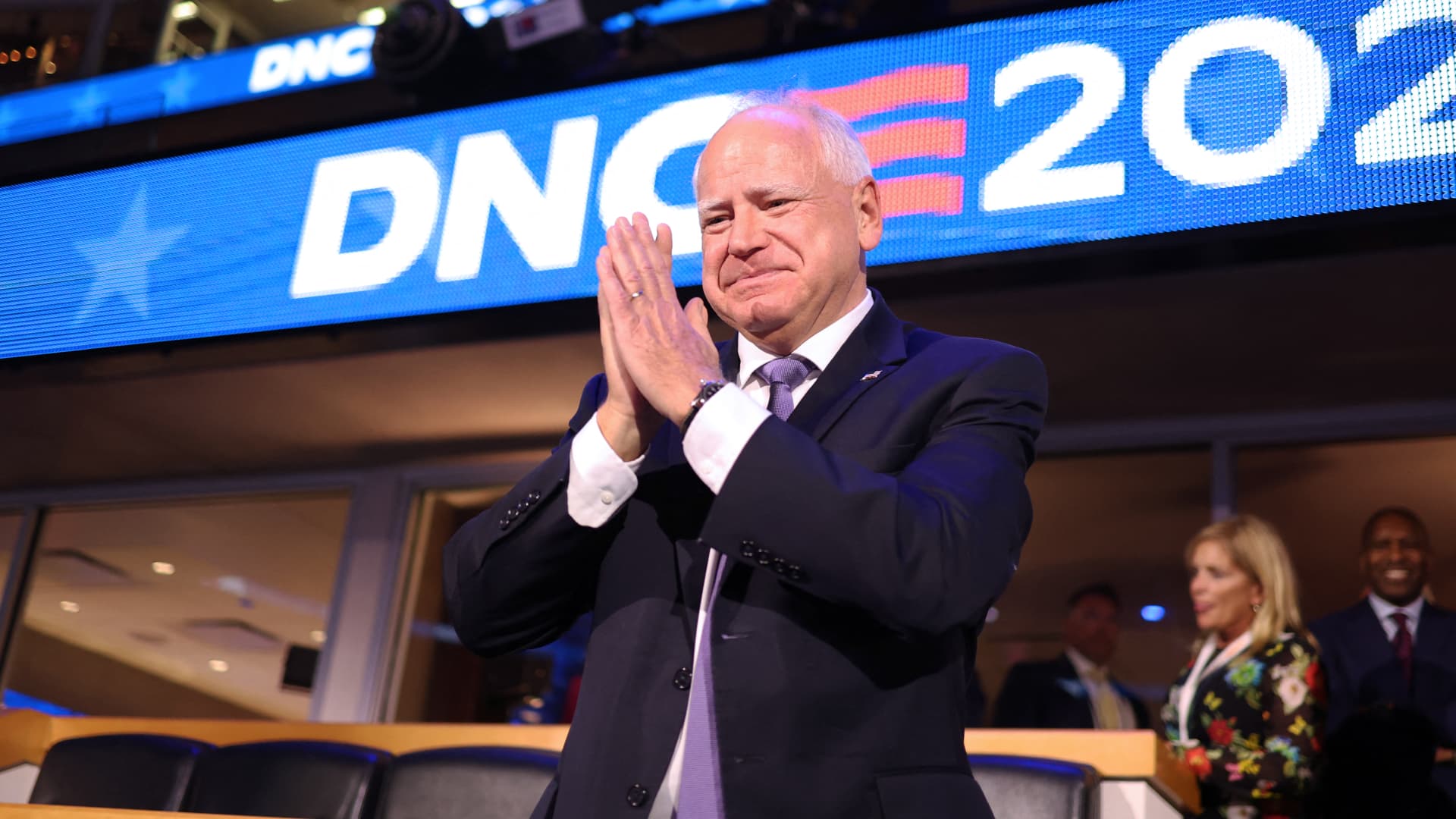

Minnesota Gov. Tim Walz accepted the Democratic vice presidential nomination at the Democratic National Convention on Wednesday night.

In his speech, Walz credited a particular source of support for helping to get his family to where they are today — Social Security survivor benefits.

His father died of lung cancer when Walz was 19, leaving a “mountain of medical debt,” Walz said. Social Security benefits allowed his family, including his mother and younger brother, to “live with dignity,” he recently posted on social media.

“Thank God for Social Security survivor benefits,” Walz said during his Wednesday night speech.

About 3.7 million children receive Social Security benefits, according to recent Social Security Administration data.

Children can receive benefits if they are unmarried and younger than 18; between 18 and 19 and are full-time students in grades 12 or below; and age 18 or older with a disability that started before age 22.

If a working parent dies, 98 out of 100 children in the U.S. could get Social Security benefits, the agency estimates. The monthly checks are based on the earnings of a deceased parent.

The average monthly surviving child benefit is $1,103 as of July, with more than 2 million children receiving those checks, according to the Social Security Administration.

More from Personal Finance:

Vance wants to raise the child tax credit to $5,000

Harris calls for expanded child tax credit of up to $6,000

How families are covering the rising cost of college

Yet families are not always aware they qualify for this financial support.

“Lots of kids all across the country do not claim their survivor benefits,” Social Security Commissioner Martin O’Malley said at a National Academy of Social Insurance event in Washington, D.C., in June.

Data suggests as many as half of orphaned children in the U.S. are not receiving the Social Security benefits for which they are eligible, according to Joyal Mulheron, founder and executive director at Evermore, a nonpartisan nonprofit focused on improving the lives of bereaved people.

“That’s … children potentially who could be lifted out of poverty as a result of accessing this benefit,” Mulheron said.

The Social Security Administration is working to figure out who those families are and to develop more targeted approaches to reach them, O’Malley said at the NASI event in June.

To date, those efforts have included sending information letters to households with potential applicants, launching a new web page on survivor benefits and working with states and communities to help raise awareness of these benefits, according to the agency. In Utah, for example, a check box has been added to death reporting forms to indicate when the deceased has a minor child.

When someone dies, a funeral director may send a family to Social Security, particularly since there may be a $255 lump sum death benefit available, said Jim Blair, vice president of Premier Social Security Consulting and a former Social Security administrator.

At that time, widows and widowers may be informed of the benefits available to them, as well as their children, he said. Still, it’s possible some situations may fall through the cracks.

Children may not access the benefits for which they are eligible if they switch to a different guardian, for example, who many not be able to answer all of Social Security’s questions, Mulheron said. Families may also fail to access benefits due to immigration issues, missed deadlines or administrative errors with applications, she said.

It could help for the Social Security Administration to make applications for children’s benefits more accessible online, Mulheron said.

“You don’t want to see anybody lose out on any benefits, because that’s what the benefit is there for,” Blair said.

“If you think you might even have an inkling that there might be something payable, call and ask,” he said.

The Social Security Administration can be reached at 1-800-772-1213. When applying for children’s benefits, the agency may require you to provide a child’s birth certificate, proof of birth or adoption, the parent’s and child’s Social Security numbers, and when relevant, a parent’s death certificate or medical evidence of a child’s disability.

Accounting1 week ago

Accounting1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago