Auditing & Assurance

Feds Cracking Down on Unlawful Tax Return Preparers

Published

1 month agoon

The Justice Department is advising taxpayers to choose their return preparers wisely as the April 15 federal tax filing deadline approaches. Unscrupulous preparers who include errors or false information on a tax return could leave a taxpayer open to liability for unpaid taxes, penalties and interest.

“Taxpayers must look out for unscrupulous preparers, who often will promise refunds that are too good to be true,” said Deputy Assistant Attorney General David A. Hubbert of the Justice Department’s Tax Division. “If your tax preparer asks you to sign a blank return, refuses to sign your return as your preparer or fails to give you a copy of your return, consult the IRS’s website to make sure that you are not exposing yourself to trouble. Taxpayers are responsible for the information on their tax return, so it is important to choose a tax professional that you trust to prepare your returns correctly.”

“Tax preparers contemplating filing false returns for their customers should know that our criminal prosecutors are prepared for the filing season too,” said Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division. “As the division’s work this past year reflects, we have the expertise and resources to identify and hold preparers fully accountable for their criminal conduct.”

Over the last year, the Tax Division has worked with U.S. Attorneys’ Offices around the country to bring civil and criminal actions against dishonest tax preparers. These actions seek criminal penalties and civil injunctions to stop ongoing fraud, civil penalties or disgorgement of ill-gotten proceeds. The Justice Department’s message has been clear: those who prepare fraudulent returns will face serious and lasting consequences.

Examples of civil injunctions obtained by the Tax Division over the last and current filing seasons include:

- On March 2, 2023, a federal district court in the Southern District of Florida permanently barred Rudy Aly, Rhonda Hudge, Cindy Odige and TUPS Tax LLC from preparing tax returns for others or owning or operating a tax preparation business. The court also ordered Aly to disgorge approximately $400,000 in proceeds he received from preparing tax returns from 2018 to 2020. The court ordered Hudge to pay about $15,000 and Odige and TUPS Tax to pay $48,000 based on their settlement agreements with the United States.

- On May 17, 2023, a federal district court in the Eastern District of New York permanently barred Melida Portorreal individually and through her business, International Travel Multi & Tax Corp., from preparing returns for others and from owning or operating a tax return preparation business in the future. The government alleged that Portorreal prepared tax returns claiming fabricated business income and expenses, as well as various false tax deductions and false non-deductible expenses for her customers to receive the earned income tax credit and the child tax credit. The government estimated that Portorreal’s actions caused losses to the United States exceeding $3 million over a three-year period.

- On Sept. 1, 2023, a federal court in the Southern District of Texas permanently enjoined a Galveston-area tax preparer Johnathan Perry, doing business as X-Pert Taxes, from preparing tax returns or assisting or directing the preparation or filing of tax returns. The complaint says that Perry, over a six-year period, prepared over 4,000 tax returns that greatly overstated his customers’ tax refunds by claiming fictitious business income and expenses, fabricated household help income and fake education credits or fuel tax credits to which his customers were not entitled. The court also ordered Perry to pay around $325,000 to the United States in ill-gotten tax preparation fees.

The Tax Division has also sought to strip fraudulent preparers of ill-gotten gains and to hold in contempt those who attempt to flout court-ordered restraints on further fraudulent activity. Over the last year, the division has brought cases to court including:

- On March 22, 2023, a federal district court in the Southern District of Florida held that Jeffrey Cadet violated a permanent injunction entered against him in August 2019 that barred him from acting as a federal tax return preparer or requesting, assisting in or directing the preparation or filing of federal tax returns for others. To remedy his contempt, the court ordered Cadet to disgorge $24,410 in ill-gotten fees he received for conduct violating the injunction and ordered him to pay the United States about $7,400 in reimbursement for the attorneys’ fees incurred in investigating and litigating his post-injunction conduct.

- On May 11, 2023, a federal court for the Southern District of Texas permanently barred Houston-area tax return preparer Hollins Ray Alexander from preparing tax returns for others and from owning, operating or franchising any tax return preparation business in the future. The terms of injunction required Alexander to send notices of the injunction to each person for whom he prepared tax returns and to post the injunction in places he conducts business, including social media accounts and websites. Finally, the court ordered Alexander to pay $165,940 to the United States in illicitly obtained tax preparation fees.

- On July 11, 2023, federal court in the Southern District of Florida found Rose M. Chazulle in contempt for violating the injunction that bars her from preparing tax returns. The court found that Chazulle continued to prepare tax returns despite the court’s order entered in 2016 prohibiting her from doing so by using the personal tax identification numbers (PTIN) assigned to her daughter and brother-in-law and electronic filing identification numbers (EFINs) associated with their businesses. As a contempt sanction, the court ordered Chazulle to disgorge $48,100 in tax preparation fees she earned in violation of the injunction.

Criminal convictions against fraudulent preparers obtained by the Tax Division since the 2023 filing season began include:

- In February 2023, Thanh Ngoc Rudin and Seir Havana of California were sentenced to 34 months and 42 months in prison, respectively, for their role in a conspiracy to prepare and file false tax returns for professional athletes. Both were also ordered to pay over $38 million in restitution to the United States.

- In March 2023, Labanda Lody and Jaleesia Sais, Texas return preparers, were sentenced to over four and three years in prison, respectively, for their role in preparing and filing false tax returns on behalf of clients of their return preparation business. Lody and Sais were both ordered to pay nearly $1 million in restitution to the United States.

- In August 2023, Georgina Gonzalez, formerly a Miami-based return preparer, was sentenced to over three years in prison for her role in filing false tax returns that claimed false losses and tax credits on behalf of clients. She was also ordered to pay $423,917 in restitution to the United States.

- In November 2023, Adam Earnest, Christopher Randell and James Klish, return preparers in Jackson, Mississippi, were found guilty for their role in conspiring to file thousands of false income tax returns on behalf of customers of the tax return preparation business where they worked. For their conduct, Earnest was sentenced to more than eight years, Klish more than four years, and Wells to 15 months in prison for their role in a conspiracy to prepare and file false tax returns for their customers.

- In December 2023, Ronald Eugene Watson, a Maryland return preparer, was sentenced to over two years in prison for filing false returns for clients. He was also ordered to pay $268,634 in restitution to the United States.

The Tax Division reminds taxpayers that the IRS has information, tips and reminders on its site for choosing a tax preparer carefully (Choosing a Tax Professional and How to Choose a Tax Return Preparer) and has launched a free directory of credentialed federal tax preparers. The IRS also offers taxpayers tips

to protect their identities and wallets when filing their taxes.

In addition, IRS Free File, a public-private partnership, offers free online tax preparation and filing options on IRS partner websites for individuals whose adjusted gross income is under $79,000. For individuals whose income is over that threshold, IRS Free File offers electronic federal tax forms that can be filled out and filed online for free. The IRS has tips

on how seniors and individuals with low to moderate income can get other help or guidance on tax return preparation, too.

In the past decade, the Justice Department’s Tax Division has obtained civil injunctions and criminal convictions against hundreds of unscrupulous tax preparers. Information about these cases is available on the Justice Department’s website. An alphabetical listing of persons enjoined from preparing returns and promoting tax schemes can be found on this page. If you believe that one of the enjoined persons or businesses may be violating an injunction, please contact the Tax Division with details.

You may like

Auditing & Assurance

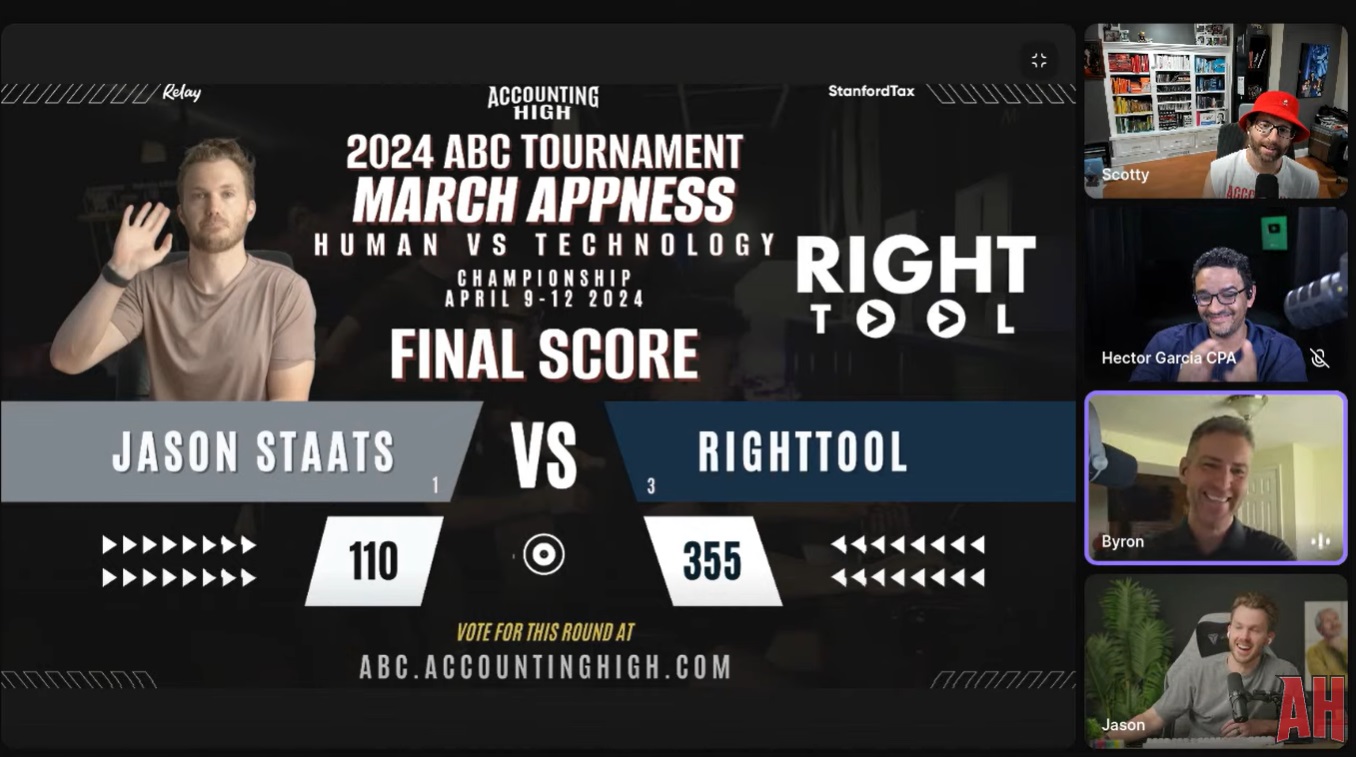

RightTool Wins 2024 Accountant Bracket Challenge

Published

1 month agoon

April 12, 2024

QuickBooks automation tool RightTool is the champion of the 2024 Accountant Bracket Challenge, presented by Accounting High, as the 3 seed defeated 1 seed CPA Jason Staats, host of the Jason Daily podcast, by a score of 355 votes to 110 votes in the final.

“To everybody in the RightTool Facebook community and all the RightTool users, all of you came together and helped us get the most votes, so I wanted to thank you guys for being the best community in the industry, in my opinion,” said Hector Garcia, CPA, co-founder of RightTool, during the championship final show, which was streamed by Accounting High on YouTube and LinkedIn earlier this afternoon.

RightTool joins accounting and bookkeeping app Uncat as winners of the ABC Tournament. In the inaugural Accountant Bracket Challenge last year, Uncat defeated Staats 339-190 in the championship match.

“I think what we’ve learned is … machines win,” Staats said about his consecutive losses in the tournament final. “We thought that would be down the road, but it’s happening.”

A grand total of 36,831 votes were cast during the three-week tournament.

“This has been so much fun. It only works if other people participate and pay attention and have fun, so thank you to the 1,806 ‘students’ who participated,” said Scott Scarano, an accounting firm owner who founded Accounting High, a community for forward-thinking accountants.

He added that the tournament will return next year, with some tweaks to make it better.

Dana Hull

Bloomberg News

(TNS)

Tesla Inc. plans to unveil its long-promised robotaxi later this year as the electric carmaker struggles with weak sales and competition from cheap Chinese EVs.

Chief Executive Officer Elon Musk posted Friday on X, his social media site, that Tesla’s robotaxi will be unveiled on Aug. 8.

Shares gained as much as 5.1% in postmarket trading in New York. Tesla’s stock has fallen 34% this year through Friday’s close. Shortly before Musk posted the news about the robotaxi, he lost the title of third-richest person in the works to Mark Zuckerberg, CEO of Meta Platforms Inc.

A fully autonomous vehicle, pitched to investors in 2019, has long been key to Tesla’s lofty valuation. In recent weeks, Tesla has rolled out the latest version of the driver-assistance software that it markets as FSD, or Full Self-Driving, to consumers.

The company has said that its next-generation vehicle platform will include both a cheaper car and a dedicated robotaxi. Though the company has teased both, it has yet to unveil prototypes of either. Musk’s Friday tweet indicates that the robotaxi is taking priority over the cheaper car, though both will be designed on the same platform.

Reuters reported earlier Friday that the carmaker had called off plans for the less-expensive vehicle and was shifting more resources toward trying to bring a robotaxi to market. Musk responded by saying “Reuters is lying,” without offering specifics.

Tesla also produced 46,561 more vehicles than it delivered in the first quarter, which has forced it to slash prices. U.S. consumers have been turning away from more expensive EVs in favor of hybrid models, causing many manufacturers to rethink pushes to electrify their fleets.

Splashy product announcements by Musk have always been a key part of Tesla’s ability to gin up enthusiasm among customers and investors without spending on traditional advertising. They don’t always work: the company unveiled the Cybertruck to enormous fanfare in November 2019, but production was delayed for years and the ramp up of that vehicle has been slow.

___

(With assistance from Catherine Larkin.)

Retail sales grew at a steady pace in March, according to the CNBC/NRF Retail Monitor, powered by Affinity Solutions, released today by the National Retail Federation.

“As inflation for goods levels off, March’s data demonstrates steady spending by value-focused consumers who continue to benefit from a strong labor market and real wage gains,” NRF President and CEO Matthew Shay said. “In this highly competitive market, retailers are having to keep prices as low as possible to meet the demand of consumers looking to stretch their family budgets.”

Total retail sales, excluding automobiles and gasoline, were up 0.36% seasonally adjusted month over month and up 2.72% unadjusted year over year in March, according to the Retail Monitor. That compared with increases of 0.4% month over month and 2.7% year over year in February, based on the first 28 days in February.

The Retail Monitor calculation of core retail sales – excluding restaurants in addition to automobiles and gasoline – was up 0.23% month over month and up 2.92% year over year in March. That compared with increases of 0.27% month over month and 2.99% year over year in February, based on the first 28 days in February.

For the first quarter, total retail sales were up 2.65% year over year and core sales were up 3.12%.

This is the sixth month that the Retail Monitor, which was launched in November, has provided data on monthly retail sales. Unlike survey-based numbers collected by the Census Bureau, the Retail Monitor uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions and does not need to be revised monthly or annually.

March sales were up in six out of nine retail categories on a yearly basis, led by online sales, sporting goods stores and health and personal care stores, and up in five categories on a monthly basis. Specifics from key sectors include:

- Online and other non-store sales were up 2.48% month over month seasonally adjusted and up 15.47% year over year unadjusted.

- Sporting goods, hobby, music and book stores were up 0.86% month over month seasonally adjusted and up 8.33% year over year unadjusted.

- Health and personal care stores were up 0.03% month over month seasonally adjusted and up 4.5% year over year unadjusted.

- Grocery and beverage stores were up 1.17% month over month and up 4.22% year over year unadjusted.

- General merchandise stores were up 0.13% month over month seasonally adjusted and up 3.38% year over year unadjusted.

- Clothing and accessories stores were down 0.01% month over month and up 2.13% year over year unadjusted.

- Building and garden supply stores were down 2.13% month over month and down 3.97% year over year unadjusted.

- Furniture and home furnishings stores were down 1.46% month over month seasonally adjusted and down 5.28% year over year unadjusted.

- Electronics and appliance stores were down 2.27% month over month seasonally adjusted and down 5.92% year over year unadjusted.

To learn more, visit nrf.com/nrf/cnbc-retail-monitor.

As the leading authority and voice for the retail industry, NRF provides data on retail sales each month and also forecasts annual retail sales and spending for key periods such as the holiday season each year.

Betting on the Kentucky Derby? Here’s how to think like a professional handicapper.

Warren Buffett says Greg Abel will make Berkshire Hathaway investing decisions when he’s gone

EV makers win 2-year extension to qualify for tax credits

Are American progressives making themselves sad?

‘Best Firms for Tech’ 2024 deadline extended to April 10