QINGDAO, CHINA – NOVEMBER 8, 2023 – Container ships frequently enter and exit the Qianwan Container Terminal of Qingdao Port in Qingdao, Shandong Province, China, Nov 8, 2023. (Photo by Costfoto/NurPhoto via Getty Images)

Nurphoto | Nurphoto | Getty Images

A trade war is brewing — and, if history is any guide, the U.S. economy may not be too happy about it.

President Donald Trump levied a 10% tariff on all imports from China starting Tuesday. In response, China retaliated with its own tariffs of up to 15% on select U.S. imports, starting Feb. 10.

Experts believe these are just the initial salvos of a broader trade war between the two nations.

Meanwhile, the U.S. is on the precipice of a trade spat with Canada and Mexico. Trump has also threatened to impose tariffs on the European Union — and, if that happens, the nations have vowed retribution.

“I will never support the idea of fighting allies,” Danish Prime Minister Mette Frederiksen said Monday. “But of course, if the U.S. puts tough terms on Europe, we need a collective and robust response.”

More from Personal Finance:

Trump moves to abolish the education department

The Fed holds rates steady. What that means for you

IRS announces the start of the 2025 tax season

The current animosity bears many similarities to an earlier episode in U.S. history — the Tariff Act of 1930 — which triggered an all-out trade war and exacerbated the Great Depression, according to economic historians.

The law, known as the Smoot-Hawley Tariff, was “one of the most controversial tariff acts ever enacted by Congress,” Doug Irwin, an economics professor at Dartmouth College and past president of the Economic History Association, wrote in 2020.

It was also the last instance of a trade war involving the U.S., prior to Trump’s first term, said Kris James Mitchener, an economics professor at Santa Clara University who studies economic history and political economy.

Smoot-Hawley sparked “the mother of all trade wars,” Mitchener said.

What was the Smoot-Hawley Tariff?

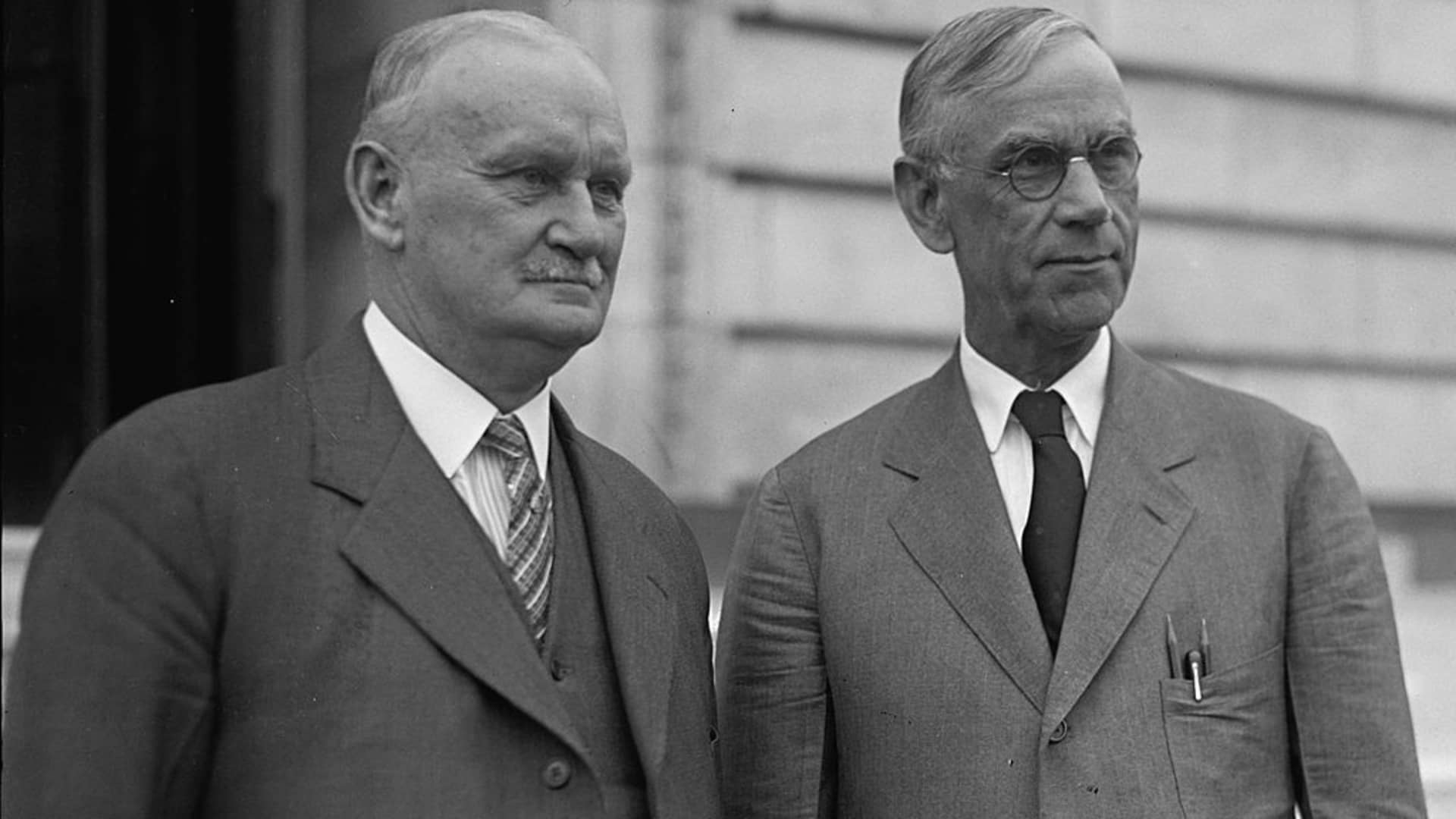

Hawley (left) and Reed Smoot in April 1929, shortly before the Smoot–Hawley Tariff Act passed the House

Source: Library of Congress

If the Smoot-Hawley Tariff sounds vaguely familiar, it may be thanks to pop culture: The 1986 movie “Ferris Bueller’s Day Off” has a memorable scene in which a high school teacher drones on in a crawling monotone voice about the tariffs.

Among Smoot-Hawley’s chief aims was to safeguard U.S. farmers, who had expanded agricultural production during WWI but suffered after the war as European production came back online and prices collapsed, Mitchener said.

However, Congress expanded the scope of the tariffs considerably, extending beyond agriculture to include all sectors of the economy. The law got its name from its chief Republican supporters in Congress: Rep. Willis Hawley of Oregon, chair of the tax-writing House Ways and Means Committee, and Sen. Reed Smoot of Utah, who chaired the Senate Finance Committee.

Smoot-Hawley was “broad,” putting tariffs on roughly 25% of all goods imported to the U.S. — about 800 to 900 different types of goods, Mitchener said.

If the U.S. puts tough terms on Europe, we need a collective and robust response.

Mette Frederiksen

prime minister of Denmark

Herbert Hoover, who had run for president on a platform to help farmers with protective tariffs, signed the law in June 1930, ignoring a petition signed by more than 1,000 economists asking him to veto the bill.

The law raised dutiable tariffs — tariffs on goods subject to import duties — by about six percentage points, on average, Mitchener said.

While that may not sound like much, those duties sparked a trade war with major U.S. trading partners, which was perhaps their “most important ramification,” wrote Irwin of Dartmouth College.

How did Smoot-Hawley provoke a trade war?

Smoot-Hawley raised the average tariff on dutiable imports to 47% from 40%, Irwin said. Depression-era price deflation ultimately helped push that average to almost 60% in 1932, he added.

Nine nations — Argentina, Australia, Canada, Cuba, France, Italy, Mexico, Spain and Switzerland — imposed retaliatory tariffs directed specifically at U.S. products, Mitchener said.

“Canada, which was heavily dependent on the U.S. market, retaliated almost immediately and imposed tariffs significant enough to put a sizable dent into American exports,” Irwin wrote.

That “tit-for-tat response” with targeted tariffs is the hallmark of a trade war, Mitchener said.

Other nations formed trade blocs that excluded the U.S., Irwin wrote. Ultimately, 35 governments lodged official protests against Smoot-Hawley, Mitchener said.

The result: Global trade collapsed, exacerbating the Great Depression, which was the worst economic downturn in U.S. history, economists said. U.S. exports to retaliating nations fell by about 28% to 32%, said Mitchener. Further, nations that protested Smoot-Hawley also reduced their U.S. imports by 15% to 23%.

It was “among the most catastrophic acts in congressional history,” according to a historical overview on the U.S. Senate website.

Tariffs leading up to President Trump

The U.S. reversed course after realizing how tariffs can fuel foreign policy issues and contribute to world wars, said Scott Lincicome, vice president of general economics at the Stiefel Trade Policy Center of the CATO Institute.

The global economy is “like an intricate choreographed dance,” Lincicome said. “Tariffs are just kind of throwing a wrench in that dance.”

The average tariff rate for dutiable imports cratered from about 59% in 1932 to roughly 13% in 1950, and fell below 5% from the mid-1990s to 2015, according to a 2024 analysis by the CATO Institute.

Meanwhile, the average tariff rate across all imports — which include products not subject to tariffs — fell from about 20% in 1933 to below 2% from 2000 to 2019.

While presidents who preceded Trump, as well as President Joe Biden, have also used tariffs, they were enacted for different reasons and at different magnitudes, experts say.

These have not been rationales used for tariffs in the past.

Brett House

professor of professional practice in the economics division at Columbia Business School

Historically, “tariffs have been typically invoked by U.S. administrations when domestic industry has complained about competition from foreign suppliers,” said Brett House, professor of professional practice in the economics division at Columbia Business School.

For instance, during President Barack Obama’s second administration in 2013, the International Trade Commission issued “anti-dumping duties,” or a form of tariff, on washing machines specifically from Mexico and South Korea.

Years later, during his first term, Trump issued a tariff on washing machines as well, but it was global instead of narrowing it to specific countries. At the same time, Trump imposed other tariffs such as costs on steel and aluminum.

Other presidents, including George W. Bush, Ronald Reagan and Richard Nixon, had also put tariffs on steel, an industry that’s historically received federal protection, Irwin told CNBC. But Trump’s second term is unique in that he’s using tariffs in a “broad brush” manner — applied to all a nation’s goods, for example — something “no president in recent memory” has done, Irwin said.

Additionally, “what is very distinct about Trump’s tariff policy is the supposed justification for it, which is to try to discipline Canada and Mexico for the flow of illegal drugs and undocumented people across their borders,” House said.

“These have not been rationales used for tariffs in the past.”

Will history repeat?

The Smoot-Hawley-induced spat resembles today’s trade environment in a few key ways — including prominent trade partners calling for retaliation against U.S. policy, economists said.

For example, before reaching 11th-hour deals to delay 25% tariffs for one month, officials in Canada and Mexico vowed to fight back.

Canadian President Justin Trudeau on Saturday warned that his country would implement a 25% tariff on about $107 billion of U.S. goods. They included duties on meat, dairy, produce and other food products, and beer, wine and spirits.

China said it will impose 15% tariffs on coal and liquefied natural gas imports from the U.S., and 10% on American crude oil, agricultural machinery and certain cars.

“We’re already seeing a trade war unfold,” Irwin told CNBC.

Proposed tariffs on Canada, China and Mexico would shrink U.S. economic output by 0.4 percentage points and increase taxes on Americans by $1.1 trillion between 2025 and 2034, before accounting for any retaliation, according to an estimate by the Tax Foundation.

Of course, “whether it becomes a trade war and history repeats in that [Smoot-Hawley] dimension depends on the response of our trade partners and/or whether Trump is bluffing to get some sort of concession,” Mitchener wrote in an e-mail.

Economics1 week ago

Economics1 week ago

Accounting1 week ago

Accounting1 week ago

Blog Post4 days ago

Blog Post4 days ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics6 days ago

Economics6 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance1 week ago

Finance1 week ago