Private sector job creation slowed to a near-standstill in May, hitting its lowest level in more than two years as signs emerged of a weakening labor market, payrolls processing firm ADP reported Wednesday.

Payrolls increased just 37,000 for the month, below the downwardly revised 60,000 in April and the Dow Jones forecast for 110,000. It was the lowest monthly job total from the ADP count since March 2023.

The report comes two days before the more closely watched nonfarm payrolls count from the Bureau of Labor Statistics, which is expected to show a gain of 125,000 and the unemployment rate steady at 4.2%.

While the two reports often differ, occasionally by large margins, the ADP count provides another snapshot of the jobs picture at a time when questions are being raised over broader economic conditions.

“After a strong start to the year, hiring is losing momentum,” said Nela Richardson, chief economist for ADP.

Goods-producing industries lost a net 2,000 positions for the month, with natural resources and mining off 5,000 and manufacturing down 3,000, offset by a gain of 6,000 in construction.

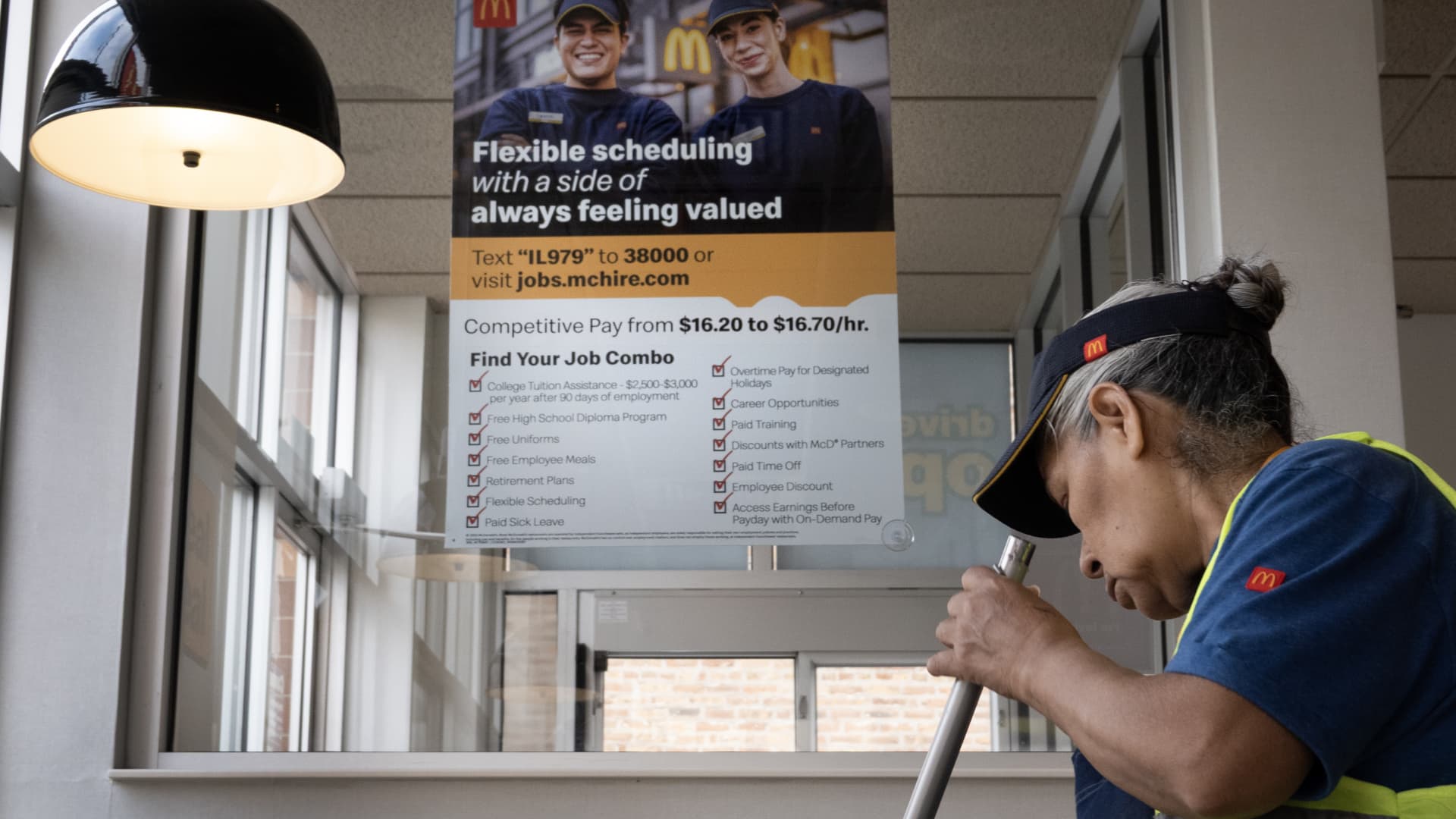

On the services side, leisure and hospitality (38,000) and financial activities (20,000) provided some signs of strength. However, declines of 17,000 in professional and business services, 13,000 in education and health services and 4,000 in trade, transportation and utilities weighed on the total.

Companies employing fewer than 50 workers saw a loss of 13,000 while those with 500 or more employees reported a drop of 3,000. Mid-size firms gained 49,000.

Regarding wages, annual pay grew at a 4.5% rate for those remaining in their positions and 7% for job changers, both little changed from April and still “robust” levels, Richardson said.

Economic data has provided a mixed bag of late for the labor market. The BLS reported Tuesday that job openings rose more than expected in April, though other indicators, such as surveys from employment site Indeed and the National Federation of Independent Business, show weaker levels of openings and hiring intentions.

“The market remains distressingly gridlocked, with limited hiring and low quits, and the market can’t keep steadily cooling off forever before it just turns cold,” Indeed economist Allison Shrivastava said after Tuesday’s job openings report.

Federal Reserve officials have been generally optimistic about economic conditions, though in recent days they have expressed concern about the potential impact from President Donald Trump’s tariffs on both inflation and employment.

“I see the U.S. economy as still being in a solid position, but heightened uncertainty poses risks to both price stability and unemployment,” Fed Governor Lisa Cook said Tuesday.

Fed officials are expected to stay on hold regarding interest rates when they meet in two weeks.

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance7 days ago

Personal Finance7 days ago

Accounting1 week ago

Accounting1 week ago

Blog Post4 days ago

Blog Post4 days ago

Economics1 week ago

Economics1 week ago

Economics5 days ago

Economics5 days ago

Personal Finance7 days ago

Personal Finance7 days ago