Accounting

Tax Strategy: The difficult road to tax legislation in 2025

Published

2 months agoon

Congress has started on the process of enacting major tax legislation in 2025. While both chambers of Congress and the Trump administration seem to want major tax legislation this year, and most expect them to somehow be able to achieve it, it looks like it is going to be a very difficult process.

As is often done with tax legislation by the party in the majority, to avoid the filibuster rules in the Senate requiring a 60-vote margin, the Republicans propose to pass the legislation under the budget reconciliation rules, requiring only a simple majority vote. Usually, the rules only permit one budget reconciliation bill per year; however, since no budget reconciliation bill was utilized in 2024, the rules permit two budget reconciliation bills this year.

At press time, the House was working on one large bill that includes taxes, border issues, and anything else related to revenue. The rules forbid inclusion of any provisions not germane to revenue. The Senate, however, is currently pursuing two budget reconciliation bills, with the first including everything except taxes, and taxes postponed to the second bill later in the year.

Before starting on the tax legislation itself, the House and Senate are required to agree on a budget framework, specifying how much in tax cuts and spending cuts may be included in the legislation.

The House, by a bare majority vote of 217-215, approved a budget resolution specifying $4.5 trillion in tax cuts and $2 trillion in spending cuts. The House resolution also assigned some allocations of spending cuts to specific committees, including an allocation of $880 billion to the House Energy and Commerce Committee, which is responsible for Medicaid.

The Senate has approved a budget number for its first budget reconciliation bill; however, it has not yet approved a budget number for the second reconciliation bill on tax matters. The House and Senate must agree on identical budget reconciliation numbers before proceeding to the legislative committees. It has been estimated that achieving this budget agreement alone could take into the mid-April time frame, and those estimates are usually optimistic.

Budget reconciliation also comes with some additional restrictions. In addition to all provisions being required to relate to revenue, budget reconciliation also requires that there be no projection of negative revenue impact beyond 10 years. This results in budget reconciliation bills often including temporary provisions, phase-ins and phase-outs to try to stay within the approved budget numbers.

The Tax Cuts and Jobs Act

The primary focus of the tax legislation this year is extending the individual provisions of the Tax Cuts and Jobs Act that expire at the end of 2025, a result of the TCJA itself having been passed under budget reconciliation with the budget number and 10-year restrictions.

There are also several business provisions that started to phase down a couple of years ago that the Republicans would also like to restore retroactively. Extending all these provisions permanently is estimated to cost over $4 trillion. It is estimated that a seven-year extension, as discussed in the House, would cost $3.7 trillion.

One key difference between the House and Senate is whether to just extend these provisions for some additional years or make them permanent. The Senate position currently is that they should be permanent, while the House appears willing to extend them for a shorter period in order to include some additional tax breaks. Both the House and Senate appear willing to utilize a current policy baseline in determining the extent to which tax provisions need to be offset to come within the budget reconciliation limitations.

Under the current policy baseline, merely extending provisions of the Tax Code already in effect does not require revenue offsets to avoid being counted in the budget restriction numbers. Congress has more commonly used a current law baseline, which would require extensions to be offset. This opens up $4 trillion for other tax cuts proposals; however, it still adds $4 trillion to any projected deficits. While it might work for budget reconciliation, it is likely to raise opposition from deficit hawks in Congress about its use greatly contributing to the deficit.

Other tax breaks

The legislation is also likely to consider additional tax breaks. In addition to the expiring TCJA provisions, additional expiring provisions likely to get consideration for extension include the Work Opportunity Tax Credit and the New Markets Tax Credit.

President Trump has also proposed several additional tax breaks: eliminating the tax on Social Security benefits, eliminating the tax on tips, eliminating the tax on overtime, exempting Americans living abroad from income tax, and reducing the corporate tax rate to 15% for domestic manufacturers and to 18% or 20% for other corporations.

Trump has also seemed open to modifying or eliminating the $10,000 state and local tax deduction limit included in the Tax Cuts and Jobs Act, which might also be necessary to gain the support of Republicans in Congress from high-tax states, although there is also a proposal to include eliminating the pass-through entity work-around for the SALT deduction.

Republicans have also generally supported repeal of the estate tax and repeal of the corporate alternative minimum tax.

Revenue raisers and spending cuts

President Trump has also mentioned some possible revenue raisers, which might provide a revenue offset for some of these tax cuts:

- Taxing carried interests at ordinary income rates;

- Increasing the tax on private university endowments;

- Reducing deductions available to sports team owners;

- Repealing or reducing the mortgage interest deduction;

- Repealing some or all of the green energy tax credits included in the Inflation Reduction Act;

- Ending the Employee Retention Credit;

- Repealing the nonprofit status of hospitals;

- Repealing the exclusion for municipal bond interest; and,

- Pulling back some IRS enforcement funding.

Trump also views his tariff proposals as providing additional revenue offsets.

The spending cut provisions in the budget reconciliation will also require difficult decisions with respect to determining who will bear the burden of those cuts. We have already seen the disarray created by the efforts of the Department of Government Efficiency to reduce the federal workforce.

Narrow Republican margins

Not only are there differences between the Republicans in the House and Republicans in the Senate, there are also differences among the Republicans in each body.

The narrow Republican majorities in both the House and Senate means that passage requires attracting the votes of almost every Republican member. This has proved especially difficult for the House, as evidenced by the budget number approval passing by only a two-vote margin, and that was only achieved by getting members to put off their concerns until they could be addressed during the legislation drafting process.

Postponing those issues until later just adds more difficulty in crafting legislation in a way that will retain those votes. Some of those issues include the SALT deduction limit, the permanency of the Tax Cuts and Jobs Act extension, potential reductions in Medicaid funding, and deficit concerns.

Summary

While the odds of major tax legislation this year still look good, it is likely to be a very difficult process that drags on through much of the year. It appears that either some of the proposed tax cuts will have to be passed on or put into effect for only a limited period, that deficits will be significantly increased, or that budget gimmicks such as use of the current policy baseline or taking tariffs into account will be used to try to claim compliance with the budget reconciliation numbers.

You may like

Illinois approved a bill on Thursday to create additional pathways to CPA licensure, and it awaits the signature of Gov. JB Pritzker.

The legislation,

The bill preserves the legacy pathway requiring 150 credit hours plus one year of experience and passing the exam. It also ensures practice mobility so that out-of-state CPAs can serve clients in Illinois without obtaining an Illinois license.

Dave Newman – Fotolia

“For more than a year, the Illinois CPA Society has focused on eliminating barriers to entry into the profession, most notably, the time and costs required to become a CPA,” Geof Brown, president and CEO of the Illinois CPA Society, said in a statement. “The passage of House Bill 2459 is an important step in keeping Illinois’ CPAs at the forefront of the national business landscape; protecting the needs of our state’s businesses, not-for-profits, and units of government; and ensuring there’s a pipeline of next-generation accounting talent ready to step up to serve. We thank the legislation’s sponsors, co-sponsors, and other supporters who were instrumental in advancing this important initiative for the accounting profession in our state.”

The ICPAS, one of the largest CPA state associations, originally proposed the legislation. The bill was introduced in March by Reps. Natalie Manley (D-Joliet) and Amy Elik (R-Edwardsville), both of whom are CPAs, and it passed unanimously out of the House in early April. In the Senate, it was supported by chief Senate sponsor Sen. Suzy Glowiak Hilton (D-Oakbrook Terrace) and co-sponsor Chris Balkema (R-Pontiac). It passed unanimously on May 22.

Illinois is one of

Accounting

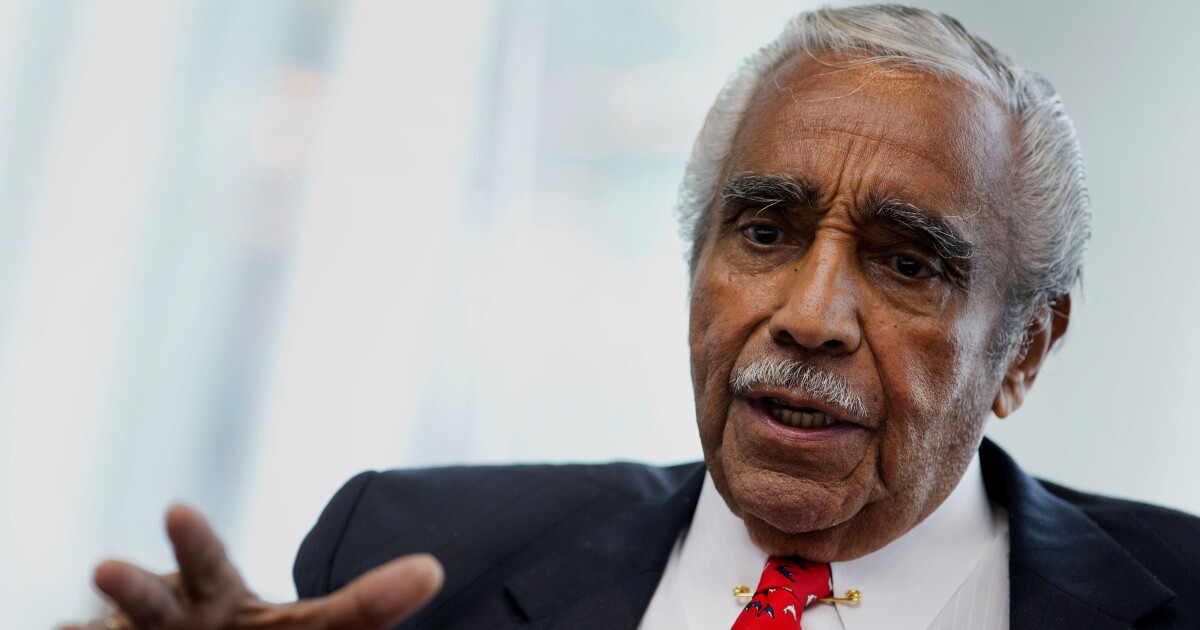

Charles Rangel, a voice for the poor in tax debates, dies at 94

Published

2 hours agoon

May 27, 2025

Charles Rangel, the dapper, voluble U.S. congressman from New York’s Harlem district who for four decades used his perch on the House tax-writing committee to advocate for inner cities and the people who live there, has died. He was 94.

The former congressman died on Monday, according to a

From 1974, when he became the first Black member of the House Ways and Means Committee, Rangel championed tax legislation to foster low-income housing and urban development, encourage trade with Caribbean nations and discourage U.S. business with South Africa’s apartheid government. He said the poor, the elderly and the infirm deserved and needed his protection.

“I don’t believe there’s any compassion in capitalism at all,” he said in 2013. “I believe it’s survival of the fittest.”

In 2007, he achieved his goal of becoming Ways and Means chairman. However, after just three years in the powerful post, he was pressured to step down during an investigation by the House ethics committee.

The panel found him guilty of 11 counts of violating House rules, including using his office to solicit donations for an academic center named after him at City College of New York and — particularly embarrassing for a member of the tax-writing committee — failing to pay taxes on rental income from his villa in the Dominican Republic. On Dec. 2, 2010, he became the first lawmaker

Admitted mistakes

Rangel admitted making mistakes but insisted he had never sought to enrich himself.

“I’m not going to be judged by this Congress,” he told lawmakers after the censure vote, “but I’m going to be judged by my life, my activities, my contributions to society, and I just apologize for the awkward position that some of you are in.”

Even as the ethics case was proceeding, voters in New York City’s 15th congressional district awarded

Rangel was the second congressman to represent his district since its creation during World War II. The first, Adam Clayton Powell Jr., pastor of the Abyssinian Baptist Church, served from 1945 to 1970 but spent part of the late 1960s in exile in the Bahamas, avoiding both a congressional investigation of his use of public funds and a contempt-of-court warrant in New York, where he had been found guilty of defamation. Rangel, a member of the New York legislature at the time, challenged and defeated the absent Powell in the 1970 primary.

O’Neill ally

In the House, Rangel allied himself with Massachusetts Representative Thomas “Tip” O’Neill, who would rise to Speaker in 1977. An original member of the Congressional Black Caucus from its founding in 1971, Rangel was elected its president in 1974 and led a push to get more Black congressmen onto key committees.

As part of a shakeup that placed 16 members of both parties onto Ways and Means, O’Neill created an opening for Rangel, who remarked that with the influx of new faces, the committee had “swung away from its conservative, rural orientation for the first time since the days of the 13 colonies.”

For the next four decades, no debate on tax or trade policy, Social Security or Medicare could be considered over until Rangel’s distinctive gravelly voice had been heard.

“There’s not a tax bill that poor and working people don’t come out ahead on because of my efforts,” he told the New Yorker for a 2000 profile. “It’s not because I’m that good. It’s just because other people want so many other things that I can say, ‘Hey, hold it. Stop the parade!'”

Reagan years

In no small part due to Rangel’s pressure, President Ronald Reagan approved factoring inflation into the earned income tax credit, which helps the working poor. In 1987, Rangel won passage of a measure — the so-called

He worked with Republicans on proposals to create so-called urban enterprise zones, where tax incentives would lure development. The idea was implemented in 1993 under President Bill Clinton, a Democrat, as empowerment zones, with one, the Upper Manhattan Empowerment Zone, located in Harlem.

In 1996, Rangel condemned as a “cruel monstrosity” Republican-drafted legislation that ended welfare as an entitlement. When Clinton agreed to sign the bill into law, Rangel lamented, “My president will boldly throw one million into poverty.”

Rangel also proposed reinstating a military draft of all men and women from 18 to 42, on the grounds that U.S. wars in Afghanistan and Iraq were being fought “predominantly by tough, loyal and patriotic young men and women from the barren hills and towns of rural and underprivileged neighborhoods in urban America where unemployment is high and opportunities are few.”

132nd and Lenox

Charles Bernard Rangel was born on June 11, 1930, in New York City, where he was raised in the home of his maternal grandfather, Charles Wharton — “by the tough corner of 132nd Street and Lenox Avenue in the heart of Harlem,” as he wrote in his 2007 memoir, authored with Leon Wynter.

His father, Ralph, who left the family when Rangel was six, was “absolutely no good,” Rangel said. He grew up around the apron strings of his working mother, Blanche, and was raised in part by his grandfather and his older brother, Ralph. He also had a younger sister, Frances.

One of Rangel’s early jobs was delivering copies of a newspaper published by Powell from his headquarters at Abyssinian Baptist Church. Rangel himself was Catholic.

As Rangel told it, he was an exceptional student until reaching DeWitt Clinton High School in the Bronx, where he felt “not able to compete” in the Jewish-dominated student body. He dropped out and signed up for the U.S. Army in 1948, an experience that left him with a sour taste for military recruiters — “no more than salesmen,” he said.

Purple Heart

In Korea in 1950, part of an artillery unit, Rangel was wounded by a mortar shell during a battle with advancing Chinese troops. He was awarded a Purple Heart and a Bronze Star for continuing to lead his heavily outnumbered men to safety.

Turning to the Veterans Administration for help in what to do next, Rangel said, he was given two options: electrician or mortician. But one counselor urged him to finish his education. Rangel took one year to complete his last two years of high school, then went on to graduate from New York University in 1957.

At St. John’s University, studying law on a full scholarship, he got involved with student government and displayed an ease with the ethnic politicking that dominates New York City elections.

“A group of us actually started our own national fraternity — mainly to stick it to the dean, because we thought he catered to one Irish fraternity,” Rangel wrote in his memoir. “And who was in our fraternity? Everybody except the preferred Irish majority.”

Enters politics

Following his graduation in 1960, Rangel worked as an attorney in private practice and a federal prosecutor while testing the waters in local Democratic politics. In 1966, he won election to the New York State Assembly to succeed Percy Sutton, who had been appointed Manhattan borough president. They became longtime allies.

Initially seen as reformers, Sutton and Rangel, along with Basil Paterson and future New York City Mayor David Dinkins, became known as the “Gang of Four” for their control of Harlem politics.

Rangel decided to challenge Powell for Congress after traveling to the Bahamian island of Bimini to try to persuade him to come home and serve. Rangel surpassed Powell by 150 votes out of 25,000 in the Democratic primary that September, then breezed to victory in the general election.

Drug trade

His initial priority was the illegal drug trade, and he urged more spending for rehabilitation programs. He was a member of the House Judiciary Committee when it approved articles of impeachment against President Richard Nixon.

While rising in seniority on Ways and Means, Rangel also sought a role in House Democratic leadership but was derailed in 1986, when Representative Tony Coelho of California defeated him for the role of House majority whip.

With his wife, the former Alma Carter, he had two children, Alicia and Steven.

Book’im; out of Service; what a pill; and other highlights of recent tax cases.

Greenbelt, Maryland: Jerome Brown, of Detroit, has been sentenced to five years in prison for laundering money stolen from federal and North Carolina state refunds.

In his guilty plea in 2022, Brown acknowledged that from February through August 2020 he conspired with individuals in Nigeria and Michigan to launder wire-fraud money. Using information from ID-theft victims (including in Maryland), the conspirators put the money on prepaid debit cards that Brown deposited into bank accounts and cashed out through ATM withdrawals and by purchasing money orders and cryptocurrency.

Brown cashed at least some $540,975.80 from prepaid cards as part of the scheme. He kept about $216,390 and sent some $324,585 in Bitcoin to his co-conspirator in Nigeria.

He was also ordered to pay $604,889.64 in restitution.

Somerset, New Jersey: Tax preparer Vito A. Pascarella has pleaded guilty to preparing false returns for clients.

Pascarella reported false wage numbers, falsely reported that taxpayers owned and operated businesses, and falsely reported that those purported businesses earned gross receipts and incurred business expenses.

He caused a total federal tax loss exceeding $550,000.

Sentencing is Sept. 15. He faces up to three years in prison, as well as a period of supervised release, restitution and monetary penalties.

Santa Monica, California: Christopher Scott King has pleaded guilty to operating an illegal gambling business, tax evasion and money laundering.

Working out of Los Angeles County, King used a sports betting website in Costa Rica to facilitate bettors wagering on sporting events in violation of both California state and federal law.

Between 2019 and 2022, King also concealed $13,586,493 of income from the IRS by, among other things, not reporting all his income. On his 2022 income tax return, for example, he reported $143,258 in taxable income but had earned more than $5 million that year.

King laundered his money by channeling it through real estate development projects and gold. He also used money from his gambling business to fund brokerage and financial accounts.

He caused a total federal tax loss of $3,804,218.

King has agreed to forfeit $10 million at sentencing, which is Sept. 9. He faces up to five years in prison for each count of tax evasion, operating an illegal gambling operation and accepting a financial instrument for unlawful internet gambling, and 10 years in prison for money laundering. He also faces a period of supervised release, restitution and monetary penalties.

St. David, Arizona: Roy Layne has been sentenced to four years in prison for filing false returns and loan applications to obtain pandemic relief.

To create the appearance that he was operating several businesses, Layne filed paperwork with the IRS, applied for a business license from the City of Tucson, opened business bank accounts and filed false employment-related returns. In April 2020, he filed an application with the U.S. Small Business Administration that claimed he operated a “wholesale” business with 17 employees that had annual revenue of more than $500,000. In 2021, he submitted a false application for a Paycheck Protection Act loan, claiming that same wholesale business had 31 employees and $1.2 million in revenue.

Layne ultimately received $306,700 in undeserved pandemic-related loans. He also used the personal ID information and the identity of another person to file false claims for federal refunds with the IRS.

In total, Layne, who

He was also ordered to serve three years of supervised release and pay $856,692.91 in restitution to the United States.

Hackensack, New Jersey: Tax preparer Joshlyn Raye, 49, of Elmwood Park, New Jersey, has been sentenced to three years in prison for tax evasion and for helping her clients file falsified returns that generated larger refunds.

Raye previously

Between March 2010 and September 2023, Raye owned JB Tax Services. She evaded her personal income taxes over three of those years, filed 177 false returns for clients and filed three false quarterly employment returns for her business. She used fabricated and inflated figures, including expenses and itemized deductions.

She was also sentenced to three years of supervised release and ordered to pay $1,109,214.10 in restitution.

Corpus Christi, Texas: Business owner Timothy Gaines Pollard has admitted failing to pay employment taxes.

Pollard owned and operated Tim Pollard Construction, a residential remodeling and fence-installation business in Bishop and Kingsville, Texas. He admitted that from 2019 through 2021, he was responsible for collecting and withholding employment taxes from his employees’ paychecks. He also admitted that he withheld the money from his employees but failed to pay it to the U.S. and instead used the funds to pay personal expenses.

The total tax loss exceeded $400,000.

Sentencing is July 30. Pollard faces up to five years in prison and up to a $250,000 fine.

Grandview, Missouri: Tax preparer and ex-IRS employee Sandra Mondaine, 64, has been sentenced to 33 months in prison for filing false returns.

Mondaine, who

She retained a portion of the claimed refunds before providing the rest to clients. Authorities said Mondaine also appears to have submitted doctored and fake substantiation documentation when her clients were audited by the IRS.

The total tax loss related to the counts of conviction was $1,113,215.90, which Mondaine was ordered to pay in restitution to the IRS.

Baltimore: Pharmacy owner Moshe Gabay, 54, has pleaded guilty to one count of filing false federal returns.

Gabay underreported his income by more than $3.5 million and so owed more than $1 million in taxes.

He owned and operated SINU-RX Pharmacy and provided information to his bookkeepers and tax preparers that falsely categorized funds taken from SINU-RX. These funds were listed as business expenses, but Gabay had diverted the money for his personal use.

Gabay agreed to pay restitution of more than $1 million; he also faces up to three years in prison.

Illinois passes CPA licensure changes bill

Stocks making the biggest moves midday: DJT, CRM, TSLA, AMC

Charles Rangel, a voice for the poor in tax debates, dies at 94

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoThe MAGA revolution threatens America’s most innovative place

-

Accounting5 days ago

Accounting5 days agoHouse tax bill includes provision eliminating PCAOB

-

Economics6 days ago

Economics6 days agoWhat happens if the Inflation Reduction Act goes away?

-

Personal Finance5 days ago

Personal Finance5 days agoWhat House Republican ‘big beautiful’ budget bill means for your money

-

Economics1 week ago

Economics1 week agoThree paths the Supreme Court could take on birthright citizenship

-

Accounting5 days ago

Accounting5 days agoTrump tax bill faces Senate’s arcane rules, desire for changes

-

Economics1 week ago

Economics1 week agoJoe Biden did not decline alone

-

Finance4 days ago

Finance4 days agoPersonal finance app Monarch raises $75 million