Auditing & Assurance

The Accounting Technology Lab Podcast – Cybersecurity for High Net Worth Clients – Apr. 2024

Published

1 month agoon

Transcript (Note: There may be typos due to automated transcription errors.)

Brian F. Tankersley, CPA.CITP, CGMA 00:00

Welcome to the accounting Technology Lab sponsored by CPA practice advisor with your hosts, Randy Johnston, and Brian Tankersley.

Randy Johnston 00:10

Welcome to the accounting Technology Lab. I’m your host Randy Johnson along with co host, Brian Tankersley. Today we’re pleased to have a special guest with us Rahul Mata, who’s a Partner at isern advisory group. And he’s going to talk to us about the five cybersecurity risks for high net wealth individuals. So, Rahul, would you like to introduce yourself please? Thank

00:33

you very much, Randy. It’s a pleasure to be here with you. By way of background and introduction, my name is Rohit mana, and I’m the managing partner of iser, Amber’s outsourced it practice. Our mandate is to protect our clients by using best practices of what we’re seeing out there today. What’s happening in the industry, what’s happening with governance and compliance and putting a solution together to robustly protect the clients in all aspects.

Randy Johnston 00:59

So as you as you as our regular listeners know, our sessions on security are basically trying to provide practical guidance. Now I know that you’ve written an article for grain currency, which we could refer and I think our lead readers can find that as well. And in there, you’ve made really five different interesting points on several different risks. Would you like to speak to those for just a moment?

01:29

Sure, I’d be happy to, you know, being part of iser ampere, obviously, I have a lot of accountants that talk to me, and I have a lot of accountants clients that talk to me. So some of these ideas, and topics are coming from what we’re seeing within the firm and within our client base. And so with that, one of the overall things that we are seeing is, a lot of our high net worth individuals have multiple bank accounts doesn’t sound unusual to have a few. But even in my personal life, when I talked to my family, about two years ago, we found 15 bank accounts that were scattered around. And so that does create a hardship for the financial advisor, whoever that might be. But it also creates a hardship to protect all of those assets. So one thing that we are trying to increase awareness around is if you have multiple bank accounts, if you’re advising folks that have multiple bank accounts, it’s really hard to centralize the security of those or to feel good that you have something simple such as multifactor authentication in some manner that you’re accessing those bank accounts, you can set those procedures up for one or two. But if you expand out to 15, obviously, your beta increases your risk profile increases. So taking a look at where all your assets are and trying to consolidate them a little bit to create a heightened cyber awareness. Thought Process is one of the topics we’re looking at right now. And

Randy Johnston 02:59

makes sense. Now Brian and I have talked multifactor for a long time, is there a particular platform that you’re recommending to the clients?

03:08

Well, here’s what we’re seeing, we’re seeing clients are deliberating between using the multifactor platforms that they get for free and some that they pay for, we typically don’t provide guidance on which is the right platform, we just like to make sure that they’re using a platform that is enforced and supported by usually the financial institution that they’re dealing with more than anything. That’s where you really need to start with the security of the multifactor. And then of course, having a strong password after you MFA is really the next barrier to have.

Randy Johnston 03:46

Yeah, understood on that role. As it turns out, both Brian and I have some banking background. And I just categorically disagree with the text MFA that most banks are using. So Brian, so

Brian F. Tankersley, CPA.CITP, CGMA 03:59

it’s interesting. You mentioned cryptocurrency and protecting some of these assets. What are some of the ins what are some of the lessons learned from crypto and other things in your world?

04:12

Wonderful. We have found a lot of individuals try to get involved with currency in whatever cryptocurrency as you mentioned, they might be involved in I think the the challenge over the last few years is how do you get involved and so some of the advanced I would say clients of ours went directly and created wallets on their own. And then probably a couple of years ago, coin base became popular to have a more of a public and easier wallet to use and, and so there became challenges with that. And so I think that overall, people have different approaches. I think the third evolution now is you can actually go and buy an ETF which just started in the last few months to make it even easier now. The first few iterations to answer your question, the challenge we came on how Been a secure way to keep your wallet in place. And so was it a USB stick where you’d put your code on and keep that USB stick? Well, we found some of our early clients, those USB sticks were getting lost, they forgot them or somehow gets stolen. And they’re those x 1000s or millions of dollars. The second way was using a platform such as Coinbase, which is still very popular. And, again, you have your password challenges. And so you know, an advancements there we’ve seen is trying to suggest using a third party tool like a YubiKey. And UB keys, I think, are really a much stronger way to do it at a very low cost point. You can buy that key off Amazon these days for $50 or less. And I like that a lot. If you’re going in. I see you have one right in front of you. So we’re talking the same thing.

Randy Johnston 05:51

Yeah, in fact, we both known Steena ever insurance, she created those products. And we did cover those in our CES presentation a little earlier. Prior podcast, so so it makes perfect sense to use these hardware keys to us as well.

06:09

Yeah. So I think now with the ETFs I think that makes a obviates a lot of the security where you can just call a broker and buy like a stock. Pros and cons, of course, but a third generation, if you may.

Brian F. Tankersley, CPA.CITP, CGMA 06:22

So I’m gonna play devil’s advocate here for a minute, you mentioned, one of the risks is archaic technology. You know, my mother used to swear by her AOL email account. You know, what, what’s the problem there? And what’s the problem with archaic techno with old technology.

06:42

With, if I can, I’ll take a step back and put some context around it. So taking an elder generation, like you mentioned, your mother in my elders as well. They started off probably around 2000. And they that’s back in the days where you used to get those CDs coming to your home, and you know, those lovely, those sounds that came from your US robotics modem, and you would dial in and you’d get your AOL email. And that’s where many many folks started getting their email accounts. And now fast forward, it’s the year 2024. So you got 24 years, AOL kind of became, you know, your, your habit. And so many of that generation used AOL, for example, is just focus there. And so they have 24 years of pictures of chats of email history. And so they’re very attached to using that archaic technology. The reason I called archaic is AOL has been bought and sold multiple times over that 25 years. And so the effort to increase the cybersecurity platform and hygiene around that platform is not as much there and then focus anymore. And so we just had a recent case where a clinic came to us where they had, they were a victim of some identity theft. And really the issue was, they had been corresponding with their CPA for 24 years on AOL, they had 24 years of tax returns in their AOL account, 24 years of PII information of them in their family. And so that data all became compromised. And truly, because, you know, nobody really is focusing on AOL, and heightened security and new, you know, ransomware techniques. And so, you know, it becomes a problem. And I understand the shifting, emotional cost is high for that individual, because they don’t want to lose 24 years. But the risk return is incredibly unbalanced right now, using those technologies.

Brian F. Tankersley, CPA.CITP, CGMA 08:45

You know, I completely agree with you. And, you know, I’ve talked to a number of practitioners, and I’ve, I’ve said, I’ve told them, and I’ve told anybody I talked to you that nothing says I’m not serious about cybersecurity, and your privacy, like a CPA having a because a lot of our audiences practitioners, a CPA having [email protected] or [email protected] [email protected] email account, as opposed to having your own custom internet domain. It’s really, you know, I don’t know how you can comply with the FTC safeguards rules and circular 230 and the IRS requirements by using using email like that. I just don’t, I just don’t think you can.

Randy Johnston 09:33

Yeah, and you know, Elwood Edwards, so many of us knew that name, that’s for sure. But just a reminder that the dot CPA domain may be a way for you to increase your security if you’re a public practice firm. So we have talked about that in prior sessions as well. It’s

09:52

well said I completely agree with that, that comment and for those that want to buy Your domain or get secure email, you can go to microsoft.com. And it’s $5. And so that investment, I think, just, you know, is well worth it. Yeah, I

Brian F. Tankersley, CPA.CITP, CGMA 10:11

mean, it’s not like we’re talking about a big spender thing here. You know, it’s just, it’s, it is painful to make that switch. But there are tools that, that consultants and managed service providers like Eisner can help you make that switch and pull in all that content and everything else. So talk to us about family members, you know, it’s family is just seems to be the gift that keeps on giving, especially when we get money involved in it. Talk to us about that.

10:39

I love the way you say that the gift that keeps on giving. There’s so many wonderful things about having your family and being involved with your family. I was part of a family business for 20 some odd years before joining Eisner. And I think it’s wonderful that the downside that we see from a cybersecurity perspective is not all family members have the same heightened security awareness that other family members do. And the balance becomes how do you how do you handle those family members. And so some examples of that risk that we continually see from our financial advisors and our accounting team members trying to handle these situations are starting off with just password management and understanding the risk of having really weak passwords and allowing weak passwords to exist in a family office, for example, and how you do that. The second aspect that we see is just not a sense of cybersecurity hygiene. So we continually will will face our accountants that will receive let’s call it a picture of a license for some reason, just on general email, and the family members will take a picture and think that that’s okay, because they have their iPhone, snap it, email it and don’t realize the implication, you know, a quick side note, I’m not sure if you or your audiences done this, if you have an iPhone, and just go to your photos and search for just a license. The iPhone technology now will actually search every image. And it’s really quite alarming to me of how advanced that feature has become and what it can dig out of your photos where you thought a photo is safer. Many people have historically thought a photo is safe, it’s really not anymore. You

Brian F. Tankersley, CPA.CITP, CGMA 12:31

know, I completely agree with you on that. And one other caution, I would just mention that I’ll just throw in since you mentioned iPhone, by default to your iPhone and your your Android phone both do something called geo tagging on photos. And so what happens is it puts your latitude longitude on there for photos. And so when you post things on social media, like you go to your grandkids house, your grandkids home to see them. Guess what, somebody that’s a cyber criminal now can go in and look at those photos on social media that are shared publicly, they can right click and look at properties. And there’s the lat long of where that kid is. And so they may inadvertently be making those children effectively a target for some kind of crime to get at get a ransom or other things like that.

Randy Johnston 13:18

And your point about the quality of the AI in the iPhone image scan is pretty stunning. You know, Apple, of course, has purchased over 30 AI companies. And in my experimentation with it, I’ve actually searched on something obscure like dinosaur, and a small toy dinosaur in the corner of the image is recognized. So you can absolutely guarantee that the image recognition across the Microsoft Windows platform, the Google platform, or the Apple platform, actually, I think increases the risk, as it turns out. And when you know, you consider the data exposure, Brian, which you and I have talked about so many times with the MailChimp exposure instead from Intuit. And now with Google potentially buying HubSpot. You know, both of those transactions are, you know, data mining as far as I’m concerned. So as practitioners, we have to worry about protecting our data. Just like Rahul, you’re talking about it in terms of high net wealth individuals here. We have kind of a loosey goosey approach to protecting data here in the United States. So that’ll change a little bit with privacy laws, but those will take several years to catch up as I see it.

14:44

I completely agree with that comment in terms of where we’re going. You know, I think last year, Brian, you talked a little bit about safeguards rule, just perhaps a little non sequitur, but I think appropriate to our conversation here is where’s the government? going with this. And, and so, you know, I think this year has been a real turning point from our practice and what we’re seeing where we are definitely seeing a little bit more heightened awareness from, I would say, financial professionals or clients themselves. And I would say C suite. And so with that, I think there’s been some cases in the last year where the C suite was held liable on a personal basis for having poor information security policies, and I would say, acting in a general duty of care to those stakeholders and shareholders that they’re involved with. And I think that’s a that’s a real turning point in my mind over what’s happened in the last year. drizzly was one case where the CEO was was found liable. I’m not sure if you know about that case or not, we can talk about that. I think the the, the Uber CTO a couple of years ago, having some personal liability attached to their lack of care, I think is another aspect. And I liked the new provisions about if there is a breach of much more heightened awareness to to disclose that breach, otherwise, you can be found, you know, not acting in the right care as well. So I’ll just take a pause there. And I know I went a little off topic, but it’s definitely something we’re seeing a lot more this year.

Randy Johnston 16:26

Yeah. And as you were talking about that rule, I was considering, you know, Brian has written a session for our K to business called AI confidential on privacy and artificial intelligence. And many of the regulations around that, again, probably a little off the topic for today, but it was stunning. What was inside some of the license agreements, the ethics statements, and so forth, them a variety of it.

Brian F. Tankersley, CPA.CITP, CGMA 16:56

And when you read, the other thing that folks need to know is that when you start reading the pronouncements like the executive order that President Biden came out with last November on on AI and privacy, and you listen to some of the comments that have been made by the the commissioners of the FTC and other organizations like that, it’s very clear that that privacy regulation is coming to town, whether or not it can get through Congress one way or another. Yeah. So it’s a it’s I think that’s an area that that’s that we’re we’re gonna have more need for third party at a station and third party consulting, because the compliance on those things, you know, from from the Proposed Regs and other things I’m reading, the compliance is not going to be simple. And it’s not going to be cheap.

Randy Johnston 17:46

Yeah, you’re right there, Brian, because if you look at that executive order 14 110, the EU artificial intelligence act, and then compound that with the finally updated NIST standards, from this year, you know, the NIST framework getting updated to two Oh, finally, those those are some pretty radical shifts. While we’re, you know, in terms of just thinking things through, are there any key recommendations that you’d make? I guess what I’m looking for is just, if you could only do one or two things, what might those be in

18:20

relation to an individual a financial? Like? Who would who would I be giving that advice to?

Randy Johnston 18:27

Yeah, let’s keep it over on the individual frame for just a minute. And then we might turn it to business. Yeah,

18:33

yeah. So on the individual side, I would probably have more than one or two, but I would say, just be a little more thoughtful about where you are. So on the individual side, I would say our perspective used to be protect the castle. So individual went to an office or a place of work that was secure. It’s important for the individual to realize they’ve left the castle, they’ve left the means and bounds of security that were around them, the moats that were protecting them, and now they’re on their own, really. And so our framework has been to protect the individual now and how do we think about that and so when an individual travels, you know, often all of us go to airports or train stations, you see people working, because all we do is work the now in this country all the time. And so connecting to a Wi Fi, just because it says free Wi Fi, you don’t know who is promoting or sponsoring that Wi Fi, it could be a hacker sitting right next to you with a free Wi Fi spot Wi Fi calling it free Amtrak. And so I think just recognizing, you shouldn’t just use anything that’s free, whether that’s a Wi Fi, whether that’s a charging station, I often see these devices blokes that have all these cables coming out to say hey, feel free to plug in and power. The who knows where that is, and what that is. And just because it’s free doesn’t mean it’s regulated. It has any type of compliance around it, it’s updated. So just being thoughtful, I think about where you are what you’re doing. There’s a lot of free simple tools you can use. If you want a free VPN, you can get one, there’s for a couple dollars a month, you can get one Cloudflare is a great free, that gives you just an updated DNS that protects at least something that you’re doing. On the password side, I know LastPass, I think they still give a free version where you can have a little bit better profile and the way you are using your password structure. So that’s a long story, perhaps not one or two, but just in general, a heightened awareness of who you are, where you are, what you’re doing is the most important thing. No,

Randy Johnston 20:47

I appreciate that. And if you were to likewise give just one or two ideas about primary business protection, what might you give there?

20:58

On the business side, again, I think it’s back to not protecting in the castle, but protecting you know, where individuals are. And so with that, I think the compliance landscape is entirely changed. Both of you said it far more articulate than I did, and you know the exact role in numbers that they are. I just know in general, from our perspective, at iser, from our professionals, we are all much much more concerned about compliance regulation and governance in general, performing risk assessments is something that we start our conversations always with, I always say it’s measure, manage and monitor. And so the first step is, in our engagements and talking to whomever we do is how do you measure your risk? Whether you’re trying to measure your, you know, risk to meet an SEC standard? Are you measuring a risk to meet your cyber insurance, which is some just basic things, you have to really measure where you are, as Brian said, a third party I think is much better than just asking your IT department to go check a list or your current MSP get a third party to check off where you are in terms of your compliance or internal your cybersecurity, and just some of the basic things I can’t tell you how many people still, our companies are not educating their own employees. So doing cybersecurity training, we did a recent survey, I think almost 40%, roughly, of our companies aren’t even doing it annually. And so in that survey, it’s mind blowing to me, how people are not just educating their their general shareholders, stakeholders that are involved in that business.

Randy Johnston 22:41

Well, that is pretty stunning. Rogal. So with that, I appreciate that. You’ve certainly provided some good insights today. We thank you for that. Brian, any other parting thoughts to maybe wrap up with rules presented for us today?

Brian F. Tankersley, CPA.CITP, CGMA 22:54

No more than anything, I appreciate you being here, Rahul. It’s nice to have someone of your stature and of your firm’s. You know, one of your firm’s leaders join us here on the podcast. If folks want to have a further conversation with you, how can they get a hold of you?

23:09

Very simply, if you go to our website, iser ampere.com that you can go to to outsource day T, you’ll see a lovely big picture of me. And it’s pretty easy to get a hold of me if you put my name in to Google. It’s right there. I think also in this podcast, we’ll have some information that’s available and as a free resource. We just released a cybersecurity ebook that can help individuals I know it’s listed on your website in the download section. And so that’s another great asset and tool and from there, you know, our team can be reached as well.

Randy Johnston 23:40

Well, that’s super well. We appreciate all of you listening in today and we look forward to having you in a future accounting Technology Lab. Good day.

Brian F. Tankersley, CPA.CITP, CGMA 23:51

Thank you for sharing your time with us. We’ll be back next Saturday with a new episode of the technology lab, from CPA practice advisor. Have a great week.

= END =

You may like

Auditing & Assurance

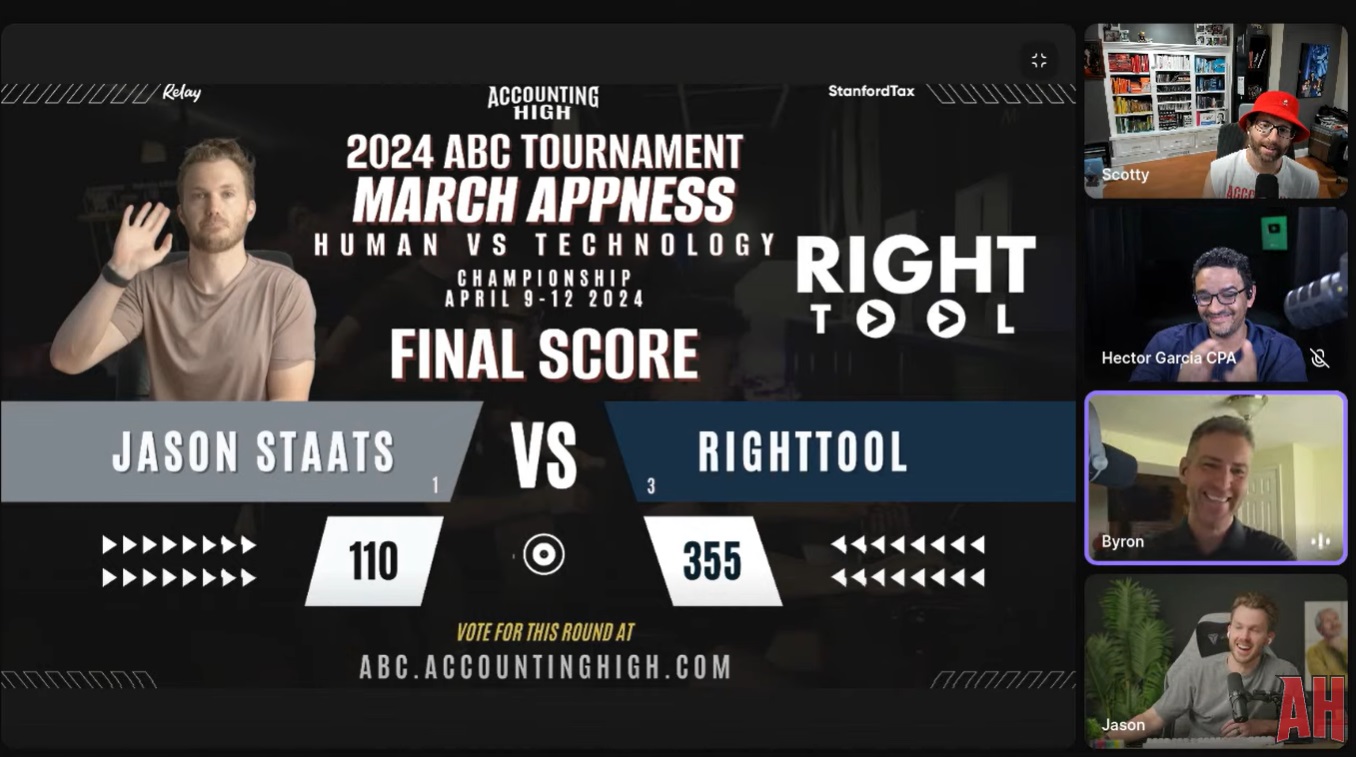

RightTool Wins 2024 Accountant Bracket Challenge

Published

1 month agoon

April 12, 2024

QuickBooks automation tool RightTool is the champion of the 2024 Accountant Bracket Challenge, presented by Accounting High, as the 3 seed defeated 1 seed CPA Jason Staats, host of the Jason Daily podcast, by a score of 355 votes to 110 votes in the final.

“To everybody in the RightTool Facebook community and all the RightTool users, all of you came together and helped us get the most votes, so I wanted to thank you guys for being the best community in the industry, in my opinion,” said Hector Garcia, CPA, co-founder of RightTool, during the championship final show, which was streamed by Accounting High on YouTube and LinkedIn earlier this afternoon.

RightTool joins accounting and bookkeeping app Uncat as winners of the ABC Tournament. In the inaugural Accountant Bracket Challenge last year, Uncat defeated Staats 339-190 in the championship match.

“I think what we’ve learned is … machines win,” Staats said about his consecutive losses in the tournament final. “We thought that would be down the road, but it’s happening.”

A grand total of 36,831 votes were cast during the three-week tournament.

“This has been so much fun. It only works if other people participate and pay attention and have fun, so thank you to the 1,806 ‘students’ who participated,” said Scott Scarano, an accounting firm owner who founded Accounting High, a community for forward-thinking accountants.

He added that the tournament will return next year, with some tweaks to make it better.

Dana Hull

Bloomberg News

(TNS)

Tesla Inc. plans to unveil its long-promised robotaxi later this year as the electric carmaker struggles with weak sales and competition from cheap Chinese EVs.

Chief Executive Officer Elon Musk posted Friday on X, his social media site, that Tesla’s robotaxi will be unveiled on Aug. 8.

Shares gained as much as 5.1% in postmarket trading in New York. Tesla’s stock has fallen 34% this year through Friday’s close. Shortly before Musk posted the news about the robotaxi, he lost the title of third-richest person in the works to Mark Zuckerberg, CEO of Meta Platforms Inc.

A fully autonomous vehicle, pitched to investors in 2019, has long been key to Tesla’s lofty valuation. In recent weeks, Tesla has rolled out the latest version of the driver-assistance software that it markets as FSD, or Full Self-Driving, to consumers.

The company has said that its next-generation vehicle platform will include both a cheaper car and a dedicated robotaxi. Though the company has teased both, it has yet to unveil prototypes of either. Musk’s Friday tweet indicates that the robotaxi is taking priority over the cheaper car, though both will be designed on the same platform.

Reuters reported earlier Friday that the carmaker had called off plans for the less-expensive vehicle and was shifting more resources toward trying to bring a robotaxi to market. Musk responded by saying “Reuters is lying,” without offering specifics.

Tesla also produced 46,561 more vehicles than it delivered in the first quarter, which has forced it to slash prices. U.S. consumers have been turning away from more expensive EVs in favor of hybrid models, causing many manufacturers to rethink pushes to electrify their fleets.

Splashy product announcements by Musk have always been a key part of Tesla’s ability to gin up enthusiasm among customers and investors without spending on traditional advertising. They don’t always work: the company unveiled the Cybertruck to enormous fanfare in November 2019, but production was delayed for years and the ramp up of that vehicle has been slow.

___

(With assistance from Catherine Larkin.)

Retail sales grew at a steady pace in March, according to the CNBC/NRF Retail Monitor, powered by Affinity Solutions, released today by the National Retail Federation.

“As inflation for goods levels off, March’s data demonstrates steady spending by value-focused consumers who continue to benefit from a strong labor market and real wage gains,” NRF President and CEO Matthew Shay said. “In this highly competitive market, retailers are having to keep prices as low as possible to meet the demand of consumers looking to stretch their family budgets.”

Total retail sales, excluding automobiles and gasoline, were up 0.36% seasonally adjusted month over month and up 2.72% unadjusted year over year in March, according to the Retail Monitor. That compared with increases of 0.4% month over month and 2.7% year over year in February, based on the first 28 days in February.

The Retail Monitor calculation of core retail sales – excluding restaurants in addition to automobiles and gasoline – was up 0.23% month over month and up 2.92% year over year in March. That compared with increases of 0.27% month over month and 2.99% year over year in February, based on the first 28 days in February.

For the first quarter, total retail sales were up 2.65% year over year and core sales were up 3.12%.

This is the sixth month that the Retail Monitor, which was launched in November, has provided data on monthly retail sales. Unlike survey-based numbers collected by the Census Bureau, the Retail Monitor uses actual, anonymized credit and debit card purchase data compiled by Affinity Solutions and does not need to be revised monthly or annually.

March sales were up in six out of nine retail categories on a yearly basis, led by online sales, sporting goods stores and health and personal care stores, and up in five categories on a monthly basis. Specifics from key sectors include:

- Online and other non-store sales were up 2.48% month over month seasonally adjusted and up 15.47% year over year unadjusted.

- Sporting goods, hobby, music and book stores were up 0.86% month over month seasonally adjusted and up 8.33% year over year unadjusted.

- Health and personal care stores were up 0.03% month over month seasonally adjusted and up 4.5% year over year unadjusted.

- Grocery and beverage stores were up 1.17% month over month and up 4.22% year over year unadjusted.

- General merchandise stores were up 0.13% month over month seasonally adjusted and up 3.38% year over year unadjusted.

- Clothing and accessories stores were down 0.01% month over month and up 2.13% year over year unadjusted.

- Building and garden supply stores were down 2.13% month over month and down 3.97% year over year unadjusted.

- Furniture and home furnishings stores were down 1.46% month over month seasonally adjusted and down 5.28% year over year unadjusted.

- Electronics and appliance stores were down 2.27% month over month seasonally adjusted and down 5.92% year over year unadjusted.

To learn more, visit nrf.com/nrf/cnbc-retail-monitor.

As the leading authority and voice for the retail industry, NRF provides data on retail sales each month and also forecasts annual retail sales and spending for key periods such as the holiday season each year.

Betting on the Kentucky Derby? Here’s how to think like a professional handicapper.

Warren Buffett says Greg Abel will make Berkshire Hathaway investing decisions when he’s gone

EV makers win 2-year extension to qualify for tax credits

Are American progressives making themselves sad?

‘Best Firms for Tech’ 2024 deadline extended to April 10