Personal Finance

This 79-year-old lost home to California wildfires, hopes to rebuild

Published

4 months agoon

Remains of Karen Bagnard’s Altadena, California, house after it burned in the January 2025 Los Angeles-area wildfires.

Courtesy: Chelsea

On the night of Jan. 7, Karen Bagnard sat in her Altadena, California, house in the dark.

Forceful winds had caused her home to lose power, and she also had no running water, save for one bathroom.

“My daughter called and said, ‘Mom, do you realize there’s a fire?'” said Bagnard, who is 79 years old and legally blind. “I had no idea there was a fire.”

At that point, the evacuation zone for the Eaton Fire was far enough away for her to feel safe.

“I thought, ‘Oh, they’ll never get to my house,'” Bagnard said.

More from Personal Finance:

How climate change is reshaping home insurance costs

California wildfire victims may receive a one-time $770 payment

Top-rated charities active in Los Angeles fire relief efforts

About 30 minutes later, her daughter Chelsea Bagnard called back. With the fire spreading quickly, Bagnard’s home was now near the border of the evacuation zone.

After Bagnard’s grandson, Dalton Sargent, who is 32 and also lives in her home, came back from work, the two decided to leave for the night.

In the more than 50 years she lived in the house, Bagnard had been close to evacuating before but had never actually left.

“I thought, ‘Okay, we’ll evacuate this time, but we’ll be back,'” she said.

That was the last time she stepped foot in her home.

The next day, Bagnard’s daughter and grandson returned to the neighborhood to check on the home before authorities sealed off the area. What they found was a “smoldering pile of debris,” her daughter wrote on Facebook, with only larger appliances such as the refrigerator and stove recognizable.

It was Jan. 22 before Bagnard was able to return to her neighborhood to see the devastation for herself.

“They brought a chair for me, and I sat in the driveway, and what I could see was just the land,” Bagnard said of the surreal scene. “I started looking at it in terms of, ‘How would we rebuild?'”

Karen Bagnard, 79, sits in the ruins of her Altadena, California, home, after it burned in the Los Angeles-area wildfires of January 2025. “I hope to live long enough to see it rebuilt,” she said.

Courtesy: Chelsea Bagnard

Older adults especially vulnerable to natural disasters

The Los Angeles-area wildfires destroyed tens of thousands of acres, ruining homes and entire neighborhoods. Insured losses could climb to $50 billion, according to estimates from JP Morgan.

Additionally, an unknown number of residents have been left homeless.

For older individuals, the catastrophe comes at a vulnerable time in their lives, when relocating and coping with physically difficult conditions can be more challenging.

By 2034, we’ll have more people over 65 than under 18 in our country, according to Danielle Arigoni, an urban planning and community resilience expert and author of the book “Climate Resilience for an Aging Nation.”

Yet those demographics are not used as a lens for climate resilience planning in most cases, she said.

“In two decades, we have not seen any improvement in the fatality rate of older adults in these kinds of disasters,” Arigoni said. “When you see that kind of trend line, to me that just screams for a different approach.”

The LA-area wildfires forced some assisted living facilities to evacuate, and some burned down, according to Joyce Robertson, CEO and executive director of Foundation for Senior Services.

In the aftermath of the fire, the public charity is focusing on providing supplies, including wheelchairs, and is working with nursing and assisted living facilities to help fill gaps for services and resources.

“You can imagine the stress for all those seniors having to evacuate,” Robertson said.

For older individuals who live on their own, the risk is that they will not be able to leave their homes, said Carolyn Ross, co-executive director of the Village Movement California, a coalition of 50 neighborhood-based community organizations that provide community programming and expertise to help older residents age in place.

“In natural disasters, they are disproportionately affected, more likely to be the ones found in their homes because they couldn’t evacuate,” Ross said.

The hardest hit of the Village Movement’s communities — Pasadena Village — had around 60 members displaced by the fires, and 19 lost their homes entirely, including Bagnard.

“It’s been heartbreaking,” said Katie Brandon, executive director at Pasadena Village.

“But it’s also been really beautiful to see the older adults really support each other, be there for each other, and see the communities of support that they’ve built over the last months and years really work for them,” Brandon said.

As Bagnard searched for a new residence, one of the Pasadena Village members stepped up to offer her a six-month temporary lease to live with her in her home, though the two women had not previously met.

Bagnard has been a valued member of the Pasadena Village for many years, according to Brandon, having hosted many events and programs at her “beautiful house, outside on her patio.”

As Bagnard regroups, the Pasadena Village is replacing the computer she lost with the accessibility features she needs due to her vision loss. The community organization is working with other affected area residents to help provide the equipment they need, such as air purifiers and computer printers. Where possible, it’s also encouraging older residents to continue to gather socially.

“The insurance companies seem to be pretty good at reacting and seeing what they can replace, but sometimes it’s quite a process,” Brandon said. “The sooner we can get our older adults the resources and equipment that they need, the better off they’ll be in this recovery period.”

Older victims face greater health, financial risks

Experts emphasize that older individuals may face a prolonged recovery.

In the aftermath of a disaster, there tends to be a lot of people helping, providing donations and other support, said Joan Casey, associate professor at the University of Washington’s School of Public Health.

Yet in the rebuilding period that follows, there’s often a lull, where volunteer efforts and donations dry up, she said.

Yet more than a year from now, those same disaster victims may still be displaced from their homes, she said.

“It’s that medium-term disaster period where we still want to check in on people,” Casey said.

They may be more susceptible to certain health and financial risks, particularly if they do not have a community safety net.

Nearly 80% of older adults have two or more chronic conditions, according to research from the National Council on Aging. If that includes respiratory or heart disease, the worsened air quality may be even more harmful to their health.

Older adults may also have paid off their homes, which means they may not be required to have homeowners’ insurance. Consequently, some may be completely uninsured, while others may be underinsured in an effort to keep their monthly expenses down, Arigoni said.

Scientific literature on how disasters affect older adults is “pretty mixed,” especially with regard to mental health, according to Casey. Some neurologists have found natural disasters may be a tipping point in cognitive function for older adults, she said.

Yet there’s also evidence that older individuals may be more resilient because they have developed better strategies to deal with stress over time, Casey said. They may have already experienced a disaster before, and therefore may be better prepared to handle another event.

‘I hope to live long enough to see it rebuilt’

Remains of Karen Bagnard’s Altadena, California, house after it burned in the January 2025 Los Angeles-area wildfires.

Courtesy: yesterday, my mom saw her home of over 50 years for the first time since it burned

Prior to losing her home in the wildfire, Bagnard, a professional visual artist, had recently gone through a big life adjustment as she dealt with her vision loss.

In early 2024, she held a show of her work at Pasadena Village, where she talked about coming to terms with blindness. Her favorite piece — of a sphere falling — played on darkness and light amid a color scheme of blue, teal and black, a symbol of her own journey.

“Knowing that you’re going blind is like a free fall into the darkness, and then at some point you realize that you bring the light with you, so it isn’t really dark,” Bagnard said. “You have a different kind of light; the light is inside.”

That piece was destroyed and is now among her home’s ashes, along with most of her other artwork.

For most of her life, Bagnard did pen-and-ink drawings with watercolor washes. Since the onset of her vision loss, she has transitioned to other methods, using decoupage and handmade papers as well as writing haikus.

The process of coping with her vision loss has helped her to keep the more recent loss of her home in perspective, she said, though she admits she still has moments of frustration.

To help rebuild, she has applied for a Small Business Administration loan, and her daughter started a GoFundMe account.

Other community organizations, in addition to Pasadena Village, have also stepped in to offer support.

A local nonprofit organization, Better Angels, has provided grant money to Bagnard and her grandson. And Journey House, a provider of foster care services, has promised to help Bagnard’s grandson, a former foster youth, who also lost everything in the fire.

Amid her home’s rubble, Bagnard said she has also seen signs of hope. A Danish plate with a mermaid, which Bagnard considers an art muse, survived the fire, as well as cement stairs she had painted with images of the four seasons.

She has told her two daughters and grandson it is up to them to decide what to do with the property they will eventually inherit.

“I’m going to be 80 next month, and I hope to live long enough to see it rebuilt,” Bagnard said.

You may like

Personal Finance

Summer Fridays are increasingly rare as hybrid schedules gain steam

Published

18 hours agoon

June 13, 2025

People enjoy an unusually warm day in New York City as temperatures reach the low 80s on June 4, 2025 in New York City.

Spencer Platt | Getty Images

Summer Fridays may be considered the most desirable perk of the season, but fewer employers are on board with the shortened workweek.

Companies have steadily phased out summer Fridays — a policy that allows workers to take Friday afternoon off over the summer months — as work-from-home Fridays became more common, experts say.

“Pre-pandemic, summer Fridays were thing, but hybrid overall has taken over,” said Bill Driscoll, technology workplace trends expert at staffing and consulting firm Robert Half.

As more commuters settle into flexible working arrangements, fewer workers are making Friday trips at all compared to mid-week traffic patterns, according to the 2024 Global Traffic Scorecard released in January by INRIX Inc., a traffic-data analysis firm.

More from Personal Finance:

Job market is ‘trash’ right now, career coach says

Millions would lose health insurance under GOP megabill

Average 401(k) balances drop 3% due to market volatility

Among employees, however, summer Fridays are the most valued summer benefit, followed by summer hours and flextime, according to a new survey by job site Monster, which polled more than 400 U.S. workers in June.

“Summer Fridays are highly valued among workers because, for many, they represent more than just a few extra hours off,” said Scott Blumsack, Monster’s chief strategy and marketing officer. This perk “can go a long way in showing employees they’re valued, which can help prevent burnout, boost morale, and improve retention during a season when disengagement can run high.”

Still, 84% of workers are not offered any summer-specific benefits, even though 55% also said those benefits improve productivity, Monster found.

Instead, hybrid — and to a lesser extent fully remote — job postings have increased in the last year as employers compete for talented job seekers who prioritize flexibility, according to research by Robert Half.

“Hybrid is a highly desirable situation right now and one that all levels of employees are looking for,” said Robert Half’s Driscoll.

More than five years after the pandemic, 72% of organizations also have return-to-office mandates, according to a separate hybrid work study by Cisco.

But, even with the mandates, employees are less likely to work in the office on Fridays, and much more likely to commute Monday to Thursday, Cisco found.

Employees value flexibility

As employee burnout and disengagement grows amid the wave of in-office mandates, work-life balance and flexible hours have become increasingly important, other studies show.

Corporate wellness company Exos, which works with large organizations such as JetBlue and Adobe, says burnout has gone down significantly among employees at firms that have made Fridays more flexible. Exos also tested out “You Do You Fridays” — and found significant benefits.

The more adaptable the schedule, the more positively employees view their company’s policies, the Cisco report also found.

With hybrid arrangements now common, workers put a high value on that flexibility — and 63% of all workers would even accept a pay cut for the option to work remotely more often, according to Cisco’s global survey of more than 21,500 employers and employees working full-time.

Personal Finance

How House Republicans’ ‘big beautiful’ bill may affect children

Published

19 hours agoon

June 13, 2025

Speaker of the House Mike Johnson, R-La., pictured at a press conference after the House narrowly passed a bill forwarding President Donald Trump’s agenda on May 22 in Washington, DC.

Kevin Dietsch | Getty Images

House reconciliation legislation, also known as the One, Big, Beautiful Bill, includes changes aimed at helping to boost family’s finances.

Those proposals — including $1,000 investment “Trump Accounts” for newborns and an enhanced maximum $2,500 child tax credit — would help support eligible parents.

Proposed tax cuts in the bill may also provide up to $13,300 more in take-home pay for the average family with two children, House Republicans estimate.

“What we’re trying to do is help hardworking Americans who are trying to provide for their families and make ends meet,” House Speaker Mike Johnson, R-La., said during a June 8 interview with ABC News’ “This Week.”

Yet the proposed changes, which emphasize work requirements, may reduce aid for children in low-income families when it comes to certain tax credits, health coverage and food assistance.

Households in the lowest decile of the income distribution would lose about $1,600 per year, or about 3.9% of their income, from 2026 through 2034, according to a June 12 letter from the Congressional Budget Office. That loss is mainly due to “reductions in in-kind transfers,” it notes — particularly Medicaid and the Supplemental Nutrition Assistance Program, or SNAP, formerly known as food stamps.

20 million children won’t get full $2,500 child tax credit

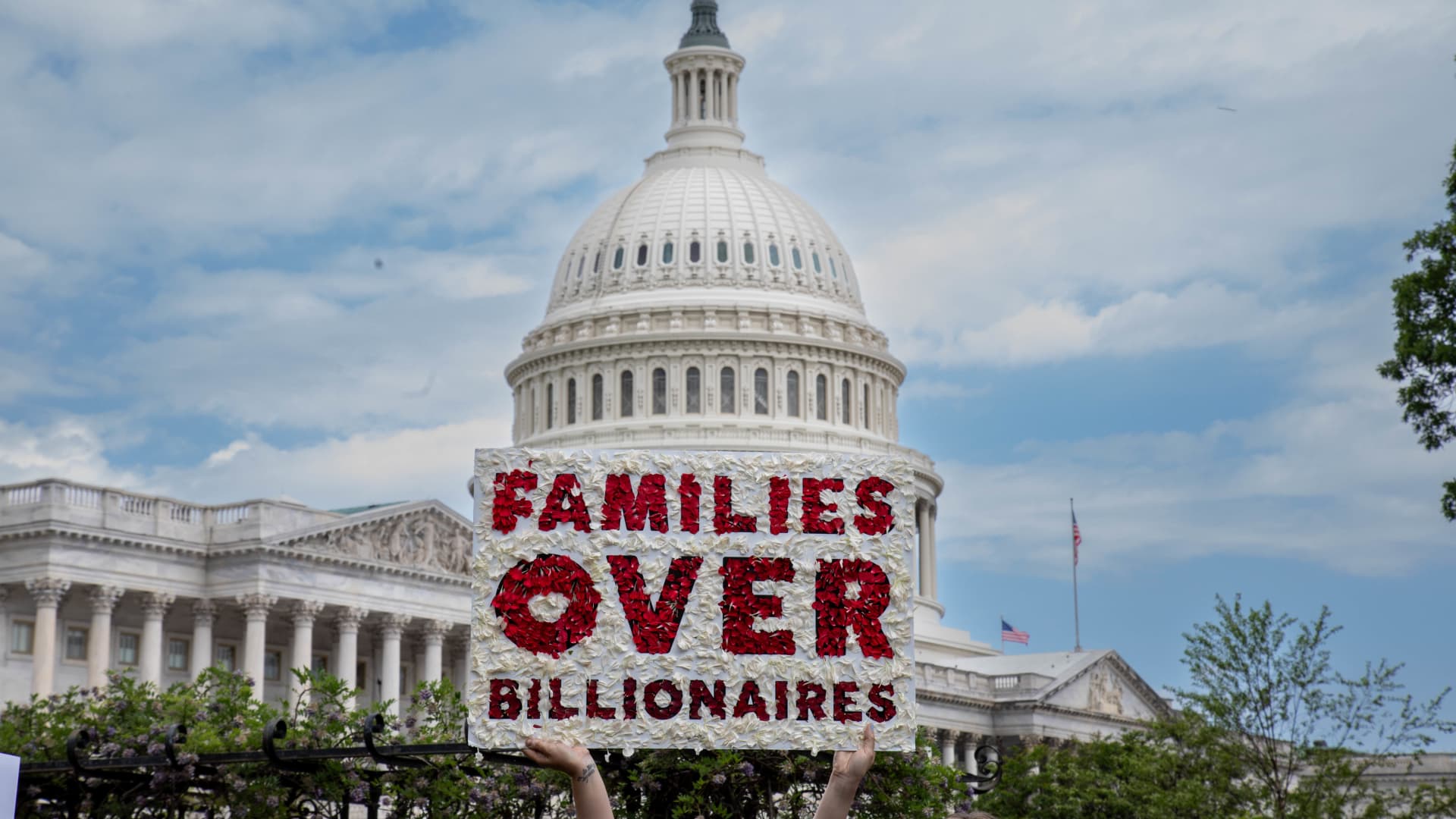

A member of MomsRising holds a sign on Capitol Hill to urge lawmakers to reject tax breaks for billionaires and protest cuts to Medicaid and child care on Capitol Hill on May 8 in Washington, D.C.

Brian Stukes | Getty Images Entertainment | Getty Images

House Republicans have proposed increasing the maximum child tax credit to $2,500 per child, up from $2,000, a change that would go into effect starting with tax year 2025 and expire after 2028.

The change would increase the number of low-income children who are locked out of the child tax credit because their parents’ income is too low, according to Adam Ruben, director of advocacy organization Economic Security Project Action. The tax credit is not refundable, meaning filers can’t claim it if they don’t have a tax obligation.

Today, there are 17 million children who either receive no credit or a partial credit because their family’s income is too low, Ruben said. Under the House Republicans’ plan, that would increase by 3 million children. Consequently, 20 million children would be left out of the full child tax credit because their families earn too little, he said.

“It is raising the credit for wealthier families while excluding those vulnerable families from the credit,” Ruben said. “And that’s not a pro-family policy.”

A single parent with two children would have to earn at least $40,000 per year to access the full child tax credit under the Republicans’ plan, he said. For families earning the minimum wage, it may be difficult to meet that threshold, according to Ruben.

In contrast, an enhanced child tax credit put in place under President Joe Biden made it fully refundable, which means very low-income families were eligible for the maximum benefit, according to Elaine Maag, senior fellow at the Urban-Brookings Tax Policy Center.

In 2021, the maximum child tax credit was $3,600 for children under six and $3,000 for children ages 6 to 17. That enhanced credit cut child poverty in half, Maag said. However, immediately following the expiration, child poverty increased, she said.

The current House proposal would also make about 4.5 million children who are citizens ineligible for the child tax credit because they have at least one undocumented parent who files taxes with an individual tax identification number, Ruben said. Those children are currently eligible for the child tax credit based on 2017 tax legislation but would be excluded based on the new proposal, he said.

New red tape for a low-income tax credit

House Republicans also want to change the earned income tax credit, or EITC, which targets low- to middle-income individuals and families, to require precertification to qualify.

When a similar requirement was tried about 20 years ago, it resulted in some eligible families not getting the benefit, Maag said. The new prospective administrative barrier may have the same result, she said.

More than 2 million children’s food assistance at risk

Momo Productions | Digitalvision | Getty Images

House Republican lawmakers’ plan includes almost $300 billion in proposed cuts to the Supplemental Nutrition Assistance Program, or SNAP, through 2034.

SNAP currently helps more than 42 million people in low-income families afford groceries, according to Katie Bergh, senior policy analyst at the Center on Budget and Policy Priorities. Children represent roughly 40% of SNAP participants, she said.

More than 7 million people may see their food assistance either substantially reduced or ended entirely due to the proposed cuts in the House reconciliation bill, estimates CBPP. Notably, that total includes more than 2 million children.

“We’re talking about the deepest cut to food assistance ever, potentially, if this bill becomes law,” Bergh said.

More from Personal Finance:

Experts weigh pros and cons of $1,000 Trump baby bonus

How Trump spending bill may curb low-income tax credit

Why millions would lose health insurance under House spending bill

Under the House proposal, work requirements would apply to households with children for the first time, Bergh said. Parents with children over the age of 6 would be subject to those rules, which limit people to receiving food assistance for just three months in a three-year period unless they work a minimum 20 hours per week.

Additionally, the House plan calls for states to fund 5% to 25% of SNAP food benefits — a departure from the 100% federal funding for those benefits for the first time in the program’s history, Bergh said.

States, which already pay to help administer SNAP, may face tough choices in the face of those higher costs. That may include cutting food assistance or other state benefits or even doing away with SNAP altogether, Bergh said.

While the bill does not directly propose cuts to school meal programs, it does put children’s eligibility for them at risk, according to Bergh. Children who are eligible for SNAP typically automatically qualify for free or reduced school meals. If a family loses SNAP benefits, their children may also miss out on those benefits, Bergh said.

Health coverage losses would adversely impact families

A protestor holds a sign on May 7, 2025 in Washington, D.C.

Leigh Vogel | Getty Images Entertainment | Getty Images

Families with children may face higher health care costs and reduced access to health care depending on how states react to federal spending cuts proposed by House Republicans, according to the Center on Budget and Policy Priorities.

The House Republican bill seeks to slash approximately $1 trillion in spending from Medicaid, the Children’s Health Insurance Program and Affordable Care Act marketplaces.

Medicaid work requirements may make low-income individuals vulnerable to losing health coverage if they are part of the expansion group and are unable to document they meet the requirements or qualify for an exemption, according to CBPP. Parents and pregnant women, who are on the list of exemptions, could be susceptible to losing coverage without proper documentation, according to the non-partisan research and policy institute.

Eligible children may face barriers to access Medicaid and CHIP coverage if the legislation blocks a rule that simplifies enrollment in those programs, according to CBPP.

In addition, an estimated 4.2 million individuals may be uninsured in 2034 if enhanced premium tax credits that help individuals and families afford health insurance are not extended, according to CBO estimates. Meanwhile, those who are covered by marketplace plans would have to pay higher premiums, according to CBPP. Without the premium tax credits, a family of four with $65,000 in income would pay $2,400 more per year for marketplace coverage.

Personal Finance

‘White collar’ jobs are down — but don’t blame AI yet, economists say

Published

20 hours agoon

June 13, 2025

Artificial intelligence makes people more valuable, according to PwC’s 2025 Global AI Jobs Barometer report.

Pixdeluxe | E+ | Getty Images

While there hasn’t been much hiring for so-called “white collar” jobs, the contraction is not because of artificial intelligence, economists say. At least, not yet.

Professional and business services, the industry that represents white-collar roles and middle and upper-class, educated workers, hasn’t experienced much hiring activity over the past two years.

In May, job growth in professional and business services declined to -0.4%, slightly down from -0.2% in April, according to the Bureau of Labor Statistics. In other words, the sector has been losing job opportunities, according to Cory Stahle, an economist at job search site Indeed.

Meanwhile, industries like health care, construction and manufacturing have seen more job creation. In May, nearly half of the job growth came from health care, which added 62,000 jobs, the bureau found.

More from Personal Finance:

Here’s what’s happening with unemployed Americans — in five charts

The pros and cons of a $1,000 baby bonus in ‘Trump Accounts’

Social Security cost-of-living adjustment may be 2.5% in 2026

However, economists have said that the decline in white-collar job openings is more driven by structural issues in the economy rather than artificial intelligence technology taking people’s jobs.

“We know for a fact that it’s not AI,” said Alí Bustamante, an economist and director at the Roosevelt Institute, a liberal think tank.

Indeed’s Stahle agreed: “This is more of an economic story and less of an AI disruption story, at least so far.”

Artificial intelligence is still in early stages

There are a few reasons AI is not behind the declining job creation in white-collar sectors, according to economists.

For one, the decline in job creation has been happening for years, Bustamante said. In that timeframe, AI technology “was pretty awful,” he said.

What’s more, the technology is even now still in early stages, to the point where the software cannot execute key skills without human intervention, said Stahle.

A 2024 report by Indeed researchers found that of the more than 2,800 unique work skills identified, none are “very likely” to be replaced by generative artificial intelligence. GenAI creates content like text or images based on existing data.

Across five scenarios — “very unlikely,” “unlikely,” “possible,” “likely” and “very likely” — about 68.7% of skills were either “very unlikely” or “unlikely” to be replaced by GenAI technology, the site found.

“We might get to a point where they do, but right now, that’s not necessarily looking like it’s a big factor,” Stahle said.

‘Jobs are going to transform’

While AI has yet to replace human workers, there may come a time where the technology does disrupt the labor force.

“Certainly, jobs are going to transform,” Stahle said. “I’m not going to downplay the potential impacts of AI.”

Stahle said that openings for consulting jobs focused on implementing generative AI have been rising. Over the past year, management consulting roles with AI language accounted for 12.4% of GenAI postings, showing signs of growing demand, per a February report by Indeed.

A separate report by the World Economic Forum in January forecasts that by 2030, the new technology will create 170 million new jobs, or 14% of the current total employment.

However, that growth could be offset by the decline in existing roles. The report cites that about 92 million jobs, or 8% of the current total employment, could be displaced by AI technology.

For knowledge-based workers whose skills may overlap with AI, consider investing in developing skills on how to use AI technology to stay ahead, Stahle said.

Amazon is selling an $800 portable power station for $550, and shoppers 'love the mobile design and durability'

Amazon is selling a 'high-quality' $525 Citizen Eco-Drive watch for $260, and buyers love its 'useful functions'

Accounting firms seeing increased profits

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoJobs report May 2025:

-

Economics1 week ago

Economics1 week agoDonald Trump has many ways to hurt Elon Musk

-

Economics6 days ago

Economics6 days agoSending the National Guard to LA is not about stopping rioting

-

Finance1 week ago

Finance1 week agoStocks making the biggest moves midday: WOOF, TSLA, CRCL, LULU

-

Economics1 week ago

Economics1 week agoDonald Trump has many ways to hurt Elon Musk

-

Blog Post6 days ago

Blog Post6 days agoMastering Bookkeeping Tasks During Peak Business Seasons

-

Personal Finance6 days ago

Personal Finance6 days agoWhat Pell Grant changes in Trump budget, House tax bill mean for students

-

Finance6 days ago

Finance6 days agoChina’s EV race to the bottom leaves a few possible winners