The House-passed version of President Donald Trump’s tax and spending bill would add $2.42 trillion to U.S. budget deficits over the next decade, according to a new estimate from the nonpartisan Congressional Budget Office.

The CBO’s calculation, released Wednesday in its so-called scoring of the “One Big Beautiful Bill,” reflects a $3.67 trillion decrease in expected revenues and a $1.25 trillion decline in spending over the decade through 2034, relative to baseline projections.

Prospects for an even more dire U.S. fiscal trajectory threaten to stoke concerns about the bill among GOP fiscal hawks. Trump ally Elon Musk on Tuesday blasted the package as a “massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination.”

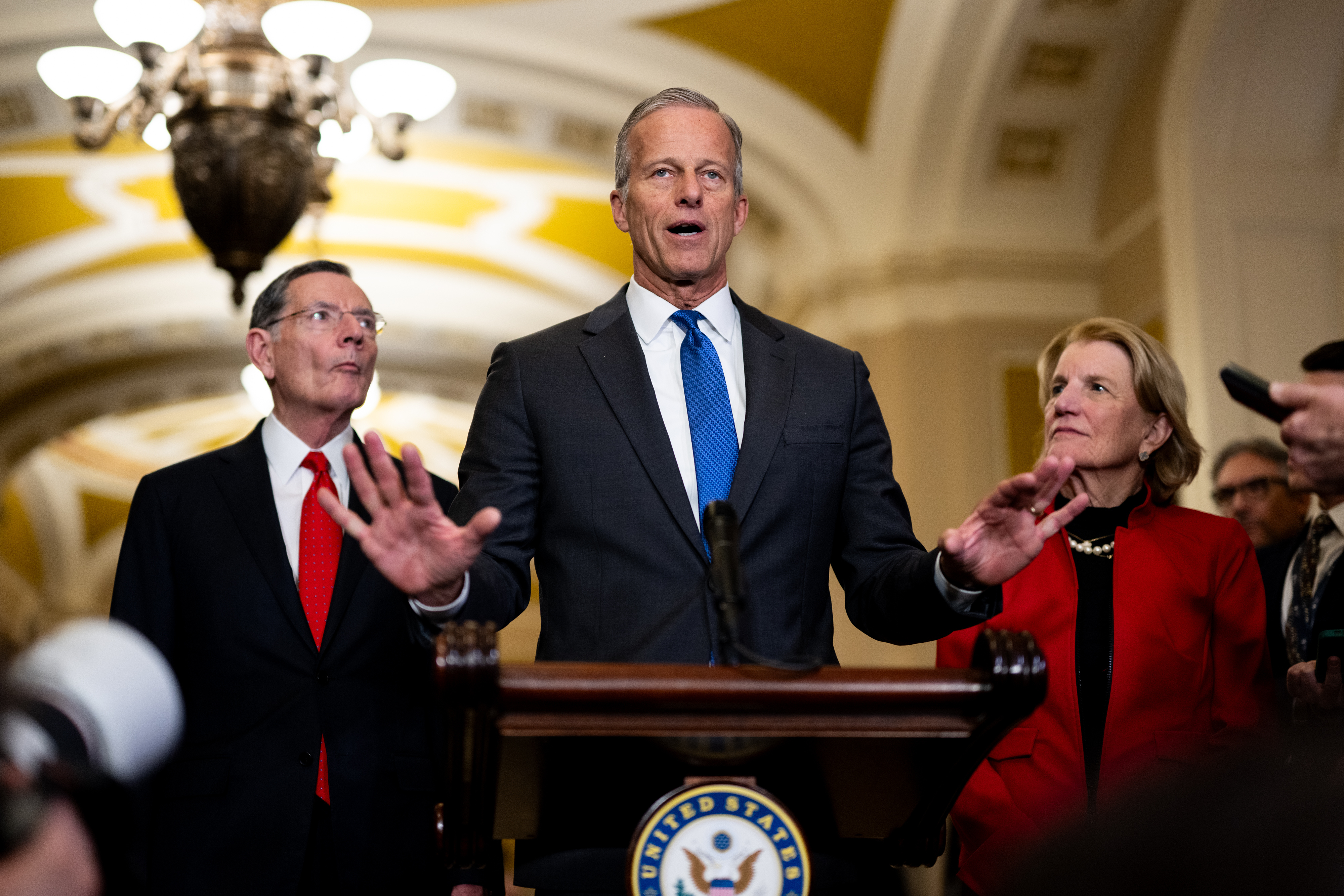

House Republicans narrowly passed the bill last month, and it now faces opposition in the Senate, where multiple lawmakers have expressed varying demands for changes. Trump is expected to meet with Senate Finance Committee Republicans Wednesday to discuss the bill.

Trump administration officials have repeatedly dismissed CBO projections as inaccurate, saying they fail to account for the uplift to economic growth that the tax cuts, along with tariff hikes and deregulation, will provide. Treasury Secretary Scott Bessent said last month, “I’m not worried about the U.S. debt dynamics,” because a swelling GDP will ease the burden. He also predicted “north of 3%” growth by this time next year.

Timing for passage

The CBO’s $2.42 trillion deficit-increase estimate doesn’t incorporate any so-called dynamic effects from changes in economic growth or other indicators resulting from the new tax and spending measures.

Bessent has called on lawmakers to pass the bill, which includes an increase in the statutory debt limit, by mid-July. The Treasury has been using special accounting maneuvers to keep within the debt ceiling since the start of the year, and has warned it could exhaust its capacity in August.

Fiscal conservatives have demanded the measure do more for deficit reduction. But other GOP members have demanded that temporary tax cuts in the bill be made permanent — which would further dampen revenues. The CBO score will also be reviewed by the Senate’s rules-keeper who could determine whether provisions comply with the chamber’s requirements.

The bill encompasses much of Trump’s economic agenda. It would make permanent his 2017 income-tax cuts, and provide new benefits promised on the campaign trail — including eliminating taxes on tips and overtime pay through 2028. It also raises the cap on the federal deduction for state and local taxes to $40,000 from $10,000.

The bill has various federal spending cuts, including to clean-energy credits, and features new work requirements for Medicaid beneficiaries and new guidelines for the Supplemental Nutrition Assistance Program. Some of those cuts also face opposition among Senate Republicans.

Wednesday’s CBO release indicated that measures in the existing bill could leave 10.9 million people without health insurance in 2034. That includes 1.4 million without verified citizenship, nationality or satisfactory immigration status who would no longer be covered in state-only funded programs.

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Blog Post4 days ago

Blog Post4 days ago

Economics5 days ago

Economics5 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance1 week ago

Finance1 week ago