The Federal Reserve’s key inflation measure rose more than expected in February while consumer spending also posted a smaller than projected increase, the Commerce Department reported Friday.

The core personal consumption expenditures price index showed a 0.4% increase for the month, putting the 12-month inflation rate at 2.8%. Economists surveyed by Dow Jones had been looking for respective numbers of 0.3% and and 2.7%.

Core inflation excludes volatile food and energy prices and is generally considered a better indicator of long-term inflation trends.

In the all-items measure, the price index rose 0.3% on the month and 2.5% from a year ago, both in line with forecasts.

At the same time, the Bureau of Economic Analysis report showed that consumer spending accelerated 0.4% for the month, below the 0.5% forecast. That came as personal income posted a 0.8% rise, against the estimate for 0.4%.

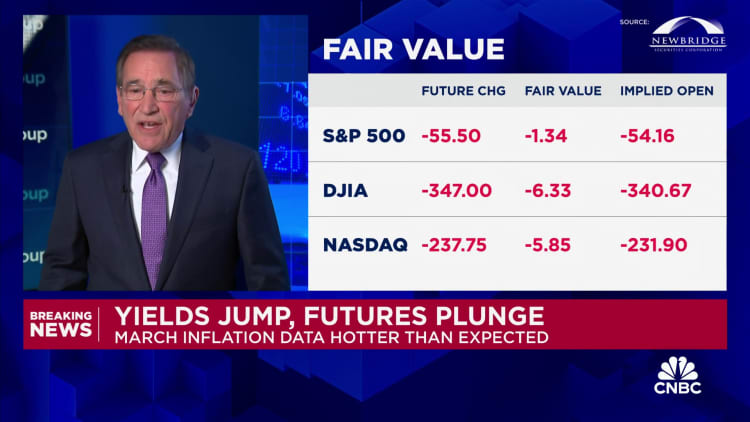

Stock market futures moved lower following the release as did Treasury yields.

Federal Reserve officials focus on the PCE inflation reading as they consider it a broader measure that also adjusts for changes in consumer behavior and places less of an emphasis on housing than the Labor Department’s consumer price index. Shelter costs have been one of the stickier elements of inflation and rose 0.3% in the PCE measure.

“It looks like a ‘wait-and-see’ Fed still has more waiting to do,” said Ellen Zentner, chief economic strategist at Morgan Stanley Wealth Management. “Today’s higher-than-expected inflation reading wasn’t exceptionally hot, but it isn’t going to speed up the Fed’s timeline for cutting interest rates, especially given the uncertainty surrounding tariffs.”

Good prices increased 0.2%, led by recreational goods and vehicles, which increased 0.5%. Gasoline offset some of the increase, with the category falling by 0.8%. Services prices were up 0.4%.

The report comes with markets on edge that President Donald Trump’s tariff intentions will aggravate inflation at a time when the data was making slow but steady progress back to the Fed’s 2% goal.

After cutting rates a full percentage point in 2024, the central bank has been on hold this year, with officials of late expressing concern over the impact the import duties will have on prices. Economists tends to consider tariffs as one-off events that don’t feed through to longer-lasting inflation pressures, but the encompassing scope of Trump’s tariffs and the potential for an aggressive global trade war are changing the stakes.

Correction: Consumer spending increased 0.4% in February. An earlier headline misstated the number.

This is breaking news. Please refresh for updates.

Get Your Ticket to Pro LIVE

Join us at the New York Stock Exchange!

Uncertain markets? Gain an edge with CNBC Pro LIVE, an exclusive, inaugural event at the historic New York Stock Exchange.

In today’s dynamic financial landscape, access to expert insights is paramount. As a CNBC Pro subscriber, we invite you to join us for our first exclusive, in-person CNBC Pro LIVE event at the iconic NYSE on Thursday, June 12.

Join interactive Pro clinics led by our Pros Carter Worth, Dan Niles, and Dan Ives, with a special edition of Pro Talks with Tom Lee. You’ll also get the opportunity to network with CNBC experts, talent and other Pro subscribers during an exciting cocktail hour on the legendary trading floor. Tickets are limited!

Blog Post7 days ago

Blog Post7 days ago

Finance7 days ago

Finance7 days ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Accounting1 week ago

Accounting1 week ago

Personal Finance7 days ago

Personal Finance7 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance4 days ago

Personal Finance4 days ago