Picture this: an accountant in 2005, sifting through mountains of invoices, ledgers and receipts, a painstakingly manual process prone to human error. Now, imagine the same task completed in seconds, not by human hands but by an AI system that doesn’t just follow instructions but learns, adapts and autonomously optimizes processes. This is not a glimpse into a distant future — it’s the reality unfolding today with agentic artificial intelligence.

Unlike traditional AI systems, which follow rigid pre-programmed instructions, agentic AI operates autonomously. It sets goals, learns continuously and adapts to ever-changing environments, unlocking possibilities that were once unimaginable. From streamlining financial operations to enhancing compliance and decision-making, agentic AI promises to reshape the accounting profession. Yet, with this potential comes the need for firms and professionals to adapt, upskill and build ethical frameworks to navigate the challenges ahead.

Agentic AI represents more than mere automation — it’s a paradigm shift that elevates the role of accountants from transactional operators to strategic advisors. This transformation is being realized through several key applications:

1. Financial reporting and reconciliation: from manual to intelligent automation

One of the most impactful areas of agentic AI is its ability to automate labor-intensive processes like financial reporting, journal entries and bank reconciliation. Tasks that once took hours can now be completed in minutes with unparalleled accuracy. AI-powered dashboards provide accountants with real-time insights into financial health, enabling them to quickly identify trends, anomalies and opportunities.

In the era of intelligent automation, the competitive edge lies not in data collection, but in its interpretation. Large language models integrated into AI systems can analyze contracts, invoices, and receipts, extracting relevant data for real-time processing. This capability extends beyond mere efficiency gains — it represents a paradigm shift in how financial professionals engage with data. While the systems process vast amounts of information, accountants can focus on higher-order analysis and strategic guidance. With agentic AI continuously learning and recalibrating strategies in response to market changes, organizations gain the agility to thrive in volatile environments.

2. Auditing: smarter, faster and more comprehensive

The era of sampling is giving way to an age of complete financial visibility. Traditional audits had relied on sampling a subset of transactions due to resource constraints, leaving room for oversight. Agentic AI changes the game by analyzing 100% of financial transactions in real time, flagging discrepancies, irregularities, or potential fraud. This level of scrutiny enhances accuracy and transforms the nature of audits into a proactive, continuous process.

Liberated from routine verification tasks, auditors now occupy a more sophisticated role as financial investigators and strategic advisors. Predictive analytics, a cornerstone of agentic AI, allows firms to foresee compliance risks and mitigate them before they escalate, marking a shift from retrospective auditing to forward-looking risk management.

3. Tax planning and compliance: simplifying complexities

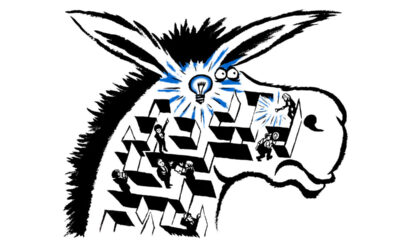

Navigating the labyrinth of global tax codes and regulations has always been among the most intricate challenges for accounting professionals. Agentic AI redefines this complexity by automating tasks like tax research, return preparation and error detection. These systems can analyze massive datasets, adapt to evolving tax laws, and identify opportunities for strategic tax optimization — all while ensuring precise compliance across multiple jurisdictions..

Tax professionals, freed from routine compliance tasks, can now focus on providing strategic advice to clients, such as optimizing tax liabilities or assessing the implications of mergers and international expansions. By leveraging AI’s ability to handle intricate tax scenarios, accountants can enhance their advisory roles, helping businesses stay compliant while achieving significant cost savings. The future of tax planning lies at the intersection of artificial intelligence and human judgment.

4. Proactive compliance and fraud prevention

Compliance excellence in today’s financial landscape demands foresight, not just oversight. Agentic AI has elevated compliance management from a reactive function to a predictive discipline. AI-powered systems can now monitor regulatory changes in real time, analyze their implications and flag potential violations before they become issues. By automating the preparation of compliance documentation and regulatory reporting, these systems reduce manual errors and ensure timely submissions.

This predictive capability has become a cornerstone of modern financial governance. With AI at the helm, organizations can embed foresight into their compliance strategies, minimizing exposure to risks before they materialize. The impact extends beyond avoiding penalties — it strengthens operational integrity and builds stakeholder trust through proactive risk management.

In parallel, fraud prevention has reached new levels of sophistication. Agentic AI detects suspicious activities early by identifying anomalies in financial data and transaction patterns. In some cases, AI agents can autonomously halt suspicious activities or escalate them for further investigation. This proactive approach not only mitigates risks but also reinforces trust and transparency within financial operations.

Trust in financial systems is no longer built on human oversight alone, but on the synergy between AI vigilance and human judgment. This new approach to compliance and fraud prevention creates multiple layers of protection, where AI’s tireless monitoring combines with strategic human intervention. The result is a more robust financial ecosystem where transparency isn’t just maintained — it’s continuously reinforced through predictive intelligence and automated safeguards.

What this means for accounting professionals

As AI takes over routine tasks, the roles of accounting professionals are evolving:

- Accountants: Shift from transactional tasks to strategic advisory, focusing on interpreting AI insights and delivering tailored recommendations.

- Auditors: Use AI for comprehensive risk assessments and deeper investigations, enhancing the value of their audits.

- Tax professionals: Rely on AI for compliance and optimization while focusing on complex tax scenarios that require human judgment.

- CFOs and financial analysts: Leverage AI for predictive analytics, enabling more informed, forward-looking decisions.

- Compliance officers: Collaborate with AI to proactively manage regulatory risks and ensure ethical AI use in financial processes.

Professionals must adapt by developing skills in AI interpretation, data analysis and strategic decision-making to remain relevant in this AI-driven era.

The challenges ahead

While agentic AI offers immense opportunities, it also brings challenges that accounting firms must address:

- Data privacy and security: Protecting sensitive financial data from breaches remains critical.

- Ethical considerations: AI decision-making must be transparent and unbiased, requiring robust governance frameworks.

- Workforce adaptation: Upskilling professionals to collaborate with AI systems is essential for long-term success.

Firms must also invest in the infrastructure needed to integrate agentic AI effectively, ensuring smooth transitions from legacy systems.

A future redefined by agentic AI

Accounting’s evolution through agentic AI represents more than just technological advancement; it marks a fundamental shift in how financial services are conceived and delivered. As these systems continue to evolve and improve, they will enable accounting professionals to focus increasingly on high-value activities that require human judgment, creativity and strategic thinking. The future of accounting lies not in replacing human expertise, but in augmenting it with intelligent systems that learn and adapt. The distinction between good and great accounting firms will increasingly lie in how they harness AI’s potential while maintaining human judgment.

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Blog Post7 days ago

Blog Post7 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago

Economics6 days ago

Economics6 days ago

Economics7 days ago

Economics7 days ago