Economics

Checks and Balance newsletter: Depending on America is a vulnerability

-

Economics1 week ago

Economics1 week agoBusiness already are trying to pass tariff cost onto customers, Fed report says

-

Economics1 week ago

Economics1 week agoECB members say inflation job nearly done but tariff risks loom

-

Accounting1 week ago

Accounting1 week agoAt Schellman, AI reshapes a firm’s staffing needs

-

Economics7 days ago

Economics7 days agoAmericans are getting flashbacks to 2008 as tariffs stoke recession fears

-

Economics1 week ago

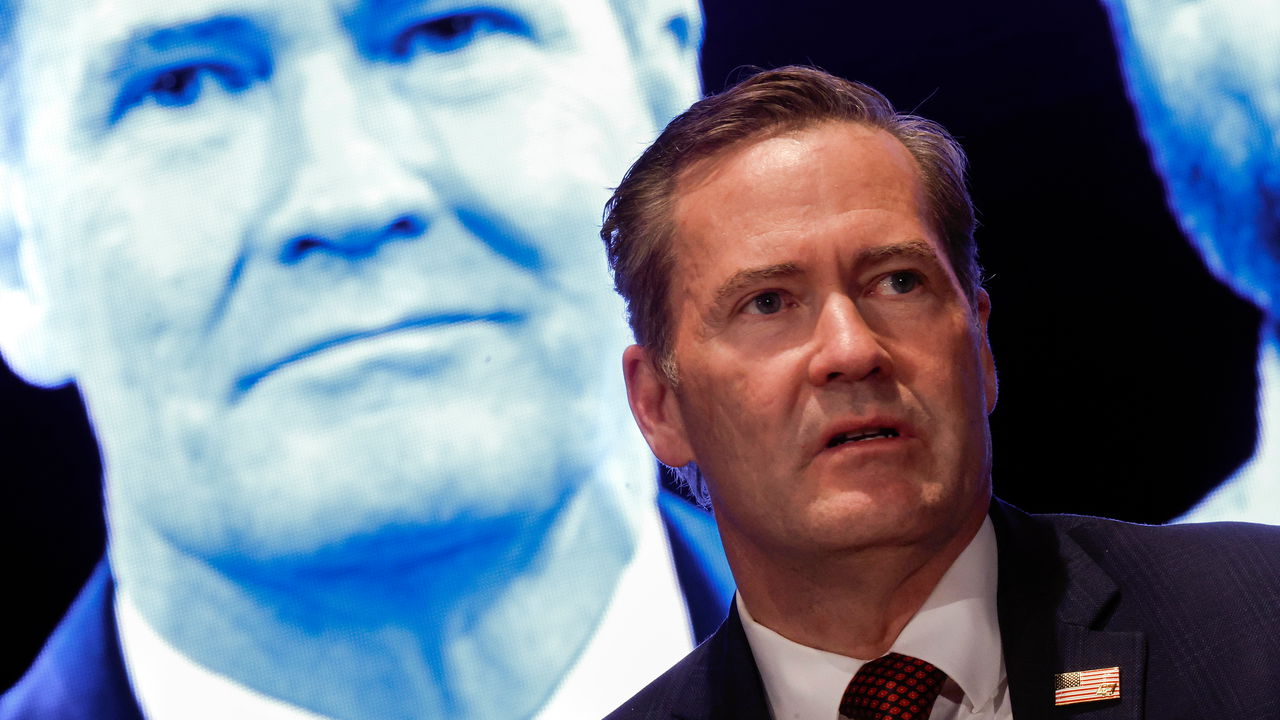

Economics1 week agoTrump insists bond market tumult didn’t influence tariff pause: ‘I wasn’t worried’

-

Economics7 days ago

Economics7 days agoChecks and Balance newsletter: Predictions for the Democrats’ future

-

Economics1 week ago

Economics1 week agoOrders for big-ticket items like autos and appliances surged 9.2% in March in rush to beat tariffs

-

Personal Finance1 week ago

Personal Finance1 week agoIncoming college freshmen may owe $40K in student debt by graduation