Arriel Vinson hadn’t traveled much before the pandemic. Now she can’t stop.

Personal Finance

Americans are YOLO spending more but savings hits lows of Great Recession

Published

1 year agoon

“My mind-set has completely changed after covid: When I see something I want to do, I make it happen,” she said, adding that her new priorities have required some financial rejigging. “For a while I was going to dinner all the time. I was getting things delivered, but now I’m like, ‘I don’t want to waste money on that.’ I want to travel and go to shows.”

Whatever you call it — doom spending, soft saving, YOLOing (“you only live once”) — the coronavirus pandemic has changed the way Americans spend money. They are saving less but vacationing more, splurging on concerts and sporting events, and booking lavish trips years in advance. Spending on international travel and live entertainment surged roughly 30 percent last year, five times the rate of overall spending growth. Meanwhile, the personal savings rate is at a low not seen since the Great Recession.

And the spending spree has continued into 2024. Consumers spent $145.5 billion more in February than they did the month before — much of that on services — fueling the biggest monthly increase in more than a year, according to data from the Bureau of Economic Analysis released Friday. Meanwhile, the personal savings rate fell to 3.6 percent, from 4.1 percent the previous month.

Just like the Great Depression ushered in decades of frugality and austerity — with an entire generation reusing plastic bags, jam jars and aluminum foil — there are signs the coronavirus crisis has had the opposite effect: nudging Americans toward spending more, especially on experiences.

“When you live through a crisis, it gets ingrained in your brain,” said Ulrike Malmendier, a professor of behavioral finance at the University of California at Berkeley. “The official economic reports might say everything is coming back to normal, but we are different people than we were before the pandemic.”

Financial shocks have repeatedly reshaped the way people think about money, Malmendier said. “Depression babies,” those who came of age after the stock market crash of 1929, were notoriously mistrustful of banks and financial markets. People who have been unemployed are often cautious about spending long after they have found another job. And after the 2008 financial crisis, Americans began saving more of their paychecks, to guard against another massive downturn.

But unlike those financial crises, which led people to pull back, the coronavirus pandemic has left a decidedly different legacy.

“The adverse effects of covid weren’t necessarily financial; people got jobs quickly and the government stepped in with support,” Malmendier said. “Instead, it’s about all of the things we were starved for: human interaction, socializing, travel. People are spending money on the things they missed most.”

Carolyn McClanahan, a financial adviser in Jacksonville, Fla., is seeing this firsthand. Her clients are generally saving less than they were before the pandemic, she said. Instead of solely planning for retirement, they’re focused on “maximizing life now” to make room for more travel, concerts and fun.

“People already had this attitude that you only live once — and that’s been put on steroids,” she said. “Covid was a big wake-up call that life is precious, so you’ve got to enjoy it now.”

It helps that many Americans still have more money in the bank than they did before the pandemic. They have gotten substantial raises or higher-paying jobs that have made it possible to keep spending, despite inflation. Stock portfolios and home prices have soared, giving middle- and upper-class households an extra boost. As of last fall, Americans were still sitting on an extra $430 billion in pandemic savings, according to estimates from the Federal Reserve Bank of San Francisco. Yet consumers have been saving consistently less since the pandemic, with a particular drop-off last summer, coinciding with a strong spending boom.

Still, in a worrisome twist, families have been spending even if they don’t have the money. Credit card debt has risen 22 percent since the pandemic, and more shoppers are turning to “buy now, pay later” installment plans for routine purchases. Bank of America cardholders, for example, spent 7 percent more on travel and entertainment last year than they did in 2022. European summer vacations were particularly popular, with a 26 percent increase from the previous year.

That momentum has continued into the new year. More Americans are traveling than they were a year ago, Transportation Security Administration passenger data shows. And a near-record 22 percent of Americans say they are planning to vacation in a foreign country in the next six months, roughly double pre-pandemic levels, according to Conference Board survey data released this week.

Meanwhile, Live Nation — the parent company of Ticketmaster and the world’s largest entertainment company — posted a record $23 billion in sales last year and expects this year to be even bigger.

“Shows are flying out the door from top to bottom,” chief executive Michael Rapino said in a February earnings call. “We’re seeing no slowdown on the consumer.”

In interviews with more than a dozen Americans, many acknowledged that they are financially better off than they were a few years ago. But just as importantly, they said, they were spending differently — cutting back on midweek restaurant visits, for example, or buying fewer clothes, in favor of big-ticket items and memorable experiences.

All that spending on services helped push economic growth even higher in late 2023, up to a strong 3.4 percent — making the latter half of 2023 the strongest since 2014, outside of the pandemic years, according to data released Thursday by the Bureau of Labor Statistics.

In Seattle, Mike Lee’s free time has become a whirlwind of comedy shows, concerts, hockey games and weekend trips. The software developer, who got divorced early in the pandemic, has been lining up experiences far in advance: Hawaii in April, a Foo Fighters show in August.

“It’s changed the way I move through life,” the 40-year-old said. “I used to save obsessively, almost to a fault, but I’m learning to go out and enjoy life a little bit more.”

But he isn’t splurging across the board. Lee still drives a 20-year-old Toyota Corolla and has cut his restaurant spending by half. Instead, he has stocked his freezer with soup dumplings, chicken wings and other prepared foods to hold him over on evenings when he doesn’t feel like cooking.

Those types of trade-offs, economists say, are likely to continue as households settle into new habits. Families are canceling HBO Max and Disney Plus subscriptions, for example, or ditching grocery delivery and getting rid of Pelotons they hoarded back in 2020.

“People are trying to find the right balance between how they lived during the pandemic and how they want to live now,” said Nadia Vanderhall, a financial planner in Charlotte. “They’re spending more on experiencing life, but they’re also trying to figure out what it means for their finances.”

Although economists expect a drop-off in spending this year, some are revising their forecasts: Fitch Ratings, for example, now expects consumer spending to grow by 1.3 percent in 2o24, even after inflation, more than double what it had initially predicted. Consumers are poised to keep tapping into savings, the firm said, which is expected to “support spending well into 2024.”

Susan Blume, a travel agent in Garden City, N.Y., is already booking river cruises along the Danube for 2026. International travel has exploded in the past few years, she said, and this year is on track to top them all.

“Everybody was just so confined during the pandemic that they never want to have that experience again,” she said.

But the biggest surprise: the rush of travelers in their mid-20s, far younger than Blume’s usual clientele.

“Gen Z has a very different attitude — they’re not going broke on Gucci or takeout,” she said. “Instead they’re squirreling away for travel. And they’re already planning next year’s big trip: all of Italy, or island-hopping in Greece, or four stops in France.”

It’s unclear exactly how long this era of experiential living will last, though economists say it’s likely to take a major shock, such as widespread job losses or a recession, to get Americans to rethink their spending.

“You have to really have a crash in employment to derail this consumer,” said Diane Swonk, chief economist at KPMG. “This spending isn’t just a mirage, it’s a fundamental change.”

That relentless consumption has invigorated the economy and propped up millions of service-sector jobs. But it has also contributed to a run-up in prices: Inflation for services is at 3.8 percent, compared with a 0.2 percent decline for goods in the past year. That’s creating an ongoing challenge for the Federal Reserve, which has specifically flagged the need to see services inflation cool.

“There is certainly a big question mark there: Can the Fed get hotel inflation, airline inflation, concert inflation down without slowing demand for those things?” said Torsten Slok, chief economist at Apollo Global Management. “But so far people are still spending.”

Michael Sheridan, who lives in Clearwater, Fla., has been on 13 cruises in 17 months. The latest, which he booked on a Friday afternoon, left for the Bahamas the next morning.

The 58-year-old, who once owned a couple of Outback Steakhouses, is on a fixed income. He receives $2,400 a month in Social Security Disability Insurance payments because of a rare genetic disorder that forced him to stop working a decade ago. Sheridan relies on a wheelchair to get around, but he says he has been financially fortunate: His mother, who died in 2020, left him enough cash to buy a $109,000 condo outright.

Now his monthly checks go toward homeowners association fees ($350), phone bills ($40), groceries ($250) — and travel. He’s in Japan now and headed to Seattle in April, the Caribbean in June and Switzerland in July.

“The pandemic absolutely fed this travel addiction,” he said, adding that he was quick to take advantage of cheap airfares and hotel rates during early lockdowns. “I just realized, if all of a sudden something goes south, I’m going to regret not having traveled while I could.”

You may like

Personal Finance

‘SALT’ deduction in limbo as Senate Republicans unveil tax plan

Published

1 hour agoon

June 16, 2025

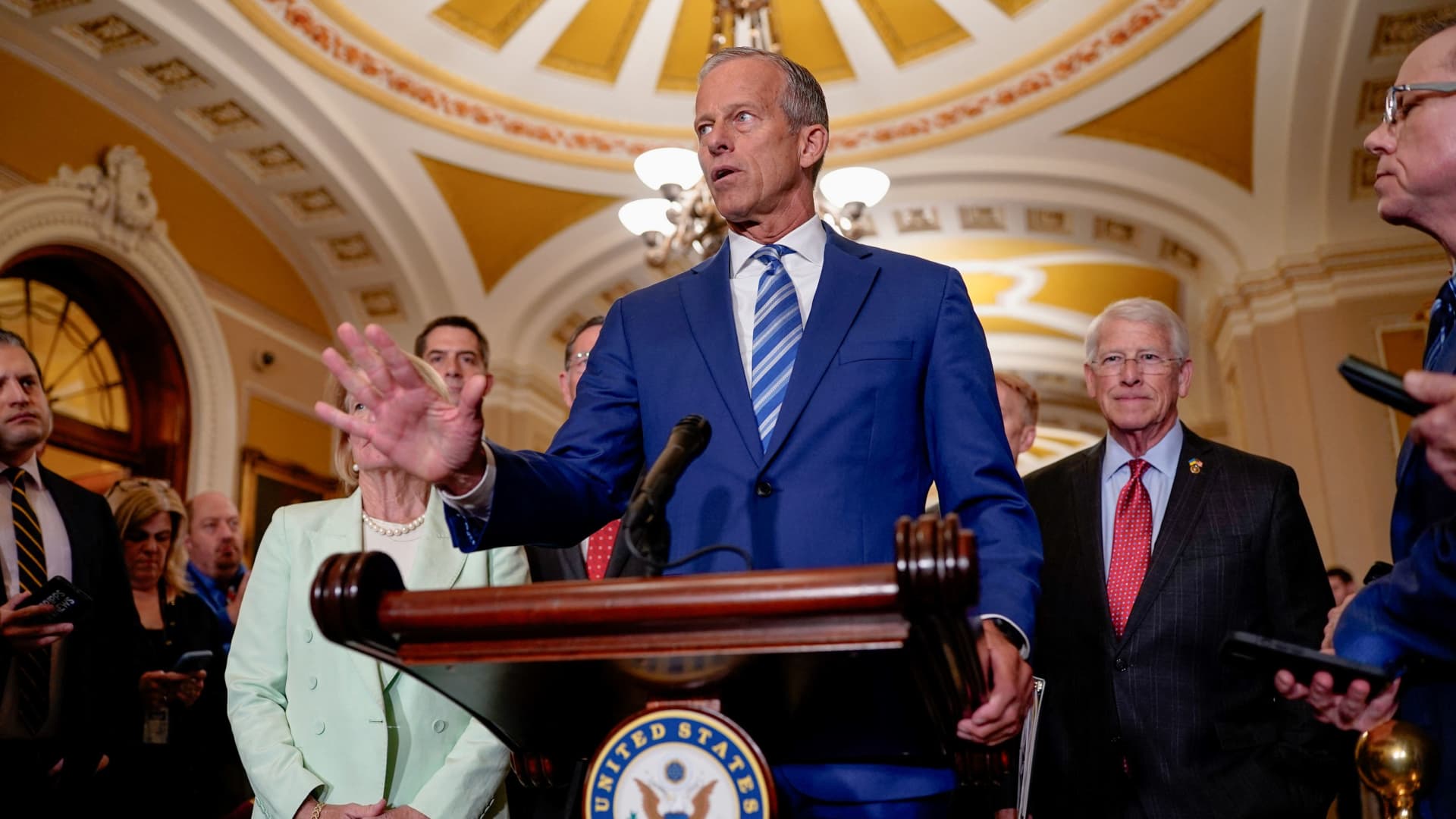

U.S. Senate Majority Leader John Thune (R-SD) speaks at a press conference following the U.S. Senate Republicans’ weekly policy luncheon on Capitol Hill in Washington, D.C., U.S., June 10, 2025.

Kent Nishimura | Reuters

As Senate Republicans release key details of President Donald Trump‘s spending package, some provisions, including the federal deduction for state and local taxes, known as SALT, remain in limbo.

Enacted via the Tax Cuts and Jobs Act, or TCJA, of 2017, there’s currently a $10,000 limit on the SALT deduction through 2025. Before 2018, the tax break — including state and local income and property taxes — was unlimited for filers who itemized deductions. But the so-called alternative minimum tax reduced the benefit for some higher earners.

The Senate Finance Committee’s proposed text released on Monday includes a $10,000 SALT deduction cap, which is expected to change during Senate-House negotiations on the spending package. That limit is down from the $40,000 cap approved by House Republicans in May.

More from Personal Finance:

Fed is likely to hold rates steady this week. What it means for you

How to protect assets amid immigration raids, deportation worries

IRS: Make your second-quarter estimated tax payment by June 16

The SALT deduction has been ‘contentious’

“SALT has been contentious for eight years,” said Andrew Lautz, associate director for the Bipartisan Policy Center’s economic policy program.

Since 2017, the SALT deduction cap has been a key issue for certain lawmakers in high-tax states like New York, New Jersey and California. These House members have leverage during negotiations amid a slim House Republican majority.

Under current law, filers who itemize tax breaks can’t claim more than $10,000 for the SALT deduction, including married couples filing jointly, which is considered a “marriage penalty.”

However, raising the SALT deduction cap has been controversial. If enacted, benefits would primarily flow to higher-income households, according to a May analysis from the Committee for a Responsible Federal Budget.

Currently, the vast majority of filers — roughly 90%, according to the latest IRS data — use the standard deduction and don’t benefit from itemized tax breaks.

Plus, the 2017 SALT cap was enacted to help pay for other TCJA tax breaks, and some lawmakers support the lower limit for funding purposes.

In the Senate, “there isn’t a high level of interest in doing anything on SALT,” Senate Majority Leader John Thune said June 15 on “Fox News Sunday.”

“I think at the end of the day, we’ll find a landing spot, hopefully that will get the votes that we need in the House, a compromise position on the SALT issue,” he said.

But some House Republicans have already pushed back on the proposed $10,000 SALT deduction cap included in the Senate draft.

Rep. Mike Lawler, R-N.Y., on Monday described the Senate proposed $10,000 SALT deduction limit as “DEAD ON ARRIVAL” in an X post.

Meanwhile, Rep. Nicole Malliotakis, R-N.Y., on Monday also posted about the $10,000 cap on X. She said the lower limit was “not only insulting but a slap in the face to the Republican districts that delivered our majority and trifecta.”

Personal Finance

Welcome to the zoo. That’ll be $47 today — ask again tomorrow.

Published

7 hours agoon

June 16, 2025

Giant panda Bao Li chews on bamboo during his public debut at the Smithsonian’s National Zoo in Washington, U.S., January 24, 2025.

Kevin Lamarque | Reuters

How much will it cost to visit a museum, zoo or aquarium this summer? The answer, increasingly, is: It depends.

John Linehan can rattle off almost two dozen factors that Zoo New England’s dynamic pricing contractor, Digonex, uses to recommend what to charge guests.

“It’s complicated,” said Linehan, president and CEO of the operator of the two zoos in eastern Massachusetts.

Before adopting dynamic pricing, the organization was changing prices seasonally and increasing entry rates little by little. “As we watched that pattern, we were afraid some families were going to get priced out,” he said of the earlier approach. “I’m a father of four and I know what it is like.”

Now, Zoo New England’s system provides cheaper rates for tickets purchased far in advance. That, coupled with the zoo’s participation in the Mass Cultural Council’s discounted admissions program for low-income and working families, “puts some control back in the consumer’s hands,” Linehan said.

We charge what we need to make ends meet while delivering on our mission.

John Linehan

CEO of Zoo New England

The zoo is one of many attractions embracing pricing systems that were earlier pioneered by airlines, ride-hailing apps and theme parks. While these practices allow operators to lower prices when demand is soft, they also enable the reverse, threatening to squeeze consumers who are increasingly trimming their summer travel budgets.

Before the pandemic, less than 1% of attractions surveyed by Arival, a tourism market research and events firm, used variable or dynamic pricing. Today, 17% use variable pricing, in which entry fees are adjusted based on predictable factors such as the day of the week or the season, Arival said. And 6% use dynamic pricing, in which historical and real-time data on weather, staffing, demand patterns and more influence rates.

The changes come as barely half of U.S. museums, zoos, science centers and similar institutions have fully recovered to their pre-Covid attendance levels, according to the American Alliance of Museums. That has led many to pursue novel ways of filling budget gaps and offsetting cost increases.

“There’s a saying: ‘No margin, no mission,'” Linehan said, “and we charge what we need to make ends meet while delivering on our mission.”

Entry costs are climbing even at attractions that aren’t using price-setting technology. The broad “admissions” category in the federal government’s Consumer Price Index, which includes museum fees alongside sports and concert tickets, climbed 3.9% in May from the year before, well above the annual 2.4% inflation rate.

In 2024, the nonprofit Monterey Bay Aquarium raised adult ticket prices from $59.95 to $65 and recently upped its individual membership rate, which includes year-round admission, from $95 to $125. “Gate admission from ticket sales funds the core operation of the aquarium,” a spokesperson said.

While the Denver Art Museum has no plans to test dynamic pricing, it raised admissions fees last fall, three years after a $175 million renovation and a survey of ticket prices elsewhere, a spokesperson said. Entry costs went from $18 to $22 for Colorado residents and from $22 to $27 for out-of-state visitors. Prices rise on weekends and during busy times, to $25 and $30 for in- and out-of-state visitors, respectively. Guests under age 19 always get in free thanks to a sponsored program.

Some attractions are doing a daily analysis of their bookings over the next several days or weeks and making adjustments.

Douglas Quinby

CEO of Arival

Like many attractions, the art museum posts these prices on its website. But many attractions’ publicly listed ticket prices are liable to fluctuate. The Seattle Aquarium — which raised its price ranges last summer by about $10 ahead of the opening of a new ocean pavilion — also uses Digonex’s algorithmic recommendations.

During the week of June 8, for example, the aquarium’s online visit planner, which displays the relative ticket availability for each day, offered out-of-state adult admissions as low as $37.95 for dates later in the month and as much as $46.95 for walk-in tickets that week. In addition to booking in advance, there are more than half a dozen other discounts available to certain guests, including seniors and tribal and military members, a spokesperson noted.

At many attractions, however, admission fees aren’t even provided until a guest enters the specific day and time they want to visit — making it difficult to know that lower prices may be available at another time.

“Some attractions are doing a daily analysis of their bookings over the next several days or weeks and making adjustments” to prices continuously, said Arival CEO Douglas Quinby. Prices might rise quietly on a day when slots are filling up and dip when tickets don’t seem to be moving, he said.

Digonex, which says it provides automated dynamic pricing services to more than 70 attractions worldwide, offers recommendations as frequently as daily. It’s up to clients to decide how and whether to implement them, a spokesperson said. Each algorithm is tailored to organizations’ goals and can account for everything from weather to capacity constraints and even Google Analytics search patterns.

Data-driven pricing can be “a financial win for both the public and the museum,” said Elizabeth Merritt, vice president of strategic foresight at the American Alliance of Museums. It can reduce overcrowding, she said, while steering budget-minded guests toward dates that are both cheaper and less busy.

The stegosaurus fossil nicknamed Apex is unveiled to the media at the American Museum of Natural History in New York, December 5, 2024. Billionaire Kenneth C. Griffin, who bought the stegosaurus fossil for $44.6 million, is loaning it to the museum for four years.

Timothy A. Clary | Afp | Getty Images

But steeper prices during peak periods and for short-notice visits could rankle guests — who may see anything less than a top-notch experience as a rip-off, said Stephen Pratt, a professor at the University of Central Florida’s Rosen College of Hospitality Management who studies tourism.

“Because of the higher prices, you want an experience that’s really great,” he said, transforming a low-key day at the zoo into a big-ticket, high-stakes outing. “You’ve invested this money into family time, into creating memories, and you don’t want any service mishaps.”

That could raise the risk of blowback at many attractions, especially those grappling with Trump administration cuts this summer. Some historic sites and national parks have already warned that their operations are under pressure.

Consumers should expect more price complexity to come. Arival said 16% of attractions ranked implementing dynamic pricing as a top priority for 2025-26. Among large attractions serving at least half a million guests annually, 37% are prioritizing dynamic pricing, up from the 12% that use it currently.

For visitors, that could mean hunting harder for cheaper tickets. While many museums are free year-round, others provide lower rates for off-season visits and those booked in advance. It’s also common to reduce or waive fees on certain days or hours, and many kids and seniors can often get discounted entry.

Here are a few other ways to keep admissions costs low:

Ways to save on museum tickets:

- Ask your local library. Many have museum passes that cardholders can check out.

- Bundling programs such as CityPass, GetOutPass, Go City and others allow visitors to save money on admissions to a range of attractions.

- Bank of America’s Museums on Us program offers cardholders free entry to many institutions during the first full weekend of each month.

- For the past decade, Museums for All has been providing free or reduced entry at more 1,400 U.S. museums and attractions to anyone receiving SNAP food assistance benefits.

- And each summer, the Blue Star Museums program offers museum discounts to actively serving military personnel and their families.

“It may take a bit of research,” said Quinby, “but it’s still possible to find a good deal.”

U.S. President Donald Trump looks on as Fed Chair Jerome Powell speaks at the White House in Washington on Nov. 2, 2017.

Carlos Barria | Reuters

Political pressure is mounting against the Federal Reserve Chair Jerome Powell, and yet the Federal Reserve is expected to hold interest rates steady at the end of its two-day meeting this week.

Despite a wave of recent attacks on Powell from President Donald Trump, futures market pricing is implying virtually no chance of an interest rate cut, according to the CME Group’s FedWatch gauge.

The president has argued that maintaining a fed funds rate that is too high makes it harder for businesses and consumers to borrow, adding more strain to the U.S. economy. The federal funds rate sets what banks charge each other for overnight lending, but also affects many of the borrowing and savings rates most Americans see every day.

More from Personal Finance:

Here’s the inflation breakdown for May 2025

What’s happening with unemployed Americans — in five charts

The economic cost of Trump, Harvard battle over student visas

With a rate cut likely postponed until at least September, consumers struggling under the weight of high prices and high borrowing costs aren’t getting much relief, experts say.

“The combination of high interest rates, stubborn inflation and economic uncertainty is a pretty challenging one,” said Matt Schulz, chief credit analyst at LendingTree. “Most Americans don’t have a ton of wiggle room and today they have even less.”

From credit cards and mortgage rates to auto loans and savings accounts, here’s a look at how the Fed plays a role in your finances.

Credit cards

Credit card debt continues to be a pain point for consumers struggling to keep up with high prices. Since most credit cards have a variable rate, there’s a direct connection to the Fed’s benchmark.

But even with the Fed on the sidelines, credit card rates have edged higher. The average annual percentage rate is currently just over 20%, according to Bankrate, not far from last year’s all-time high.

“This is a sign of banks trying to protect themselves from the risk that is out there in these uncertain times,” Schulz said. However, in this case, there is something consumers can do about higher APRs.

“The truth is that people have way more power over the rates they pay than they think they do, especially if they have good credit,” Schulz said.

Rather than wait for a rate cut that may be months away, borrowers could switch now to a zero-interest balance transfer credit card or consolidate and pay off high-interest credit cards with a lower-rate personal loan, he said.

Mortgages

Since 15- and 30-year mortgages are largely tied to Treasury yields and the economy, those rates haven’t moved much — and that hasn’t helped would-be buyers.

The average rate for a 30-year, fixed-rate mortgage has stayed within the same narrow range for months and is currently near 6.9%, according to Bankrate. Tack on the nationwide problem of limited inventory and housing affordability remains a key issue, regardless of the Fed’s next move.

“I don’t see any major changes coming in the immediate future, meaning that those shopping for a home this summer should expect rates to remain relatively high,” Schulz said.

Auto loans

Auto loan rates are fixed, and not directly tied to the Fed. But payments are getting bigger because car prices are rising, in part due to impacts from Trump’s trade policy.

Currently, the average rate on a five-year new car loan is 7.24%, according to Bankrate.

The growth in median car payments is outpacing both new and used car prices, according to separate data from Bank of America. Now, of those households with a monthly car payment, 20% pay more than $1,000 a month.

“Combine that with the potential for tariffs to drive auto prices even higher, and it adds up to a really challenging time to buy a car,” Schulz said. “However, shopping for the best rate and getting approved for financing before you ever set foot in the dealership can bring significant savings,” he added.

Student loans

Federal student loan rates are set once a year, based in part on the last 10-year Treasury note auction in May and fixed for the life of the loan, so most borrowers are somewhat shielded from Fed moves and recent economic turmoil.

Current interest rates on undergraduate federal student loans made through June 30 are at 6.53%. Starting July 1, the interest rates will be 6.39%.

Although borrowers with existing federal student debt balances won’t see their rates change, many are now facing other headwinds and fewer federal loan forgiveness options.

Savings

On the upside, top-yielding online savings accounts still offer above-average returns and currently pay more than 4%, according to Bankrate.

While the central bank has no direct influence on deposit rates, the yields tend to be correlated to changes in the target federal funds rate — so holding that rate unchanged has kept savings rates elevated, for now.

“The thing that is lost in this, is that savers, including millions of retirees, are actually earning good income on their savings, provided they have their money parked in a competitive place,” said Greg McBride, Bankrate’s chief financial analyst.

Tax savings for business owners hiring kids

‘SALT’ deduction in limbo as Senate Republicans unveil tax plan

One Big Beautiful Tax Bill full of impactful provisions

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoSending the National Guard to LA is not about stopping rioting

-

Blog Post1 week ago

Blog Post1 week agoMastering Bookkeeping Tasks During Peak Business Seasons

-

Accounting1 week ago

Accounting1 week agoInstead adds AI-driven tax reports

-

Personal Finance1 week ago

Personal Finance1 week agoWhat Pell Grant changes in Trump budget, House tax bill mean for students

-

Personal Finance6 days ago

Personal Finance6 days agoHow markets performed for investors so far

-

Economics6 days ago

Economics6 days agoIs there a “woke right” in America?

-

Personal Finance6 days ago

Personal Finance6 days agoTrump’s ‘big beautiful’ bill may curb access to low-income tax credit

-

Finance6 days ago

Finance6 days agoGundlach says to buy international stocks on dollar’s ‘secular decline’