The U.S. economy contracted over the past six weeks as hiring slowed and consumers and businesses worried about tariff-related price increases, according to a Federal Reserve report Wednesday.

In its periodic “Beige Book” summary of conditions, the central bank noted that “economic activity has declined slightly since the previous report” released April 23.

“All Districts reported elevated levels of economic and policy uncertainty, which have led to hesitancy and a cautious approach to business and household decisions,” the report added.

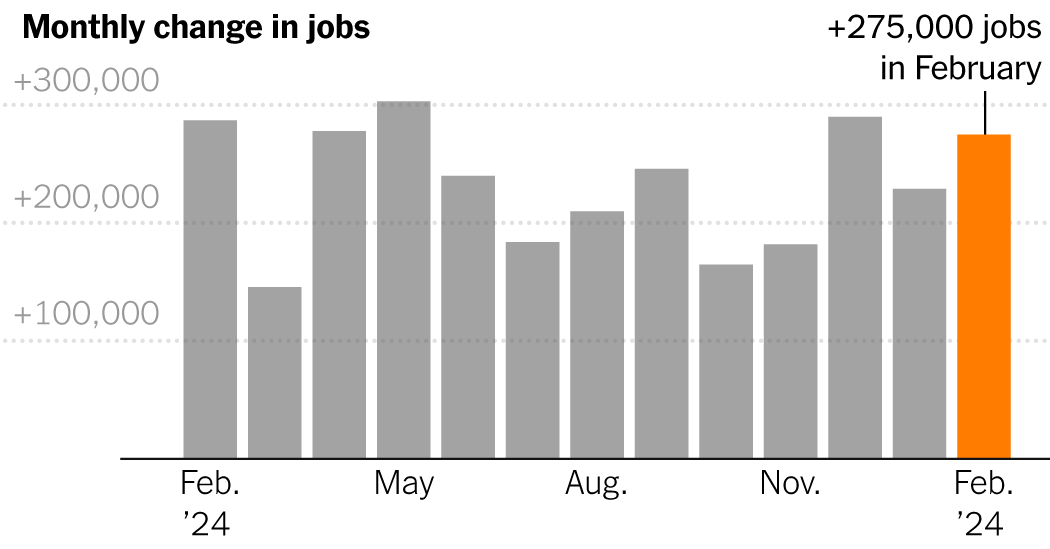

Hiring was “little changed” across most of the Fed’s 12 districts, with seven describing employment as “flat” amid widespread growth in applicants and lower turnover rates.

“All Districts described lower labor demand, citing declining hours worked and overtime, hiring pauses, and staff reduction plans. Some Districts reported layoffs in certain sectors, but these layoffs were not pervasive,” the report said.

On inflation, the report described prices as rising “at a moderate pace.”

“There were widespread reports of contacts expecting costs and prices to rise at a faster rate going forward. A few Districts described these expected cost increases as strong, significant, or substantial,” it said. “All District reports indicated that higher tariff rates were putting upward pressure on costs and prices.”

There were disparities, though, over expectations for how much prices would rise, with some businesses saying they might reduce profit margins or add “temporary fees or surcharges.”

“Contacts that plan to pass along tariff-related costs expect to do so within three months,” the report said.

The report covers a period of a shifting landscape for President Donald Trump’s tariffs.

In early May, Trump said he would relax so-called reciprocal tariffs against China, which responded in kind, helping to set off a rally on Wall Street amid hopes that the duties would not be as draconian as initially feared.

However, fears linger over the inflationary impact as well as whether hiring and the broader economy would slow because of slowdowns associated with the tariffs.

Tariffs were mentioned 122 times in Thursday’s report, compared to 107 times in April.

Regionally, Boston, New York and Philadelphia all reported declining economic activity. Richmond, Atlanta and Chicago were among the districts reporting better growth.

In New York specifically, the Fed found “heightened uncertainty” and input prices that “grew strongly with tariff-inducted cost increases. Richmond reported a slight increase in hiring despite Trump’s efforts to trim the federal government payroll.

Economics1 week ago

Economics1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Blog Post4 days ago

Blog Post4 days ago

Economics5 days ago

Economics5 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance1 week ago

Finance1 week ago