US Secretary of Education Linda McMahon attends the International Women of Courage Awards Ceremony at the State Department in Washington, DC, on April 1, 2025.

Brendan Smialowski | Afp | Getty Images

Jason Collier, a special education teacher in Virginia, often needs to wait until payday to fill up the gas tank of his car — and in the meantime hopes he doesn’t run out.

“Money is tight when you’re a teacher,” Collier, 46, said.

Now he’s afraid that the U.S. Department of Education will soon garnish up to 15% of his wages because he’s behind on his student debt payments. Collier said he hasn’t been able to meet his monthly bill for years, while juggling the expenses of raising two children and medical expenses from a cancer diagnosis.

If his paycheck is garnished, “it would just be more of a pinch,” Collier said. “If I need a car repair, or something comes up, I might not be able to do those things.”

The consequences are punitive and sometimes tragic.

James Kvaal

former Education Dept. undersecretary

After a half-decade pause of collection activity on federal student loans, the Trump administration announced on April 21 that it would once again seize defaulted borrowers’ federal tax refunds, paychecks and Social Security benefits.

More than 5 million student loan borrowers are currently in default, and that total could swell to roughly 10 million borrowers within a few months, according to the Education Department.

The Biden administration focused on extending relief measures to struggling borrowers in the wake of the Covid pandemic and helping them to get current. The Trump administration’s aggressive collection activity is a sharp turn away from that strategy.

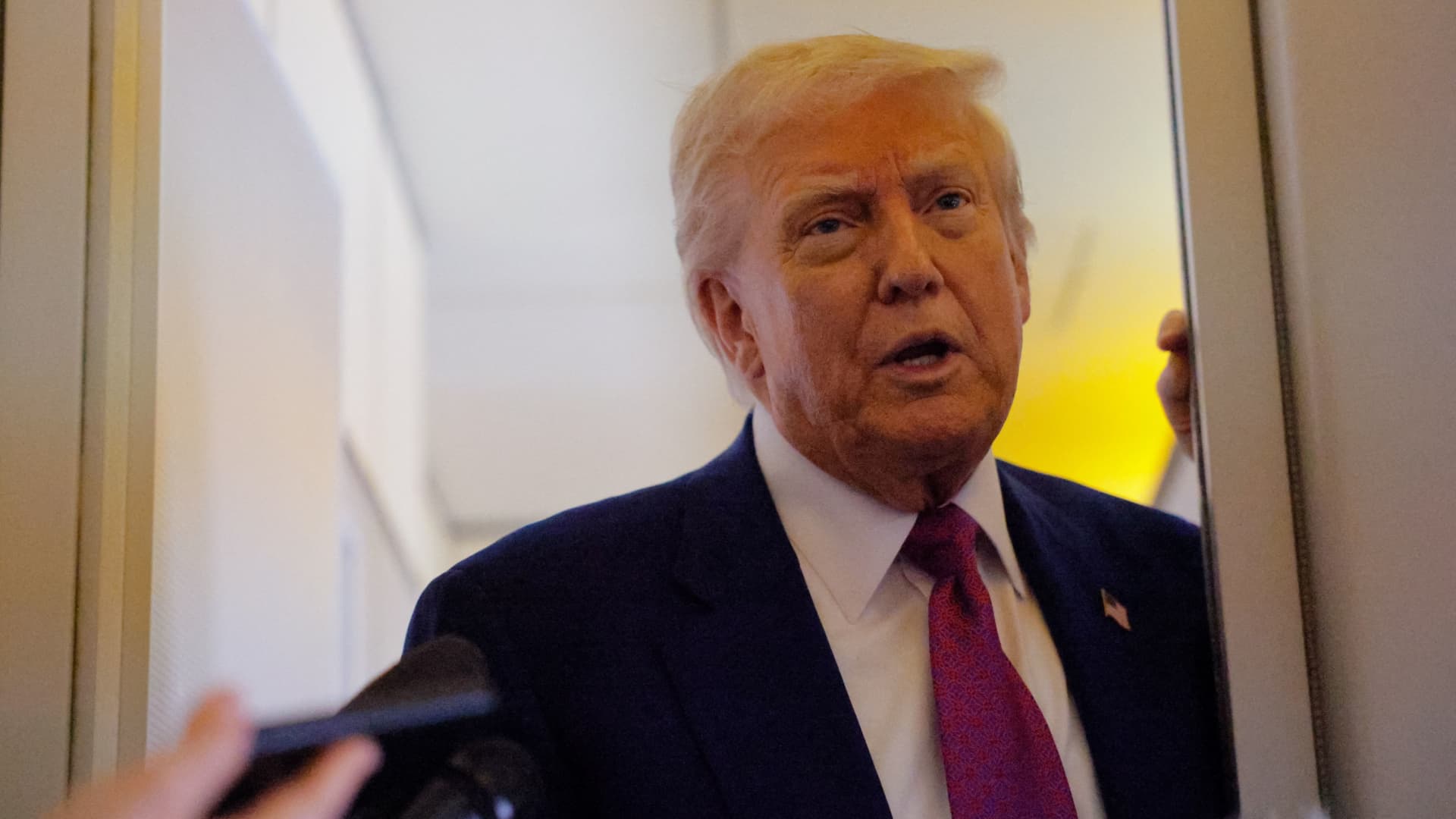

“Borrowers should pay back the debts they take on,” said U.S. Secretary of Education Linda McMahon in a video posted on X on April 22.

More than 42 million Americans hold student loans, and collectively, outstanding federal education debt exceeds $1.6 trillion. The Education Department can garnish up to 15% of defaulted borrowers’ disposable income and federal benefits, as well as their entire federal tax refunds.

“In an environment where the cost of living remains stubbornly high, this kind of withholding from your income can pose real problems when trying to make ends meet, and force people into choosing between vital expenses,” said Nancy Nierman, assistant director of the Education Debt Consumer Assistance Program in New York.

Most people who default on their student loans “truly cannot afford to pay them,” James Kvaal, who served as U.S. undersecretary of education for former President Joe Biden, said in an April interview with CNBC.

“The consequences are punitive and sometimes tragic,” Kvaal said.

Marceline Paul and her grandson

Courtesy: Marceline Paul

Marceline Paul is homesick.

But if the Trump administration begins garnishing her Social Security benefit next month, there’s no way she’ll be able to afford a trip back to Trinidad. She moved from there to the United States in the ’70s.

“I need to go home,” said Paul, 68, who worked for decades in the health care industry and retired during the Covid-19 pandemic to take care of her sick mother.

The student debt she had taken on for her daughter was the last thing on her mind during that time, she said: “I couldn’t focus on anything else.”

She felt terrified when she received a recent notice from the Education Dept. that her retirement check could be offset. Nearly all of her income comes from her monthly Social Security benefit of around $2,600. Social Security benefits can generally be reduced by up to 15% to repay student debt in default, so long as beneficiaries are left with at least $750 per month.

“When I saw that email, it made me sick to my stomach,” Paul said.

Already on a tight budget in retirement, the garnishment will force her to cut back on her everyday expenses, skip necessary repairs on her house in Maryland and forgo traveling to her home country.

“I don’t know the last time I had a vacation,” she said. “I’ve paid into the system and I should be able to retire.”

More than 450,000 borrowers ages 62 and older in default on their federal student loans and likely to be receiving Social Security benefits, the Consumer Financial Protection Bureau found earlier this year.

But in recent months, the Trump administration has terminated around half of the Education Department’s staff, including many of the people who helped assist borrowers.

Now some student loan borrowers report waiting hours on the phone before being able to reach someone about their debt, despite the Trump administration telling borrowers to contact it to get current.

The Education Department did not respond to a request for comment.

Kia Brown, who works as a management analyst at the Department of Veterans Affairs, wants to start repaying her student loans again — but she said she’s run into numerous challenges trying to do so.

“The biggest issue I have is the lack of information,” said Brown, 44.

When she signed up for Biden’s SAVE plan, she could afford her monthly student loan bill of $150. But now that plan is blocked and she’s worried she won’t be able to afford her new payment.

She received conflicting information over whether her student loan servicer was Mohela or Navient (millions of people have had their accounts transferred between companies in recent years.) When she tried to reach someone at Navient about her student debt, she was on hold for more than two hours.

Meanwhile, a representative at Mohela couldn’t tell her what her new student loan payment would be, though she was quoted $319 by the company’s automated phone system.

Mohela and Navient did not respond to a request for comment.

Brown is still not sure which company is managing her account.

“The narrative is that people are dodging their payments,” Brown said, but added that she doesn’t think that’s true for many borrowers. “I truly believe many people will be blindsided due to lack of guidance on how to repay.”

If she’s not able to reach someone at the Education Dept. to get current on her payments and her wages are garnished, it’ll be a significant hardship for her family, she said.

“We’re living paycheck to paycheck,” she said. “I’m lucky if I can even put aside $100 for myself.”

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Finance1 week ago

Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Economics6 days ago

Economics6 days ago

Economics7 days ago

Economics7 days ago

Finance1 week ago

Finance1 week ago