Accounting

IRS Direct File free tax pilot enticed 140K taxpayers

Published

1 year agoon

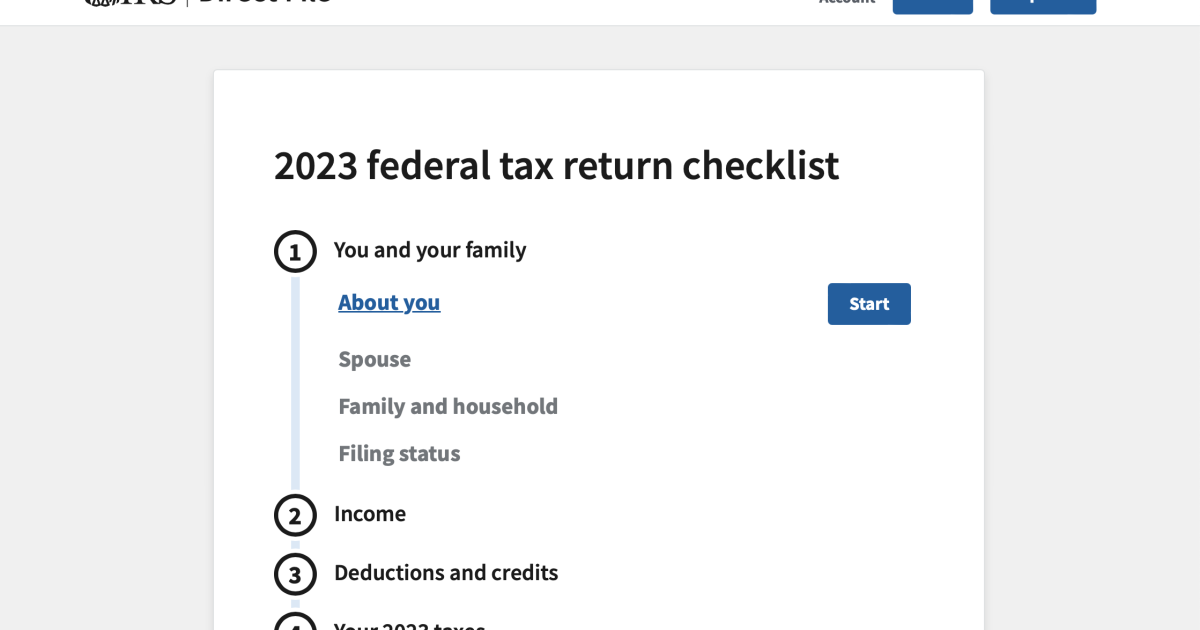

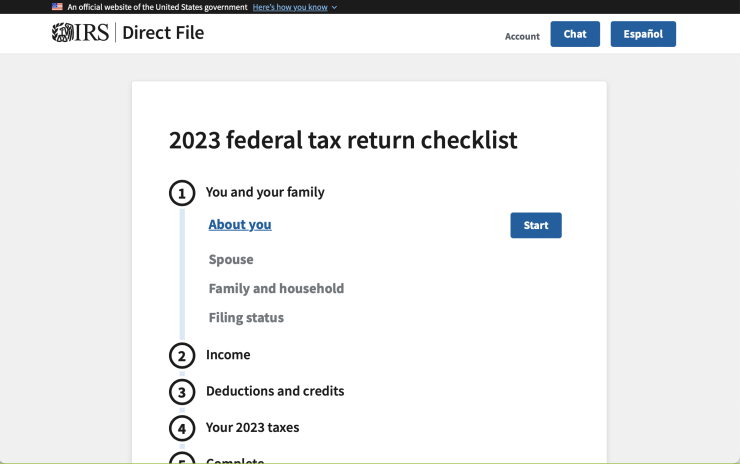

The Internal Revenue Service’s Direct File free tax filing pilot program officially closed Friday and reported that 140,803 taxpayers used it in the 12 states where it was available.

The IRS

The leading states with accepted returns included California (33,328), Texas (29,099), Florida (20,840), New York (14,144) and Washington (13,954). Across the 12 pilot states, taxpayers using Direct File claimed more than $90 million in tax refunds and reported $35 million in tax balances due.

“Last week, the IRS concluded one of the most successful filing seasons in recent memory, which saw monumental progress in our efforts to transform the taxpayer experience as directed under the Inflation Reduction Act,” said IRS Commissioner Danny Werfel during a press conference Friday. “The conclusion of the 2024 filing season also marks the closure of the Direct File pilot, a yearlong effort to study the interest in and feasibility of creating a direct e-filing system people can use to file their federal income tax return. Direct File is an important part of our efforts to meet taxpayers where they are, give them options to interact with the IRS in ways that work for them, and help them meet their tax obligations as easily and quickly as possible.”

More than 3.3 million taxpayers started an online eligibility tracker to see if they could use Direct File; 423,450 taxpayers logged into Direct File; and 140,803 taxpayers submitted accepted returns. In cases where users’ tax situation was out of scope for the pilot, they were directed to other options to complete their tax returns, including the separate Free File program that provides free software from the private sector, Werfel noted.

Wally Adeyemo, deputy secretary of the Treasury, said he met last week with finance ministers and central bank governors from the U.K., Australia and other countries and told them about how excited he was about the Direct File pilot. They were surprised because many of their countries have long offered free tax filing similar to Direct File.

Over the course of the pilot test, he said Direct File users saved an estimated $5.6 million in tax preparation fees on their federal returns alone. He said he has talked with taxpayers in states like Texas, New York and Washington, and many of them said it took less than a few hours to file their taxes using Direct File. He also cited survey figures indicating that 90% of respondents ranked their experience with Direct File as excellent or above average, and 90% of the respondents who used customer support also ranked the experience as excellent or above average.

“Direct File not only saved people money, not only saved people time, but helped people have a good experience with the IRS because ultimately our goal is to make sure the IRS works for the American people, both helping them do what the vast majority of them want to do without prompting, which is file their taxes in a way that is easy and safe and also in this case free,” said Adeyemo.

Through the end of the pilot, the total amount spent by the IRS was $24.6 million, including a

“It’s important to remember that Direct File is a new technology product,” said Werfel. “With any new product, you have fixed development costs. The cost per user only decreases as more people use the product. We intentionally designed this pilot not to have a large number of users in order to focus on delivering a strong, stable product.”

Separately, a new

Compared to individuals who filed using other methods such as professional tax preparers, paid software or self-preparation, the research found that Direct Filers are much more likely to say the process is simpler, cheaper and faster. Some 61% of users reported that tax filing this year was more straightforward than last year when Direct File was not available (compared to 25% among those who used other filing methods saying the same). In addition, 44% of Direct File users said tax filing was less expensive than last year (as opposed to 10% among others). Over a third (36% versus 13% among others) said that tax filing took less time than last year, with more than 60% of Direct File users being able to file in under an hour.

“The two essential things the IRS needed to do to make this year’s pilot a success were to build a stable tool that worked and to make sure that users liked it and found it easy to use,” said Adam Ruben, vice president of campaigns and political strategy at the Economic Security Project, in a statement. “This survey shows that Direct File users loved this free and simplified tax filing option and found it simpler, cheaper and faster. That makes this year a big win and a strong foundation for expanding Direct File next year to more states, more tax situations, and with the IRS filling in more of the data it already has.”

You may like

Accounting

Creating work-life harmony in your accounting firm

Published

15 hours agoon

May 23, 2025

Your best senior manager just handed in her resignation. Despite competitive compensation, flexible scheduling options, and a clear partnership track, she’s leaving. Her reason? “I need a life outside of work.”

Despite significant investments in retention strategies, accounting firms continue to struggle with keeping top talent. The conventional approach of striving for

The reality is that accounting doesn’t lend itself to consistent equilibrium between work and personal life. Your teams know this. You know this. So why do we keep pursuing a framework that fundamentally conflicts with the nature of accounting?

Accounting continues to face unprecedented challenges. According to the

These challenges create a perfect storm that impacts team well-being. When we’re short-staffed, the burden falls on the remaining team members. When we’re racing against deadlines with complex regulatory changes, stress multiplies. The traditional response has been to simply work harder and longer — a strategy that’s proving increasingly unsustainable.

A perfect work-life balance is a myth. Accounting has natural rhythms and seasonal demands that make equal distribution of time impossible. When we frame the goal as “balance,” we set ourselves up for failure and create unnecessary guilt during intensive work periods.

“Work-life harmony” acknowledges that sometimes work will be the dominant priority, particularly during tax season or major client deadlines. Other times, personal life takes precedence. The key is creating intentional integration rather than forced separation between these aspects of our lives.

One firm I worked with transformed its approach by embracing this concept. Instead of pretending busy season wouldn’t be demanding, they built intentional recovery periods into their annual schedule. They created “no meeting Fridays” during non-peak times and implemented mandatory vacation periods after major deadlines. The result? Improved retention, higher client satisfaction, and increased profitability.

The business case for work-life harmony

When I talk to managing partners about work-life harmony, I often hear: “Sounds nice, but what’s the impact on our bottom line?” This is where the conversation gets interesting.

Through years of working with accounting firms, I’ve consistently seen that prioritizing professional well-being directly improves business performance. This connection between well-being and results is what I call “Fulfillment ROI.”

The research is compelling. Organizations implementing comprehensive wellness approaches see

What might this look like in your firm? Consider the economics of retention alone: Replacing a salaried professional who leaves due to burnout typically

These costs add up quickly, but there’s good news. When professionals learn to implement work-life harmony practices, they become both happier and more effective. In my workshops and leadership programs, the data shows:

- 89% of participants successfully implement time management strategies that enhance both productivity and well-being;

- 93% improve their ability to delegate effectively; and,

- 87% experience measurable reductions in workplace stress and burnout

These individual improvements directly impact your firm’s performance. As people feel more engaged, client service improves and productivity increases. Gallup’s research confirms this connection, showing that highly engaged business units achieve 23% higher profitability while fostering environments where employee well-being is 70% higher than in disengaged units.

The most skeptical managing partners often become the strongest advocates once they see the tangible improvements in both team retention and client satisfaction. When professionals find harmony between their work and personal lives, their energy, creativity, and commitment to clients naturally increase, creating a sustainable competitive advantage for the firm.

Creating harmony in your firm: Practical implementation

Ready to transform your firm’s approach? Here are five approaches that can transform your firm:

1. Implement team coverage models. Replace the outdated expectation of constant individual availability with structured team coverage systems. Consider creating client service teams with primary, secondary and tertiary contacts clearly identified. This approach ensures clients receive consistent support while allowing individual team members to fully disconnect during designated periods. The key is clear communication about how the system works and setting appropriate expectations up front

2. Design intentional seasonal workflows. Map your firm’s natural cycles and build recovery systems directly into your annual planning. Rather than pretending every week looks the same, acknowledge the rhythm of your business. Front-load client preparation during less intense periods, schedule mandatory breaks after major deadlines, and reserve slower periods for professional development and innovation.

3. Establish communication boundaries. Create clear technological guidelines that respect personal time. Try implementing a communication protocol that specifies which channels (email, messaging, phone) should be used for different urgency levels, with corresponding response time expectations. For instance, configure systems to delay non-urgent email delivery outside working hours, or establish “email-free” periods during the day to allow for focused work.

4. Integrate strategic recovery periods. Build brief renewal periods into your daily and weekly rhythms. This might include “deep work” blocks where no meetings or interruptions are permitted, implementing 10-minute breaks between all meetings, or establishing “no-meeting” days during non-peak times. The idea isn’t to work less but to work differently. Strategic pauses increase focus, creativity, and decision-making quality.

Takeaway

The firms gaining a competitive advantage today recognize that professional excellence and personal well-being reinforce each other. They’re creating sustainable high-performance cultures where intensity and recovery work in tandem.

The most successful accounting firms of the next decade will be those that recognize team wellbeing as a strategic advantage rather than a concession. Where will your firm stand?

Accounting

SALT write-off, Harvard tax, Medicaid cuts: What’s in Trump’s bill

Published

16 hours agoon

May 23, 2025

House Republicans narrowly

The legislation now heads to the Senate where lawmakers are looking to make their own stamp on the bill. The core of the package — an extension of the president’s 2017 first-term tax cuts — is likely to stay, but the senators could make some changes to a slew of new tax and spending measures that touch many aspects of the economy.

Here’s a rundown of the House bill’s main provisions impacting people and businesses:

$40,000 SALT limit

The limit on

The bill also separately creates a new limit on the value of itemized deductions for those in the top 37% tax bracket that partly erodes the value of the new SALT cap.

Tips, overtime and autos

Tips and overtime pay would be exempt from income tax through 2028, the end of Trump’s second term, fulfilling — at least for four years — his

Medicaid

The bill would accelerate new Medicaid work requirements to December 2026 from 2029 in a gesture to satisfy ultraconservatives who wanted more spending cuts.

The December 2026 deadline would fall just one month after midterm elections, with Democrats eager to criticize Republicans for

Food stamps

The bill aims to save $300 billion by forcing states to pay more into the Supplemental Nutrition Assistance Program. It would also apply work requirements for longer. Beneficiaries must work through age 64, up from 54 under current law.

Interest expensing

Private equity and other heavily indebted business sectors won a major fight in the tax bill on interest expensing. The bill adds depreciation and amortization when determining the tax deductibility of a company’s debt payments. The maximum amount any company can get in such tax write-offs is calculated as a percentage of earnings. That’s why using EBITDA – which is typically bigger than EBIT — in this process would generate heftier tax deductions.

University endowment tax

Some private universities would face a

The provision would create a tiered system of taxation so that colleges and universities that meet a threshold based on the number of students would pay more. Under Trump’s 2017 tax law, some colleges with the most well-funded endowments currently pay a 1.4% tax on their net investment income. The levy would rise to as high as 21% on institutions with the largest endowments based on their student population.

The provision is a major escalation in Trump’s fight with Harvard and other elite colleges and universities, which he has sought to strong-arm into making curriculum and cultural changes that he favors. Harvard, Yale, Stanford, Princeton and MIT would face the

Private foundation tax

Private foundations also would face an

Sports teams

The bill would limit write-offs for professional football, basketball, baseball, hockey and soccer franchises that claim deductions connected to the team’s intangible assets, including copyright, patents or designs.

Electric vehicles

A popular consumer tax credit of up to $7,500 for the purchase of an electric vehicle would be fully eliminated by the end of 2026, and only manufacturers that have sold fewer than 200,000 electric vehicles by the end of this year would be eligible to receive it in 2026. Tax incentives for the purchase of commercial electric vehicles and used electric vehicles would also be repealed.

Renewable tax credits

The legislation would cut hundreds of billions of dollars in spending by

It would also hasten more stringent restrictions that would disqualify any project deemed to benefit China from receiving credits. Those limits, which some analysts have said could render the credits useless for many projects, would kick in next year.

The legislation would also extend through 2031 tax credits for the production of biofuels.

Bonus for elderly

Americans 65 and older who don’t itemize their taxes would get a $4,000 bonus added to their standard deduction through 2028. That benefit would phase out for individuals making more than $75,000 and couples making more than $150,000. It would be retroactive to the beginning of this year.

Trump had campaigned on ending taxes on Social Security benefits, but that proposal would have run afoul of a special procedure Republicans are using to push through the tax-law changes without any Democratic votes. The higher standard deduction is an alternative way of targeting a benefit to the elderly but doesn’t fully offset Social Security taxes paid by many seniors.

Targeting immigrants

Immigrants would face a new 3.5% tax on

Factory incentives

The bill does not include Trump’s call for a lower corporate tax rate for domestic producers. Instead, it allows 100% depreciation for any new “qualified production property,” like a factory, if construction begins during Trump’s term — beginning on Jan. 20 and before Jan. 1, 2029, and becomes operational before 2033. That would be a major incentive for new facilities as Trump

Child tax credit

The maximum child tax credit would rise to $2,500 from $2,000 through 2028 and then drop to $2,000 in subsequent years.

Trump Accounts

The bill would create new tax-exempt investment accounts to benefit children, dubbed Trump Accounts. An earlier version of the bill called them

Pass-through deduction

Owners of pass-through businesses would be allowed to exclude 23% of their business income when calculating their taxes, a 3-percentage-point increase from the current rate. The increase is a win for pass-through firms — partnerships, sole proprietorships and S corporations — which make up the vast majority of businesses in the US.

Research and development

The bill would temporarily reinstate a tax deduction for research and development, a top priority for manufacturers and the tech industry. The deduction will last through the end of 2029.

Oil, gas and coal

The bill would raise billions by mandating the Interior Department hold at least 30 oil and gas lease sales over 15 years in the Gulf of Mexico, which Trump ordered to be renamed to the Gulf of America. It would withdraw Biden-era restrictions on development in Alaska’s Arctic National Wildlife Refuge. The measure would also mandate at least six offshore lease sales in Alaska’s Cook Inlet region over six years. The legislation would also require Interior to offer at least four million acres of coal resources for lease in the West within 90 days of enactment.

Radio spectrum

The legislation would restore the Federal Communications Commission’s ability for the next decade to

New spending

The bill would allocate $150 billion for the military and $175 billion for immigration and border security.

Accounting

Boomer’s Blueprint: Leveraging assets to grow: A guide for firm leaders

Published

16 hours agoon

May 23, 2025

Growth in the accounting profession isn’t just about adding more clients or staff; it’s about thinking differently. As market demands shift and technology reshapes our work, firms that want to lead the pack must learn to grow smarter, not just bigger.

One powerful way to do that is to leverage assets. Inspired by the Exponential Organizations model, this strategy allows firms to scale rapidly, control overhead, and expand their impact without increasing what they own. At a time when efficiency and agility are competitive advantages, understanding how to make the most of resources you don’t own could be the difference between stagnation and strategic growth.

What are leveraged assets?

Leveraged assets refer to resources a business uses but doesn’t own. Instead of holding physical or digital assets on its balance sheet, a firm can rent, lease, borrow or access these assets through innovative arrangements. Examples of leveraged assets include:

- Physical assets. Accessing office spaces, IT infrastructure or shared client meeting rooms on demand.

- Digital assets. Cloud-based software for tax preparation, client relationship management systems, or collaborative work platforms like Microsoft Teams or Asana.

Big companies like Uber employ this strategy, building scalable businesses by accessing underutilized physical assets rather than owning them.

Accounting firms traditionally rely on owning resources, from office buildings to proprietary software systems. However, embracing a leveraged model can bring several benefits, including:

1. Cost optimization. By leasing or renting resources, firms can convert fixed costs into variable costs, reducing financial risk and improving cash flow.

2. Scalability. Leveraged assets help firms scale operations quickly to meet demand during busy seasons without long-term commitments.

3. Focus on core competencies. Outsourcing noncore functions like IT infrastructure or HR lets team members concentrate on delivering high-value advisory and consulting services.

4. Flexibility and resilience. Accessing on-demand resources gives firms the agility to adapt to market changes or technological advancements.

Applying leveraged assets in your firm

Here are four ways your firm can reduce costs, improve efficiency, and expand capabilities without increasing ownership.

1. Digital transformation. Start by embracing digital tools that remove the limitations of traditional infrastructure. Migrating to cloud-based accounting platforms like Xero or QuickBooks Online improves accessibility for your team and clients, and eliminates the ongoing costs of server maintenance and upgrades.

Layer in AI-driven tools to automate routine processes like document collections, data aggregation, tax calculations, and client communications. This frees up your team to focus on high-value advisory work.

2. Shared physical resources. Rethinking your physical footprint can also drive efficiency. Rather than investing in permanent office space in every market, consider co-working or shared spaces for occasional client meetings to create a more flexible and cost-effective approach.

Likewise, leasing equipment like high-speed scanners and printers gives you access to the latest technology without the burden of ownership, maintenance or depreciation.

3. Platform ecosystems. Tapping into established software ecosystems allows firms to deliver better service without building everything in-house. Platforms like Intuit ProConnect, Wolters Kluwer and Thomson Reuters offer integrated tools tailored to tax and audit workflows.

Add-on solutions like TaxCaddy and SafeSend enhance the client experience by streamlining document exchange, electronic signatures, and payment collection while keeping your core systems tightly connected.

4. Outsourced expertise. Not every capability needs to live within your four walls. Bring in outside consultants for specialized services like cybersecurity reviews and strategic planning. This lets your firm offer premium expertise without hiring full-time staff. This on-demand access to deep knowledge ensures you stay competitive and relevant, even as client needs evolve.

A leveraged assets strategy

Follow these steps to successfully integrate leveraged assets into your firm.

1. Audit current resources. Identify underutilized assets within the firm and assess opportunities for outsourcing or sharing.

2. Explore digital solutions. Research tools and platforms that align with your firm’s “Massive Transformative Purpose.”

3. Validate the market. Ensure sufficient demand for the services or solutions you plan to scale.

4. Build partnerships. Establish agreements with third-party providers for seamless access to assets.

5. Measure performance. Track the effectiveness of leveraged assets using metrics such as cost savings, client satisfaction, and revenue growth.

Leveraging assets offers several advantages, but it’s important to consider potential downsides. For example, overreliance on gig economy workers for seasonal tax help may impact team culture or service quality. Make sure your growth strategies align with ethical practices and long-term client relationships.

Leveraging assets isn’t just a tactic for tech startups; it’s a transformative strategy your firm can adopt to unlock exponential growth. By strategically accessing physical and digital resources, you can enhance agility, reduce costs, and better serve clients in an increasingly complex financial landscape. The path to becoming an Exponential Organization starts with a single step: rethinking ownership and optimizing leverage.

Think — plan — grow!

Trump greenlights Nippon merger with US Steel

Deferred capital gains tax on mutual funds: Lawmakers pitch rule change

Stocks making the biggest moves midday: AAPL, ROST, INTU, BAH

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Personal Finance1 week ago

Personal Finance1 week agoHouse Republicans advance Trump’s tax bill. ‘SALT’ deduction in limbo

-

Economics1 week ago

Economics1 week agoThe low-end consumer is about to feel the pinch as Trump restarts student loan collections

-

Economics1 week ago

Economics1 week agoViolent crime is falling rapidly across America

-

Economics1 week ago

Economics1 week agoAre American Catholics ready for an American pope?

-

Economics1 week ago

Economics1 week agoEmbrace the woo woo

-

Blog Post7 days ago

Blog Post7 days agoBest Practices to Auditing Your Bookkeeping Records

-

Economics1 week ago

Economics1 week agoConsumer sentiment falls in May as Americans’ inflation expectations jump after tariffs

-

Economics6 days ago

Economics6 days agoThe MAGA revolution threatens America’s most innovative place