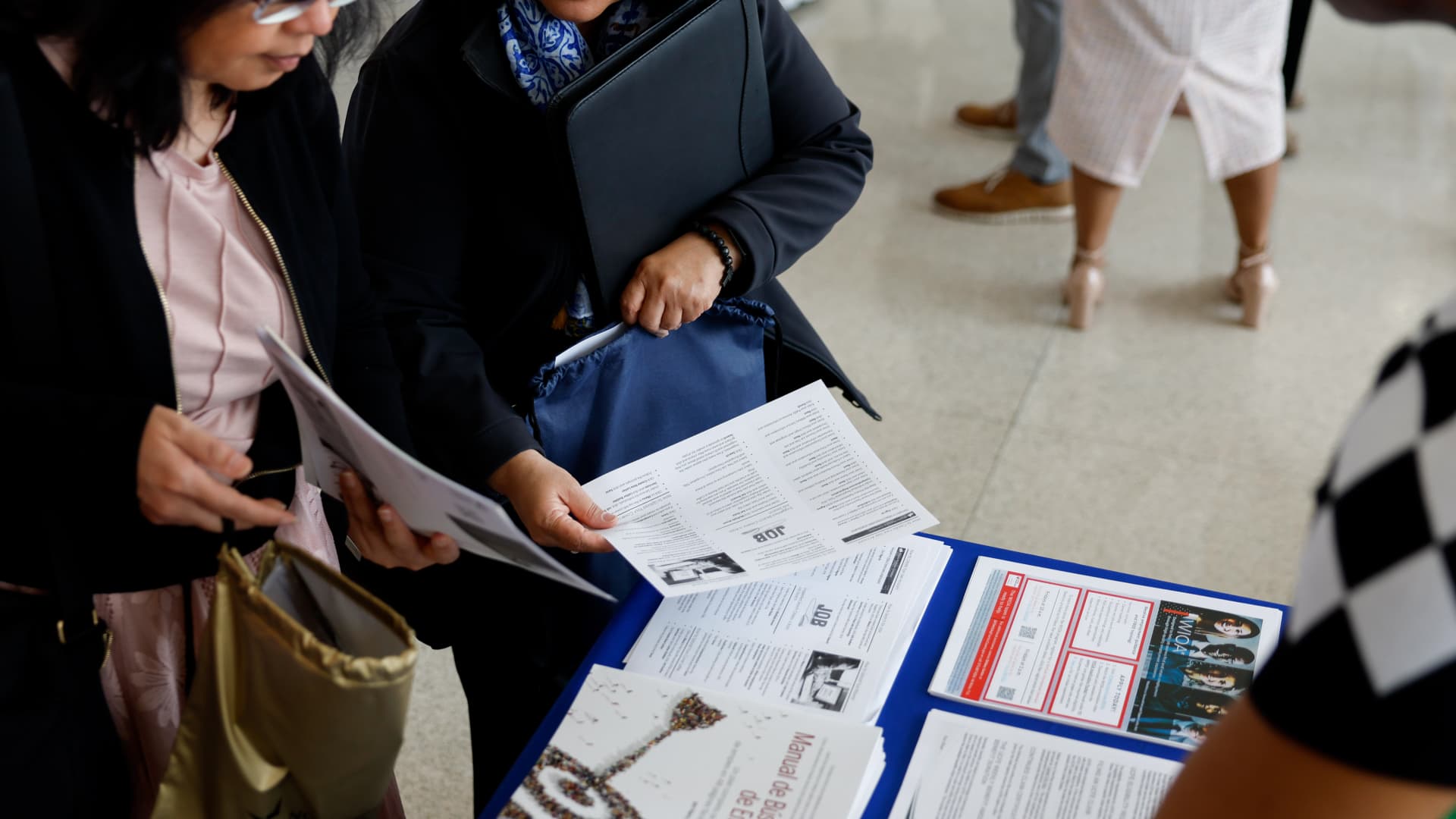

Job seekers at a job fair hosted by the Metropolitan Washington Airports Authority to support federal workers looking for new career opportunities, at Ronald Reagan Washington National Airport in Arlington, Virginia, on April 25, 2025.

Ting Shen/Bloomberg via Getty Images

These days, job hunting may feel like something of a paradox: Even though the overall market is strong, it can be tough for jobseekers to find a new gig, according to economists.

Unemployment was relatively low in April, at 4.2%, and job growth exceeded expectations. The layoff rate is historically low, meaning those with jobs are holding onto them.

Yet it has gotten harder to find new work.

Businesses are hiring at their slowest pace since 2014. Nearly 1 in 4 jobless workers, 23.5%, are long-term unemployed — meaning they’ve been out of work for more than six months — up from 19.6% a year ago.

Cory Stahle, an economist at the Indeed Hiring Lab, called it a “low firing, low hiring trend” in a note on Friday.

There’s a “growing divide” in the labor market between those out of work and those who are employed, Stahle wrote.

The changing market conditions may feel jarring for job seekers, given that a few years ago there were record-high job openings and workers were quitting at record levels amid ample opportunity.

“This is just how it is right now: Companies are not hiring,” said Mandi Woodruff-Santos, a career coach and personal finance expert. “If they are, it’s very infrequent.”

Economic headwinds like trade wars and tumbling consumer confidence may make job-finding more difficult in coming months, economists said.

“The market can’t escape the consequences of rapidly souring business and consumer confidence forever,” Stahle wrote.

How job seekers can stand out in a tough market

Shannon Fagan | The Image Bank | Getty Images

Even in this “low firing, low hiring” market, there are ways for jobseekers to stand out, experts said.

“When the market changes, the way you search for a job may also have to be adjusted,” Jennifer Herrity, a career trends expert at Indeed, wrote in an e-mail.

1. Be ‘creative’ with networking

Job seekers will likely have to lean on personal relationships more than in the recent past, experts said.

Most jobs come through referrals or internal candidates, meaning people need to be “creative” and “strategic” about networking possibilities, Woodruff-Santos said.

“Instead of waiting for someone to pick your resume from a pile, you have to make it undeniable: Put yourself in front of them,” she said.

“Creating space for human connections and creating relationships will give you a little something extra,” she added.

More from Personal Finance:

Prices are falling on some purchases but ‘not here to stay’

Your Social Security card will soon be available digitally

Student loan default has ‘dramatic and immediate’ credit score impact

Don’t just look for obvious networking events like job fairs or expos heavily attended by other job seekers, Woodruff-Santos said.

She recommends seeking out conferences, seminars, special talks and book signings. For example, say you work in information technology and someone writes a book on corporate security in the world of artificial intelligence. Go to that author’s book signing, lecture, seminar or Q&A, Woodruff-Santos said — since the audience would likely be people in businesses with an interest in IT security.

Reconnect with former colleagues to get on a hiring manager’s radar before a role opens to the general public, Herrity said.

2. Look for internal opportunities

Workers dissatisfied with their current roles may be overlooking internal career opportunities, experts said.

“While hiring may appear to be slowing on the surface, it usually just means that opportunities have gone further underground,” Frances Weir, a principal at organizational consulting firm Korn Ferry, said in a March briefing.

However, employees should be strategic: For example, they likely shouldn’t apply to several different jobs at the company or seek to move on from a role they started only months ago, according to the firm.

3. Customize applications

“Generic resumes won’t stand out to employers in a tight market,” Herrity said. “Tailor your resume and cover letter to each role, echoing keywords from the job description and aligning your skills with the employer’s needs.”

Applicants should also highlight results — instead of responsibilities — on their resume and in interviews, she said. That shows they’re a proven performer by quantifying achievements.

4. Upskill and reskill

“Employers value candidates who use slow periods to grow,” Herrity said. “This is especially important for those facing long-term unemployment who may find themselves in a skills gap.”

She recommends finding free or low-cost courses in any relevant career areas to help fill gaps and signal initiative, motivation and self-teaching.

List recent certifications or course completions in the “education” or “skills” section of a resume, she said.

5. Be flexible

While waiting for your ideal job, success might mean being open to contract work, hybrid roles or adjacent industries, Herrity said.

“Short-term roles can be a great opportunity to grow your network and skills, then leap when the right full-time role appears,” she said.

Finance6 days ago

Finance6 days ago

Finance6 days ago

Finance6 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago