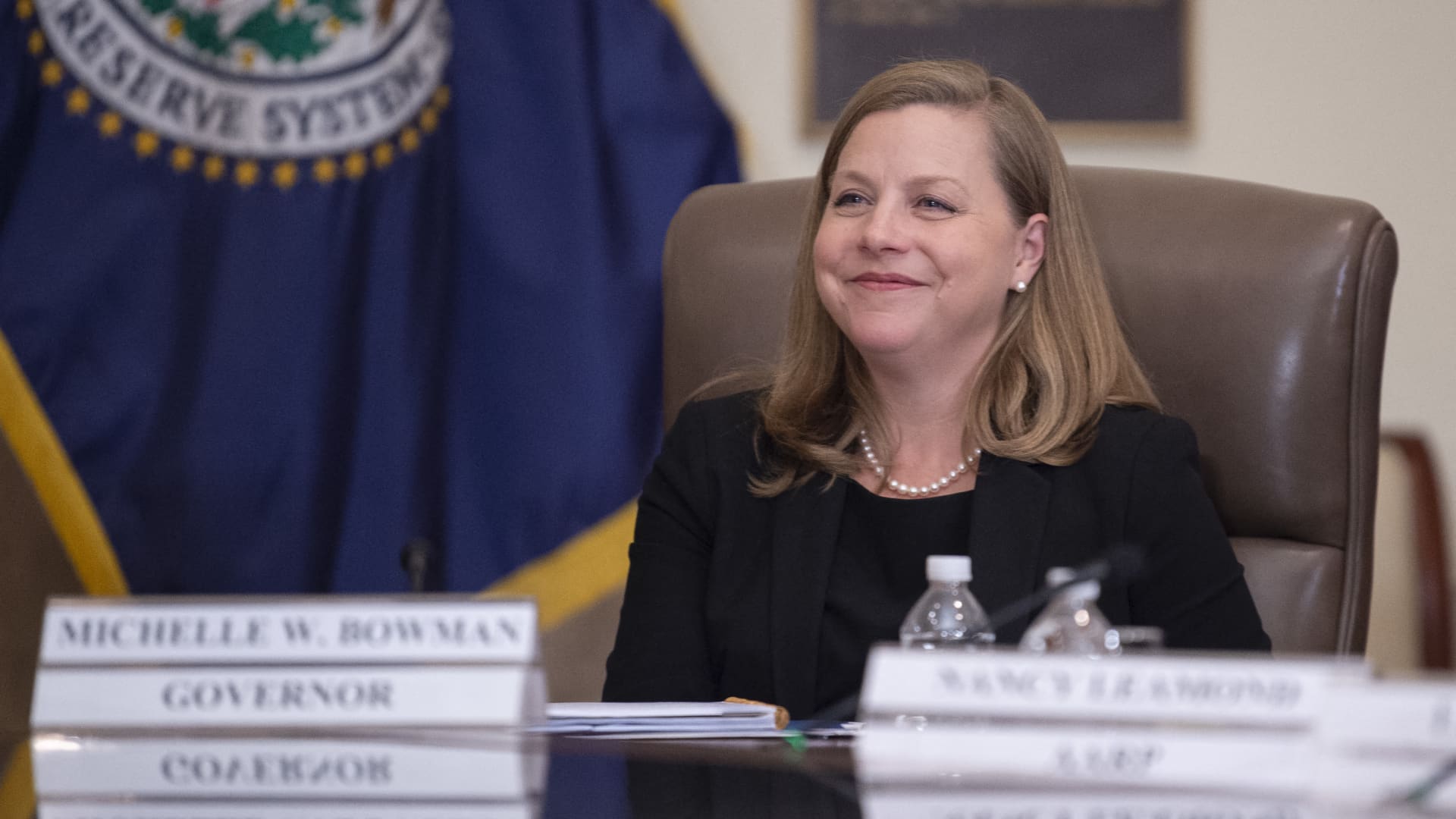

Federal Reserve Governor Michelle Bowman said Tuesday she thought her colleagues should have taken a more measured approach to last week’s half percentage point interest rate cut as she worries that inflation could reignite.

Bowman was the lone dissenter from the Federal Open Market Committee’s decision to lower benchmark interest rates for the first time in more than four years. No governor had dissented from an interest rate decision since 2005.

In explaining her rationale, Bowman said the half percentage point, or 50 basis point, reduction posed a number of risks to the Fed’s twin goals of achieving low inflation and full employment.

The jumbo cut “could be interpreted as a premature declaration of victory on our price-stability mandate. Accomplishing our mission of returning to low and stable inflation at our 2 percent goal is necessary to foster a strong labor market and an economy that works for everyone in the longer term,” she said in remarks to a bankers group in Kentucky.

Inflation by the Fed’s preferred metric is running at 2.5%, above the central bank’s 2% goal. Excluding food and energy, core inflation is at 2.6%.

Though Bowman favored a reduction, she preferred the Fed lower by a quarter percentage point, more in line with the traditional moves at the central bank. The FOMC last cut by half a point in the early days of the Covid pandemic in March 2020, and before that the global financial crisis in 2008.

Bowman cited several specific concerns: that the big move would indicate that Fed officials see “some fragility or greater downside risks to the economy”; that markets might expect a series of large cuts; that large amounts of sideline cash could be put to work as rates fall, stoking inflation; and her general feeling that rates won’t need to come down as much as her fellow policymakers have indicated.

“In light of these considerations, I believe that, by moving at a measured pace toward a more neutral policy stance, we will be better positioned to achieve further progress in bringing inflation down to our 2 percent target, while closely watching the evolution of labor market conditions,” she said.

In recent statements, Fed officials have cited easing inflation and a softening labor market as justification for the cut. At last week’s meeting, individual policymakers indicated they expect another half percentage point in cuts this year and another full point in 2025. Market pricing, however, is more aggressive, expecting 2 full percentage points in cuts through next year.

The Fed’s benchmark overnight borrowing rate is now targeted at 4.75%-5%.

Bowman said she respects the committee’s decision and emphasized that policy isn’t on a preset course and will depend on the data, which she said has indicated the labor market has softened a bit but is still strong

“I continue to see greater risks to price stability, especially while the labor market continues to be near estimates of full employment,” she said.

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago