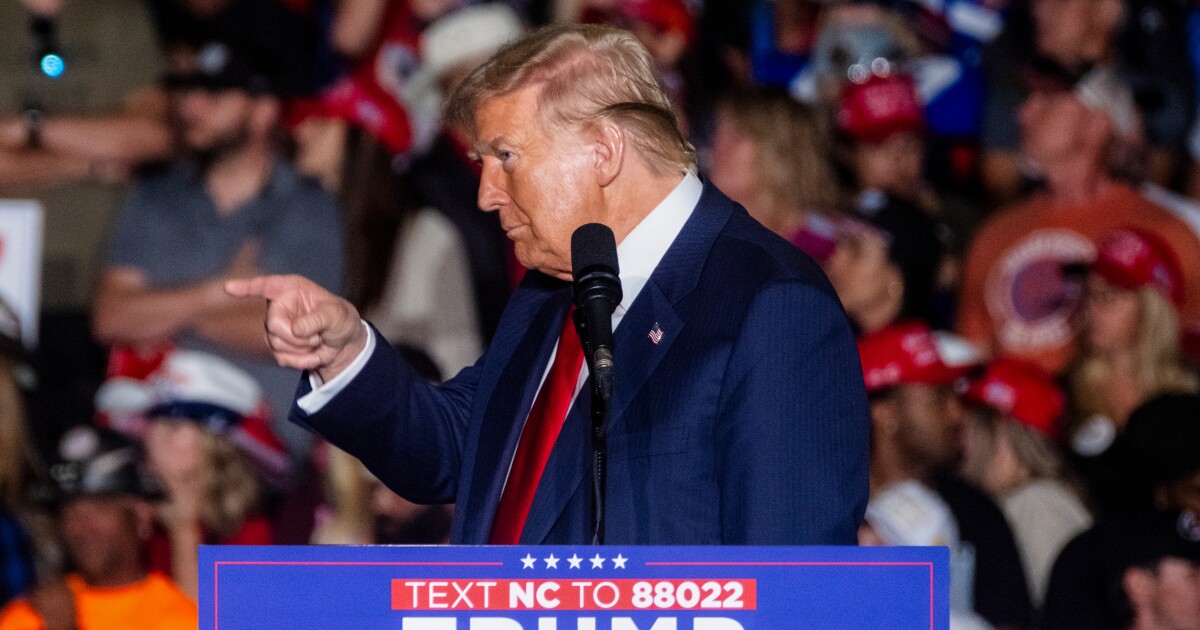

Donald Trump touted his pledge to provide tax breaks for purchasing cars, highlighting that the benefit would only apply to vehicles made in the U.S. as he rallied voters in a crucial swing state with just two weeks until Election Day.

“I don’t want it to benefit other countries. I want it to benefit us,” Trump said Tuesday at a rally in Greensboro, North Carolina. “Deductibility of interest is great, but only if the car is manufactured in the United States.”

Trump has increased his focus on U.S. automakers in recent weeks as he’s sought to assuage voter concerns about domestic manufacturing jobs, repeatedly pledging to restore industries that have closed factories as supply chains have shifted overseas. Trump said his plan to allow car buyers to write-off the loan interest on their federal taxes would be a boon to U.S. car sales.

“Why the hell would we give them taxes if they manufacture the car in China, Japan or lots of other places that stole our business over the years?” Trump said. “I think that’s going to be great for Detroit,” he added, referring to the U.S. auto manufacturing hub, located in battleground Michigan.

Trump didn’t specify if the tax breaks would be available to many foreign-owned carmakers who produce millions of vehicles in the U.S., including Volkswagen AG, Toyota Motor Corp. and Hyundai Motor Co.

Trump on Tuesday mused about what he called the “glory days” of American car manufacturing, saying his father — who was born in 1905 — considered the “definition of luxury” to be buying a new Cadillac every two years.

In addition to tax breaks for car buyers, Trump has pledged to impose steep tariffs on cars and other products made in Mexico, China and other countries. Economists have warned that could cause household prices to spike and serve as a drag on economic growth.

Trump’s focus on manufacturing jobs comes as he and his Democratic rival Vice President Kamala Harris are in a tight race in the seven battleground states, with the former president ahead by 1.1 percentage points in the RealClearPolitics average of polls.

The United Auto Workers endorsed Harris for president, but Trump has made inroads with rank-and-file union members, a potentially decisive voting bloc in the “Blue Wall” states of Michigan, Wisconsin and Pennsylvania.

Swing states

Trump has spent the better part of the past two days in North Carolina, and both campaigns have been targeting voters in the state with early voting already underway. The State Board of Elections said that more than 1 million voters had already cast ballots as of Sunday at 4 p.m.

Trump carried the state in both of his past two presidential runs but only narrowly against President Joe Biden in 2020, spurring Democratic hopes of taking the state.

North Carolina is still recovering from Hurricane Helene, which hit the U.S, southeast, subsuming the state with historic levels of flooding in late September and early October and devastating communities in its path.

Nearly 1.3 million registered voters live in North Carolina counties in the designated Helene disaster area and the state has implemented emergency measures for those displaced by the storm to make it easier to vote, including allowing voters to have absentee ballots sent to them in temporary housing and to cast their ballots at any voting site around the state.

Economics1 week ago

Economics1 week ago

Blog Post6 days ago

Blog Post6 days ago

Economics1 week ago

Economics1 week ago

Accounting1 week ago

Accounting1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics7 days ago

Economics7 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance1 week ago

Finance1 week ago