Accounting

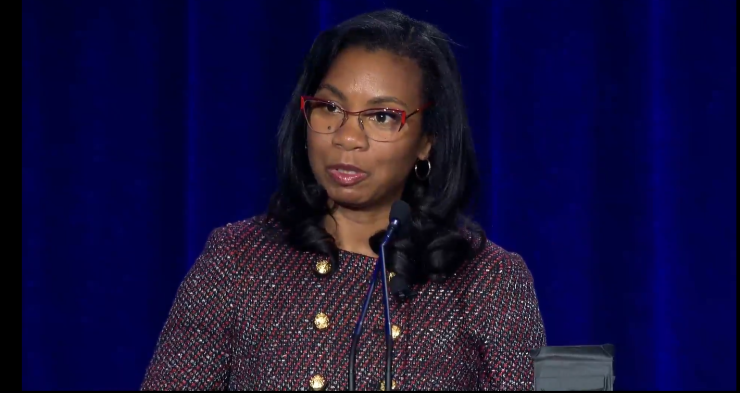

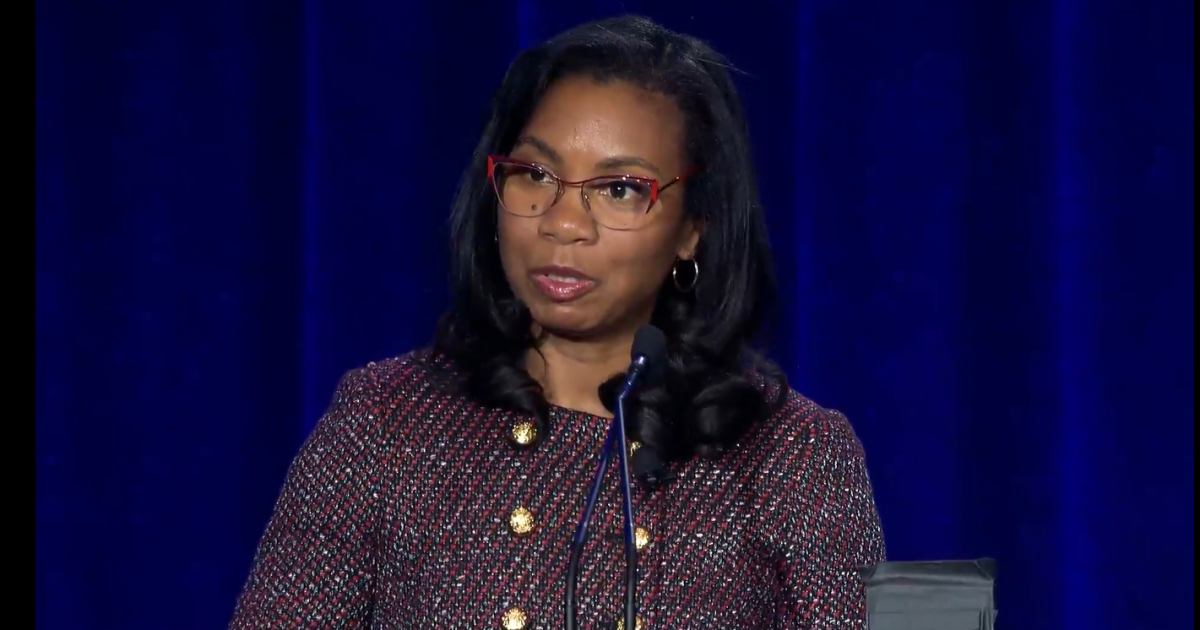

Erica Williams sworn in for second term as PCAOB chair

Accounting

On the move: HCVT hired CAS co-leader

Accounting

Tech news: Karbon Practice Management evolves into Practice Intelligence

Accounting

Trump said to be open to lowering SALT cap in GOP tax bill

-

Economics1 week ago

Economics1 week agoElon Musk says Trump’s spending bill undermines the work DOGE has been doing

-

Blog Post6 days ago

Blog Post6 days agoCommon Bookkeeping Challenges and Solutions for Small Businesses

-

Economics1 week ago

Economics1 week agoHow young voters helped to put Trump in the White House

-

Accounting1 week ago

Accounting1 week agoHighest paid jobs in corporate accounting

-

Personal Finance1 week ago

Personal Finance1 week agoHarvard, Trump international enrollment battle affects college applicants

-

Economics7 days ago

Economics7 days agoWhy the president must not be lexicographer-in-chief

-

Personal Finance1 week ago

Personal Finance1 week agoCrypto in 401(k) plans: Trump administration eases rules

-

Finance1 week ago

Finance1 week agoVail Resorts, GameStop and more