Accounting

Tax Fraud Blotter: Questionable resources

Published

5 months agoon

To the mat; extra help; FACS of the case; and other highlights of recent tax cases.

Corona, California: Tax preparer Salvador Gonzalez has been sentenced to six years in prison for preparing false returns for clients.

For more than a decade, Gonzalez operated the tax prep business Grace’s Lighthouse Resource Center and during that time consistently claimed false deductions such as charitable donations and medical expenses on thousands of returns he prepared for clients. He also directed his clients to create sham corporations and fraudulently deduct such personal expenses as their mortgage, car and utility payments as business expenses.

Gonzalez, who previously

The court also ordered him to serve a year of supervised release and to pay $403,908 in restitution to the United States. The federal government also filed a civil complaint against Gonzalez that seeks to permanently enjoin him from preparing, assisting in, directing or supervising the preparation or filing of federal tax returns, amended tax returns or other related documents or forms for others. Gonzalez consented to the entry of the civil judgment and permanent injunction.

New York: Gregory Gumucio, of Colorado, leader of a nationwide yoga business, has pleaded guilty in connection with a conspiracy to commit tax evasion.

Gumucio was the longtime leader of Yoga to the People, from which he received more than $3.5 million in income between 2012 and 2020. He did not file individual or business returns or pay any income taxes for at least eight consecutive years.

In or around 2006, Gumucio founded To the People, which was originally donation-based. Over the following years, the enterprise opened some 20 studios or affiliated entities throughout New York City and in various other places, including California, Colorado, Arizona, Florida and the State of Washington.

From 2010 to 2020, To the People and its affiliates generated gross receipts of more than $20 million yet never filed a corporate return with the IRS. From approximately 2012 through 2020, Gumucio never filed a personal return with the IRS or paid any income taxes. During the period, Gumucio enjoyed an extravagant lifestyle, which included frequent foreign travel; expensive hotels, meals and clothing; NFL season tickets; and country club payments.

Gumucio and his conspirators used various methods to evade taxes, including accepting yoga students’ payments in cash; failing to maintain a corporate headquarters or keep corporate books and records; using nominees to disguise Gumucio and his co-conspirators’ connection to various entities; and maximizing unreported income.

Gumucio faces up to five years in prison. He has agreed to pay $2,560,300.93 in restitution to the IRS.

Slidell, Louisiana: Tax preparer Celina Bolton-Fultz, 35, has pleaded guilty to 30 counts of assisting in filing false returns, five counts of filing her own false returns, four counts of making false statements and two counts of theft of government funds.

From 2018 through 2022, Bolton-Fultz submitted 30 false returns for seven clients of her tax prep business, fraudulently inflating their income by adding fake “household help” income to their returns to fabricate and inflate tax credits. She also fraudulently reduced her own income on her returns for 2017 through 2021, fraudulently reducing her gross receipts and reporting false expenses for businesses that she owned.

Bolton-Fultz also pleaded guilty to two frauds concerning the CARES Act. She pleaded guilty to four counts of making false statements for submitting applications in 2020 and 2021 for Paycheck Protection Program loans in which she submitted fake tax forms and provided false information about her businesses’ payroll. She also pleaded guilty to two counts of theft of government funds for making fraudulent applications for Economic Injury Disaster Loans, inflating her businesses’ revenues and expenses and submitting false tax documents.

In total, she received $204,103 in funds through the fraudulent applications. She has agreed to pay at least $405,133 in restitution to the IRS and the Small Business Administration.

She faces up to three years in prison for each tax count, five years for each of the PPP fraud counts and 10 years for each of the EIDL fraud counts; she faces a fine of up to $100,000 for each of the tax counts and up to $250,000 for each of the PPP and EIDL fraud counts, or the greater of twice the gross gain to the defendant or twice the gross loss. Bolton-Fultz also faces supervised release of up to three years for the PPP and EIDL fraud counts and up to a year for the tax counts, as well as a special assessment fee for every count to which she pleaded guilty. Sentencing is Jan. 23.

Walled Lake, Michigan: Former CPA Paul Kozowicz, 75, has pleaded guilty to evading some $318,000 in federal income taxes.

His guilty plea arose out of a scheme that, according to court papers, resulted in his intentional failure to report more than $1.1 million in taxable income to the IRS over nine years. Between around 2002 and 2011, Kozowicz worked as a full-time salaried employee providing accounting and financial services for a law firm in Birmingham, Michigan.

In 2011, that firm reorganized, and Kozowicz became a part-time employee of the firm, making approximately 20% of his previous salary. To replace his lost income, Kozowicz became an independent contractor and provided accounting and consulting services to several other businesses.

Kozowicz formed FACS Inc., which purported to be the entity that provided these accounting and consulting services. He opened a bank account in the name of FACS but did not declare any of the income he earned using the name FACS on any individual or corporate tax return between 2011 and 2019. He also did not maintain any corporate books or records for FACS, nor did he observe or respect any other corporate formalities such as the State of Michigan’s annual corporate filing requirements.

In addition, according to the plea agreement, Kozowicz treated the monies deposited in the FACS account as his own and used the money freely for personal expenses and needs. Yet on his personal federal income tax returns, the only income Kozowicz declared was his reduced law-firm salary and certain taxable Social Security receipts. FACS never filed a corporate tax return.

Kozowicz further admitted that between 2011 and 2019, he earned some $1.15 million in unreported income through FACS and evaded payment of approximately $318,243 in tax.

Sentencing is Jan. 21. He faces up to five years in prison and must pay $318,243 in restitution to the IRS.

Randolph, New Jersey: Business owner Joseph Caravella has pleaded guilty to tax evasion for evading employment tax penalties.

Caravella owned several masonry companies and from 2008 to 2016 the IRS assessed some $650,000 in Trust Fund Recovery penalties against him for causing three masonry businesses that he owned to not pay their federal employment taxes.

From around March 2008 through around April 2019, Caravella sought to evade the payment of these penalties by placing companies that he controlled in the names of nominee owners and avoiding using a bank account in his own name. During that time, he continued to cause his businesses not to pay employment taxes, resulting in an additional loss of $1.2 million to the IRS.

In total, Caravella caused a federal tax loss of $1,885,519.39.

Sentencing is March 18. He faces up to five years in prison, a period of supervised release, restitution and monetary penalties.

You may like

What becomes of the broken-hearted; the earth moved; Kreative accounting; and other highlights of recent tax cases.

Providence, Rhode Island: Four Florida residents have been convicted and sentenced for what authorities called one of the largest schemes to defraud CARES Act programs.

The defendants defrauded various federally funded programs of more than $4.8 million, and each of the defendants pleaded guilty to charges of conspiracy to commit wire fraud and aggravated identity theft. The schemes involved obtaining and using stolen ID information to submit fraudulent applications to multiple state unemployment agencies, including the Rhode Island Department of Labor and Training, and to submit fraudulent Economic Injury Disaster Loans and Paycheck Protection Program loan applications. The defendants also submitted fraudulent applications in the names of other persons to federal and state agencies to obtain tax refunds, stimulus payments, and disaster relief funds and loans.

The scheme involved using the stolen information to open bank accounts to receive, deposit and transfer fraudulently obtained government benefits and payments and to obtain debit cards to withdraw the money.

Sentenced were Florida residents Tony Mertile, of Miramar, identified in court documents as the leader of the conspiracy, to six years in prison; Junior Mertile, of Pembroke Pines, sentenced to 54 months; Allen Bien-Aime, of Lehigh Acres, to four years; and James Legerme, of Sunrise, to four years. All four were also sentenced to three years of supervised release to follow their prison terms.

The government moved to forfeit a total of $4,857,191, or $1,214,294.75 apiece, proceeds of the conspiracy. The defendants have also forfeited hundreds of thousands of dollars’ worth of Rolex watches and assorted jewelry and more than $1.1 million in cash. Each defendant is also liable for $4,456,927.36 in restitution to defrauded agencies and financial intuitions.

Raleigh, North Carolina: Michon Griffin, 46, who engaged as a money mule (a.k.a. middleman) in an international romance scheme, has been sentenced to two years in prison and three years of supervised release after pleading guilty to conspiracy to commit money laundering and to making false statements on her 1040.

Between 2021 to 2023, Griffin received more than $2 million from the scheme that she deposited into fictitious bank accounts that she controlled. She converted the money to virtual currency and wired the funds to overseas accounts controlled by her co-conspirators in Nigeria.

Griffin received some $300,000 from the romance fraud, which she did not report as income on her 1040 for 2021.

She was also ordered to pay $109,119 in restitution to the IRS.

Las Vegas: Tax preparer Keisy Altagracia Sosa has pleaded guilty to preparing false income tax returns.

Sosa has operated the tax prep business National Tax Service, and from 2016 to 2021 prepared and filed false federal returns for clients. These returns included falsely claimed dependents, and fictitious Schedule A and Schedule C expenses such as sales taxes paid and unreimbursed employee expenses.

Sosa continued to prepare false returns even after the IRS notified her that her returns appeared inaccurate and informed her that she may not be meeting due diligence requirements.

Sosa caused at least $550,000 in tax loss to the IRS.

Sentencing is June 11. She faces up to three years in prison, as well as a period of supervised release and monetary penalties.

Elk Mound, Wisconsin: Business owner Deena M. Hintz, of Eau Claire, Wisconsin, has been sentenced to a year in prison for failure to pay employment taxes.

Hintz, who pleaded guilty in December, owned and operated Jade Excavation and Trucking for nearly 10 years and at times had up to 15 employees. From 2017 to 2021, Hintz deducted more than $400,000 in federal employment taxes from employees’ pay and, instead of paying those taxes to the government, kept the money.

She was also ordered to pay $482,185.46 in restitution.

Littleton, Colorado: Tax preparer Thuan Bui, 60, has been sentenced to three years in prison and a year of supervised release and ordered to pay a $50,000 fine after pleading guilty to one count of aiding or assisting in preparation of false documents.

From about 2016 to 2021, Bui operated a tax prep business under several names, lying to clients that he was a CPA. On hundreds of returns, Bui overstated or fabricated expenses on Schedules C.

Philadelphia: Resident Joseph LaForte has been sentenced to 15 and a half years in prison for defrauding investors, conspiring to defraud the IRS, filing false tax returns, employment tax fraud, wire fraud, obstruction and other charges.

LaForte defrauded investors using a fraudulent investment vehicle known as Par Funding. Along with conspirators, he caused a loss to investors of more than $288 million.

He and conspirators diverted some $20 million in taxable income from Par Funding to another entity controlled by LaForte and nominally owned by another, then filed returns that did not report this income; he also received more than $9 million in kickbacks from a customer of Par Funding and did not report this income to the IRS. He paid off-the-books, cash wages to some employees, failing to report these wages to the IRS and not paying employment taxes.

The federal tax loss exceeds $8 million. He also caused $1.6 million in state tax loss to the Pennsylvania Department of Revenue by falsely reporting that he and his wife were residents of Florida from 2013 through 2019 when they lived in Pennsylvania.

Hampton Roads, Virginia: Two area residents have pleaded guilty to their roles in a refund scheme involving pandemic relief credits.

Between October 2022 and May 2023, Kendra Michelle Eley of Norfolk, Virginia, filed eight 941s for Kreative Designs by Kendra LLC using the EIN assigned to another company, Kendra Cleans Maid Service. These forms covered four tax periods in 2020 and four in 2021. On each of the forms, Eley falsely reported wages paid and federal tax withholdings for 18 purported employees, knowing there were no such employees.

For the four forms filed for 2021, Eley claimed false sick and family leave credits and Employee Retention Credits, totaling some $975,000. In December 2022, the IRS issued two refund checks payable to the cleaning company totaling $649,050.

That same month, Eley and Rejohn Isaiah Whitehead, of Portsmouth, Virginia, opened a business checking account in the name of Kendra Cleans; signatories on the account were Eley and Whitehead. The two falsely represented the nature and extent of the business, including that it had 16 employees and that the average pay of each was $2,000. Eley funded the account by depositing one of the refund checks in the amount of $389,640. In January 2023, Eley wrote Whitehead two checks from the account totaling $60,000.

Whitehead’s sentencing is June 26 and Eley’s is July 9. They each face up to 10 years in prison.

Accounting

Accountants tackle tariff increases after ‘Liberation Day’

Published

5 hours agoon

April 3, 2025

President Trump’s imposition of steep tariffs on countries around the world is likely to drive demand for accounting experts and consultants to help companies adjust and forecast the ever-changing percentages and terms.

On April 2, which Trump dubbed “Liberation Day,” he announced a raft of reciprocal tariffs of varying percentages on trading partners across the globe and signed an

“A lot of CFOs are thinking they are going to pass along the tariffs to their customer base, and about another half are thinking we’re going to absorb it and be more creative in other ways we can save money inside our company,” said Tom Hood, executive vice president for business engagement and growth at the AICPA & CIMA.

The AICPA & CIMA’s most recent

“CFOs in our community are telling us that, effectively, they’re looking at this a lot like what happened over COVID with a big disruption out of nowhere,” said Hood. “This one, they could see it coming. But the point is they had to immediately pivot into forecasting and projection with basically forward-looking financial analysis to help their companies, CEOs, etc., plan for what could be coming next. This is true for firms who are advising clients. They might be hired to do the planning in an outsourced way, if the company doesn’t have the finance talent inside to do that.”

The tariffs are not set in stone, and other countries are likely to continue to negotiate them with the U.S., as Canada and Mexico have been doing in recent months.

“The one thing that I think we can all count on is a certain amount of uncertainty in this process, at least for the next several months,” said Charles Clevenger, a principal at UHY Consulting who specializes in supply chain and procurement strategy. “It’s hard to tell if it’s going to go beyond that or not, but it certainly feels that way.”

Accountants will need to make sure their companies and clients stay compliant with whatever conditions are imposed by the U.S. and its trading partners. “This is a more complex tariff environment than most companies have experienced in the past, or that seems to be where we’re headed, and so ensuring compliance is really important,” said Clevenger.

Big Four firms are advising caution among their clients.

“Our point of view is we’re advising all of our clients to do a few things right out of the gate,” said Martin Fiore, EY Americas deputy vice chair of tax, during a webinar Thursday. “Model and analyze the trade flows. Look at your supply chain structures. Understand those and execute scenario planning on supply chain structures that could evolve in new environments. That is really important: the ability for companies to address the questions they’re getting from their C-suite, from their stakeholders, is critical. Every company is in a different spot according to the discussions we’ve had. We just are really emphasizing, with all the uncertainty, know your structure, know your position, have modeling put in place, so as we go through the next rounds of discussions over many months, you have an understanding of your structure.”

Scenario planning will be especially important amid all the unpredictability for companies large and small. “They’re going to be looking at all the different countries they might have supply chains in,” said Hood. “And then even the smaller midsized companies that might not be big, giant global companies, they might be supplying things to a big global company, and if they’re in part of that supply chain, they’ll be impacted through this whole cycle as well.”

Accountants will have to factor the extra tariffs and import taxes into their costs and help their clients decide whether to pass on the costs to customers, while also keeping an eye out for pricing among their competitors and suppliers.

“It’s just like accounting for any goods that you’re purchasing,” said Hood. “They often have tariffs and taxes built into them at different levels. I think the difference is these could be bigger and they could be more uncertain, because we’re not even sure they’re going to stick until you see the response by the other countries and the way this is absorbed through the market. I think we’re going through this period of deeper uncertainty. Even though they’re announced, we know that the administration has a tendency to negotiate, so I’m sure we’re going to see this thing evolve, probably in the next 30 days or whatever. The other thing our CFOs are reminding us of is that the stock market is not the economy.”

Amid the market fluctuations, companies and their accountants will need to watch closely as the rules and tariff rates fluctuate and ensure they are complying with the trading rules. “Do we have country of origin specified properly?” said Clevenger. “Are we completing the right paperwork? When there are questions, are we being responsive? Are we close to our broker? Are we monitoring our customs entries and all the basic things that we need to do? That’s more important now than it has been in the past because of this increase in complexity.”

Accounting

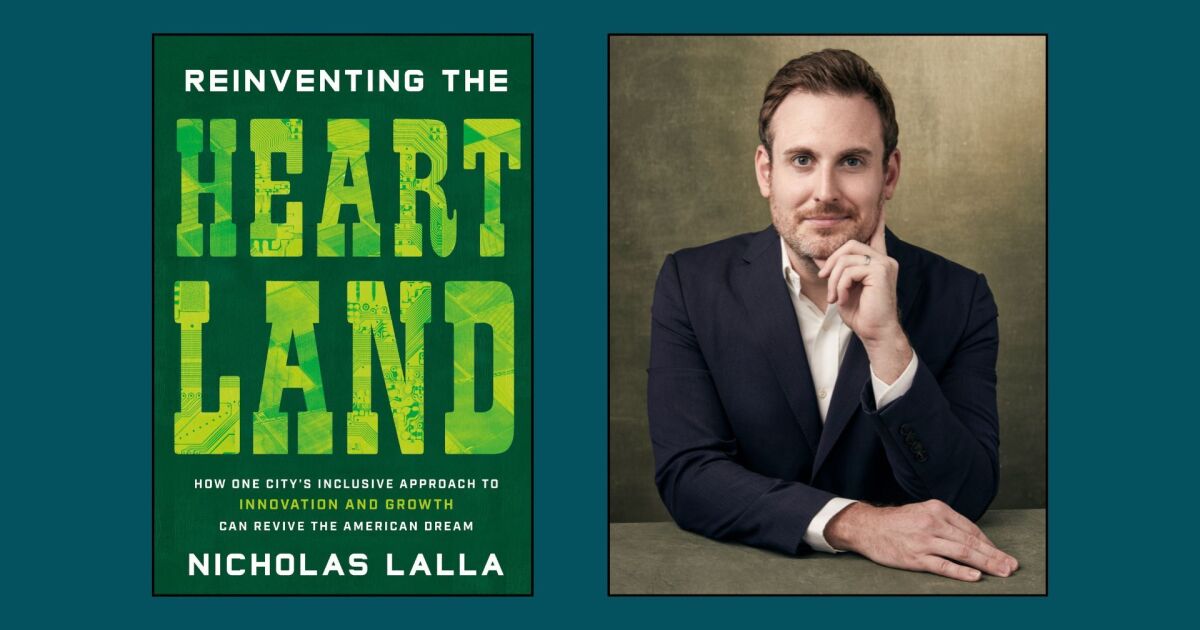

How to use opportunity zone tax credits in the ‘Heartland’

Published

5 hours agoon

April 3, 2025

A tax credit for investments in low-income areas could spur long-term job creation in overlooked parts of the country — with the right changes to its rules, according to a new book.

The capital gains deferral and exclusions available through the “opportunity zones” credit represent one of the few areas of the Tax Cuts and Jobs Act of 2017 that drew support from both Republicans and Democrats. The impact of the credit, though, has proven murky in terms of boosting jobs and economic growth in the roughly 7,800 Census tracts qualifying based on their rates of poverty or median family incomes.

Altering the criteria to focus the investments on “less traditional real estate and more innovation infrastructure” and ensuring they reach more places outside of New York and California could “refine the where and the what” of the credit, said Nicholas Lalla, the author of “

“I don’t want to sound naive. I know that investors leveraging opportunity zones want to make money and reduce their tax liability, but I would encourage them to do a few additional things,” Lalla said. “There are communities that need investment, that need regional and national partners to support them, and their participation can pay dividends.”

READ MORE:

A call to action

In the book, Lalla writes about how the Innovation Labs received $200 million in fundraising through public and private investments for projects like a startup unmanned aerial vehicle testing site in the Osage Nation called the Skyway36 Droneport and Technology Innovation Center. Such collaborations carry special relevance in an area like Tulsa, Oklahoma, which has a history marked by the wealth ramifications of the

“This book is a call to action for the United States to address one of society’s defining challenges: expanding opportunity by harnessing the tech industry and ensuring gains spread across demographics and geographies,” he writes. “The middle matters, the center must hold, and Heartland cities need to reinvent themselves to thrive in the innovation age. That enormous project starts at the local level, through place-based economic development, which can make an impact far faster than changing the patterns of financial markets or corporate behavior. And inclusive growth in tech must start with the reinvention of Heartland cities. That requires cities — civic ecosystems, not merely municipal governments — to undertake two changes in parallel. The first is transitioning their legacy economies to tech-based ones, and the second is shifting from a growth mindset to an inclusive-growth mindset. To accomplish both admittedly ambitious endeavors, cities must challenge local economic development orthodoxy and readjust their entire civic ecosystems for this generational project.”

READ MORE:

Researching the shortcomings

And that’s where an “opportunity zones 2.0” program could play an important role in supporting local tech startups, turning midsized cities into innovation engines and collaborating with philanthropic organizations or the federal, state and local governments, according to Lalla.

In

Other research suggested that opportunity-zone investments in metropolitan areas generated a 3% to 4.5% jump in employment, compared to a flat rate in rural places,

“It creates a strong incentive for taxpayers to make investments that will appreciate greatly in market value,” Tax Foundation President Emeritus Scott Hodge wrote in the analysis, “Opportunity Zones ‘Make a Good Return Greater,’ but Not for Poor Residents” shortly after the Treasury study.

“This may be the fatal flaw in opportunity zones,” he wrote. “It explains why most of the investments have been in real estate — which tends to appreciate faster than other investments — and in Census tracts that were already improving before being designated as opportunity zones.”

So far, three other research studies have concluded that the investments made little to no impact on commercial development, no clear marks on housing prices, employment and business formation and a notable boost in multifamily and other residential property,

The credit “deviates a lot from previous policies” that were much more prescriptive, Feldman said.

“It didn’t want the government to have a lot of oversay over what was going on, where the investment was going, the type of investments and things like that,” she said. “It offered uncapped tax incentives for private individual investors to invest unrealized capital gains. So this was the big innovation of OZs. It was taking the stock of unrealized capital gains that wealthy individuals, or even less wealthy individuals, had sitting, and they could roll it over into these funds that could then be invested in these opportunity zones. And there were a lot of tax breaks that came with that.”

READ MORE:

A ‘place-based’ strategy

The shifts that Lalla is calling for in the policy “could either be narrowing criteria for what qualifies as an opportunity zone or creating force multipliers that further incentivize investments in more places,” he said. In other words, investors may consider ideas for, say, semiconductor plants, workforce training facilities or data centers across the Midwest and in rural areas throughout the country rather than trying to build more luxury residential properties in New York and Los Angeles.

While President Donald Trump has certainly favored that type of economic development over his career in real estate, entertainment and politics, those properties could tap into other tax incentives. And a refreshed approach to opportunity zones could speak to the “real innovation and talent potential in midsized cities throughout the Heartland,” enabling a policy that experts like Lalla describe as “place-based,” he said. With any policies that mention the words “

“We can’t have cities across the country isolated from tech and innovation,” he said. “When you take a geographic lens to economic inclusion, to economic mobility, to economic prosperity, you are including communities like Tulsa, Oklahoma. You’re including communities throughout Appalachia, throughout the Midwest that have been isolated over the past 20 years.”

READ MORE:

Hope for the future?

In the book, Lalla compares the similar goals of opportunity zones to those of earlier policies under President Joe Biden’s administration like the Inflation Reduction Act, the CHIPS and Science Act, the American Rescue Plan and the Infrastructure Investment and Jobs Act.

“Together, these bills provided hundreds of millions of dollars in grant money for a more diverse group of cities and regions to invest in innovation infrastructure and ecosystems,” Lalla writes. “Although it will take years for these investments to bear fruit, they mark an encouraging change in federal economic development policy. I am cautiously optimistic that the incoming Trump administration will continue this trend, which has disproportionately helped the Heartland. For example, Trump’s opportunity zone program in his first term, which offered tax incentives to invest in distressed parts of the country, should be adapted and scaled to support innovation ecosystems in the Heartland. For the first time in generations, the government is taking a place-based approach to economic development, intentionally seeking to fund projects in communities historically disconnected from the nation’s innovation system and in essential industries. They’re doing so through a decidedly regional approach.”

Advisors and

“This really is a bipartisan issue. Opportunity zones won wide bipartisan approval,” he said. “Heartland cities can flourish and can do so in a complicated political environment.”

Tax Fraud Blotter: Big plans

U.S. tariff rates under Trump will be higher than the Smoot-Hawley levels from Great Depression era

Accountants tackle tariff increases after ‘Liberation Day’

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoYoung Americans are losing confidence in economy, and it shows online

-

Personal Finance1 week ago

Personal Finance1 week agoStudent loans could be managed by the Small Business Administration

-

Economics7 days ago

Economics7 days agoPCE inflation February 2025:

-

Accounting6 days ago

Accounting6 days agoIRS sets new initiative with banks to uncover fraud

-

Economics1 week ago

Economics1 week agoWhite House denials over the Signal snafu ring hollow

-

Economics6 days ago

Economics6 days agoConsumer sentiment worsens as inflation fears grow, University of Michigan survey shows

-

Economics1 week ago

Economics1 week agoTexas troopers are in more and more lethal car chases

-

Personal Finance1 week ago

Personal Finance1 week agoMillions of student loan borrowers past-due after bills restarted: Fed