Blog Post

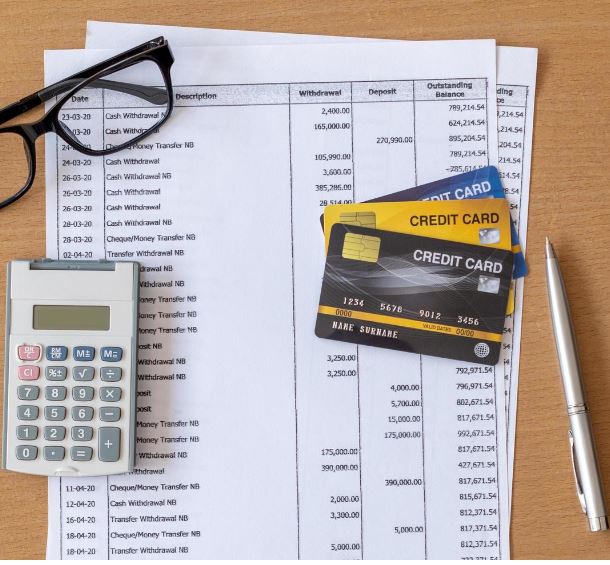

The Essential Practice of Bank and Credit Card Statement Reconciliation

Published

5 months agoon

In the landscape of financial management, reconciling bank and credit card statements stands out as an indispensable practice that can make or break an organization’s financial accuracy. Often overlooked or undervalued, this process plays a critical role in catching discrepancies, preventing costly errors, and reducing exposure to fraud. For businesses striving to maintain clear and accurate financial records, diligent reconciliation of statements is non-negotiable, laying a foundation of financial reliability and trustworthiness.

Understanding the Reconciliation Process

The reconciliation process ensures that all transactions in the company’s financial records align with those listed on the bank or credit card statements. In other words, it’s a comprehensive comparison of each item recorded in the company’s books to the transactions listed by financial institutions. This includes verifying payments, cash receipts, transfers, deposits, and withdrawals. For credit card statements, it means checking that every charge, refund, and credit aligns with company records and has an associated source document for accuracy. For businesses dealing with high transaction volumes, the reconciliation process may seem overwhelming; however, it is a necessary safeguard for detecting errors. Missing, duplicate, or incorrect entries can lead to inaccurate cash balances, resulting in misleading financial reports and forecasts. Such discrepancies, if not caught in time, can erode confidence in the company’s financial health and open doors to mismanagement and fraudulent activity.

Why Reconciliation is Crucial for Financial Health

Accurate reconciliation is the bedrock of sound financial management, particularly when it comes to effective cash management and planning. Regular and accurate reconciliation ensures that cash flows and bank balances are appropriately monitored and recorded. It mitigates risks of misstatements that can lead to significant setbacks, such as inflated expenses or understated revenues, which could impact business strategy, budgeting, and financial forecasting. Beyond just tracking the flow of funds, reconciliation is a powerful tool for fraud prevention. Without regular reconciliation, unauthorized transactions or payments may go unnoticed. Reconciling statements diligently can highlight unusual activity early, giving businesses a chance to investigate and mitigate any financial threats. A robust reconciliation protocol, therefore, is an essential component in establishing financial control and stability within any organization.

The Role of Technology in Modern Reconciliation Practices

Today’s reconciliation processes benefit immensely from technological advancements. Financial software, mobile apps, and direct integrations with banks now streamline much of the reconciliation workflow, automating data entry and organizing transaction data in real time. Such tools can reduce human error, simplify tracking, and make reviewing large volumes of transactions far more manageable. However, technology alone is not a complete substitute for human oversight. Financial professionals must still apply sound judgment and conduct thorough reviews of flagged items to ensure that all data accurately reflects the financial status of the business. Many software solutions offer customizable reconciliation templates, automated alerts for anomalies, and powerful reporting features that allow for precise, real-time insights. When these tools are combined with proper training and oversight, they can transform what was once a time-consuming process into an efficient, streamlined operation.

Recommended Practices for Effective Reconciliation

An effective reconciliation process incorporates several best practices to maximize efficiency and ensure accuracy. Regularity in reconciliation is vital, with most businesses choosing weekly or monthly reconciliation schedules. Conducting these reviews while the transaction details are still fresh reduces the likelihood of errors and makes it easier to track down supporting documentation if discrepancies arise. The periodic frequency of reconciliation also enables businesses to catch discrepancies sooner, allowing for timely adjustments. Implementing segregation of duties is another essential aspect. Separating the tasks of recording transactions and reconciling accounts minimizes the risk of errors and potential fraud. Dual-approval requirements on significant transactions add an additional layer of control. For instance, having one team member responsible for data entry and another responsible for the final review reduces opportunities for unchecked errors or unauthorized adjustments. Establishing communication protocols with banks and financial institutions is also helpful for resolving discrepancies or identifying fraud in a timely manner. Many banks offer proactive fraud detection services, and maintaining an open line of communication can facilitate quicker responses to fraud alerts or unusual activity.

Formalizing Reconciliation as a Standard Operating Procedure

Establishing a consistent and formal reconciliation process as a standard operating procedure is crucial for maintaining accountability. When a structured approach to reconciliation is enforced, the company can effectively safeguard its financial health. This involves setting detailed guidelines for handling discrepancies, documenting procedures, and training employees on the importance of reconciliation as part of routine financial management. Formalized reconciliation procedures should be periodically reviewed and updated to accommodate changes in the business environment, such as new software tools, updated financial regulations, or changes in transaction volumes. This adaptability keeps the reconciliation process aligned with the company’s goals and regulatory requirements.

Long-Term Benefits of Regular Reconciliation

Implementing a disciplined approach to bank and credit card statement reconciliation offers numerous long-term benefits. Accurate, up-to-date financial data builds a foundation of trust with stakeholders, including shareholders, auditors, and regulators. It supports informed decision-making, enabling leaders to navigate business challenges with a clear understanding of cash flows, expenses, and financial obligations. Furthermore, regular reconciliation helps establish a culture of transparency and accountability. Employees working in finance, accounting, and related areas understand the critical importance of accurate financial reporting and are more likely to follow best practices and maintain accuracy in their work. In the long run, reconciliation processes contribute to the resilience of the business, positioning it for sustainable growth. As companies grow and transaction volumes increase, having an established reconciliation protocol ensures that the financial reporting infrastructure is prepared to handle expansion without compromising accuracy or security.

Conclusion

Bank and credit card statement reconciliation is not just a routine task but a vital pillar of effective financial management. It helps companies ensure that financial records accurately reflect cash flows, mitigate the risk of fraud, and establish a foundation of trust and transparency. In today’s technology-driven landscape, businesses can leverage advanced software to streamline the process while maintaining essential human oversight. By making reconciliation a non-negotiable standard, businesses can better safeguard their financial health, build credibility, and support informed decision-making. This indispensable practice is key to sustainable growth and robust financial management.

You may like

-

‘He should bring them down’

-

China targets U.S. services and other areas after decrying ‘meaningless’ tariff hikes on goods

-

Global trade outlook for 2025 has ‘deteriorated sharply,’ WTO warns

-

Retail sales March 2025:

-

Fed Governor Waller sees tariff inflation as ‘transitory’ in ‘Tush Push’ comparison

-

Unemployment fears hit worst levels since Covid, Fed survey shows

Sales tax compliance can often feel overwhelming, especially for businesses that operate across multiple states or sell products online. With each jurisdiction setting its own rules and tax rates, managing sales tax accurately has become a critical part of bookkeeping. Whether you’re a small business owner or a growing e-commerce brand, staying compliant with sales tax regulations is essential to avoid costly penalties and maintain financial accuracy. This guide breaks down the fundamentals of sales tax compliance and offers actionable tips to help you manage it effectively within your bookkeeping process.

Understanding Sales Tax Obligations

The first step in handling sales tax compliance is understanding where your business is required to collect and remit tax. This concept is known as sales tax nexus. Nexus can be established through physical presence, such as a store, warehouse, or employees in a state. However, with the rise of online sales, economic nexus rules have become more common. These laws require businesses to collect sales tax if their revenue or number of transactions exceeds certain thresholds in a state, even without a physical location there.

Identifying your nexus points is crucial. Each state has its own criteria, and failing to recognize where you have nexus can lead to non-compliance. Review your sales data and business activities regularly to determine where your obligations lie.

Using Accounting Software for Automation

Once you’ve pinpointed your nexus locations, it’s important to implement systems that can help manage your sales tax responsibilities efficiently. Modern accounting software can simplify this process by automatically applying the correct tax rates based on customer location and product type. Many platforms also integrate with sales channels like Shopify, Amazon, or Etsy, making real-time tax calculations seamless across various sales platforms.

While automation can reduce human error and save time, it’s not a set-it-and-forget-it solution. Periodically review your software settings and sales reports to make sure tax rates are applied correctly. Misclassifications or outdated settings can result in inaccurate tax collection.

The Importance of Accurate Record-Keeping

Sales tax compliance depends heavily on precise and organized record-keeping. You should maintain detailed documentation for every transaction, including taxable and tax-exempt sales. For exempt sales, it’s important to collect and store valid exemption certificates. This documentation serves as proof in case of an audit and protects your business from liability.

Additionally, keep a record of the tax collected, amounts remitted to the state, and filing dates. This audit trail ensures you can quickly verify your compliance and correct any issues that arise.

Staying on Top of Filing Deadlines

Each jurisdiction has its own filing schedule—most require monthly, quarterly, or annual filings, depending on your total tax liability. Missing a deadline can result in fines, interest charges, or even suspension of your business license. The best way to avoid this is to set up a tax calendar with reminders for all upcoming due dates.

Some businesses also choose to enroll in automated tax filing services that submit returns on their behalf. Whether you file manually or use automation, punctuality is non-negotiable when it comes to sales tax.

Keeping Up with Changing Regulations

Sales tax laws are not static—they evolve regularly, especially with the rapid growth of e-commerce. States are frequently updating their nexus laws, tax rates, and exemption rules. Staying informed is a vital part of remaining compliant. Subscribe to tax news alerts, join bookkeeping forums, or work with a tax advisor to stay up to date with changes that might affect your business.

Reevaluate your compliance strategy periodically to ensure it aligns with current laws. A proactive approach helps you adapt to new requirements without disrupting operations.

When to Seek Professional Help

While many small businesses manage sales tax compliance in-house, complex scenarios may require expert guidance. If your company operates in multiple states, sells across various platforms, or deals with products that have special tax classifications, consulting with a sales tax expert or CPA can be invaluable.

A professional can help assess your nexus, set up your tax systems, review past filings, and ensure your business meets all local and federal regulations. This not only protects you from potential penalties but also provides peace of mind as your business grows.

Turning Compliance Into a Strategic Advantage

Complying with sales tax regulations isn’t just about avoiding fines—it’s about building financial integrity into your bookkeeping. Businesses that treat sales tax compliance as part of their regular financial operations tend to have more accurate reports, better cash flow forecasting, and smoother audits.

Sales tax tracking also provides insights into regional sales performance, helping you identify growth opportunities and customer trends. When integrated correctly, sales tax compliance becomes less of a burden and more of a tool for strategic business management.

Final Thoughts

Sales tax compliance doesn’t have to be a daunting process. With a solid understanding of your responsibilities, the right tools, and a proactive approach to record-keeping and reporting, you can manage it confidently. By embedding these practices into your bookkeeping routine, you’ll not only stay compliant but also strengthen your business’s financial foundation. Whether you’re selling locally or across state lines, mastering sales tax compliance is a smart move that pays off in both accuracy and trust.

Blog Post

Recording Loan Transactions and Interest Payments for Financial Accuracy

Published

3 weeks agoon

March 29, 2025

Accurate financial record-keeping is essential for any business, especially when it comes to managing loan transactions and interest payments. Properly tracking these financial obligations ensures compliance with accounting standards, simplifies tax reporting, and provides a clear picture of a company’s financial health. Whether you are a small business owner or a financial professional, understanding the correct way to record loans and interest expenses is key to maintaining an accurate and transparent accounting system.

Recording the Initial Loan Transaction

When a business secures a loan, the first step is properly recording the transaction in its accounting records. The loan amount should be recorded as a liability on the balance sheet, reflecting the total borrowed. At the same time, the cash received from the loan increases the company’s assets, keeping the accounting equation balanced. Depending on the nature of the loan, it may be classified as a short-term or long-term liability. Short-term loans, which are payable within a year, appear under current liabilities, while long-term loans extending beyond a year are categorized under non-current liabilities. Proper classification is important for financial reporting and for understanding a company’s liquidity position.

Understanding Loan Repayments

Once loan repayments begin, each payment typically consists of two components: principal and interest. The principal portion reduces the outstanding loan balance, while the interest is recorded as an expense. Correctly distinguishing between these components is critical, as they have different accounting and tax implications. The principal repayment affects the balance sheet by reducing liabilities, whereas the interest expense is recorded on the income statement and can often be deducted from taxable income.

Interest Payments and Their Financial Impact

Interest payments represent the cost of borrowing money and must be recorded separately from the principal repayment. Since interest expenses impact profitability, accurate tracking is essential for financial planning and tax reporting. Businesses must ensure they correctly allocate payments between interest and principal based on the loan’s amortization schedule. Amortization schedules outline how much of each payment goes toward interest and how much reduces the principal. Over time, the interest portion of payments decreases while the principal repayment increases. Using accounting software can help automate these calculations and ensure accuracy in financial reporting.

Utilizing Amortization Schedules

Most business loans follow an amortization schedule, which details the breakdown of each payment over the loan’s lifespan. Early payments in the schedule typically consist of a higher proportion of interest, with the principal component increasing over time. Understanding this structure allows businesses to plan their cash flow more effectively. Many businesses use accounting software to automatically track and apply amortization schedules, reducing the risk of errors in recording interest and principal payments.

Reconciling Loan Transactions

Regular reconciliation of loan statements with accounting records is crucial to detect discrepancies early. Businesses should compare loan balances in their books against lender-provided statements to identify any missing or incorrect entries. This process ensures financial accuracy and helps businesses stay on top of their debt obligations. Consistent reconciliation also provides valuable insights into a company’s financial position, enabling better decision-making regarding debt management and future borrowing needs.

Tax Considerations for Interest Payments

One of the key advantages of properly recording interest expenses is the potential tax benefits. In most cases, interest paid on business loans is tax-deductible, reducing taxable income and overall tax liability. To maximize these benefits, businesses must maintain detailed and accurate records of all interest payments. Proper documentation is also essential in the event of a tax audit, as authorities may require evidence of legitimate business expenses.

Importance of Transparency in Financial Reporting

Accurate loan recording is not just about compliance—it also plays a crucial role in financial transparency. Investors, lenders, and stakeholders rely on a company’s financial statements to assess its stability and growth potential. Misreporting loan transactions can distort financial statements, leading to misinformed business decisions and potential regulatory issues. By maintaining clear and accurate loan records, businesses can ensure financial integrity and build trust with stakeholders.

Leveraging Accounting Software for Loan Management

Managing loan transactions manually can be complex and time-consuming. Many businesses invest in accounting software that automates the recording of loan payments, interest calculations, and amortization schedules. These tools help reduce human error and provide real-time insights into a company’s financial standing. Additionally, software integration with banking systems allows for seamless transaction tracking and automated reconciliation.

Final Thoughts: Ensuring Accuracy in Loan Accounting

Properly recording loan transactions and interest payments is essential for maintaining financial accuracy, ensuring regulatory compliance, and optimizing tax benefits. By understanding loan structures, utilizing amortization schedules, and reconciling financial records regularly, businesses can manage their debt efficiently. Leveraging accounting software further streamlines the process, reducing errors and improving overall financial transparency. Ultimately, accurate loan accounting empowers businesses to make informed financial decisions, maintain healthy cash flow, and support long-term growth.

Navigating the regulatory landscape for nonprofits in New York City can be challenging, especially when working with city agencies. One of the most critical compliance requirements is Form 65A, which governs subcontractor approval processes. Understanding and adhering to these regulations is essential for maintaining funding, avoiding penalties, and ensuring the smooth operation of nonprofit programs.

Understanding Form 65A and Its Purpose

Form 65A is a compliance requirement for nonprofit organizations that engage in third-party contracts while receiving funding from New York City agencies. This form ensures transparency and financial accountability when nonprofits subcontract work to external vendors. The city uses this process to monitor subcontractor relationships and verify that funds are used responsibly. Nonprofits that fail to comply risk payment delays, contract disputes, and potential funding losses.

The $25,000 Threshold for Subcontractor Approval

The most important aspect of Form 65A is its threshold requirement. Any nonprofit that enters into a subcontractor agreement exceeding $25,000 must seek formal approval from the city. This applies not only to single contracts but also to multiple agreements with the same vendor if their total value surpasses this threshold. Understanding this rule is crucial for financial planning and vendor management, as failing to obtain approval can lead to significant administrative and financial consequences.

Registering Subcontractors and Required Documentation

The first step in the Form 65A compliance process is registering subcontractors in the City’s Payee Information Portal (PIP). Nonprofits must submit comprehensive details about the proposed vendor, including contract terms, service descriptions, and maximum payment values. If a contract exceeds $25,000, nonprofits must also provide proof of a competitive bidding process. Typically, this requires three bids from potential vendors unless the organization chooses a pre-approved Essensa network vendor. Proper documentation ensures a smooth approval process and minimizes the risk of rejection.

Key Timeline Considerations for Approval

Timeliness is essential when managing Form 65A submissions. Many New York City agencies require a minimum of 30 days to review and approve subcontractor agreements. Because of this, nonprofits should plan ahead and avoid engaging subcontractors before obtaining official authorization. In many cases, approvals are processed through Passport, the city’s digital procurement system, or via written confirmation. Organizations that fail to account for these processing times risk delays in project implementation and funding disbursement.

Risks of Non-Compliance and Financial Consequences

Failure to comply with Form 65A requirements can result in serious repercussions. If a nonprofit engages a subcontractor without prior approval, city agencies have the right to withhold payment for services rendered. This can lead to severe cash flow issues, disrupting operations and potentially jeopardizing critical programs. Non-compliance may also damage an organization’s reputation and eligibility for future city contracts. By prioritizing compliance, nonprofits can avoid these risks and maintain financial stability.

Best Practices for Ensuring Compliance

To simplify compliance and reduce administrative burdens, nonprofits should adopt best practices for managing subcontractor agreements. Key strategies include:

- Submitting complete documentation upfront – Providing all necessary information at the time of submission minimizes delays caused by incomplete paperwork.

- Maintaining organized contract records – Keeping detailed records of all third-party agreements ensures that organizations can track contract values and submission deadlines.

- Aligning subcontractor terms with city contract requirements – Ensuring that subcontractor agreements reflect the terms and conditions of the primary city contract helps avoid conflicts during the approval process.

- Implementing a vendor management system – Tracking all agreements and cumulative spending with subcontractors can prevent unintentional violations of the $25,000 threshold.

Understanding Second-Tier Subcontractor Approval

Many nonprofits overlook the fact that second-tier subcontractors—vendors hired by an approved subcontractor—must also be reviewed under Form 65A requirements. Organizations should establish clear vendor oversight protocols to ensure that all subcontractors, including those hired indirectly, comply with city regulations. By proactively managing these relationships, nonprofits can prevent compliance issues before they arise.

Staying Compliant While Advancing Your Mission

For nonprofits working with New York City agencies, Form 65A compliance is a crucial aspect of financial and operational management. By understanding the approval process, adhering to documentation requirements, and maintaining strict oversight of subcontractor agreements, organizations can avoid funding disruptions and regulatory penalties. With a proactive approach to compliance, nonprofits can focus on their mission—serving communities and making a positive impact—without unnecessary administrative hurdles.

Acting IRS commissioner reportedly replaced

‘He should bring them down’

Capital One and Discover merger approved by Federal Reserve

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Personal Finance1 week ago

Personal Finance1 week agoStudent loan changes likely coming under Trump

-

Accounting1 week ago

Accounting1 week agoTrump’s tariff shift has markets, industry groups panicked

-

Personal Finance1 week ago

Personal Finance1 week agoSocial Security updates anti-fraud measures for benefit claims

-

Personal Finance1 week ago

Personal Finance1 week agoSocial Security COLA projected to be lower in 2026. Tariffs may change that

-

Personal Finance1 week ago

Personal Finance1 week agoMajority of Americans are financially stressed from tariff turmoil: CNBC survey

-

Economics1 week ago

Economics1 week agoTrump’s triple-digit tariff essentially cuts off most trade with China, says economist

-

Economics1 week ago

Economics1 week agoTrump’s tariff blitz faces strong legal challenges

-

Finance1 week ago

Finance1 week agoStocks making the biggest moves midday: Frontier Group, JPMorgan, Apple, Stellantis, BlackRock and more