BOI is back; phantom stocks; continuous compliance; and other highlights from our favorite tax bloggers. Just in time Tax Vox (https://www.taxpolicycenter.org/taxvox): Who benefits and who loses...

That doesn’t look like a 1040 … . H&R Block has given the world just what it wants to see this holiday season: Santa Claus’s tax...

The SECURE 2.0 Act contained several changes to traditional and Roth individual retirement accounts and 401(k) plans that are being phased in over the coming years,...

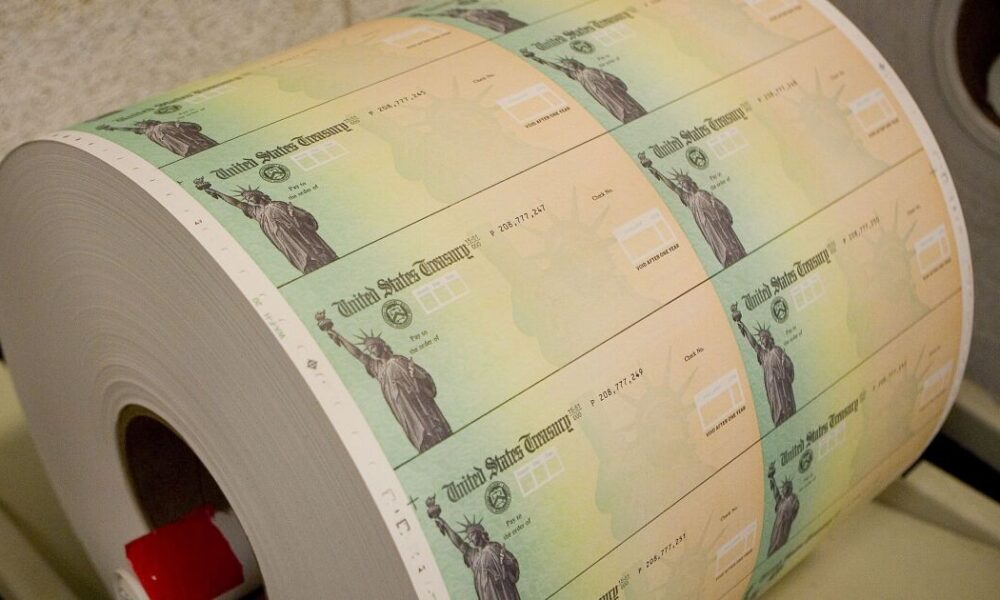

The Internal Revenue Service plans to send automatic payments later this month to eligible taxpayers who did not claim the Recovery Rebate Credit on 2021 returns. The payments,...

Becoming a Certified Public Accountant is no small feat. The CPA exam is one of the most demanding professional exams in the U.S., with a notoriously...

The Treasury Department’s Financial Crimes Enforcement Network has extended the deadline for beneficial ownership information reporting after an injunction was lifted by a federal appeals court....

There may be a surprise in store for some partnerships whose investors include an “applicable corporation” — particularly smaller ones. Regulations for the corporate alternative minimum...

Only about one-third of taxpayers globally believe tax revenues in their country are being spent for the public good, according to a recent survey. The survey,...

In a case involving phony documents and unpaid taxes, a prominent Washington, D.C.-based accountant pleaded guilty last week for making false statements on a mortgage application...

The American Institute of CPAs is asking the Securities and Exchange Commission to reject the Public Company Accounting Oversight Board’s recently adopted standard on firm and...