Big Four firms EY and Deloitte, as well as accounting automation solutions provider Digits, all announced partnerships with technology company Nvidia, which has gone from a...

Individuals and businesses in parts of West Virginia affected by severe storms, straight-line winds, flooding, landslides and mudslides that began on Feb. 15 now have until Nov....

It’s no secret that the accounting profession has grappled with a major talent crisis in recent years. About three quarters of certified public accountants are set...

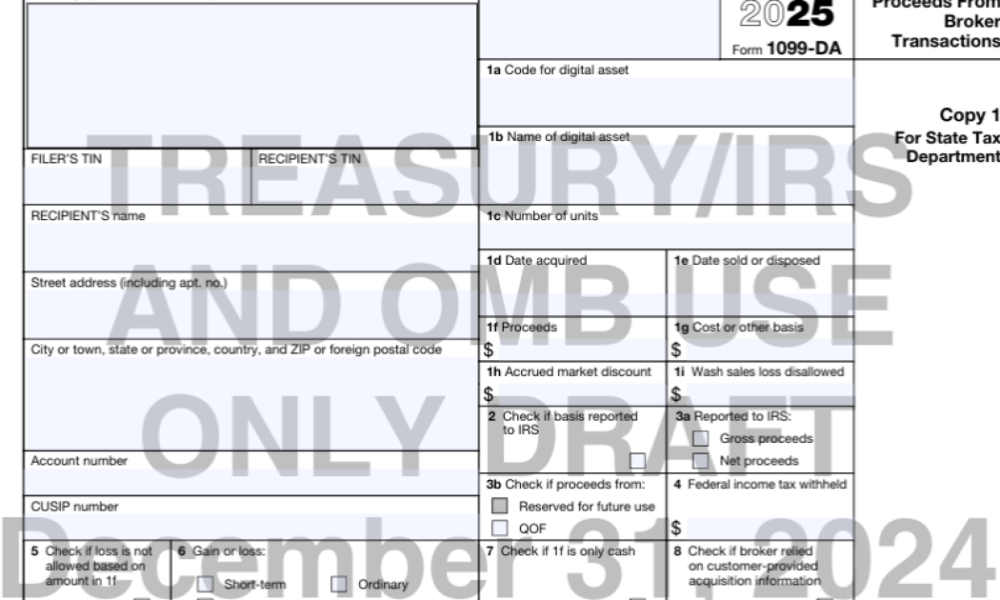

The regulatory environment for digital assets will have significant implications for state-level reporting requirements. A notable development is Montana’s introduction of the Form 1099-DA mandate, reflecting...

President Donald Trump’s nominee to lead the agency that regulates Wall Street has yet to be confirmed, but the sweeping changes to the watchdog from his...

Accounting Today is accepting submissions for its report recognizing the Best Accounting Firms for Technology. This is the seventh year the publication will recognize firms in...

Clients worry about crazy things every tax season, but this year their fears and obsessions and just-plain-odd ideas seem to be taken to a new level....

Muni bonds and taxes; BE-10 time; a troubling history; and other highlights from our favorite tax bloggers. Recovery mode Don’t Mess with Taxes (http://dontmesswithtaxes.typepad.com/): As natural...

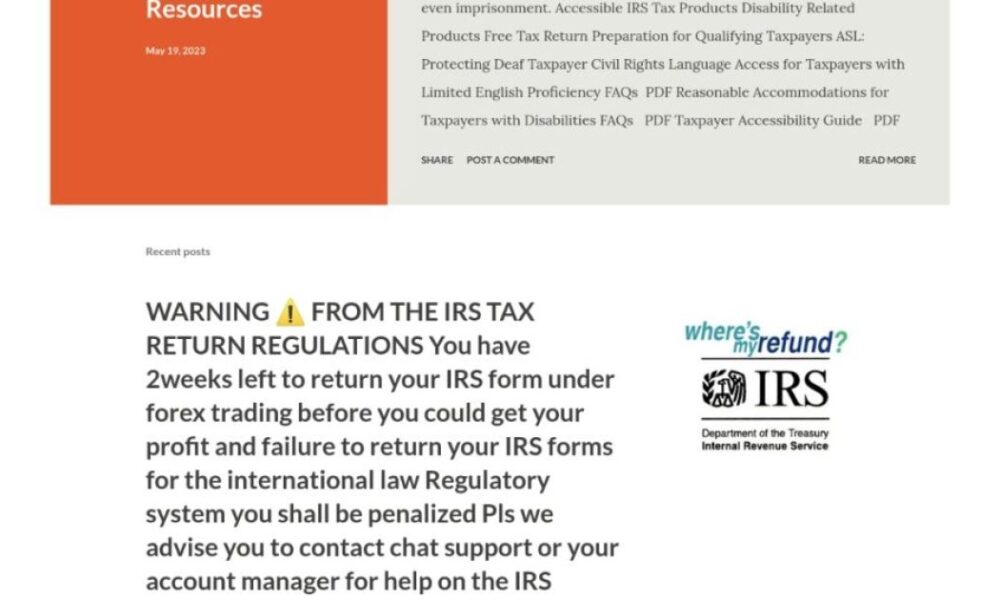

Tax scammers are exploiting the current political divide and resurrecting old websites to lure potential victims, according to a new report. The report, released Tuesday by...

The Treasury Department named a pair of Internal Revenue Service agents as special advisors to Treasury Secretary Scott Bessent and plans key roles for them in...