The Internal Revenue Service made some improvements to its IRS Individual Online Account for taxpayers, adding W-2 and 1095 information returns for 2023 and 2024, but...

KPMG elected Tim Walsh as its next U.S. chair and CEO, and Atif Zaim as its next U.S. deputy chair. Walsh will succeed Paul Knopp, and...

President Donald Trump is bending Congress to his will, hobbling minority Democrats with an everything-at-once strategy and rallying fractious Republicans behind his politically risky tax cut...

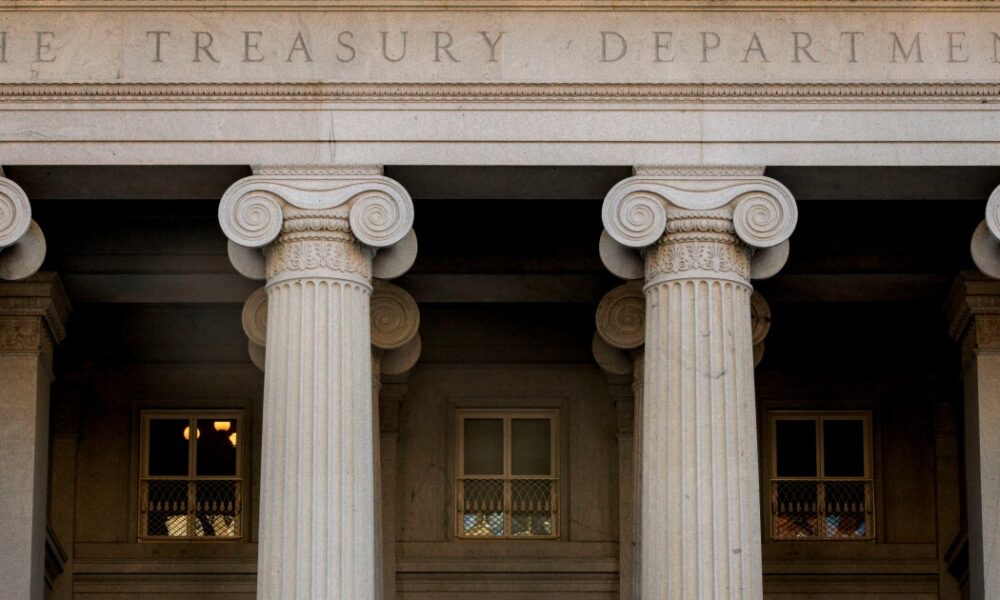

The Treasury Department announced it would no longer enforce the Corporate Transparency Act, nor enforce any penalties or fines associated with beneficial ownership reporting under the...

Wolters Kluwer announced new enhancements to its ftwilliam.com employee benefits solution that now enables users to directly file a Form 5330 with the IRS directly from...

Enjoy complimentary access to top ideas and insights — selected by our editors. A client told me that his business was worth $10 million and he...

Dismissal notices went out Saturday to about 85 employees of 18F, a federal agency that works on improving government technology — effectively shutting down an office...

Professional services solutions provider Intapp, during its Intapp Amplify event in New York City on Feb. 26, announced improvements and upgrades to its solutions for time...

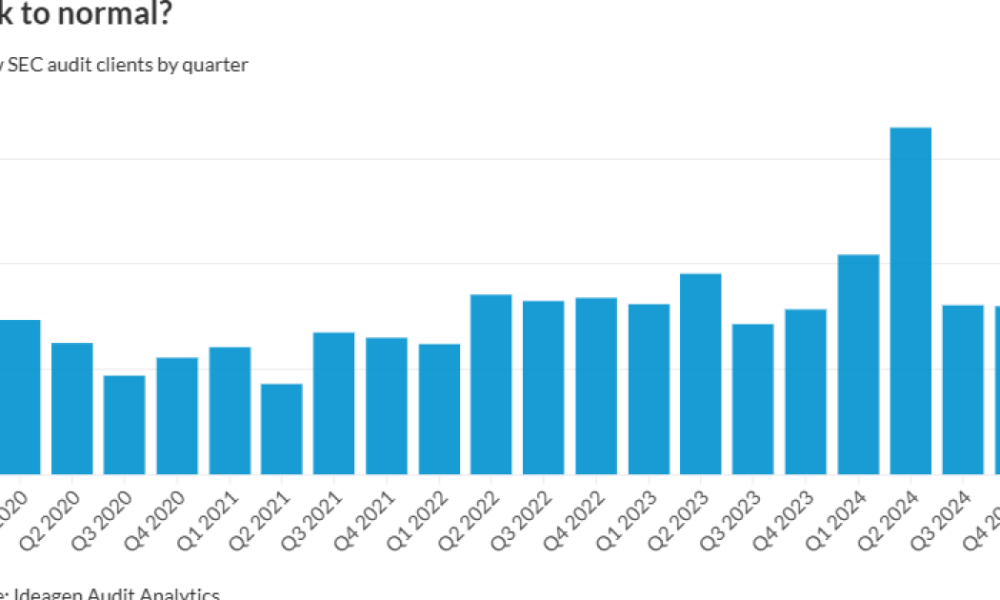

The departure of audit firms from the Securities and Exchange Commission market can prove a boon for those who remain: Pennsylvania-based auditor Stephano Slack brought on...

What will the firings at the IRS and other developments in Washington mean for tax season? Neil Fishman, returning president of the National Conference of CPA...