Builders step up construction in Yuexi County, Anqing city, Anhui province, China, on Sept 25, 2024.

Cfoto | Future Publishing | Getty Images

BEIJING — China aims to stop the property slump, top leaders said Thursday in a readout of a high-level meeting published by state media.

Authorities “must work to halt the real estate market decline and spur a stable recovery,” the readout said in Chinese, translated by CNBC. It also called for “responding to concerns of the masses.”

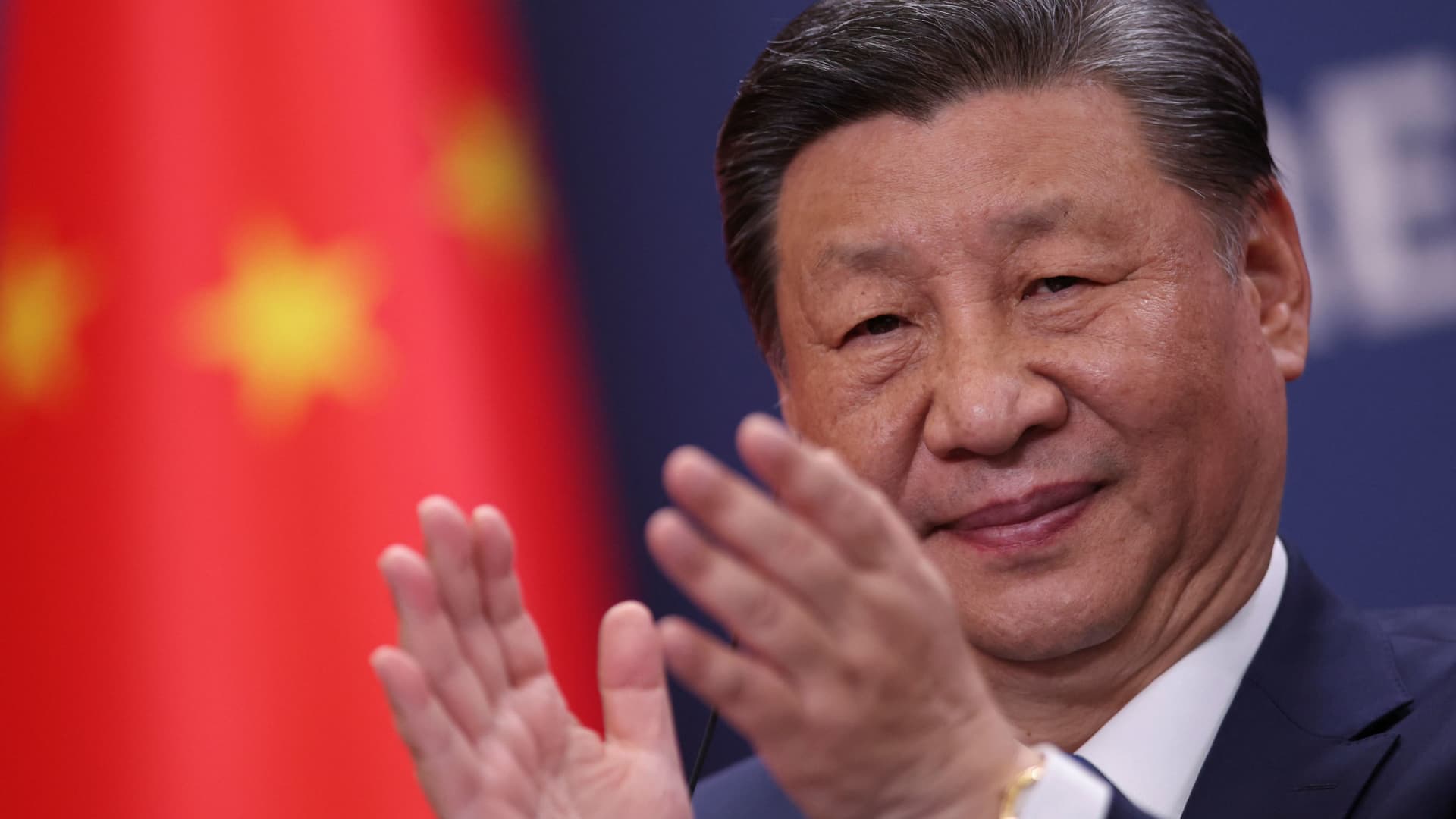

Chinese President Xi Jinping led Thursday’s meeting of the Politburo, the second-highest circle of power in the ruling Chinese Communist Party, state media said.

The readout said leaders called for strengthening fiscal and monetary policy support, and touched on a swath of issues from employment to the aging population. It did not specify the timeframe or scale of any measures.

“I take the messages from this meeting as a positive step,” Zhiwei Zhang, president and chief economist at Pinpoint Asset Management, said in an email to CNBC. “It takes time to formulate a comprehensive fiscal package to address the economic challenges, [and] the meeting took one step in that direction.”

Stocks in mainland China and Hong Kong extended gains after the news to close sharply higher on Thursday. An index of Chinese property stocks in Hong Kong surged by nearly 12%.

Real estate once accounted for more than a quarter of China’s economy. The sector has slumped since Beijing’s crackdown in 2020 on developers’ high levels of debt. But the decline has also cut into local government revenue and household wealth.

China’s broader economic growth has slowed, raising concerns about whether it can reach the full-year GDP target of around 5% without additional stimulus. Just days after the U.S. cut interest rates, the People’s Bank of China on Tuesday announced a slew of planned interest rate cuts and real estate support. Stocks rose, but analysts cautioned the economy still needed fiscal support.

Official data shows real estate’s decline has moderated slightly in recent months. The value of new homes sold fell by 23.6% for the year through August, slightly better than the 24.3% drop year-to-date as of July.

Average home prices fell by 6.8% in August from the prior month on a seasonally adjusted basis, according to Goldman Sachs. That was a modest improvement from a 7.6% decline in July.

“Bottom-out stabilization in the housing market will be a prerequisite for households to take action and break the ‘wait-and-see’ cycle,” Yue Su, principal economist China, at the Economist Intelligence Unit, said in a note. “This suggests that the policy priority is not to boost housing prices to create a wealth effect, but to encourage households to make purchases. This real estate policy is aiming at reducing its drag on the economy.”

Thursday’s meeting called for limiting growth in housing supply, increasing loans for whitelisted projects and reducing the interest on existing mortgages. The People’s Bank of China on Tuesday said forthcoming cuts should lower the mortgage payment burden by 150 billion yuan ($21.37 billion) a year.

While Thursday’s meeting did not provide many details, it is significant for a country where policy directives are increasingly determined at the very top.

The high-level meeting reflects the setting of an “overall policy,” as there previously wasn’t a single meeting to sum up the measures, Bank of China’s chief researcher Zong Liang said in Mandarin, translated by CNBC.

He noted how the meeting follows the market’s positive response to the policy announcements earlier in the week. Zong expects Beijing to increase support, noting a shift from focus on stability to taking action.

Tempering growth expectations

The meeting readout said China would “work hard to complete” the country’s full-year economic targets.

That’s less aggressive than the Politburo meeting in July, when the readout said China would work to achieve those goals “at all costs,” according to Bruce Pang, chief economist and head of research for Greater China at JLL.

That shows policymakers are looking for middle ground between short-term growth and longer-term efforts to address structural issues, he said.

Goldman Sachs and other firms have trimmed their growth forecasts in the last few weeks.

The change in tone about the economic targets signals “the government may tolerate growth below 5%,” the EIU’s Su said. “We estimate real economic growth to be around 4.7% in 2024, before slowing down to 4.5% (a moderate upward revision to our previous forecast).”

“The Politburo meetings on economic deployment usually take place in April, July, and October,” she said.

“The fact that this meeting was held earlier, along with the emphasis on stabilizing growth, reflects policymakers’ concerns about the current economic growth trend.”

Initial analyst reactions to Thursday’s meeting readout were varied.

HSBC said “the tide has turned; be prepared for more proactive initiatives.” Capital Economics, on the other hand, said Beijing’s hint at stimulus did not make it clear whether it would include large-scale fiscal support.

S&P Global Ratings analysts said in a report earlier this year that fiscal stimulus is losing its effectiveness in China and is more of a strategy to buy time for longer-term goals.

Senior officials in the summer told reporters that the economy needed to endure necessary “pain” as it transitioned to one of higher-quality growth with a bigger high-tech industry.

— CNBC’s Sonia Heng contributed to this report.

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago