The regulatory environment for digital assets will have significant implications for state-level reporting requirements. A notable development is Montana’s introduction of the Form 1099-DA mandate, reflecting a broader trend toward increased oversight of digital asset transactions.

This article provides an overview of the current and expanding 1099-DA state reporting landscape and delves into Montana’s specific requirements. I’ll discuss the limitations of relying solely on combined federal/state filing programs for compliance and outline the key steps that crypto brokers and tax professionals should take to ensure adherence and avoid penalties in 2025.

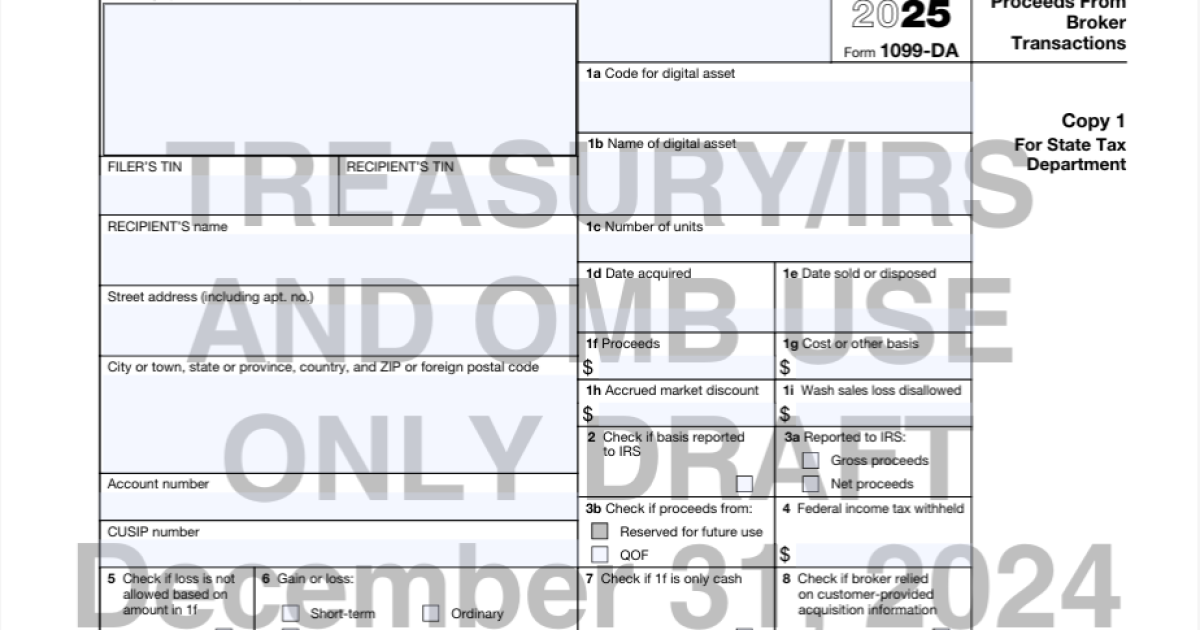

As digital assets like cryptocurrencies and non-fungible tokens become more prevalent, tax authorities are implementing measures to ensure proper reporting and taxation. The Internal Revenue Service has introduced Form 1099-DA, officially titled “Digital Asset Proceeds from Broker Transactions,” to standardize the reporting of digital asset transactions. This form is designed to capture detailed information about digital asset sales and exchanges, including acquisition dates, cost basis, sale dates and proceeds. The goal is to enhance tax compliance and provide clarity for taxpayers involved in digital asset transactions.

While the IRS has established federal reporting requirements, individual states are also enacting their own mandates to ensure accurate tax reporting within their jurisdictions. These state-level requirements often complement federal regulations but typically include additional stipulations unique to each state. For instance, some states may require direct submission of forms through state-specific portals, bypassing traditional federal-state combined filing programs.

Montana’s unique 1099-DA reporting requirements

Montana has taken a proactive approach by introducing specific reporting requirements for digital asset transactions (effective with 2025 transactions) in its 2024 Employer and Information Agent Guide. The Montana Department of Revenue mandates that businesses and brokers involved in digital asset transactions submit Form 1099-DA directly through the state’s TransAction Portal. This requirement is distinct from the federal filing process and emphasizes the state’s commitment to accurate and timely reporting of digital asset activities.

The Combined Federal/State Filing program allows businesses to file certain information returns with the IRS, which then forwards the data to participating states. While this CF/SF program streamlines the reporting process for various forms, it may not fully accommodate the specific requirements that states like Montana have implemented for digital asset transactions.

Montana’s insistence on direct submission through its TAP system of all information returns required to be filed with the state, underscores the limitations of relying solely on the CF/SF program for compliance. The state’s unique reporting mandates mean that businesses cannot depend exclusively on federal filings to meet state obligations. Failure to adhere to Montana’s specific submission protocols could result in non-compliance, leading to potential penalties and increased scrutiny from state tax authorities.

Key steps for crypto brokers and tax professionals to ensure compliance

To navigate the evolving regulatory landscape and ensure compliance with both federal and state reporting requirements, crypto brokers and tax professionals should consider the following steps:

- Stay informed about regulatory changes: Regularly monitor updates from the IRS and state tax authorities regarding digital asset reporting requirements. Subscribe to official newsletters, attend webinars and consult with professional organizations to stay abreast of any changes.

- Understand state-specific mandates: Familiarize yourself with the unique reporting requirements of each state in which you operate. For Montana, this includes understanding the TAP system and the specific protocols for submitting Form 1099-DA.

- Utilize approved software for reporting: Ensure your reporting software is approved by the Montana Department of Revenue for bulk file submissions. This may involve annual registration and testing to confirm compatibility with the state’s systems.

- Implement robust record-keeping practices: Maintain detailed records of all digital asset transactions, including dates, amounts, asset types and parties involved. Accurate record-keeping is essential for compliance and can aid in the event of an audit.

- Provide accurate and timely information to clients: Educate clients about their tax obligations related to digital assets and ensure they receive the necessary forms and information in a timely manner. This includes furnishing copies of Form 1099-DA to clients as required.

- Consult with tax professionals: Given the complexity of digital asset taxation, clients should consider consulting with tax professionals who specialize in this area. They can provide guidance tailored to the client’s specific circumstances and help ensure compliance with all applicable regulations.

- Prepare for potential audits: Develop internal protocols to respond to potential audits or inquiries from tax authorities. This includes having readily accessible records and a clear understanding of the reporting processes you have implemented.

What are the key challenges and benefits of this new reporting requirement?

As with any new significant tax law or standard that is introduced, its implications can be far-reaching and impact several parties albeit differently based upon the role they play in the process. Here are the expected impacts for the key stakeholders in the implementation of Form 1099-DA.

For taxpayers

Transparency and simplicity

- Clear record of transactions: The 1099-DA provides a clear record of transactions, eliminating the need for taxpayers to manually compile data from various exchanges.

- Simplified tax reporting: This form simplifies the process of identifying buy and sell transactions, fees and basis, making income tax reporting more straightforward.

Demand for tax information

- Standardized form: Taxpayers have long requested a standardized form to streamline their income tax reporting process. The 1099-DA answers this call, reducing the confusion and effort involved in reporting crypto transactions.

For the IRS

Enhanced compliance

- Third-party reporting: The 1099-DA is a crucial tool for the IRS to enforce income tax compliance by matching reported income with 1099-DA data.

- Accurate tax assessment: This helps the IRS more accurately assess tax liabilities and close the tax gap.

Regulatory efforts

- Regulating the crypto industry: The introduction of the 1099-DA is a significant step in the IRS’s efforts to regulate the crypto industry and gather necessary data to enforce tax laws effectively.

For brokers

Customer service experience

- Optimized tax documents: Providing specialized tax documents helps brokers meet their clients’ tax reporting needs and enhances their financial service offerings.

Risk and liability management

- Compliance benefits: Adhering to 1099-DA reporting requirements helps brokers minimize the risk of audits and penalties, ensuring they remain in compliance with tax regulations while avoiding potential fines and legal complications.

By proactively addressing these areas, crypto brokers and tax professionals can navigate the complexities of digital asset reporting and minimize the risk of noncompliance. As regulations continue to evolve, staying informed and adaptable will be key to maintaining compliance and avoiding potential penalties in 2025 and beyond.

Economics1 week ago

Economics1 week ago

Accounting1 week ago

Accounting1 week ago

Blog Post4 days ago

Blog Post4 days ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics6 days ago

Economics6 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance1 week ago

Finance1 week ago