Accounting

IMA sees role for AI in accounting

Published

1 year agoon

The Institute of Management Accountants is examining the possibilities of artificial intelligence in the accounting profession and how it will affect finance jobs now and in the future, as the organization itself recently went through a second round of staff cutbacks.

The IMA did not disclose the number of people laid off in February. The organization had an earlier round of reductions in force about two years ago.

“IMA recently implemented a strategic restructuring, which did impact headcount,” said a spokesperson. “Our focus is on positioning IMA for the future — aligned with the needs of our global members. IMA remains committed to our collective growth, and continues to invest in opportunities to advance our organization and profession.”

The IMA released a

“Generally speaking, when people talk about AI, it tends to be very theoretical and high level, and what we have found is our members —those that are working in businesses and working with day-to-day processes and procedures and people — really want to understand what’s the practical implication of this new technology on the work that they’re doing,” said IMA president and CEO Mike DePrisco.

For the report, the IMA talked to about 40 finance leaders from around the globe to understand from their perspective, the main challenges, concerns and opportunities related to leveraging AI and emerging technology into finance and accounting.

“We did a number of focus groups with this group of leaders, and they represent every region of the world,” said DePrisco. “A number of challenges surfaced that were really categorized around four areas: the human aspect, the technology data aspect, operational aspects and ethical and governance aspects.”

One of the worries about AI is the potential for layoffs. “I do think that is probably the biggest concern that many practitioners and organization leaders have as it relates to AI, and that is job displacement,” said DePrisco. “That’s another reason why stakeholders are sometimes hesitant to adopt AI technology in the workplace because of that. Everything that we see and hear suggests that AI will augment and not replace accounting and finance professionals, but the role of what people will do is different in the future than it is today.”

The most cited concern among 38% of the respondents to the IMA survey was the human aspect of working with AI. “The human aspect really is about getting the attention and support from top leadership to invest in and implement AI is a key challenge and a key opportunity for organizations,” said DePrisco. “Those organizations that have full support from leadership — those individuals that control the funding and the allocation of resources to certain projects — those organizations that have that support and alignment have a better chance of getting AI projects implemented successfully. The lack of that support, buy-in and alignment from top leadership was cited as a concern.”

Another concern relates to the skill gaps of individual employees who are required to work with AI. “Many individuals in accounting and finance may not have had exposure to this type of technology, and the challenge therefore in implementing these projects is how do you help upskill finance and accounting professionals and practitioners?” said DePrisco. “How do you give them the tools, skills and knowledge they need to work with the technology individuals and data scientists in the organization, so they are leveraging and building these algorithms, that they’re being built on practical applications or outcomes that the business needs to achieve.”

There’s also a challenge around stakeholder buy-in, with employees accepting the idea that AI and machine learning are going to add value to the organization and not take away control or displace jobs.

“Getting that buy-in is a critical challenge and an opportunity,” said DePrisco.

There are also operational challenges with implementing AI, including cross-functional collaboration. “Implementing AI projects in an organization requires your finance and accounting business people working with your data people and your IT people to ensure that the data going into the machines represents the practical real-world scenarios that accounting and finance individuals are facing and what they need help in, so that when the machine spits out the information and data, it’s useful, reliable and suitable for the needs of the business,” said DePrisco. “Resource management is always a challenge and concern. Do we have enough resources to help ensure that this project is successful? It can’t be something that is just added to someone’s plate as another thing that they need to do and manage. AI projects are pretty complex projects. They’re time-consuming projects. Create space for your team to dedicate time to a successful implementation.”

Organizations may need to reengineer their processes to get good use out of AI. “If your processes are not good, layering in AI on top of bad processes is not going to get you a successful outcome,” said DePrisco. “The first step in implementing any AI project is to look at your processes, and to re-engineer processes in a way that’s going to be added value once you begin to implement the AI technology on top of it. Making sure that you’re rooting out bad processes, reengineering those processes, and taking the time at that point to do it is really the best practice as it relates to that.”

Choosing the right AI technology can also be a challenge. “It takes a lot of investment to bring in AI technology,” said DePrisco. “You have to look at what kind of technical depth you have. What’s needed from an integration perspective before you start making purchases, and starting to think about how you implement AI on top of that?”

Data integrity and maturity are important considerations as well. “Many organizations have data siloed throughout the organization,” said DePrisco. “It’s structured data and unstructured data. How are you bringing all that together and integrating that data and making sure that it’s reliable, clean and trustworthy, so that it can be leveraged and used to develop algorithms?”

Another challenge uncovered by the research centered around ethical and governance concerns. “These concerns are what you hear most about in mainstream media, the importance of data security,” said DePrisco. “How does AI technology impact an organization’s ability to maintain data security and data privacy? How are you governing the AI in your organization? Many organizations that implement these types of projects need to set up an AI Center of Excellence, for example, to ensure that people throughout the organization have visibility into how the AI is being used. What business outcome are you driving toward? What is the cost of implementation and maintenance? And data integrity. Is the data free of bias? Is it reflective of the business problems that you’re trying to solve?”

To help accounting and finance professionals adjust to the far-reaching changes emerging from AI, the IMA is planning to provide more training. “We need to ensure that we’re providing education, knowledge and certification training for practitioners who are moving to new roles,” said DePrisco. “These can be roles like compliance analysts, individuals that utilize AI to ensure the finance operations are adhering to laws and regulations. There are probably going to be new roles in risk assessment and management, that merge financial expertise with AI proficiency, for example, roles that identify bias in data and mitigating that bias.”

He noted that the IMA has long said that accounting and finance professionals are strategic business partners. “The more work is automated, the more opportunities individuals have to step away from some of those manual routine administrative types of tasks that accountants have done over the last 100 years and into that strategic business partner role,” said DePrisco. “That’s so critically important these days to help organizations achieve their outcomes.”

Many accountants are not sure whether it’s a good idea to trust AI systems yet with their clients’ data since programs like ChatGPT have a reputation for “hallucinating” or making up plausible-sounding information that turns out to be partly or wholly fictitious.

“You need knowledgeable accounting and finance people to question the data that comes out of the machines to ensure that it reflects the real-life scenarios that happen day to day and that reflect data that’s correct, accurate and with integrity.” said DePrisco. “That becomes an important role of accounting and finance people. That’s on the back end, but you also need that capability on the front end. And that’s why when I talk about the collaboration, you need experienced, qualified accounting and finance professionals to work with data scientists to build the algorithms that are being used to automate processes and automate a number of these financial processes that are going to create financial statements and other things that the organization is going to rely on. Making sure that the data that’s going in there is accurate, free from bias, and represents both unstructured and structured data that may exist in the organization. It’s the job of the accounting and finance professional to ensure that those algorithms are being built with the proper data. That’s how you mitigate the risk around hallucinations or information coming out that’s half baked.”

AI can be used for tasks like data analytics, to spot patterns and red flags, but it still requires the professional skepticism that an accountant can bring.

“The machines are proving to be very powerful technology that is creating new value, improving efficiency and productivity overall,” said DePrisco. “Like any new technology, there needs to be a healthy dose of skepticism and rigor applied to ensure that we’re not just relying on what a machine spits out, that we’re actually applying critical thinking, bringing our experience, judgment and curiosity to any data that becomes available through a machine. We’ve seen this throughout the years as new technology is adopted. There’s a maturity curve, and we’re still in the early stages of that maturity curve with AI. There will be a lot of learning that happens over time.”

You may like

Accounting

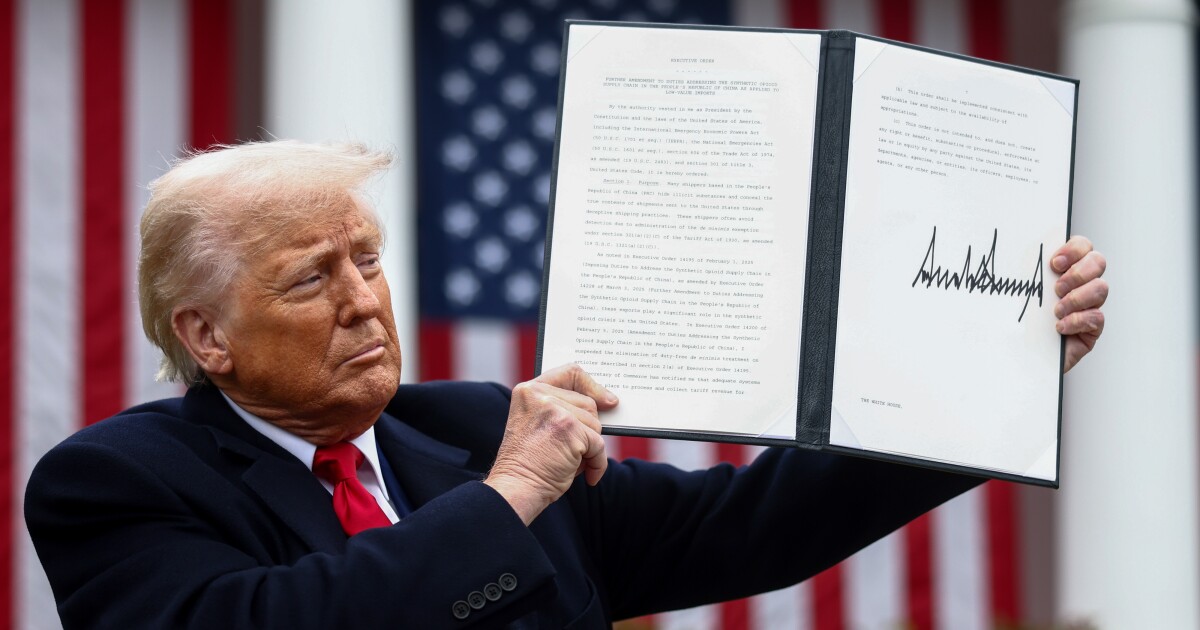

Trump wants to make it more expensive to sue over his policies

Published

18 minutes agoon

June 16, 2025

President Donald Trump and his allies are pursuing an alternative strategy to defend against mounting court orders blocking his policies: Raise the financial stakes for those suing the administration.

Republicans want to force people suing the U.S. to post financial guarantees to cover the government’s costs if they win a temporary halt to Trump’s policies but ultimately lose the case. A measure in the House’s “big, beautiful” tax-and-spending bill would condition a judges’ power to hold US officials in contempt for violating their orders to the payment of that security.

A

While the legislation faces hurdles, the push to make suing the government more expensive is gaining steam. Critics say it’s part of a broader effort to discourage lawsuits against the Trump administration.

In addition to the tax bill provision, Republican lawmakers have

Courts historically haven’t required bonds to be put up in lawsuits against the government. In recent cases, the Trump administration’s bond requests included $120,000 in litigation over union bargaining and an unspecified amount “on the high side'” in a fight over billions of dollars in frozen clean technology grants. Judges in those and other cases have denied hefty requests or set smaller amounts, such as $10 or $100 or even $1.

“Having to put that money up is going to prevent people from being able to enforce their rights,” said Eve Hill, a civil rights lawyer who is involved in litigation against the administration over the treatment of transgender people in U.S. prisons and Social Security Administration operations.

The Trump administration has faced more than 400 lawsuits over his policies on immigration, government spending and the federal workforce, among other topics, since his inauguration. A Bloomberg

White House spokesperson Taylor Rogers said in a statement that “activist organizations are abusing litigation to derail the president’s agenda” and that it is “entirely reasonable to demand that irresponsible organizations provide collateral to cover the costs and damages if their litigation wrongly impeded executive action.”

Dan Huff, a White House lawyer during Trump’s first term, defended the idea but said the language needed fixes, such as clarifying that it only applies to preliminary orders and not all injunctions. Huff, whose op-eds in support of stiffer injunction bonds have

Some judges have already found in certain cases that the administration was failing to fully comply with orders. Alexander Reinert, a law professor at Cardozo School of Law, said the timing of Congress taking up such a proposal was “troubling and perverse.”

‘Defy logic’

Some efforts by the Trump administration to curb lawsuits have already paid off. By threatening probes of law firms’ hiring practices, the White House struck deals with several firms that effectively ruled out their involvement in cases challenging Trump’s policies.

Other aspects of the effort have been less successful. Judges have overwhelmingly rebuffed the Justice Department’s efforts that plaintiffs put up hefty bonds. A judge who refused to impose a bond in a funding fight wrote that “it would defy logic” to hold nonprofit organizations “hostage” for the administration’s refusal to pay them.

Several judges entered bonds as low as $1 when they stopped the administration from sending Venezuelan migrants out of the country. In a challenge to federal worker layoffs, a judge rejected the government’s push for a bond covering salaries and benefits, instead ordering the unions that sued to post $10.

The clause in the House tax bill tying contempt power of judges to injunction bonds was the work of Trump loyalists. Representative Andy Biggs, a Republican member of the House Judiciary Committee, pushed to include the provision, Representative Jim Jordan told Bloomberg News. Jordan, who chairs the committee, said Biggs and Representative Harriet Hageman, another Republican, were “very instrumental in bringing this to the committee’s attention.”

Biggs’ office did not respond to requests for comment. Hageman said in a statement that the measure will “go a long way in curbing this overreach whereby judges are using their gavels to block policies with which they disagree, regardless of what the law may say.”

Liberals have slammed the proposed clause in the tax-and-spending bill as an attack on the judiciary, but it may not be the controversy that dooms it in the Senate. Reconciliation, the process lawmakers are using to pass the bill with only Republican support, requires the entire bill to relate directly to the budget.

‘Make it happen’

Several Republicans have expressed skepticism that the measure can survive under that process. But, Jordan, the House judiciary chair, said Republican lawmakers will seek an alternative path to pass the measure if it’s ruled out in the Senate. “I’m sure we’ll look at other ways to make it happen,” Jordan said.

The bond fight stems from an

University of Notre Dame Law School professor Samuel Bray, a proponent of injunction bonds, said courts should account for whether litigants have the ability to pay. Still, he said, defendants should be able to recover some money if a judge’s early injunction — a “prediction” about who will win, he said – isn’t borne out.

“If courts routinely grant zero dollars, what they are doing is pricing the effect of a wrongly granted injunction on the government’s operations at zero,” Bray said.

Courts have interpreted the rule as giving judges discretion to decide what’s appropriate, including waiving it, said Cornell Law School Professor Alexandra Lahav. The bond issue usually comes up in business disputes with “clear monetary costs,” she said, and not in cases against the federal government.

“It’s not clear to me what kind of injunction bond would make sense in the context of lawsuits around whether immigrants should have a hearing before they’re deported,” Lahav said. “I’m not really sure how you would price that.”

AICPA chair Lexy Kessler looks ahead at the challenges and opportunities —often one and the same — that are facing the profession, and what accountants need to do to be ready for them.

Transcription:

Transcripts are generated using a combination of speech recognition software and human transcribers, and may contain errors. Please check the corresponding audio for the authoritative record.

Dan Hood (00:03):

Welcome to On the Air with Accounting Today I’m editor-in-chief Dan Hood. With the accounting profession changing as rapidly as it does, it’s always good to have a chance to share the perspectives of those who are leading into the future and have a strong visibility into where it’s going here today to do exactly that as the new chair of the AICPA. Lexy Kessler, who’s also a partner at fast-growing Top 25 Firm Ario. Lexy, thanks for joining us.

Lexy Kessler (00:24):

Thanks for having me, Dan. It’s good to see you.

Dan Hood (00:26):

Yeah, it’s good to be talking to you. As I said, it’s always great to have this opportunity because I know from your position, both at Ayo but also at the AICPA, you have a lot of visibility to what’s going on, a lot of strong sense of where the profession is headed. So I want to start on an upbeat note. It’s always easy to say, well, what’s wrong? What’s the challenges? But I’m going to do a little differently for me. I’m going to start with the opportunities. What do you think are some of the biggest opportunities in accounting at the moment?

Lexy Kessler (00:51):

I think that there’s so many opportunities. Actually. I think that now keep in mind, I’m from the d and v, so I’ve got a little bit of slight of color towards it, just as far as disruption with change administration, which happens with any administration, but this one seems to be a little bit more so, and I think with disruption, I know it’s a cliche, it does come opportunity, and I think that this is just yet another example of how disruption is going to be a new way of life. I think the pandemic, I think really accelerated how often the disruptions are happening for us and when we see when periods of disruption happen, we see our clients and we see our businesses turn to us for guidance, for strategy, for thoughts, ideas, and most important, well actually there’s two points right now I think are most important really is that being able to put on the lens of stop listening to the noise that’s out there and filter through that noise to what is really the issue and what is it that we want to protect against?

(01:55):

Because right now, firms are struggling firms, businesses. You’re seeing in survey results that are being going on right now that the uncertainty is creating hesitation in the marketplace and rightly so. How do we help each other within the community help the business community, our ecosystem to get that noise out of our heads and to be able to focus? That’s number one. Number two is really change management. I think that I give this example when I started in public accounting and what I was doing as entry level staff person versus what people are doing today. Now, that’s obviously decades of difference, but that’s because there’s been change and that happened over time. It didn’t happen at the speed that it’s happening today. So I think that change management skill sets are a great opportunity for us, and I consider myself a change agent, by the way. I support it, I advocate for it, but it’s been really challenging for me. Also, I won’t lie, I think that those are two big just global umbrella areas of where I think that we can really within those fine opportunities to help the business community

Dan Hood (03:08):

As a change resistor, as an official opponent of change at all times and always at all kinds. Good to know who the enemy is, but what’s interesting about it is that when you talk about the opportunity and it is a tremendous opportunity, clarifying the landscape for your clients is enormous, but there’s also a degree, these are challenges that accounting firms face as well. Change management, the need to develop change management skills is huge for accounting firms. The need to see through just thinking about where we’re currently in the midst of trying to get a tax bill passed or watching a tax bill try to get passed and the uncertainty that comes along with that. What do you advise clients about? How do you prepare for next year? Are we going to have the extensions that we need, et cetera, et cetera, et cetera, and I’m always sort of fascinated by the way in which accountants in many cases seem to be like the teacher who’s one page ahead of the class in the book that they start to see what’s coming, not as well as they might want to, but better than their client does to be able to bring that back.

(04:05):

So it’s a fascinating opportunity, but also means they’ve got to be up to speed on

Lexy Kessler (04:10):

Agreed. And I think that because the nature of our profession is that we’re used to that we don’t realize that we really are a little bit further ahead and that we really can bring value to the table in the conversations and don’t take that for granted that they’ll just know that’s a very easy way to be like, oh, the clients, they know that, or our teams within our organization, they know that they don’t necessarily, or they may hear it from a different lens, from the lens that they’re looking at as a CEO or as a project manager, contracts person, whatever it may be. So it’s a different perspective to the issue.

Dan Hood (04:42):

Well, I think it’s fair to say that every accountant who might be listening to this, every accountant than the profession probably has an experience of a client who thinks they know what’s going on,

Lexy Kessler (04:54):

And then you just do the best you can with what’s there. Right? Exactly. That’s all you can do is give the guidance advice and it’s up to the person to take it or not.

Dan Hood (05:02):

Right. I think my next question is going to be about the big challenges the profession faces, and I think in some ways sort the flip side of the opportunities you’ve talked about may fit as potential challenges. The pace of change is enormous and some other things. When you look at challenges for the profession, what are you thinking firms should be paying attention to?

Lexy Kessler (05:22):

I think firms should be paying attention to what is ahead and to understand that and helping clients or the organizations with a strategy that you need to really build in a pivot. If it doesn’t have a pivot and it doesn’t have flexibility, it may not be viable. Then in addition to that, we have an obligation to be very current on what is happening out there, whether it be, now if you’re a small business, it’s a bit more difficult to do. You pick your lane where you’re good at and be up to date on it. We were listening during regional councils for an update on the tax law. You mentioned that earlier. The potential tax law changes, and I leaned over to a person next to me and I said, I can’t imagine trying to stay current on this if I wasn’t at meetings like this.

(06:04):

Being able to stay at the forefront and being educated about the changes because the more clients, the more that you can take something that you’re hearing in the news and relate it to their business, that really engages and brings value to a relationship and to an organization. So it’s taking what we know and pivoting to it. The other thing is that I would say is in thinking forward, people keep asking what’s going to change? What’s going to change? And I was at something recently where they played a clip from Jeff Bezos and Jeff said, people keep asking Jeff like I know him, Jeff, that they ask him What’s going to be changing? Is it the question that people aren’t asking me is what’s not going to be changing? It’s just as important. What’s not going to be changing? What’s the fundamental that’s out there or fundamentals that we can be pulling our organizations and clients to focus on to help weather some of this more disruptive territory? So I think that that’s another probably answering the two questions together a little bit that you’ve asked me overlapping there, but

Dan Hood (07:05):

Well, I mean this is one of those things where the challenges and the opportunities in accounting in a way that is different from a lot of other industries, they are very much different sides of the same coin. We talked about the need for clients to have help with change management. The flip side of that is the need for accountants to get help with change management. As we said, as long as they’re one step ahead

Lexy Kessler (07:25):

And if we don’t as a profession, individuals will get left behind and organizations will get left behind. If you’re not adapting technology at almost a disruptive pace in the right way, which is the other thing with the guardrails that need to be in place to use it correctly and have the quality standards around it, then you will get left behind. There are just too many, I mean the news now granted there’s very few other than the big four that have the resources that they do, that they’re investing in completely changing their methodologies and their audit methodologies and putting a billion each of them into revamping those technologies and ways to do it, which in theory we have that pipeline challenge, then that should help to free up people to be able to do the services that our clients really want to be paying for and the organizations want from their accounting and finance teams.

Dan Hood (08:18):

I want to dive here. You mentioned the pipeline. This is obviously one of the biggest issues going on in the profession. I want to dive into that because you played a major role in the National Pipeline Advisory Group and its report and the advice that put out for the profession. But before we do that, I want to talk a little bit brief. I love the, I’ve heard that quote, I didn’t realize it was Jeff Bezos talking about the question is what’s not changing? One of the things that Barry Milot used to always talk about was the trust position of the accounting profession and the need for trust. And you’ve alluded to right, with the need for certainty for understanding of what’s coming ahead, and that accountants, even though they sometimes don’t realize it can provide that in a way that fills a huge need and that demand will, I think is only going to grow the demand for that certainty. I mean, most accountants say, well, we’re not promising certainty, but you’ve got a lot more certainty than everybody else who’s out there and offer a lot more security and trust and assurance, and it seems like even though the need is the same, there may be a lot more of it. Is that a safe assumption?

Lexy Kessler (09:24):

Absolutely. I think that when you look back on history, there are cycles of disruption and we just have been fortunate for several decades to have relatively smooth sailing, so to speak. People there was certainty. Organizations could do their strategic plans, they could execute on them, but when you look back on in history, you have things like, we had two world wars, we had a depression, we had industrial revolution in some say, we’re going through another revolution, which I would tend to agree with when you’re in right now, we know we’re going through a period of change. We’re just not sure what it means yet, but there’s no question we are going through change right now, significant change, and we’ll look back in history and say, yes, I was there. But we’ve just been fortunate I think for the past few decades that we haven’t had to address that. So I do think there’s a little bit of a new norm that’s happening here because it seems like every time we turn around there is something new that is disrupting and that takes a toll too. So we kind of have to take care of ourselves in this process as well.

Dan Hood (10:24):

Yep. We all have sort lulled into a sense of security by the nineties who were relatively mild period of time. We were

Lexy Kessler (10:33):

Concerned about, remember Y 2K and then all of a sudden at midnight, oh, lights are still on. Everything’s okay.

Dan Hood (10:39):

I guess we

Lexy Kessler (10:40):

Were people off here old enough to remember that. But

Dan Hood (10:42):

Yeah, trust us. It seemed like a big, big idea at the time. A big problem at the time. That is interesting. It does seem like there’s a lot going on and the problem is no one’s given it a name or description that we’ll have in 20 years going to make it seem like a normal thing when really it’s just one pain after the other it seems. I’m sorry, we could dive into that. I think you’ve identified something there with that notion of errors of disruption and that we were coming out of a period, well, we’re well into a period of new disruption, but coming out of a period of unusually undisruptive tugs, that’s a terrible way to put it, and it’s getting used to that is going to take a while. One of the things that’s particularly related to the accounting profession where we’re seeing, I call disruption maybe not the right word, but troubling times right, is in the shortage of staff and future CPAs and future accountants coming in, and I said a great deal about that. You were on the NPAG, which worked on it for I’m you, the team there was working on it for at least a year, was it,

Lexy Kessler (11:47):

Did work on it for a year. Yes. Our first meeting to when we actually issued the final report, it was a

Dan Hood (11:53):

Year, and that report was comprehensive. I mean insanely covered the waterfront and took a lot of, really looked broadly at the problem and the issues behind it and the possible solutions and was held nothing back, I think is a good way to put it, and I think gave a lot of great advice for the profession to move forward. We have seen some inklings of things. There’s some reports about signups for accounting programs and accounting master’s programs and stuff, but there’s only a few, and I’m curious, sorry, I’m not saying what they are. The reports are saying that the signups are up, registrations in those programs are up, which is a positive sign, but it’s still pretty early days. It’s only been a couple of quarters. What’s your prognosis? I mean, are we beginning to grapple with the problem and what we need to do to solve it?

Lexy Kessler (12:50):

I think that the prognosis is going in the right direction. It’s hard to tell if this is a cycle or if this is in effect change. I think it’s too soon for me to get a feel for that, but I’m very excited. But there’s been three semesters in a row of double digit increases in accounting. Recent data has shown that really with some of the, that now I think there’s a combination of things, irons in the fire that have led to this. Okay. So what I’m saying is one of many, but I do think that the economic conditions have turned people to understand that accounting has job security, accounting can be very lucrative and starting salaries are starting to go up, which is a good thing in business and industry as well as in public accounting. And I think that with the impacts we report and the conversations really focusing on this, people are beginning to listen and understanding we need to do something different.

(13:55):

So I think there’s a whole ecosystem that is starting to respond to this, whether it’s academia and changing the introduction to accounting classes to make them more simulated case studies and more engaging to students and intermediate accounting, pulling them through, not weeding them out, which was a mindset from 40 years ago and then some to changing the conversation, how we talk about what we do and celebrating it, getting out into classrooms and talking to students about the profession. I think all of these things are beginning to put steps there and I know I’ve heard from a demographic perspective that there is a cliff that is coming. So I think that we’re going in this direction there will help us to mitigate that cliff at least some, but what I don’t know is what impact will back clip help combined with technology and the investments in ai.

(14:52):

But the reality is is that’s entry level. We really need it at that middle level though. We need the analytical skills, we need the ability to think analytically. And CGMA has just recently updated their curriculum that’s identifying three different sets of skill sets of thinking like critical strategic and the third one’s escaping me. But that type of curriculum built in to the education to get that certification is something that I know that Sue Coffey and her team are beginning to look at for how can we re-skill and change what the need is for individuals at entry level and then certainly once that three year, and I’m speaking management, I’m public accounting for the moment, how do we get them to where we need them to be, which is that critical thinking piece and being able to do that through schools or in some type of training immediately after that

Dan Hood (15:48):

For a long time. How they got that critical thinking, those skills are developed the more was by doing 10,000 tax returns and keeping their head down for 80 hours a week for five years and over the course of the time they were trained in it and sort of seated in. But as you say, with technology coming in and hopefully getting rid of a lot of that entry level grunt work, like you said somewhere, you’ve got to find a way to teach it to them at some point in the process. Otherwise they won’t be much use to you when they get to three to five years.

Lexy Kessler (16:17):

And I use an example that, I mean it’s not like this is something that hasn’t happened before, but I vividly remember not to date myself, but I’m going to, when our family household got our first handheld calculator, that was a big deal, but it was able to help you to do math well, you still need to understand that one plus one should be two or round two, not eight. There’s some core, and this is a very simple example, but you have to know if the output makes sense, which is why I really believe that we still need CPAs. It’s not like this is going away because of technology. I mean, what we do has evolved so much. I’ve seen the transformation in my career and it’s just going to continue to transform because what we bring to the table is so unique and we are the most trusted profession and people continue to turn to us in times of disruption.

Dan Hood (17:07):

Yeah, we’ve had tax prep software for 30 years and they’re still well north of a million tax repairers out there more than there’ve ever been in the past. So it’s not going to get rid of the profession. It may change it significantly, but

Lexy Kessler (17:19):

I agree that completely changed. You’re absolutely right. Absolutely right.

Dan Hood (17:23):

I am now having a flashback to the first calculator in my house because my mom was a tag prepare and we went to, she was very angry. We would go through reams and reams of those tiny little rolls of thermal paper. It was one of the first thermal printers for calculators. And me and my brothers and sisters just wasted that with reckless a abandon. I don’t know how we managed to afford to go to college given my mother spent most of her money on replacing those rolls of paper. But it was exciting stuff and now we know how old we are. I did want to just briefly touch on this. You mentioned some of the ways in which individuals can help bring more people into account, and that was one of my sort of favorite parts about the impact report was that it’s very easy to say, oh, the profession needs to do this and the profession needs to do that and firms need to do this and academia needs to do this, but there’s a role for the individual accountant, the individual CPA, to go out and bring to help get more people under profession.

(18:22):

If we just talk for a minute or two about that, I thought that was a really excellent part of the report that just pointed out the responsibility everybody has.

Lexy Kessler (18:31):

Thank you for that. And I want to give a shout out to Michelle Randall who was on impact. She’s an educator from, I believe it’s Michigan, and she, during the times when we’re going through this, there was certainly some moments that were more challenging than others where we were in the thick of it and trying to figure out, because of real understanding, learning the complexity and what are we going to do with this beast. And she said that she went back and she said that there was moments where she was starting to become overwhelmed that this thing is so big, what do we do? And she says, then I took a step back and I said, you know what? I’m going to do what I can in my piece of the world, in my role as an educator, and she is doing outstanding things where she teaches.

(19:21):

And I think that’s a great example of don’t become overwhelmed with the big picture. If we all do something, if we get just 10% of our members to do something that’s 60,000 people doing something and it’d be great to be more because that means we’re united more in what we’re doing. It’s not just somebody else’s problem and it’s not. And when I speak to a different state societies, different events, I really challenge people like, you need to own this. This isn’t something that anybody can just fix. It’s got to be how we behave. That needs to change. And I do think that’s starting to happen. You can get that sense of it when you talk to people. Now there is a sense of there’s an acknowledgement, first of all, acknowledging we have the problem with step one. Step two was trying to figure out, I think that we’ve gotten, we’re in process as far as the licensure issues. That’s kind of taken a path now and it’s building the conversation is happening now, which is what is needed for us to move forward. And I think that we’re seeing the results of all of that, but it is people owning what their real piece of the world. That’s all we’re asking people to do your piece of the world.

Dan Hood (20:40):

And it can be as simple, I always like to throw this out. It can be as simple as not telling horror stories about tax season. Stop telling people how you worked.

Lexy Kessler (20:48):

What are the great things that you’ve done? And if anybody has little children, there used to be, and I think there still is this cartoon on PBS called Arthur, and my children were very excited when I came home one day jumping up and down saying, mommy, mommy, Arthur’s, mommy has tax season two. And I became really cool. So there are some good things out there that all of a sudden it was Mommy’s like her.

Dan Hood (21:12):

That’s awesome. I didn’t realize that. That is spectacular. Obviously Arthur was sponsored by the big four, but that’s fantastic. Well, this is because we’re constantly looking for examples of accounts

(21:25):

In the real world who aren’t portrayed as never seeing their families for three months, a year, stuff like that. But very cool. Excellent. Alright, well we’re going to take a quick break, but we’ll be back in just a second. Alright. And we’re back with Lexy Kessler of the chair of the AICPA, talking about all things where the profession is, where it’s headed, what’s exciting, what’s less exciting, and most of it’s exciting. There’s a lot of exciting stuff, there’s a lot of challenges that go along with that excitement, but still a lot of positives out there. I want to talk because with the institute from the AICPA very recently managed an extraordinarily smooth transition from Barry Melanson who was CEO for 30, just around 30 years to a new president, mark pos. And it went as near as we can tell, extremely well. There were no cos, no fires, nothing exploded.

(22:24):

Everyone was sorry to see Barry go, but delighted to see Mark come in. That transition I understand went very well. We know a lot of firms are struggling with succession plans in many cases because they don’t have one at all, but in other cases just because a difficult thing to get. And I was wondering if, as someone who was on the ground for a lot of this stuff and around, do you have any lessons you think there are any lessons in how the A ICP handled its succession? Any advice or any advice you’d just give them from your own experiences?

Lexy Kessler (22:53):

Yeah, I think that first of all, I have to give credit to Carla McCall and Simon Biddlestones. They chair really the search committee piece of this end of it. I wasn’t on that committee, but I can share my thoughts and observations through that process though, is that I think that organizations need to look outside their organization as far as potential skill sets that may be needed. I think we’re very fortunate enough fact that Mark did have a history with A-I-C-P-A, many went to millennial and got that global experience, so made him really the natural fit. He knew the organization, he had a relationship with Barry already. Now firms that are struggling from a transition is that, honestly, I saw it myself that there just is no accountability to create a successor. Now, in fairness, nobody’s coaching the senior person on how to do that succession either.

(23:46):

So somebody’s never done something. It’s really hard sometimes to be able to figure out what’s the right way to do it and to take the time to figure it out, especially in today’s world. So I think it’s important that you use resources that are available to help guide. I think there’s organization, other support, CPA firms and succession planning do that because also, honestly, you just never know what life will throw at you. And it could be a life event that all of a sudden you have a hole in the organization for a period of time that maybe an illness or something that somebody is going through and they’ll be back. But what do you do in the meantime? And if you don’t have succession in there, it’s difficult. And I realize that’s a challenge if you’re sole proprietor. So I need to carve that out a little bit. But within firms that are a little bit bigger, or at least they have double digits of people, there is a process that it’s paying attention to it like anything else, if you just wait it out and wait it out and then you’re bringing on somebody just because you need to as opposed to they’re not the right person, it’s not the right skillset. You’re not setting yourself up for success with that. Right,

Dan Hood (24:59):

Right. Yeah, no, that’s the thing is simply we mentioned the big problem with succession planning that no one has succession plans or a lot of firms, and you’re certainly, I mean, it makes sense to carve out sole proprieties a different thing, but there are things they could do to prepare for a life event or something that may happen or absolutely.

Lexy Kessler (25:17):

Partnerships that people have with other organizations. Right.

Dan Hood (25:21):

See, we’re hearing of

Lexy Kessler (25:22):

That are out there. There’s a lot of relationships that can be made to help with things like that,

Dan Hood (25:27):

Right? Yeah. Every small sole provider knows another accountant in town who at least you can say, listen, if I get hit by a bus, my client, I’m telling all my clients to talk to you, talk to. But just to be thinking about it in some way, to be preparing for all the different things that might happen. Make perfect sense. Yeah. Excellent. This is a huge issue that I’m going to talk about next that we can talk about for days and days and days and days, which is why I’m saving it for the very last minutes of the podcast. But happy recently took on some outside investment. A lot of other firms are doing that private equity, but also other players are coming in and finding the accounting professions very attractive and firms who are finding that access to capital, that access to resources and advice, many of them are finding that very attractive. And I wanted to just see how you see the current wave of private equity firms and other people coming into the profession. How do you think it’s going to impact the profession?

Lexy Kessler (26:26):

So long-term? Hard to say how it’s going to impact certainly. I mean, there’s certainly the potential, but some things could go sideways. I don’t think the entire profession will. I really honestly don’t believe that there’s just too many guardrails in place and there’s too many different types of investors as well. You really to make sure you’re bringing on the right partner and the reasons why. Speaking from a R’S perspective, I can say the reason that we chose Charles bank was because they want us to keep doing what we’re doing. And they may have certain things that they just want to understand. They kind of want us to keep doing what we’re doing. That’s why they invested in us. I personally, and I know there’s different schools of thought, so I’m going to talk about my school of thought here for the moment. The reason I supported it and was actually an advocate for it was because I felt that our business model needed to change.

(27:13):

And I view it really as a recapitalization. We needed to get to where we could incentivize the younger partners, but it couldn’t be at the expense of the senior partners. They weren’t going to let that happen. So you had this rock in a hard place that you had to work through. I also think that from a firm business model perspective, if you’ve got 200 partners that all think that they have an opinion and deserve a seat at the table for that opinion, you can’t run a business. Not that they don’t have good opinions, but it’s really difficult to run a business like that. So your governance model needs to change and there needs to be accountability. So those were the three main factors for me. Why I really felt it was a change in business model, and I view it as a recapitalization, the organization now, the younger partners have financial incentive that they don’t have to wait 40 years to get. And honestly, that’s what our clients do. That’s what my clients do. Why should we be any different now? It’s going to be interesting to see. I think that, I was just reading something recently where it seems like what’s going to happen in this next phase, and some of these investments are very large. So I’m going to use a recent one, and I don’t know the numbers off the top of my head, but like a Baker Tilly, MOS Adams now, right?

(28:34):

EisnerAmper getting large grant forton that just did it. What’s that next step? Is it going to be conglomerate of investors together? Is it going to be going public? Otherwise? I’ve done that in the past. I’m not sure where direction it’s going to go in. So it’ll be very interesting to see the next few years, probably five years, seven years, what direction it goes in. And then there’s firms that are like, we can manage it, or they’re earlier in their life cycle where they can head off some of those things and maybe they don’t need to do that route, but they’re going to be very able and they’re going to be able to have the funds to invest in technology. So that’s another big one is investment in technology because that’s a key piece for you to be able to do what you do. So I’m curious to see how it plays out just like everybody else, but just to share my thoughts behind why I thought it was good for our organization and supported it. But it will be interesting if it’s an investor that is looking for a revenue stream as opposed to a flip, that type of investor would come in and that would work well.

Dan Hood (29:42):

And it’s interesting when you talk about younger firms are firms that are earlier in their life cycle. That’s a really fascinating point to think about. I don’t want to present to the reasons current firms were taking on PS because they had problems, but they had challenges they needed to meet. Younger firms may be able to set themselves up, as you say, in a way that allows them to solve those challenges in other ways. We talked about need to create a different corporate structure that doesn’t have 200 partners saying no, and no one can say yes.

Lexy Kessler (30:13):

Yeah. Or it’s where an organization that’s able to adapt that has been around for a long time. That’s not an easy thing to do. And I know for example, Carla, her firm has been able to do that and she do it pretty successfully. So the beautiful thing is this, we can make choices and we can all move forward

Dan Hood (30:32):

And one of the nice things, but the clear things you talked about because a little bit is that in part because PE has come in, all kinds of other people are going to start coming in. So there will be other options for finding ways to invest in technology. There’ll be ways to get capital from other sources from a retirement fund that is looking really more for a steady income stream as opposed to a big jump in five years, that kind of

Lexy Kessler (30:54):

Thing. I think that some of that was, I think investors are going to want stability as well. The uncertainty and A SCP as well has draft language out for modifying some of the independent standards relative to these alternative firm structures. So we’re on it and staying out of it and ensuring that the public trust remains where it needs to be.

Dan Hood (31:16):

Excellent. Very cool. We could talk on all these subjects. We could talk a lot more, but we’re probably going to have to stop shortly. But before we do, I want to just sort of get, this is a last question. I think you’re in a good position to give some solid advice to people who are looking to make a career in accounting. What advice would you give someone who’s assuming you’re going to say, yes, you should become an accountant. What advice would you give ’em about building a career here?

Lexy Kessler (31:43):

The advice that I wish I had done that I didn’t do was I did not get outside of the walls of my firm earlier on. It took me a long time and I say about getting outside the walls or virtual walls, whatever you want to call it, get out and volunteer for something. Now, it can be a charitable thing, but what I’m talking about really is like an industry trade association where you’re getting around other business leaders or the profession, state society, CPAs, AICPA, to be around other like-minded, I should say, should like-minded, to be around other people that are in the same segment or industry as you. We are one of the most, it blows me away how giving and sharing our profession is with each other. It’s quite humbling, and I give that trait. So much credit gotten me to where I am today, so I really wish I had done that sooner.

(32:43):

And for students in college say, look to the kid next to you. Sorry. Look to the person to your left. Look to the person, to your right. They’re going to be the business leaders across the conference table with you one day. So make a relationship with them. I think that that’s lost opportunity. That in hindsight, I wish I had done those things, but other than that, it’s the best profession in the world. It’s so diverse. You get to do so many different things, and it’s lucrative, it’s dynamic. You make a difference. Make a difference in the organizations you work for. You make a difference in the business community. Make a difference with the clients that you work with as well.

Dan Hood (33:25):

I feel like we should end with a URL. They can all go and sign up at

Lexy Kessler (33:28):

We are unstoppable. That’s what we are as a profession. We are unstoppable.

Dan Hood (33:34):

Now you make an excellent and excellent case, and I think you’re a hundred percent right on the givingness of the profession, the willingness of accountants to share ideas and strategies and tactics and templates and stuff that in any other profession would be considered highly guarded intellectual property. And they just hand it out, conferences, events, or when you call up. So it’s fantastic. Excellent. Well, Lexie Kessler of the A-I-C-P-A, thank you so much for joining us.

Lexy Kessler (33:59):

Thank you, Dan. It’s great to see you again.

Dan Hood (34:01):

Thank you all for listening. This podcast was produced by Accounting Today with audio production by Adnan k. Ready to review us on your favorite podcast platform and see the rest of our content on accounting today.com. Thanks again to our guest, and thank you for listening list.

Accounting

Offshoring and AI seen as partners, not competitors

Published

2 hours agoon

June 16, 2025

AI promises to free accountants from repetitive mundane tasks so they can focus on higher value advisory and analytics work that requires professional judgment. Offshoring, too, promises to free accountants from repetitive mundane tasks so they can focus on higher value advisory and analytics work that requires professional judgment. While it might intuitively seem these two things are in direct competition, offshore talent providers report that they have instead created powerful synergies with each other.

Nick Sinclair, founder of offshorer accounting talent provider TOA Global, said AI is disrupting every part of the professional services landscape and offshoring is no exception. However, he does not view AI as directly competing with offshoring but, rather, adding a new layer to it that complements his company’s services, versus replacing them. Firms that embrace both, he said, gain a significant edge.

“It’s absolutely AI and offshoring. That’s the winning formula. While AI assists offshore accountants with low-value tasks like data entry, basic reconciliations, and even first-draft reporting, human judgment remains crucial for validation and interpretation. That’s where our global team members shine. AI has strengthened our service delivery by reducing time spent on mundane tasks and increasing the speed-to-output for higher-value activities. We’ve actually built AI into our offshore model to amplify what our team can do, not replace,” he said.

freshidea – stock.adobe.com

Jigar Shah, the chief operating officer of accounting offshore talent provider Unison Globus, had a similar viewpoint, saying AI is more of a complement than a competitor to their offerings. To him, it is not an either/or proposition but a strategic and intentional integration of both.

“AI may be reshaping the landscape in terms of how work gets done, but it doesn’t solve for the true talent crisis in the accounting profession. Firms that want to grow and stay competitive rely on educated, experienced professionals as well as the strategic application of AI in their business for efficiency,” he said.

Shah said his own firm has already gotten a lot of use out of AI in the realms of automated data extraction, invoice processing, anomaly detection, tax categorization, and intelligent scheduling. He added that, like many companies, they are also exploring AI-assisted client communication tools and predictive analytics. Overall, he said that AI has empowered them to deliver faster, more accurate and cost-effective services. He added that AI has reduced the company’s invoice processing time by 40%, allowing teams to allocate more time to client advisory services.

Sinclair, from TOA Global, similarly said that AI has become a critical part of their offshore provider strategy, allowing them to become a full-scope talent solutions provider. They use AI not only in their internal operations but also to speed up the delivery of client services as well as to deliver data-driven insights that support ROI of offshore teams. He added that, in a business model based on geographic distance, AI has also been valuable in improving the customer experience by using AI-based solutions to stay connected and be able to swiftly respond to queries or requests.

In both cases, the success of these firms came from a willingness to adapt. Both have observed other offshore service providers that did not successfully do so, mainly because they were trying to hold on to old business models. Shah, from Unison Globus said that they have shifted their thinking in terms of not being a staffing firm per se but a talent and capability platform, which means they train, upskill and integrate people. Sinclair from TOA Global made a very similar point, noting that successfully transitioning into higher value activities in addition to their routine tasks has led them to avoid the fate of those who did not.

“The firms that falter are usually those that resist change or fail to invest in capability-building. Offshoring is no longer about low-cost labor but it is about smart, tech-empowered partnerships. What has allowed Unison Globus to thrive is our commitment to continuous innovation, upskilling, and client-centricity. We do not see AI as a threat; we embrace it as a growth partner. Our proactive approach of integrating AI and continuous staff training has positioned us ahead of competitors who were slow to adapt, leading to increased market share,” said Sinclair.

Mike Kempe, chief information officer at top 10 firm Grant Thornton, noted that his firm is not thinking in terms of offshoring or AI, and is not funneling clients towards one or the other. Instead, professionals think in terms of the specific problems a client is facing, and the specific solutions to address them, which may be AI, offshoring, or some combination of the two plus other resources. This in mind, he too felt it wasn’t productive to think in terms of AI versus offshoring, as the two are better seen as complements than competitors.

“Our clients are asking for a quality service and a personalized service. They don’t want to feel like they’re number 14 in the queue. So we use a combination of AI, offshoring and near-shoring resources to meet that demand. Our clients are not necessarily asking for an AI solution, they’re asking for the best quality service at an affordable price. We can deliver that, and the way we do it is with offshore plus AI plus nearshore and onshore resources,” he said.

The differentiating factors

This in mind, there will likely be some cases where AI is preferable and others where offshoring is preferable. Mark McAndrew, director of project management for firm management with Wolters Kluwer, also noted that people are often more interested in solving a specific problem than whether that problem is solved via AI or outsourcing. But what exactly they use depends on the specific situation.

“In some regards, you might tailor the type of outsourcing to specific customers in your segment or your customer base, and you choose to have those customers flow through a people centric part of your business, whereas other tax returns or other areas of your business might be more ripe for full automation,” he said.

At the same time, this doesn’t mean there are never people who prefer one or the other. For example, he raised the possibility that a customer might not yet be comfortable with AI, and so might pursue outsourcing to maintain the human element. And conversely, he said, there are also businesses that aren’t comfortable outsourcing but don’t feel as hesitant about AI, meaning that they will be more apt to pursue opportunities with the latter versus the former. And then there’s customers who don’t necessarily have a strong preference for one or the other and may even switch between them as their organization grows. In this case, he said it’s common for smaller organizations to start with outsourcing and then, as they scale, slowly transition to AI-driven automation solutions.

“For customers that are looking to grow their business and invest in technology that will sustain them in the long term, outsourcing is a big play, and is an area where they can create opportunity and [give themselves] time to be outside of the day to day while they figure out where their AI chips will reside, so to speak. And as you get mid-sized to large, you see customers that now have the wherewithal, or the internal talent, to focus on what they’ll do with AI,” he said.

But even that is not certain. McAndrew noted that a firm might decide to keep its headcount low while growing its service capacity through automation, while another firm might have a more people-centric approach and so prefer offshore talent.

“They complement one another, but do different, different things well,” he said.

Shah, from Unison Globus, said that one thing offshoring does particularly well is provide that human touch, which includes professional judgment, context-awareness and relationship building. He said his company’s clients do not just need tax execution but adaptable teams of experienced professionals that understand them.

“To be clear, offshoring has evolved greatly in the past years to provide highly skilled professionals who become an integral part of the firm’s team, solving problems, understanding the nuances of complex clients, and relieving bandwidth issues at the leadership level. This is not something AI can do,” he said.

This means that while AI technology is improving fast, it still won’t be able to completely replicate the advantages that offshoring provides, said TOA Global’s Sinclair.

“Accuracy alone doesn’t replace context, communication, or client relationships. Even if AI hits near-perfect accuracy—which I welcome, by the way—the need for skilled accountants won’t disappear. The nature of their work will shift, just like it has for decades. We’re preparing our team to be interpreters, not just processors. That means upskilling them in advisory thinking, business acumen, and communication. Offshoring will evolve into global insight teams, not just back offices. The reality is if AI replaces offshoring, that means it replaces accountants (no matter where they live), so there will be no industry (which won’t be the case),” said Sinclair.

The future

With this in mind, it would appear that offshore accounting talent isn’t going away anytime soon. In fact, all four sources interviewed for this story said that they are seeing demand for such services is growing, not shrinking. In the case specifically with Union Globus and TOA Global, they have reported some clients have even tried AI solutions and returned to offshoring once they found it didn’t meet their needs.

Shah said that clients had experimented with AI solutions mostly in data entry and document processing, but found it lacked the oversight and accuracy required for complex financial scenarios.

“What we offer is a blend of people + tech: our human-led, AI-enabled delivery model ensures accuracy, accountability, and scalability. That is something many firms found missing in AI-only solutions. A client who initially adopted an AI-driven bookkeeping solution returned to Unison Globus after facing challenges with categorizing complex transactions. Our team not only rectified the discrepancies but also provided strategic insights into financial reporting,” he said.

Sinclair, though, once more emphasized that the line between the two is not always so clear. Just as offshorers use AI, there are even AI solutions that supplement themselves with offshore labor.

“Some of our clients who once relied on AI to reinvent themselves and their business models eventually turned to outsourcing for greater sustainability. Oftentimes, AI-based solutions in the accounting world are significantly supported by outsourced operations and offshore teams,” he said.

To Kepme, from Grant Thornton, the persistence of offshoring makes sense. He noted that when robotic process automation was getting very popular, people predicted huge headcount reductions that didn’t really materialize. As AI works its way through the profession, both on and offshore, there were similar concerns that, so far, have not been borne out.

“We all thought that with RPA coming in, being able to automate all these processes, it would be kind of the lower value of work that people were doing manually and that would potentially lead to some dramatic reductions in head count. Reality was it didn’t. Our offshore talent now is bigger than it’s ever been. We have more people offshore than we’ve ever had,” he said.

Trump wants to make it more expensive to sue over his policies

Accounting in an era of disruption

Welcome to the zoo. That’ll be $47 today — ask again tomorrow.

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoDonald Trump has many ways to hurt Elon Musk

-

Economics1 week ago

Economics1 week agoSending the National Guard to LA is not about stopping rioting

-

Economics1 week ago

Economics1 week agoDonald Trump has many ways to hurt Elon Musk

-

Blog Post1 week ago

Blog Post1 week agoMastering Bookkeeping Tasks During Peak Business Seasons

-

Personal Finance1 week ago

Personal Finance1 week agoWhat Pell Grant changes in Trump budget, House tax bill mean for students

-

Accounting7 days ago

Accounting7 days agoInstead adds AI-driven tax reports

-

Personal Finance6 days ago

Personal Finance6 days agoHow markets performed for investors so far

-

Personal Finance6 days ago

Personal Finance6 days agoTrump’s ‘big beautiful’ bill may curb access to low-income tax credit