The Internal Revenue Service said tax season will begin on Monday, Jan. 27, 2025, with newly expanded and improved tools available.

The IRS anticipates over 140 million individual tax returns for tax year 2024 will be filed ahead of the Tuesday, April 15 federal deadline. Over half of all tax returns are expected to be filed this year with the help of a tax professional, and the IRS is urging taxpayers to use a trusted tax professional to avoid potential scams and schemes.

The IRS is also planning to open its new Direct File program on Jan. 27, even though the program has come under attack from Republicans in Congress. On the first day of the filing season, Direct File will open to eligible taxpayers in 25 states to file their taxes directly with the IRS for free: 12 states that were part of the pilot last year, plus 13 new states where Direct File will be available in 2025. During last year’s pilot, Direct File was available in Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington State and Wyoming. For the 2025 tax filing season, Direct File will also be available in Alaska, Connecticut, Idaho, Illinois, Kansas, Maine, Maryland, New Jersey, New Mexico, North Carolina, Oregon, Pennsylvania and Wisconsin.

In addition to covering taxpayers claiming the standard deduction and deductions for student loan interest and educator expenses, this year, Direct File will support taxpayers claiming deductions for Health Savings Accounts. The Treasury Department estimates that more than 30 million taxpayers will be eligible to use Direct File across the 25 states.

The 2025 tax season will reflect continued IRS progress to modernize and add new tools and features to help taxpayers. Since last tax season, improvements include more access to tax account information from text and voice virtual assistants, expanded features on the IRS Individual Online Account, more access to dozens of tax forms through cell phones and tablets and expanded alerts for scams and schemes that threaten taxpayers.

Direct File will include new features this year. A data import tool will allow taxpayers to opt-in to automatically import data from their IRS account, including personal information, the taxpayer’s IP PIN and some information from the taxpayer’s W-2. Also, this year, Direct File will cover more tax situations. During the pilot, Direct File supported taxpayers claiming the Earned Income Tax Credit, Child Tax Credit and Credit for Other Dependents. This year, Direct File will also cover taxpayers claiming the Child and Dependent Care Credit, Premium Tax Credit, Credit for the Elderly and Disabled, and Retirement Savings Contribution Credits.

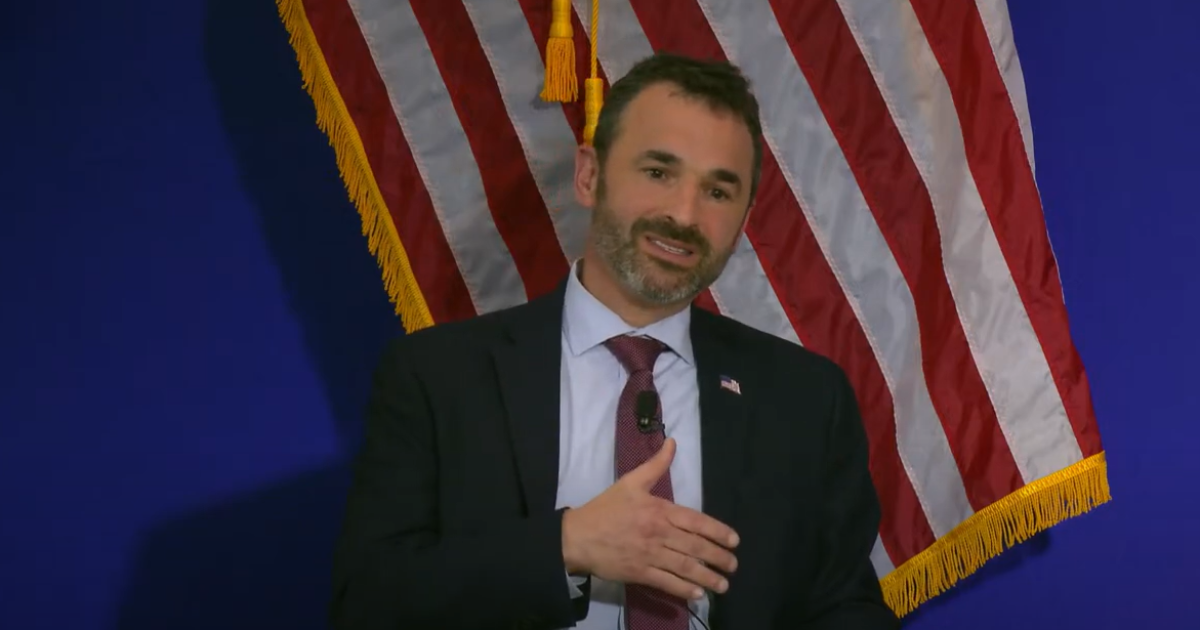

“It’s important for everyone to realize that the filing season improvements we’re highlighting today, and many others, are all a reflection of our ongoing work to modernize our agency and the interactions that taxpayers have with us,” said IRS Commissioner Danny Werfel during a press conference Friday. “The multiyear funding provided by Congress continues to drive changes across the IRS, and taxpayers will continue to see this work in the months and years ahead.”

He predicted taxpayers would see a continuing improvement in the IRS in 2025 and beyond. “Brick by brick, or online tool by online tool, we are building a modern interface with taxpayers and tax professionals,” said Werfel. “We are moving steadily to accelerate these technology advancements for the benefit of everyone. These efforts are all about making the process of filing taxes easier and less stressful for taxpayers and also making it more cost efficient.”

Werfel made a case for continuing IRS funding as the agency faces the prospect of $20 billion in budget cuts as a result of the continuing resolution that Congress passed to keep the government open. Werfel said it should not be a partisan issue to provide continued funding for the IRS. He declined to answer questions about whether he has had any conversations with former Rep. Billy Long, who has been named as the next IRS commissioner by President-elect Trump, even though Werfel’s term doesn’t end until November 2027. Asked how long he plans to remain at the IRS, he insisted he has remained “laser focused” on his job and preparing for filing season.

“I spend every waking hour during the day and, quite frankly, at night, focused on one thing and one thing only, and that’s getting ready for this filing season,” said Werfel. “That has consumed all of my energy, and that is my sole focus.”

He stressed the need for Congress to provide continued funding for the IRS. “Thanks to the efforts of employees throughout the agency, we have a great deal of momentum right now on many improvements for taxpayers, more tools, more simplicity, less stress, less burden,” said Werfel. “That momentum is important because we still have a long way to go. Our ultimate goal is to have an IRS where all taxpayers can meet all of their responsibilities, including interactions with us, from questions to payments to resolutions in a completely digital manner if they prefer. For the IRS to continue to succeed, we must ensure we provide our employees with the right training and tools, as well as a modern technology infrastructure to help taxpayers. These are essential to allow the IRS to continue its modernization work to serve the nation today and in the future, and so our ability to continue making progress on all these fronts can only happen if the IRS receives a consistent, reliable funding stream. We also should not lose sight of the fact that we have accomplished so much on this journey to modernize our agency and improve service to taxpayers with the multiyear funding Congress has provided. The decision about whether to adequately fund the agency comes down to a fundamental choice, whether or not we can and should have an IRS that you can easily interact with to help meet your tax responsibilities, that can quickly and effectively address tax scams that exploit vulnerable populations, and that can deliver updated IT infrastructure and modern technology platforms capable of supporting our work to modernize the agency. For the IRS to be able to do all these things, adequate stable funding is essential, and we will continue making our case to Congress.”

Although the IRS won’t start accepting tax returns until Jan. 27, starting today, nearly everyone can file electronically for free by using IRS Free File, available via IRS.gov. Now in its 23rd year, Free File includes free tax preparation software from eight companies in the public-private partnership between the IRS and Free File Inc. As part of this partnership, tax preparation and filing software partners offer their online products to eligible taxpayers for free. To access these tools, taxpayers should start from the IRS Free File page on IRS.gov.

Blog Post7 days ago

Blog Post7 days ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago